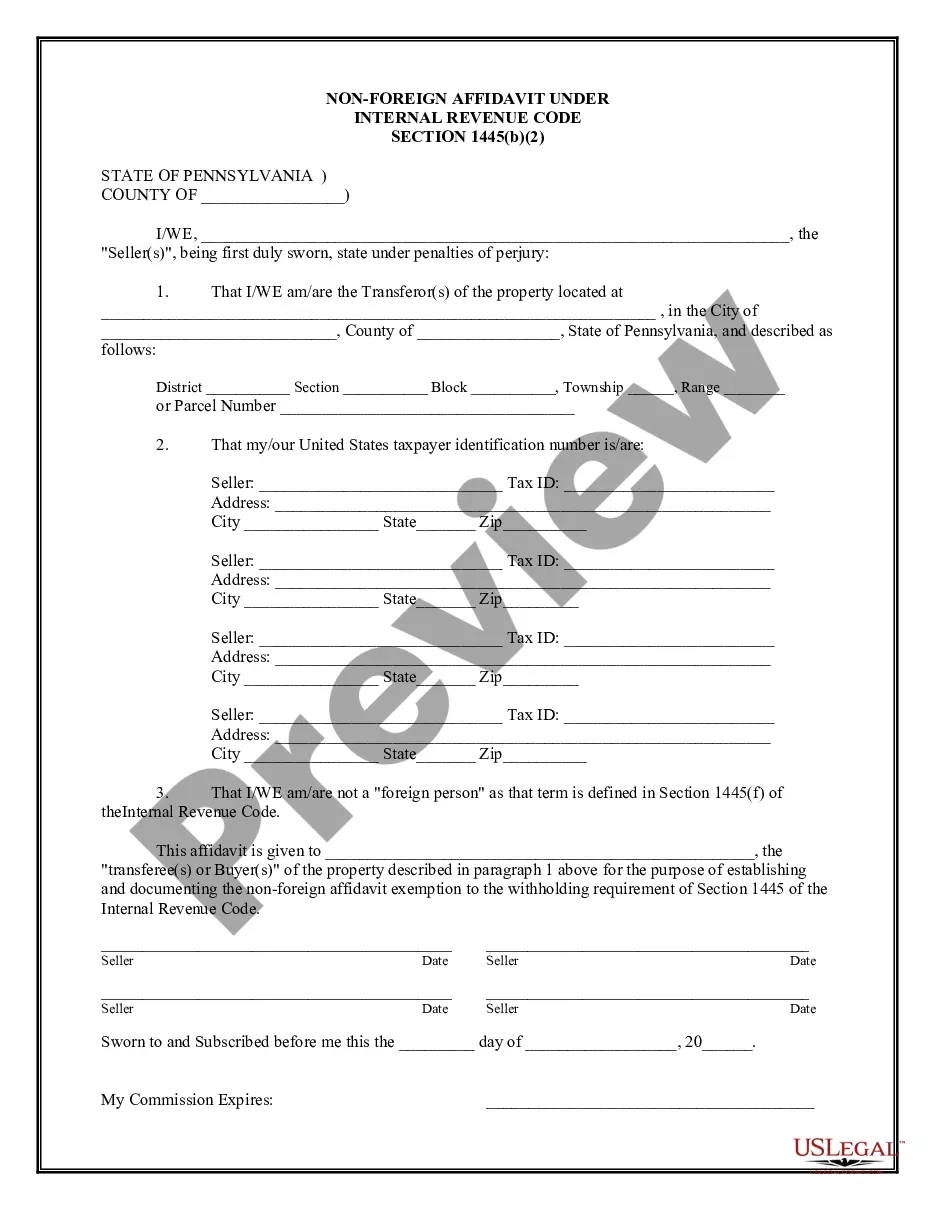

In Pittsburgh, Pennsylvania, individuals involved in certain real estate transactions may encounter the requirement of a Non-Foreign Affidavit under IRC 1445. This affidavit is a legal document that verifies the non-foreign status of the seller or transferor of real property. It is specifically required for transactions subject to the provisions of Internal Revenue Code (IRC) section 1445, which pertains to the withholding of tax on dispositions of U.S. real property interests by foreign persons. The Non-Foreign Affidavit under IRC 1445 serves as a declaration by the seller or transferor that they are not a foreign individual or entity, ensuring compliance with tax laws and regulations. This affidavit is crucial in determining whether withholding taxes need to be applied to the transaction and ensuring that the appropriate tax liability is met. There are various types or circumstances in which a Pittsburgh, Pennsylvania Non-Foreign Affidavit under IRC 1445 may be required. Some of these include: 1. Real Estate Sales: When a foreign individual or entity sells U.S. real property interests in Pittsburgh, Pennsylvania, a Non-Foreign Affidavit under IRC 1445 is typically required to establish their non-foreign status and determine the applicable withholding tax rate. 2. Transfers of Ownership: In cases where a transfer of ownership of U.S. real property occurs, such as through gifting or inheritance, the new owner or transferee might need to provide a Non-Foreign Affidavit under IRC 1445 to confirm their non-foreign status and fulfill any tax obligations. 3. Real Estate Partnerships: If a partnership that involves foreign partners disposes of U.S. real property interests, it may need to submit a Non-Foreign Affidavit under IRC 1445 for each foreign partner to ascertain their non-foreign status and comply with the related tax requirements. 4. Foreign Investment in U.S. Real Estate: Pittsburgh, Pennsylvania often attracts foreign investments in its real estate market. In such cases, individuals or entities purchasing U.S. real property interests may be subject to the Non-Foreign Affidavit requirement under IRC 1445 to establish their non-foreign status and fulfill the necessary tax obligations. To complete a Non-Foreign Affidavit under IRC 1445 in Pittsburgh, Pennsylvania, it is advisable to consult with a knowledgeable attorney or tax professional familiar with the intricacies of the process. These professionals can ensure that the affidavit is prepared accurately, providing all necessary information and declarations required by the Internal Revenue Service (IRS) and local regulations. Complying with the Non-Foreign Affidavit requirements under IRC 1445 is vital for staying in adherence to tax laws and preventing any potential penalties or legal issues arising from non-compliance. As such, it is crucial for individuals involved in real estate transactions subject to IRC section 1445 in Pittsburgh, Pennsylvania, to be aware of the necessity of this affidavit and seek proper guidance to ensure a smooth and lawful transfer of property interests.

Pittsburgh Pennsylvania Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Pittsburgh Pennsylvania Non-Foreign Affidavit Under IRC 1445?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Pittsburgh Pennsylvania Non-Foreign Affidavit Under IRC 1445? US Legal Forms is your go-to choice.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed based on the requirements of specific state and county.

To download the form, you need to log in account, find the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Pittsburgh Pennsylvania Non-Foreign Affidavit Under IRC 1445 conforms to the laws of your state and local area.

- Read the form’s description (if available) to find out who and what the form is intended for.

- Start the search over in case the form isn’t good for your specific scenario.

Now you can create your account. Then choose the subscription plan and proceed to payment. As soon as the payment is done, download the Pittsburgh Pennsylvania Non-Foreign Affidavit Under IRC 1445 in any available format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time researching legal papers online for good.