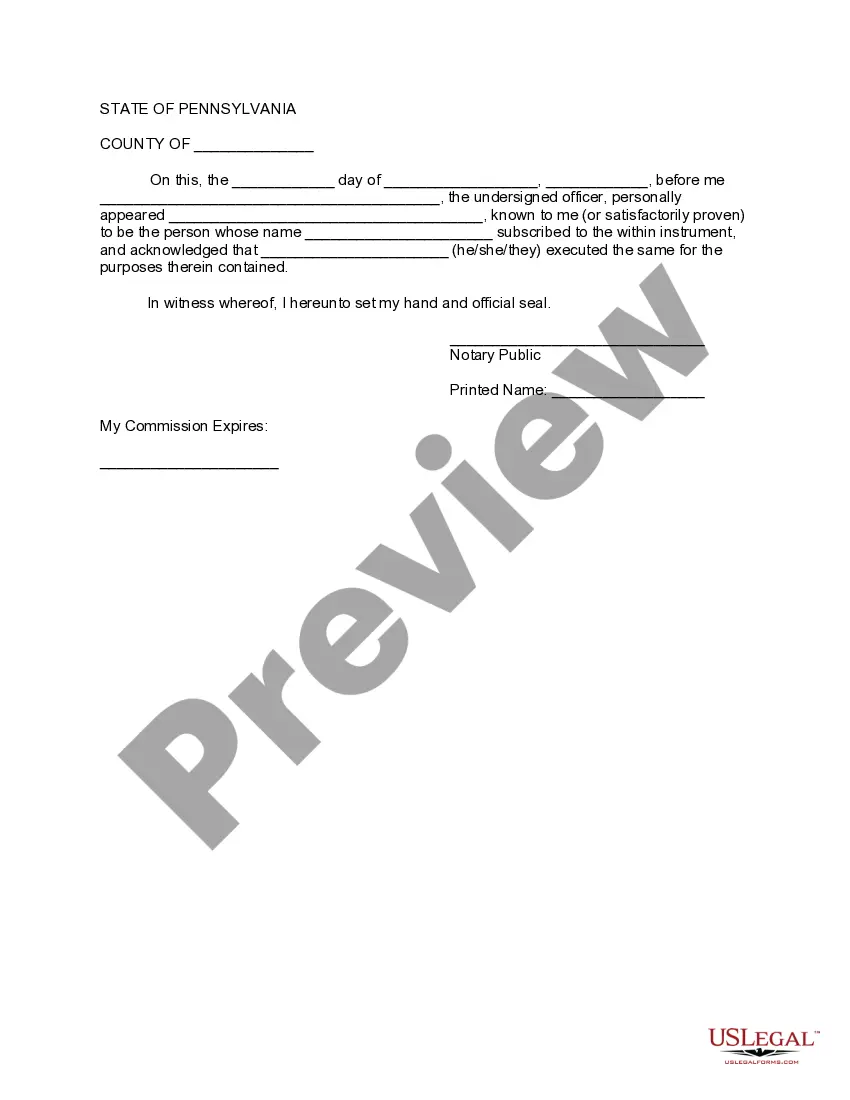

Philadelphia Pennsylvania Amendment to Living Trust is a legal document that allows individuals in Philadelphia, Pennsylvania, to make changes or updates to an existing living trust. A living trust is an important estate planning tool that helps manage assets and dictate how they will be distributed upon the trust creator's death, while also avoiding probate. The Philadelphia Pennsylvania Amendment to Living Trust is essential when circumstances change, beneficiaries need to be modified, or new assets need to be included or removed from the trust. This amendment ensures that the trust remains aligned with the trust or's wishes while reflecting their current situation and intentions. Here are a few types of Philadelphia Pennsylvania Amendment to Living Trust: 1. Beneficiary Amendment: This type of amendment is used when the trust or wants to add, remove, or modify beneficiaries listed in the original living trust. It allows the trust or to specify who will inherit their assets, ensuring that their exact wishes are upheld. 2. Asset Amendment: An asset amendment is employed when the trust or wants to include additional assets or remove existing ones from the trust. This amendment ensures that all assets intended to be part of the trust are properly accounted for, facilitating smoother asset management and distribution. 3. Administrative Amendment: This type of amendment focuses on administrative changes, such as altering the trustee designation, updating contact information, or modifying the trust's terms and conditions. It ensures that the appointed trustee has the necessary authority and beneficially reflects any changes in the trust or's life. 4. Successor Trustee Amendment: A successor trustee amendment is used to designate new trustees to replace the original trustee in case they become incapacity or pass away. This amendment ensures a smooth transition of trust responsibilities and safeguards the trust or's intended management of assets. 5. Revision Amendment: Occasionally, a trust or may wish to make substantial revisions to the original living trust. A revision amendment allows significant modifications while still retaining the core aspects of the trust. This ensures that the trust or's overall objectives and intentions are honored, even if significant changes are made. In summary, the Philadelphia Pennsylvania Amendment to Living Trust empowers individuals to modify and update their living trust as needed, ensuring that their assets are managed and distributed according to their current wishes. Whether it involves changing beneficiaries, assets, administrative details, or even revising the entire trust, these amendments enable the trust or to adapt the trust to their evolving circumstances while maintaining control and clarity.

Revocable Living Trust

Description

How to fill out Philadelphia Pennsylvania Amendment To Living Trust?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Very often, it’s almost impossible for someone without any law education to draft such paperwork from scratch, mainly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform offers a massive library with over 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you need the Philadelphia Pennsylvania Amendment to Living Trust or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Philadelphia Pennsylvania Amendment to Living Trust in minutes using our trustworthy platform. If you are presently an existing customer, you can proceed to log in to your account to get the appropriate form.

However, if you are a novice to our library, make sure to follow these steps before downloading the Philadelphia Pennsylvania Amendment to Living Trust:

- Ensure the form you have found is good for your area since the regulations of one state or county do not work for another state or county.

- Preview the document and go through a quick description (if provided) of scenarios the document can be used for.

- If the one you chosen doesn’t meet your needs, you can start over and look for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- Access an account {using your credentials or create one from scratch.

- Select the payment method and proceed to download the Philadelphia Pennsylvania Amendment to Living Trust as soon as the payment is through.

You’re good to go! Now you can proceed to print the document or fill it out online. If you have any issues getting your purchased forms, you can quickly access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.