Pittsburgh Pennsylvania Closing Statement

Description

How to fill out Pennsylvania Closing Statement?

Irrespective of societal or occupational standing, completing legal documents is an unfortunate requirement in the current professional landscape.

Too frequently, it’s nearly impossible for an individual without legal expertise to create such paperwork from scratch, primarily due to the intricate language and legal nuances they contain.

This is where US Legal Forms proves invaluable.

Ensure that the form you have selected is suitable for your area since the laws of one state or county do not apply to another state or county.

Review the form and read a brief summary (if available) of situations for which the document can be utilized.

- Our platform offers a vast collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms is also a fantastic resource for associates or legal advisors seeking to conserve time by using our DIY documents.

- Regardless of whether you need the Pittsburgh Pennsylvania Closing Statement or any other document applicable in your state or county, with US Legal Forms, everything is accessible.

- Here’s how to acquire the Pittsburgh Pennsylvania Closing Statement swiftly using our reliable platform.

- If you are already a registered user, you can go ahead and Log In to your account to obtain the required form.

- However, if you are new to our platform, be sure to follow these instructions before downloading the Pittsburgh Pennsylvania Closing Statement.

Form popularity

FAQ

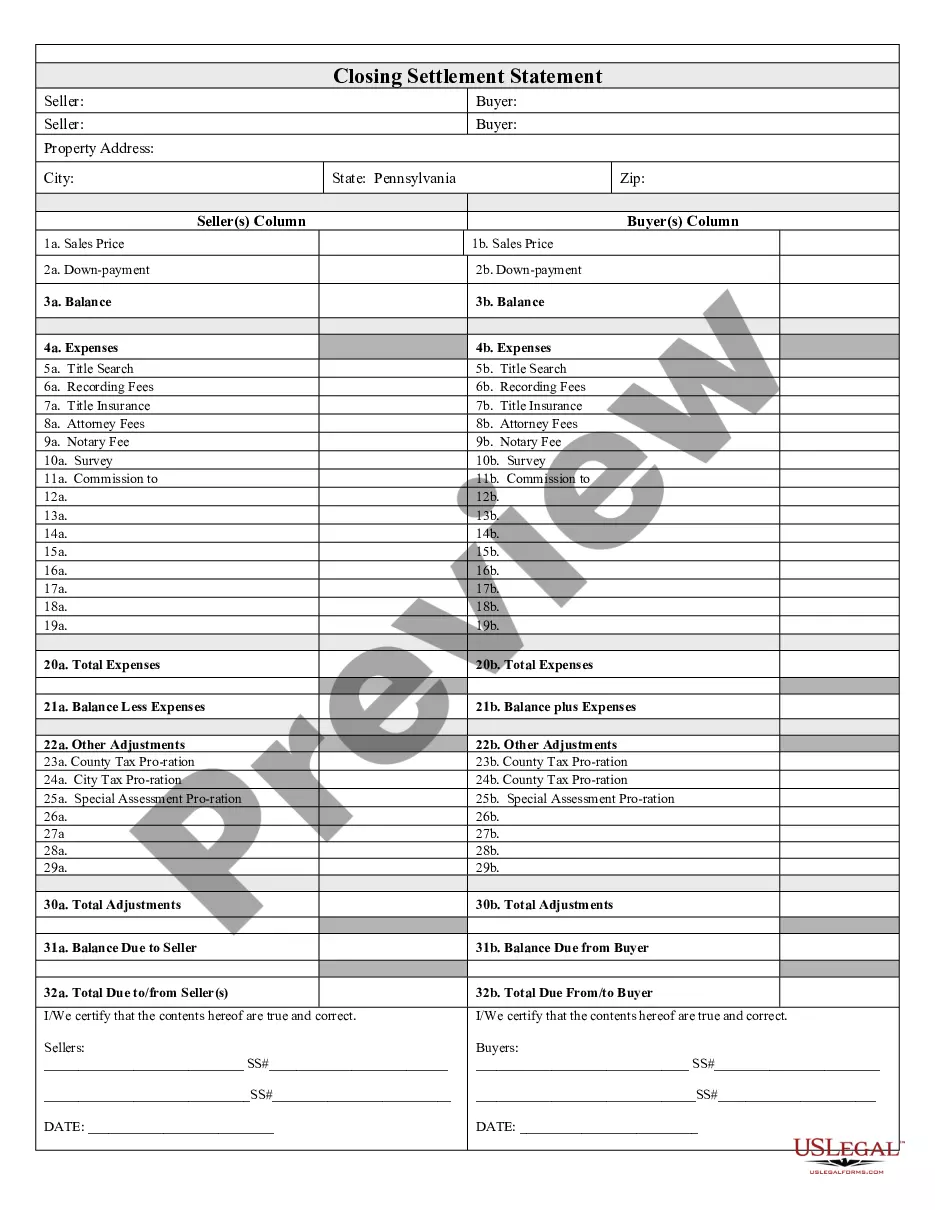

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

How To Read A Settlement Statement From Your Real Estate Closing YouTube Start of suggested clip End of suggested clip This first page also includes your principal. And interest payment for your loan. Including anyMoreThis first page also includes your principal. And interest payment for your loan. Including any escrows. So you'll see principal and interest underneath it'll say estimated escrows.

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

1 form, also called a HUD1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

HOW TO PAY Make check payable to: ?Treasurer, City of Pittsburgh.? Do not send cash. Mail to: City Treasurer LS-1 Tax, 414 Grant St., Pittsburgh, PA 15219-2476. A $30.00 fee will be assessed for any check returned from the bank for any reason.

How To Read A Settlement Statement From Your Real Estate Closing YouTube Start of suggested clip End of suggested clip This first page also includes your principal. And interest payment for your loan. Including anyMoreThis first page also includes your principal. And interest payment for your loan. Including any escrows. So you'll see principal and interest underneath it'll say estimated escrows.

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

The Closing Disclosure is a five-page form that describes the critical aspects of your mortgage loan, including purchase price, loan fees, interest rate, estimated real estate taxes, insurance, closing costs and other expenses.

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.