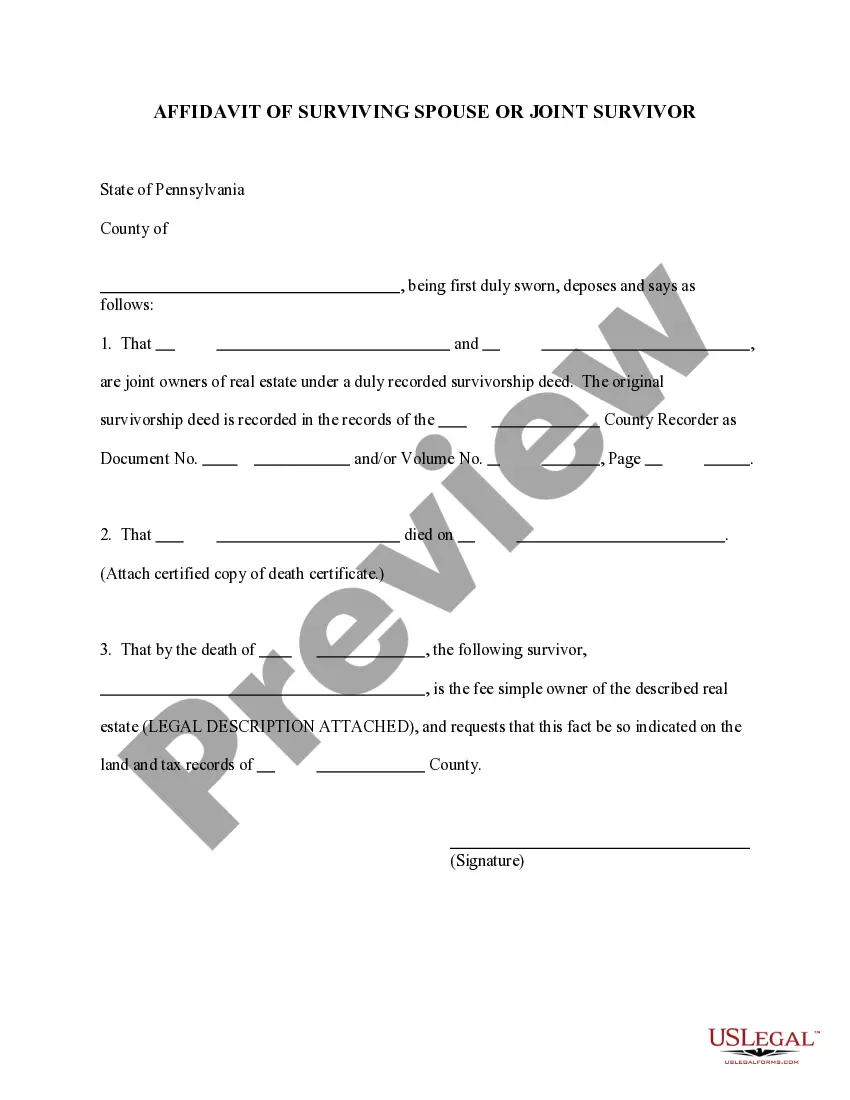

This form is an affidavit in which the affiant is the surviving tenant and former spouse in a joint tenancy, or tenancy by the entireties, with the decedent. The form is used to establish the death of the decedent and the succession of the affiant to the interest of the decedent as a result of the joint interest.

Title: Understanding Philadelphia Pennsylvania Affidavit of Surviving Spouse or Joint Survivor: Types and Usage Introduction: The Philadelphia Pennsylvania Affidavit of Surviving Spouse or Joint Survivor is a legally binding document that serves various purposes related to the estate settlement process. It allows surviving spouses or joint survivors to assert their rights and claim ownership or transfer assets and properties after the death of a spouse or joint account holder. In this article, we will delve into the intricacies of this affidavit, its significance, and explore any different types that may exist. Keywords: Philadelphia Pennsylvania, Affidavit of Surviving Spouse or Joint Survivor, estate settlement process, surviving spouse, joint account holder, ownership transfer. 1. Importance of Philadelphia Pennsylvania Affidavit of Surviving Spouse or Joint Survivor: The Affidavit of Surviving Spouse or Joint Survivor acts as a legal instrument that enables the surviving spouse or joint account holder to establish their right to certain assets, properties, or monetary benefits. Keywords: legal instrument, surviving spouse, joint account holder, assets, properties, monetary benefits. 2. Purpose of the Affidavit: a) Property Transfer: When a spouse or joint survivor desires to transfer ownership of jointly owned properties or assets, this affidavit can serve as a proof of their entitlement. Keywords: property transfer, joint assets, entitlement. b) Financial Claim: The affidavit allows the surviving spouse or joint survivor to claim insurance proceeds, pension benefits, or any outstanding financial sums, preventing any potential disputes. Keywords: financial claim, insurance proceeds, pension benefits, outstanding sums, disputes. c) Bypassing Probate: Through this affidavit, surviving spouses or joint survivors can bypass the probate process in cases where the value of the estate falls under a certain threshold, streamlining the property transfer process. Keywords: bypassing probate, estate value threshold, property transfer. 3. Different Types of Philadelphia Pennsylvania Affidavit of Surviving Spouse or Joint Survivor: While there may not be different types of affidavits with distinct names, variations in use can occur depending on specific circumstances. These might include: Keywords: types, variations, specific circumstances. a) Real Estate Affidavit: This affidavit is typically used when the surviving spouse or joint survivor wishes to assert their right to jointly-owned real estate properties, such as houses, land, or commercial assets. Keywords: real estate, jointly-owned, houses, land, commercial assets. b) Financial Account Affidavit: If the surviving spouse or joint survivor aims to claim financial assets, such as bank accounts, investments, or retirement funds, this specific type of affidavit comes into play. Keywords: financial accounts, bank accounts, investments, retirement funds. Conclusion: The Philadelphia Pennsylvania Affidavit of Surviving Spouse or Joint Survivor is an essential legal document that facilitates the smooth transfer of assets, estate settlement, and securing financial rights for surviving spouses or joint survivors. By utilizing this document appropriately, individuals can avoid lengthy probate processes and protect their legal entitlements. Keywords: estate transfer, probate processes, legal entitlements, estate settlement.