Philadelphia Pennsylvania Complex Will with Credit Shelter Marital Trust for Large Estates is a comprehensive estate planning strategy specifically designed for individuals with substantial assets and a desire to maximize wealth transfers to their beneficiaries. This sophisticated legal arrangement combines a complex will with the utilization of both a credit shelter trust and a marital trust. The main objective of the Philadelphia Pennsylvania Complex Will with Credit Shelter Marital Trust for Large Estates is to minimize the potential estate tax liability while ensuring that the surviving spouse is adequately provided for. Keywords: Philadelphia Pennsylvania, complex will, credit shelter trust, marital trust, large estates, estate planning, wealth transfers, beneficiaries, estate tax liability, surviving spouse. Different types of Philadelphia Pennsylvania Complex Will with Credit Shelter Marital Trust for Large Estates may include: 1. Irrevocable Credit Shelter Marital Trust: This type of complex will establishes an irrevocable trust that shelters a portion of the decedent's assets from estate taxes while providing income and benefits to the surviving spouse. 2. Revocable Credit Shelter Marital Trust: This variant allows the granter to retain control and modify the trust during their lifetime while still achieving similar estate tax mitigation and spousal provision goals. 3. AB Trust: Also known as a "Bypass Trust," this type of complex will establishes a trust upon the death of the first spouse, allowing the surviving spouse to benefit from the trust's income and principal while ensuring that the assets pass to the beneficiaries named in the trust upon the surviving spouse's death. 4. TIP Trust: Qualified Terminable Interest Property Trust is a marital trust that provides income and support to the surviving spouse during their lifetime but retains control over the distribution of the trust's assets to other beneficiaries (such as children or grandchildren) after the surviving spouse's passing. 5. Generation-Skipping Trust: This advanced form of credit shelter trust transfers assets to subsequent generations, skipping the generation of the surviving spouse entirely. It allows for estate tax savings and protects assets from being subject to estate taxes in multiple generations. It is essential to consult with a professional estate planning attorney in Philadelphia, Pennsylvania, to navigate the intricate legalities involved in establishing and executing a Philadelphia Pennsylvania Complex Will with Credit Shelter Marital Trust for Large Estates. The attorney will provide personalized guidance and tailor the strategy to align with your specific circumstances and objectives.

Philadelphia Pennsylvania Complex Will with Credit Shelter Marital Trust for Large Estates

Description

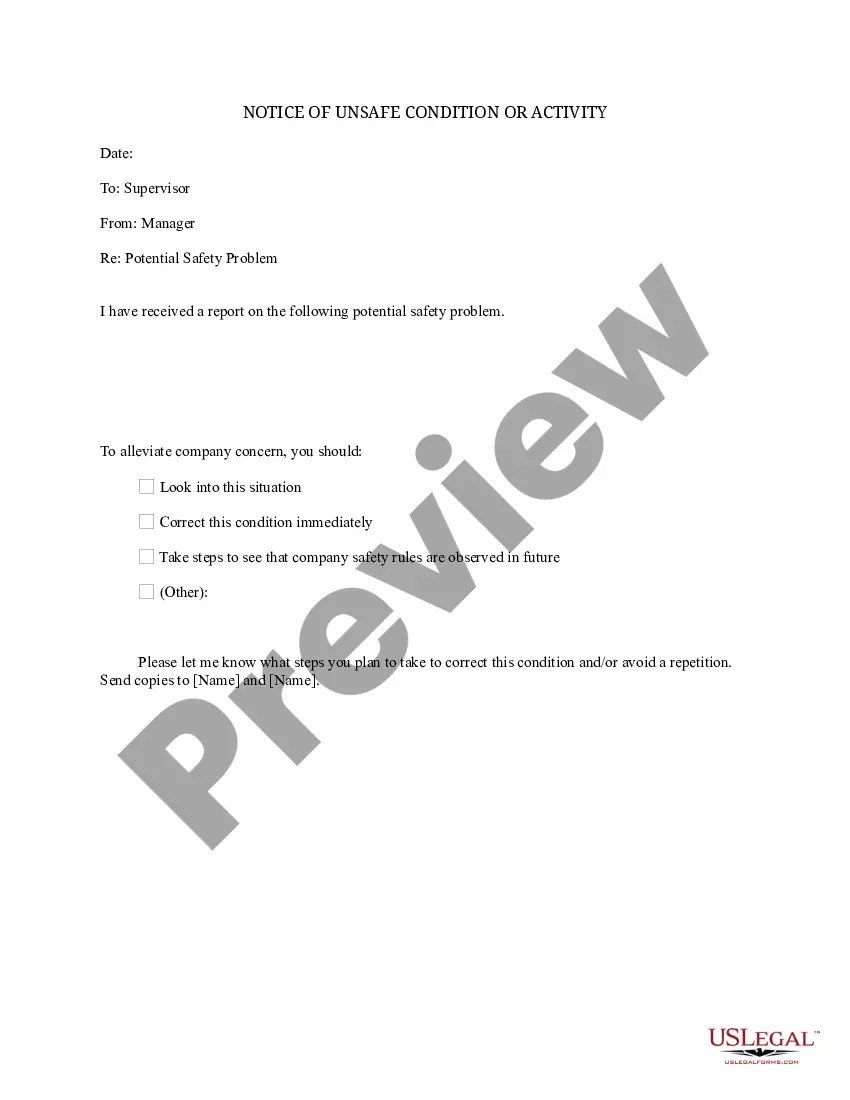

How to fill out Philadelphia Pennsylvania Complex Will With Credit Shelter Marital Trust For Large Estates?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Philadelphia Pennsylvania Complex Will with Credit Shelter Marital Trust for Large Estates becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Philadelphia Pennsylvania Complex Will with Credit Shelter Marital Trust for Large Estates takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve chosen the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Philadelphia Pennsylvania Complex Will with Credit Shelter Marital Trust for Large Estates. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

The primary benefit of CSTs is that the surviving spouse can use the trust's principal and income during the remainder of their lifetime, for example, for medical or educational expenses. The remaining assets then pass to the beneficiaries and are not subject to estate taxes.

There are three types of marital trusts: a general power of appointment, a qualified terminable interest property (QTIP) trust, and an estate trust. A martial trust protects the assets and benefits of a surviving spouse and children.

A credit shelter trust is a trust that is established in the will or living trust of the first to die of a married couple, most often for the benefit of a surviving spouse. It is generally created to avoid estate taxes at a first spouse's death by taking advantage of the available federal estate tax credit.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

A marital trust is an irrevocable trust that lets you transfer a deceased spouse's assets to the surviving spouse without incurring any taxes. The trust also protects assets from creditors and future spouses the surviving spouse may encounter.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

CREDIT SHELTER TRUST?Also known as a bypass trust or a unified credit trust, this trust is typically created under a will or revocable trust agreement and is funded after death with an amount equal to a testator's or grantor's unused ?applicable exclusion amount? the maximum amount insulated from federal estate taxes

The B trust is known by many names. These include the Bypass Trust, Decedent's Trust, Exemption Trust, Credit Shelter Trust, and/or the Non-Marital Trust. Often, a formula will dictate how much of the assets must go into the A trust, and how much must go into the B trust after the first death.

Credit Shelter Trust vs Marital Trust - Is a Marital Trust the Same as a Credit Shelter Trust? No. A Marital Trust is a type of Credit Shelter Trust. You and your spouse can use a Marital Trust to pass assets to a surviving spouse, children or grandchildren.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts. Revocable Trusts. Irrevocable Trusts. Testamentary Trusts.