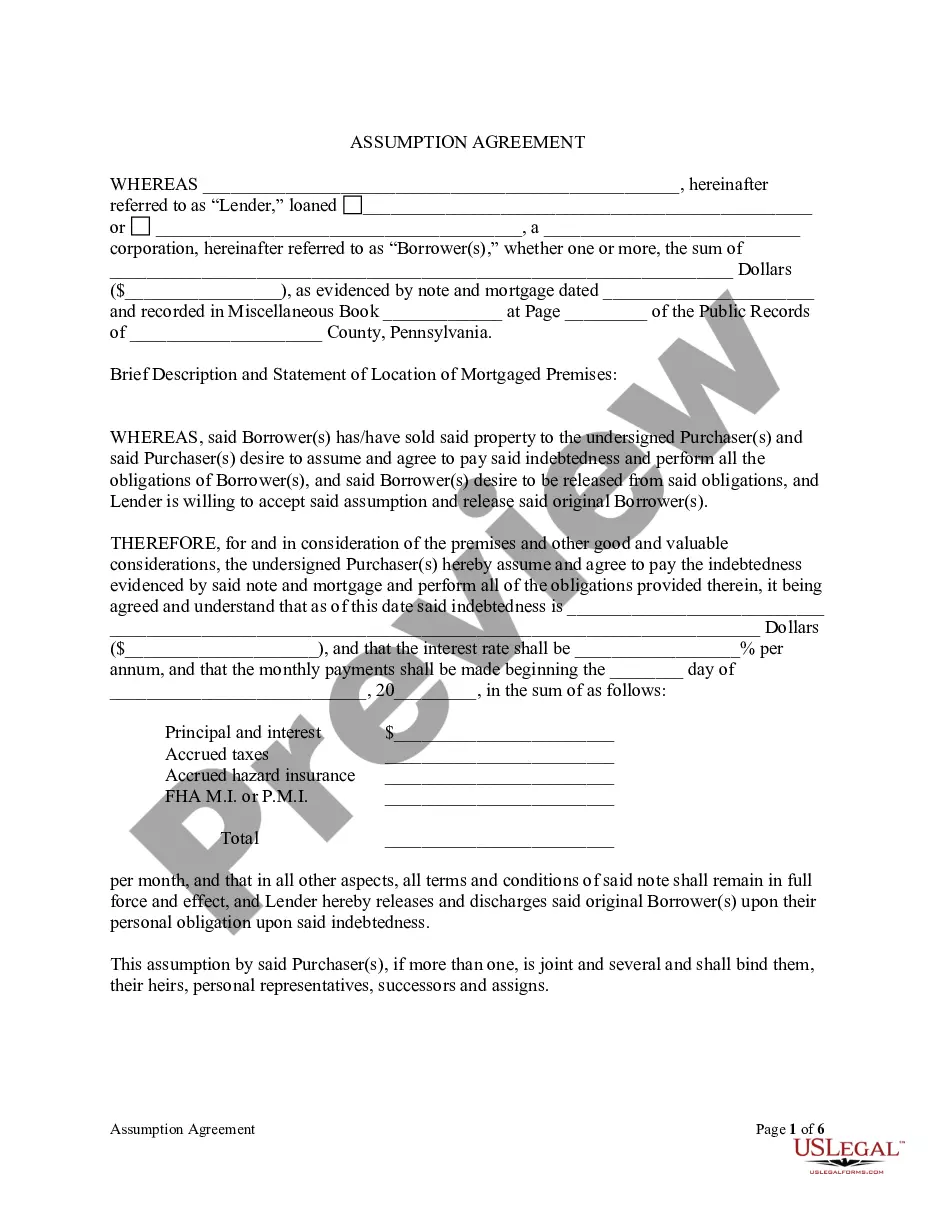

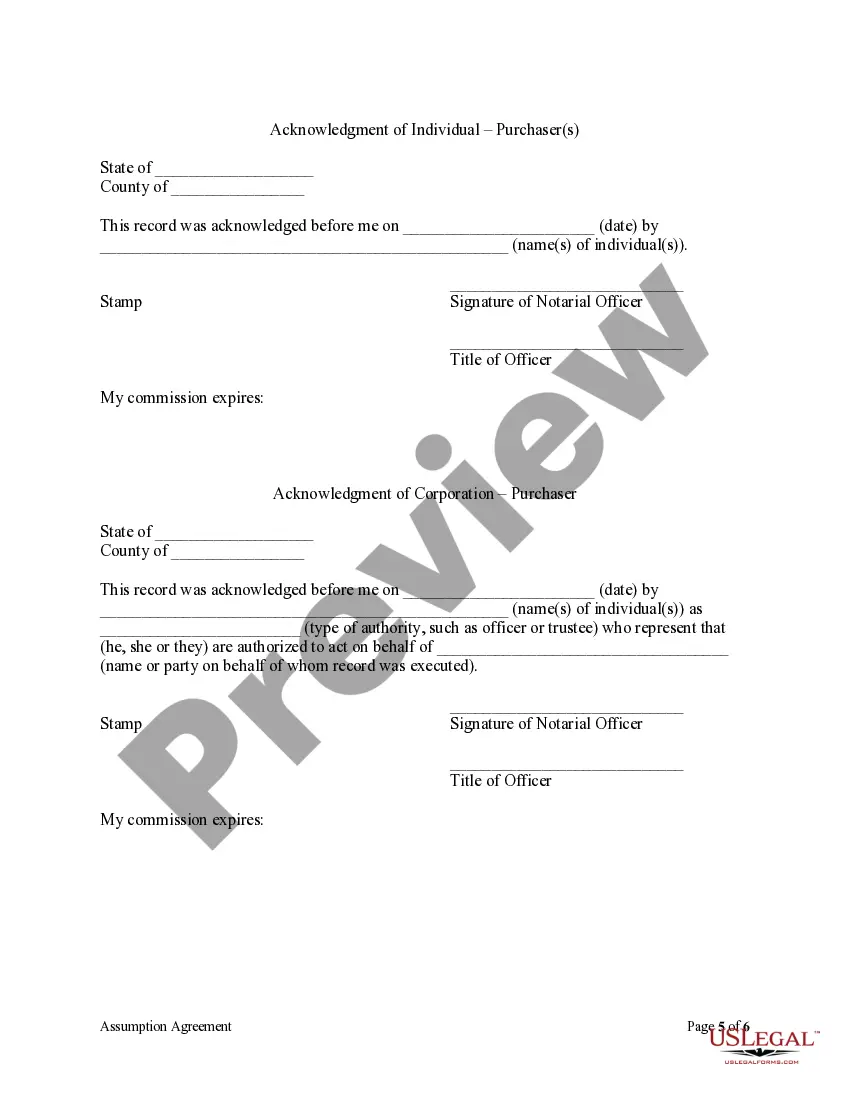

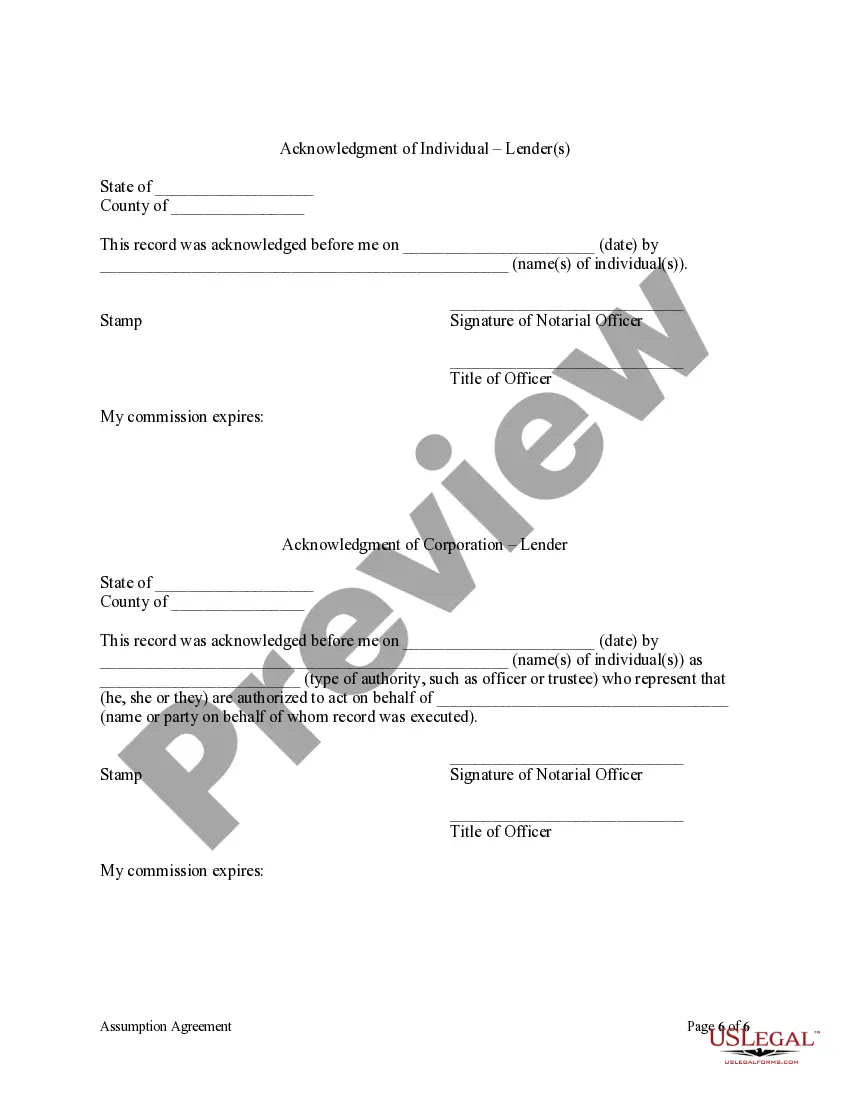

Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Pennsylvania Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Utilize the US Legal Forms and gain instant access to any document you require.

Our helpful website featuring thousands of templates allows you to easily locate and acquire nearly any document sample you need.

You can export, complete, and authenticate the Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors in just a few minutes instead of spending hours online trying to find the correct template.

Using our directory is an excellent method to enhance the security of your form submission. Our knowledgeable legal professionals routinely review all documents to ensure that the templates are appropriate for a specific area and adhere to current laws and regulations.

If you haven’t created an account yet, follow these instructions.

Visit the page containing the template you need. Verify that it is the document you were looking for: check its title and description, and use the Preview feature if it’s available. If not, use the Search field to locate the suitable one.

