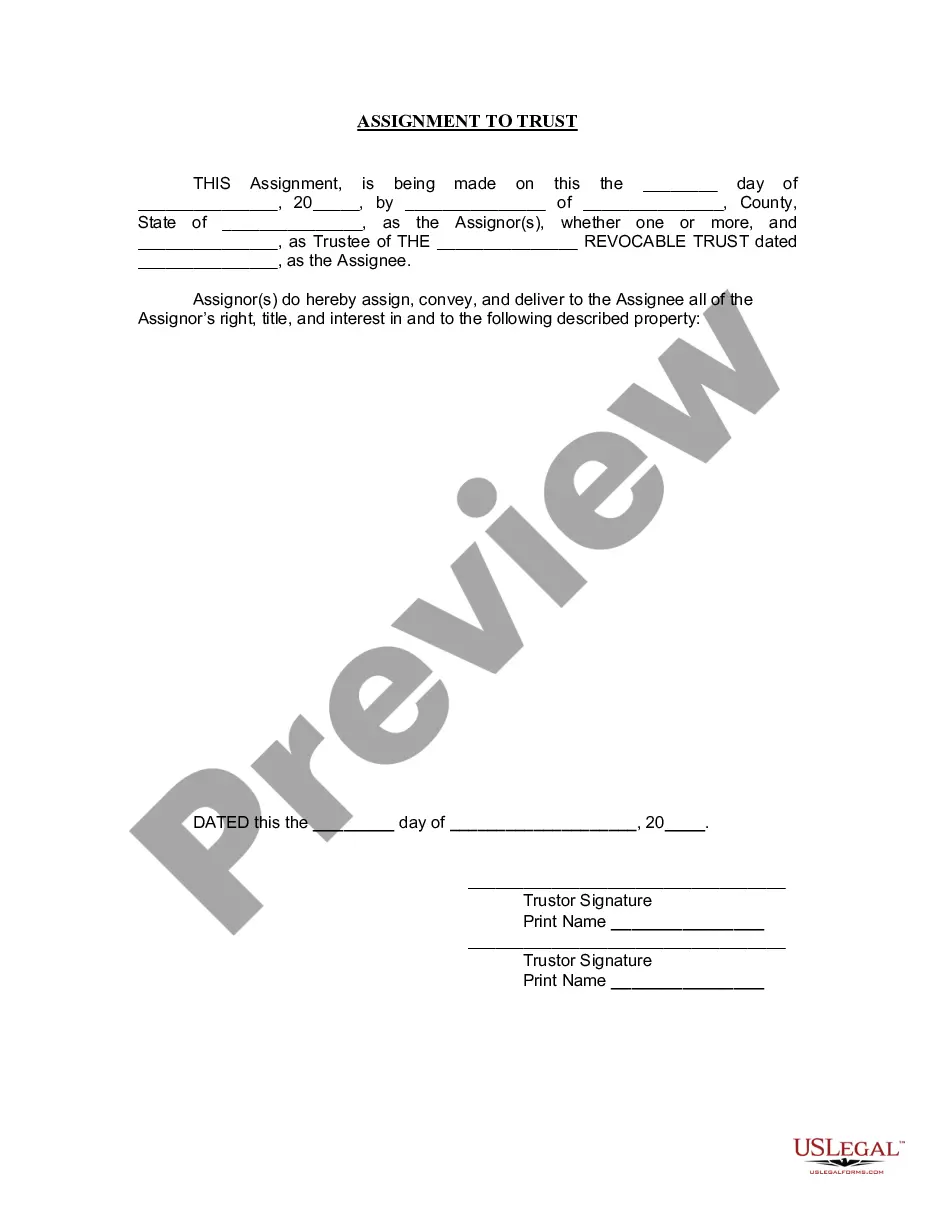

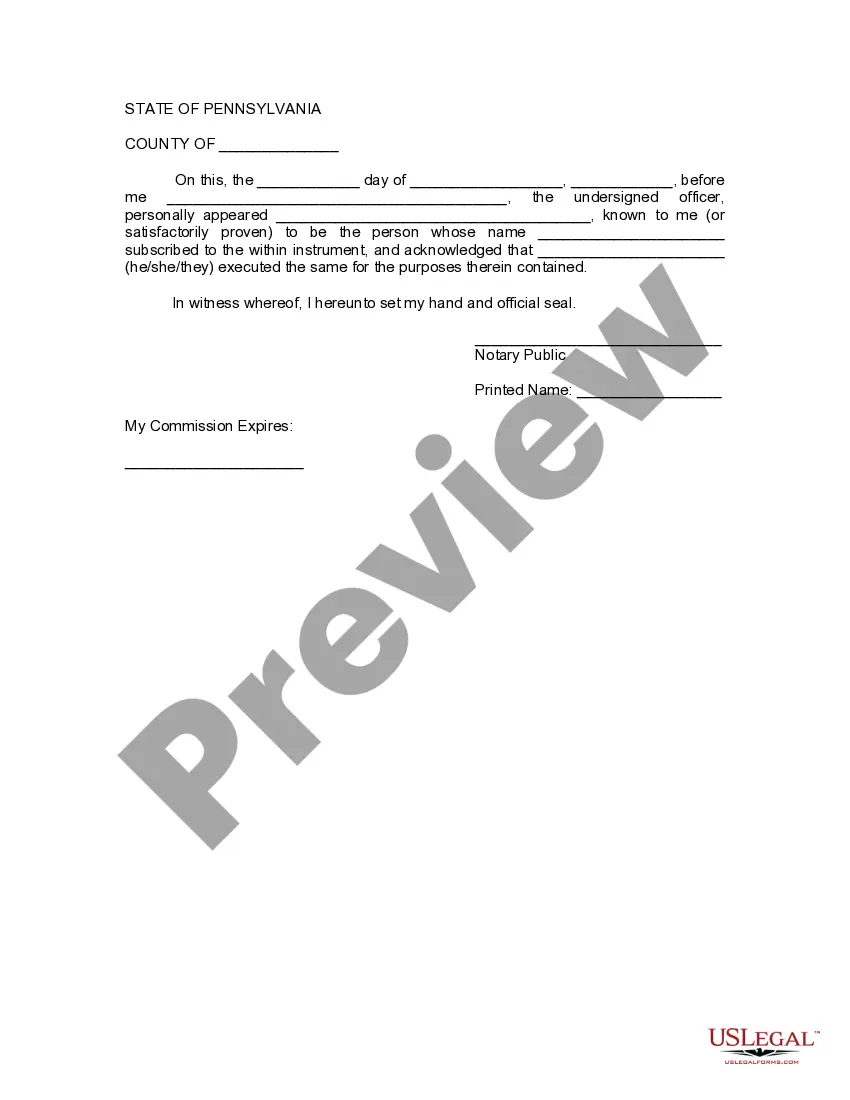

Allegheny Pennsylvania Assignment to Living Trust is a legal process that involves transferring one's assets to a trust while specifying detailed terms and conditions for their management and distribution. It is an essential estate planning strategy that ensures the smooth transfer of assets to designated beneficiaries upon the individual's death. This assignment provides numerous benefits, including avoiding probate, ensuring privacy, and allowing for efficient asset management. In Allegheny Pennsylvania, there are two main types of assignments to living trusts: revocable and irrevocable trusts. A revocable living trust allows the individual (referred to as the granter) to retain control over their assets during their lifetime. The granter can make changes, revise terms, or revoke the trust entirely if desired. This flexibility ensures that the granter has full control over their assets and may serve as a valuable tool for managing assets, even in the event of incapacity. Moreover, a revocable trust can streamline the distribution process, as it does not require the involvement of the probate court. On the other hand, an irrevocable living trust is a more restrictive type of assignment. Once the granter transfers assets to an irrevocable trust, they relinquish their ownership rights and control over the assets. This means that the granter cannot make changes or revoke the trust without the consent of the beneficiaries. Although it may seem like a loss of control, irrevocable trusts offer certain advantages such as potential tax benefits and protection against creditors. Moreover, by transferring assets to an irrevocable trust, individuals may become eligible for certain government benefits, like Medicaid, as the trust assets are not considered part of their estate. Both types of living trusts in Allegheny Pennsylvania offer unique advantages and should be considered based on individual circumstances and goals. It is essential to consult with an experienced estate planning attorney to understand the implications of each type and determine which one aligns best with one's needs and objectives. Properly setting up and funding a living trust can assist individuals in protecting their assets and ensuring a seamless transfer of wealth to their loved ones, ultimately providing peace of mind for the future.

Allegheny Pennsylvania Assignment to Living Trust

Description

How to fill out Allegheny Pennsylvania Assignment To Living Trust?

No matter the social or professional status, completing law-related forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone without any law background to create such paperwork from scratch, mainly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms can save the day. Our platform provides a massive library with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you require the Allegheny Pennsylvania Assignment to Living Trust or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Allegheny Pennsylvania Assignment to Living Trust in minutes using our trusted platform. If you are presently a subscriber, you can go on and log in to your account to download the appropriate form.

Nevertheless, in case you are a novice to our library, ensure that you follow these steps before obtaining the Allegheny Pennsylvania Assignment to Living Trust:

- Be sure the template you have chosen is suitable for your location since the regulations of one state or area do not work for another state or area.

- Preview the document and go through a brief outline (if provided) of cases the document can be used for.

- If the form you selected doesn’t suit your needs, you can start again and look for the necessary document.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your login information or create one from scratch.

- Select the payment gateway and proceed to download the Allegheny Pennsylvania Assignment to Living Trust as soon as the payment is through.

You’re all set! Now you can go on and print the document or fill it out online. In case you have any issues getting your purchased forms, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.