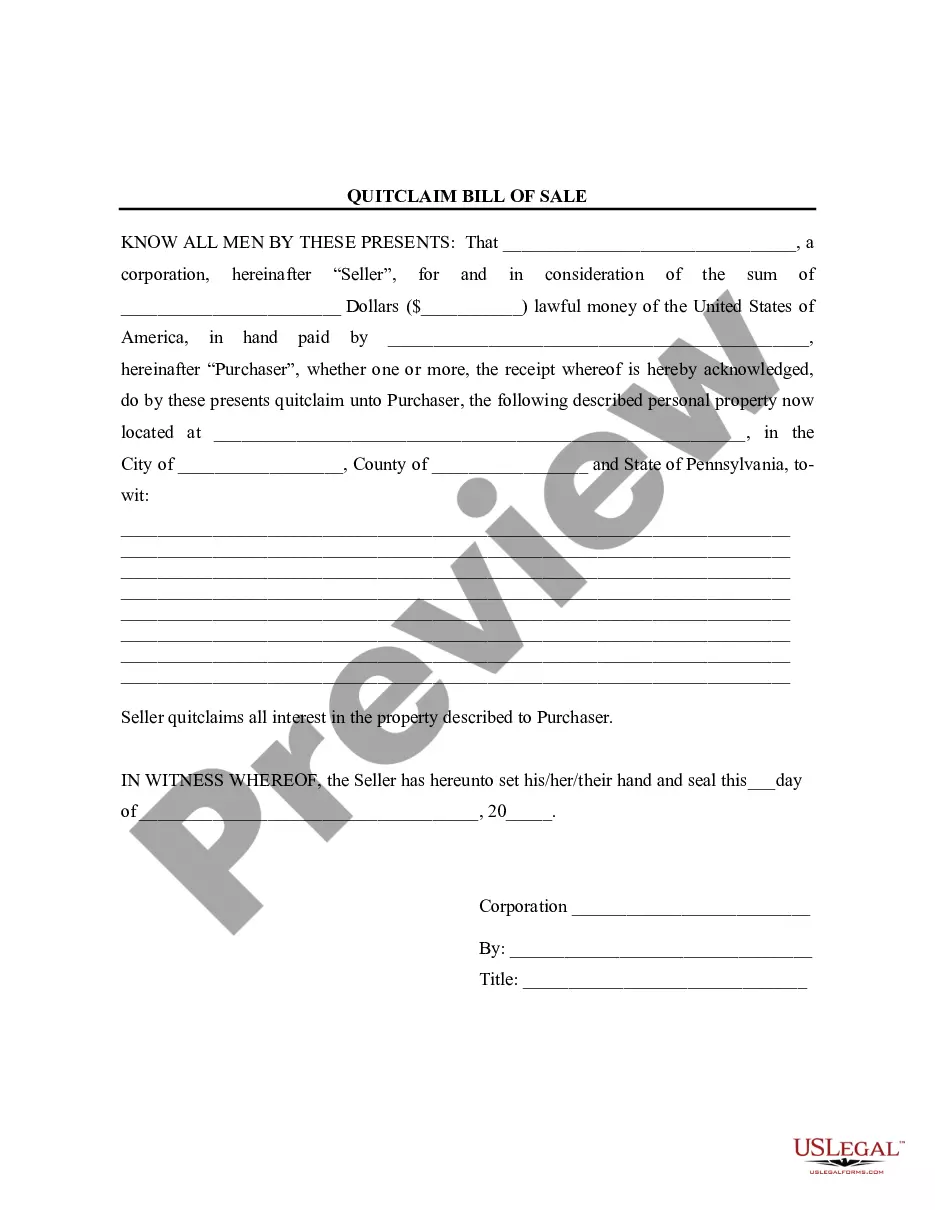

Title: Philadelphia Pennsylvania Bill of Sale without Warranty by Corporate Seller: A Comprehensive Overview Introduction: In Philadelphia, Pennsylvania, a Bill of Sale without Warranty by a Corporate Seller is a legal document used to transfer ownership of certain assets (real estate, vehicles, personal property, etc.) from a corporate entity to an individual or another corporation. This document outlines the terms of the sale and provides an understanding of the rights and responsibilities of both parties involved. In this article, we will delve into the key elements of a Philadelphia Pennsylvania Bill of Sale without Warranty by Corporate Seller, exploring its purpose, importance, and potential variations. Key Features of a Philadelphia Pennsylvania Bill of Sale without Warranty by Corporate Seller: 1. Definition and Purpose: A Bill of Sale without Warranty by Corporate Seller is a legally binding contract that establishes the details of a sale transaction between a corporate entity and a buyer. Unlike a Bill of Sale with Warranty, it disclaims any expressed or implied warranties on the sold item(s), indicating that the seller is not responsible for any defects or issues arising post-sale. 2. Parties Involved: The document identifies the corporate seller and the buyer(s) involved in the transaction. It includes their legal names, addresses, and contact details. 3. Description of Assets: The Bill of Sale provides a detailed description of the assets being sold, including any unique identifiers (such as serial numbers or VIN's), physical characteristics, and quantities involved. 4. Purchase Price and Payment Terms: The document outlines the agreed-upon purchase price for the assets and specifies the payment terms, including the acceptable payment methods, installments (if any), and due dates. 5. Transfer of Ownership: The Bill of Sale establishes the transfer of ownership from the corporate seller to the individual or corporation purchasing the assets. It includes the effective date of the transfer and any conditions or restrictions related to the transfer. 6. Release of Liability: As a document without warranty, the Bill of Sale clearly states that the corporate seller does not assume any liability or responsibility for the condition, quality, or performance of the assets sold. Types of Philadelphia Pennsylvania Bill of Sale without Warranty by Corporate Seller: 1. Philadelphia Pennsylvania Real Estate Bill of Sale without Warranty by Corporate Seller: This type of Bill of Sale is used for transferring ownership of corporate-owned real estate properties, such as buildings, land, or commercial spaces, without any expressed or implied warranties. 2. Philadelphia Pennsylvania Vehicle Bill of Sale without Warranty by Corporate Seller: Primarily used for the sale of corporate-owned vehicles (cars, trucks, motorcycles, etc.), this Bill of Sale outlines the specifics of the transaction while disclaiming any warranties associated with the vehicle. Conclusion: A Philadelphia Pennsylvania Bill of Sale without Warranty by Corporate Seller is a vital document for legally transferring assets from a corporate entity to a buyer. It provides a clear understanding of the terms and conditions of the sale while safeguarding the interests of both parties involved. A variety of Bill of Sale types, such as those pertaining to real estate or vehicles, cater to specific asset categories. Understanding the key features and variations of this legal document is crucial for a seamless and protected transaction in Philadelphia, Pennsylvania.

Philadelphia Seller

Description

How to fill out Philadelphia Pennsylvania Bill Of Sale Without Warranty By Corporate Seller?

Are you looking for a reliable and inexpensive legal forms provider to buy the Philadelphia Pennsylvania Bill of Sale without Warranty by Corporate Seller? US Legal Forms is your go-to choice.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked based on the requirements of particular state and area.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Philadelphia Pennsylvania Bill of Sale without Warranty by Corporate Seller conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is intended for.

- Start the search over if the template isn’t suitable for your legal scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Philadelphia Pennsylvania Bill of Sale without Warranty by Corporate Seller in any provided file format. You can return to the website when you need and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending hours learning about legal paperwork online for good.