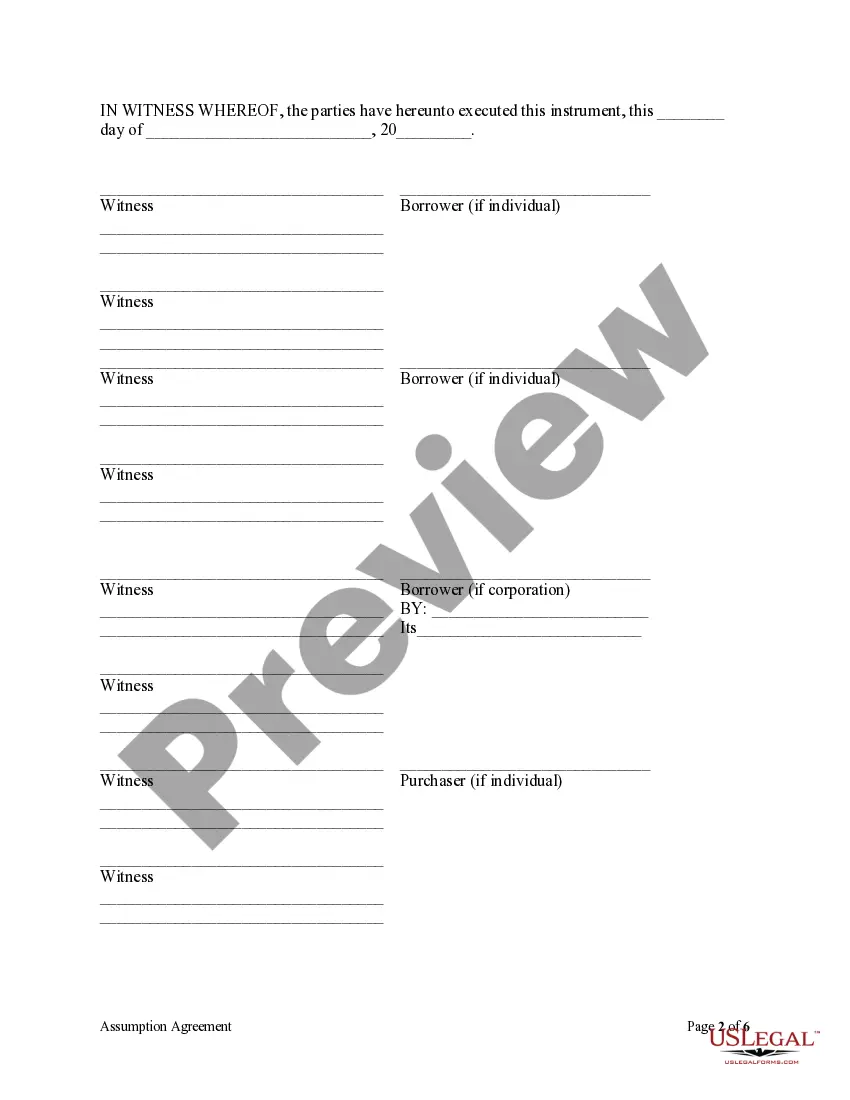

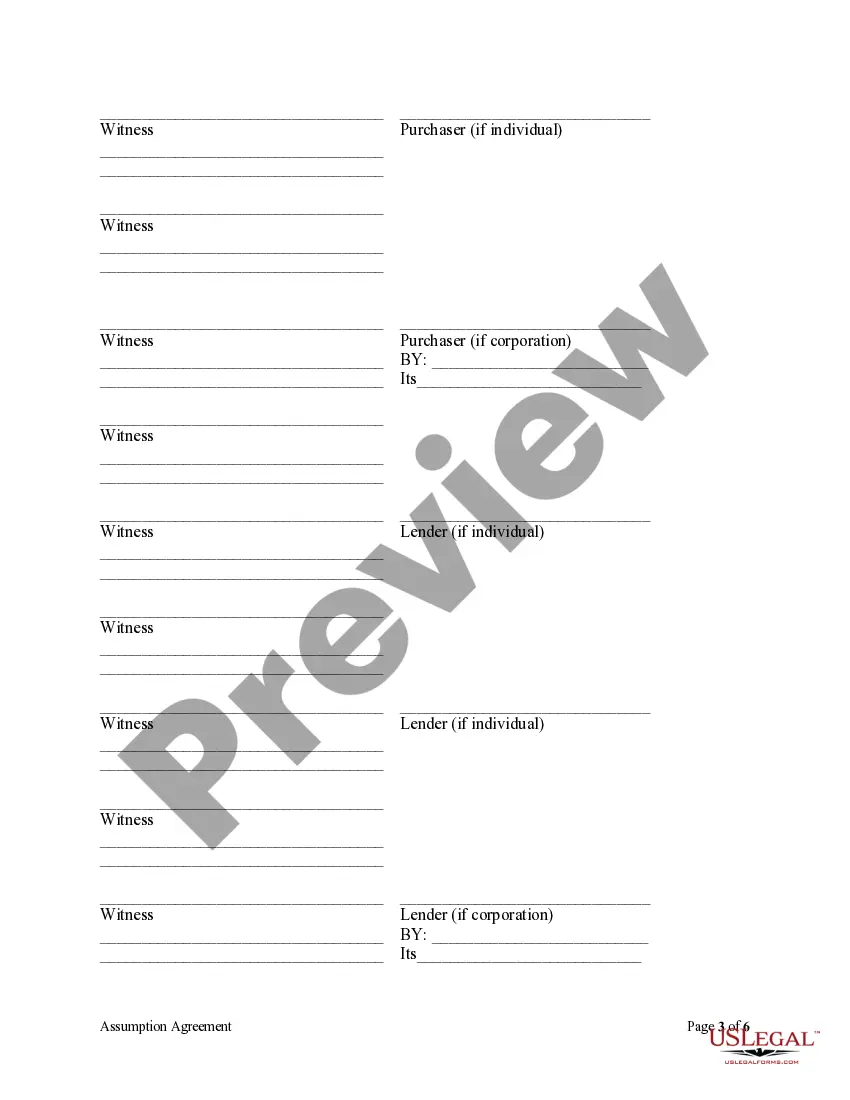

- How can you acquire the Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors.

- If you already possess an account, simply Log In to your profile. The Download button will be activated on all the documents you view.

- Additionally, you can access all the previously saved forms in the My documents section.

Form popularity

FAQ

An assumption agreement for a mortgage allows a buyer to take over the payments on an existing mortgage from the original borrower. In the context of the Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors, this arrangement can be beneficial for both parties, as it may offer lower interest rates and streamlined financing. By assuming the mortgage, the buyer also assumes liability for the mortgage, while the original mortgagor may be released from their obligation, thus simplifying the property transfer process. Using platforms like US Legal Forms can help you navigate these agreements effectively and ensure all necessary documents are handled correctly.

The catch with an assumable mortgage often involves the lender's approval process, which may include extensive background checks and additional fees. While the concept sounds appealing, not everyone may qualify for the assumption, which can lead to unexpected hurdles. To navigate this process effectively, having a clear understanding of the Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors is essential.

To assume a mortgage, you'll generally need the original mortgage agreement, a formal application for assumption, financial documentation (such as credit history and income verification), and potential disclosures from the lender. Completing this paperwork accurately is crucial for a smooth assumption process in accordance with the Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors.

