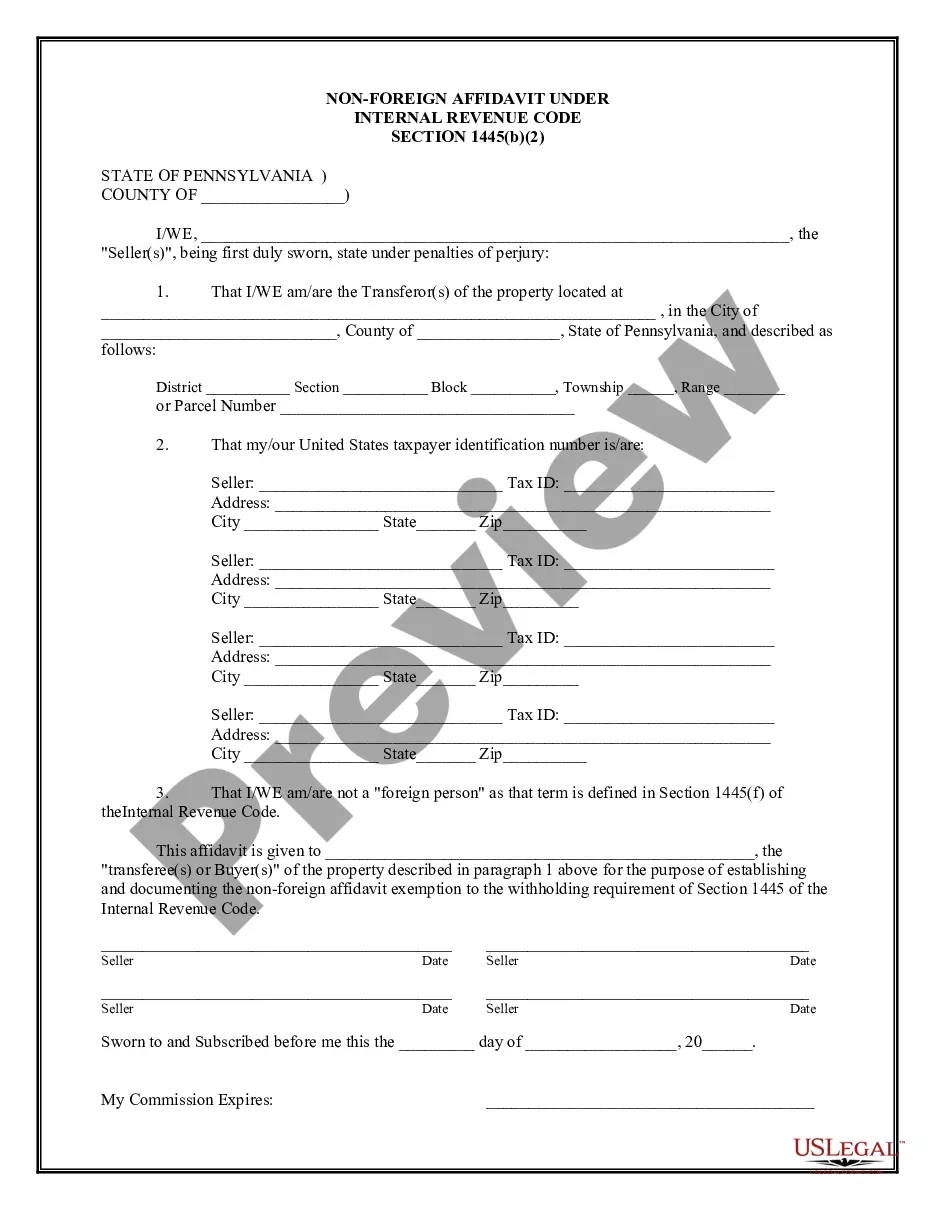

A Philadelphia Pennsylvania Non-Foreign Affidavit Under IRC 1445 is a legal document that verifies the non-foreign status of a seller in a real estate transaction. This affidavit is required by the Internal Revenue Code (IRC) Section 1445, which deals with the withholding of tax on dispositions of U.S. real property interests by foreign persons. When a non-U.S. resident sells a property located in the United States, the buyer is required to withhold a certain percentage of the total sales price and remit it to the IRS. However, if the seller can prove their non-foreign status, they become exempt from this withholding requirement. The Philadelphia Pennsylvania Non-Foreign Affidavit Under IRC 1445 confirms that the seller is not a foreign person and is therefore exempt from the withholding obligation. This affidavit is typically prepared by the seller or their authorized representative and submitted to the buyer or the buyer's settlement agent before the closing of the real estate transaction. The affidavit includes important details, such as the seller's name, address, taxpayer identification number (such as a Social Security Number or an Individual Taxpayer Identification Number), and a statement affirming their non-foreign status. The seller must also provide any additional supporting documentation required by the IRS to establish their non-foreign status, such as a valid U.S. visa or proof of U.S. residency. It is important to note that there may be variations of the Philadelphia Pennsylvania Non-Foreign Affidavit Under IRC 1445, as different jurisdictions may have their own specific requirements or forms. It is crucial for both buyers and sellers to consult with a qualified real estate attorney or tax professional who specializes in these matters to ensure compliance with all applicable laws and regulations. In summary, the Philadelphia Pennsylvania Non-Foreign Affidavit Under IRC 1445 is a legal document that enables sellers in real estate transactions to prove their non-foreign status, exempting them from the withholding requirement imposed on foreign persons. By providing accurate and complete information, sellers can facilitate the smooth closing of the transaction while ensuring compliance with tax laws and regulations.

Philadelphia Pennsylvania Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Philadelphia Pennsylvania Non-Foreign Affidavit Under IRC 1445?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any law education to create such paperwork cfrom the ground up, mainly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes in handy. Our platform provides a huge catalog with more than 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you require the Philadelphia Pennsylvania Non-Foreign Affidavit Under IRC 1445 or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Philadelphia Pennsylvania Non-Foreign Affidavit Under IRC 1445 quickly using our trustworthy platform. If you are already a subscriber, you can proceed to log in to your account to get the appropriate form.

However, if you are new to our platform, ensure that you follow these steps before obtaining the Philadelphia Pennsylvania Non-Foreign Affidavit Under IRC 1445:

- Be sure the form you have chosen is specific to your area since the rules of one state or county do not work for another state or county.

- Review the document and go through a short outline (if provided) of cases the paper can be used for.

- In case the one you selected doesn’t meet your requirements, you can start over and search for the necessary form.

- Click Buy now and pick the subscription option you prefer the best.

- with your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Philadelphia Pennsylvania Non-Foreign Affidavit Under IRC 1445 once the payment is completed.

You’re good to go! Now you can proceed to print out the document or fill it out online. In case you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.