One potential downside of assuming a mortgage in the context of a Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors is that the original borrower still holds liability if the new borrower defaults. Additionally, lenders might impose fees or require a thorough credit check for the assumption process, which could deter some buyers. It’s vital to understand all financial implications before proceeding with the assumption.

Yes, you eventually receive a physical copy of your deed, typically after it is recorded with the county. This document is crucial for proving ownership and may be necessary for future transactions, such as those involving the Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors. Keeping this copy safe is vital.

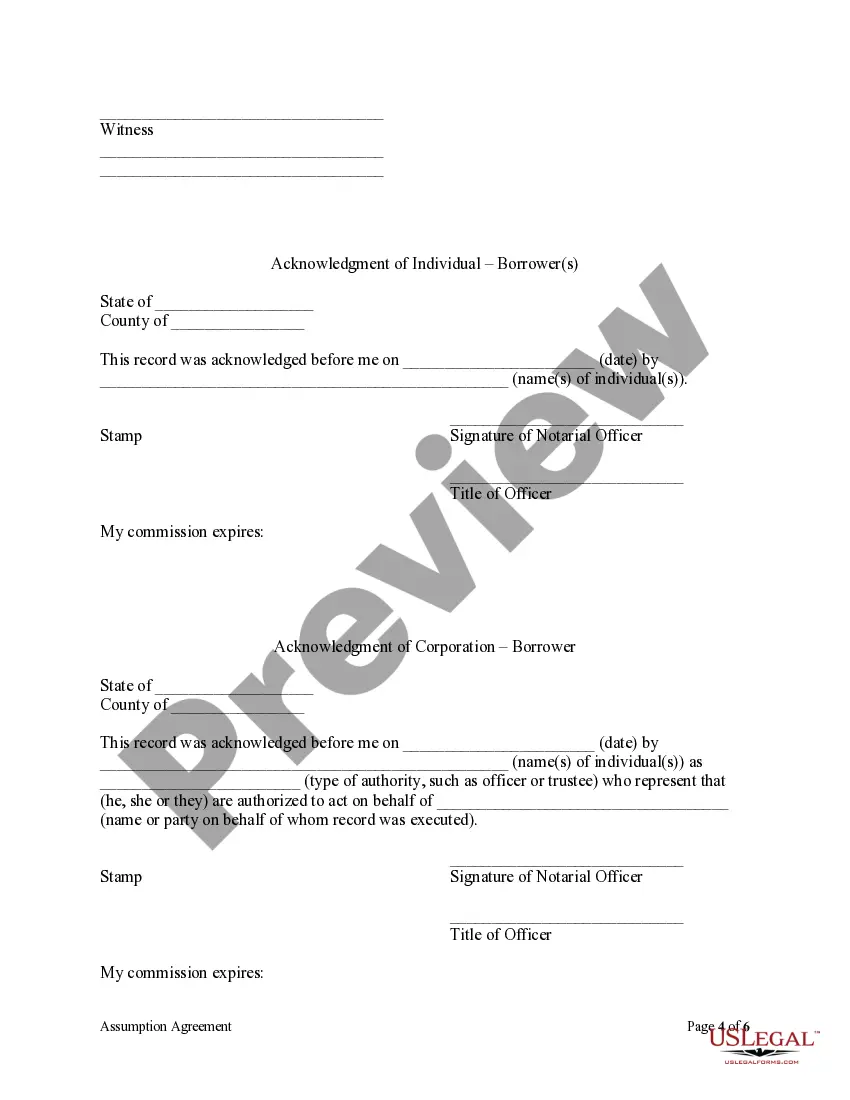

To transfer a deed in Pennsylvania, you usually require a signed and notarized document, a legal description of the property, and payment of transfer taxes. Each transaction may involve unique details, particularly for the Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors. UsLegalForms can provide templates that simplify this process.

Most people keep their deed in a safe place, such as a fireproof safe or a safety deposit box. This ensures that the document remains secure and accessible for future transactions, including processes like the Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors. It's always good to know where your important documents are stored.

The original deed is typically kept by the county recorder’s office once the property is recorded. However, homeowners may also retain copies for their records. During transactions like the Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors, having a copy handy is beneficial for reference.

At closing, you receive documents related to the property transaction, but you may not receive the physical deed immediately. Instead, the deed is often filed with the county office, which then sends you a copy. This process relates to the Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors as it confirms ownership transfer.

Yes, you can prepare your own deed in Pennsylvania, but doing so requires careful attention to detail. You must ensure that all legal requirements are met, especially in matters like the Philadelphia Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors. If you are unfamiliar with the legal language, consider using a service like USLegalForms for guidance.