Summary Administration Package - Not More than $50,000 - Small Estates

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. If the deceased had conveyed most property to a trust but there remains some property, small estate laws may also be available. Small Estate procedures may generally be used regardless of whether there was a Will. In general, the two forms of small estate procedures are recognized:

1.Small Estate Affidavit -Some States allow an affidavit to be executed by the spouse and/or heirs of the deceased and present the affidavit to the holder of property such as a bank to obtain property of the deceased. Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.

2.Summary Administration -Some states allow a Summary administration. Some States recognize both the Small Estate affidavit and Summary Administration, basing the requirement of which one to use on the value of the estate. Example: If the estate value is 10,000 or less an affidavit is allowed but if the value is between 10,000 to 20,000 a summary administration is allowed.

Pennsylvania Summary:

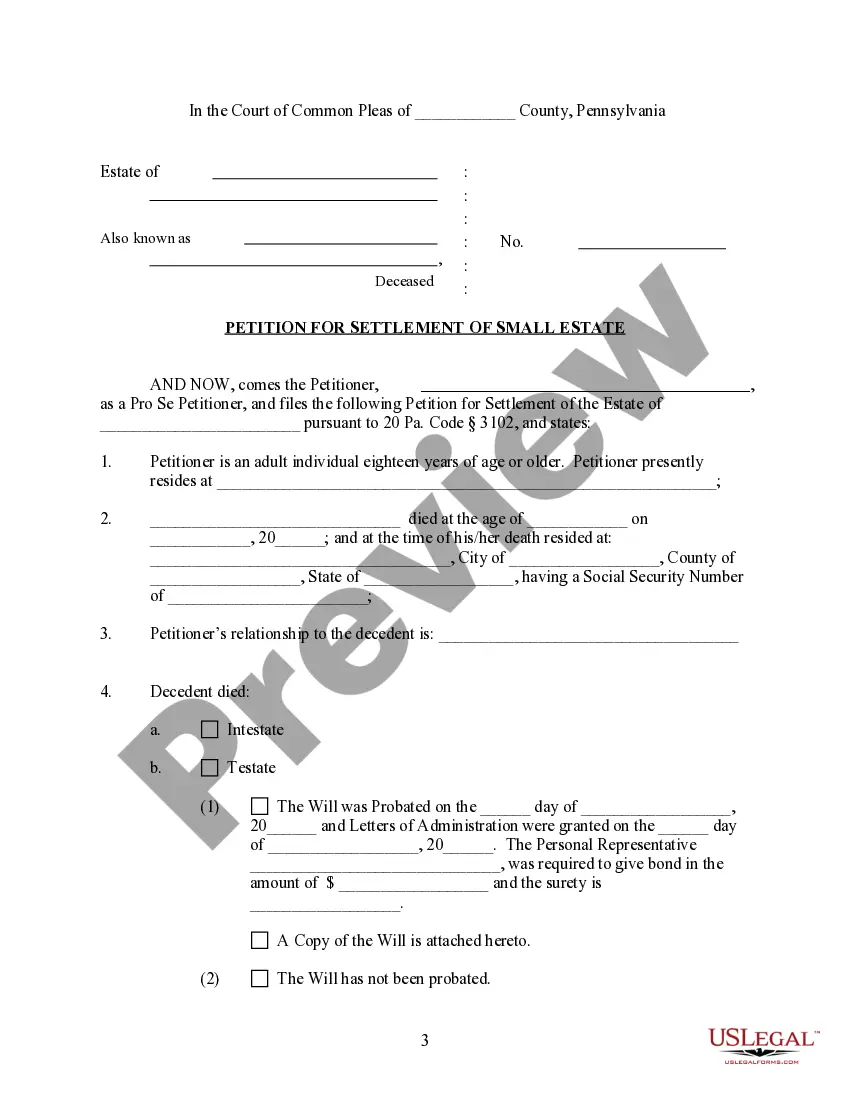

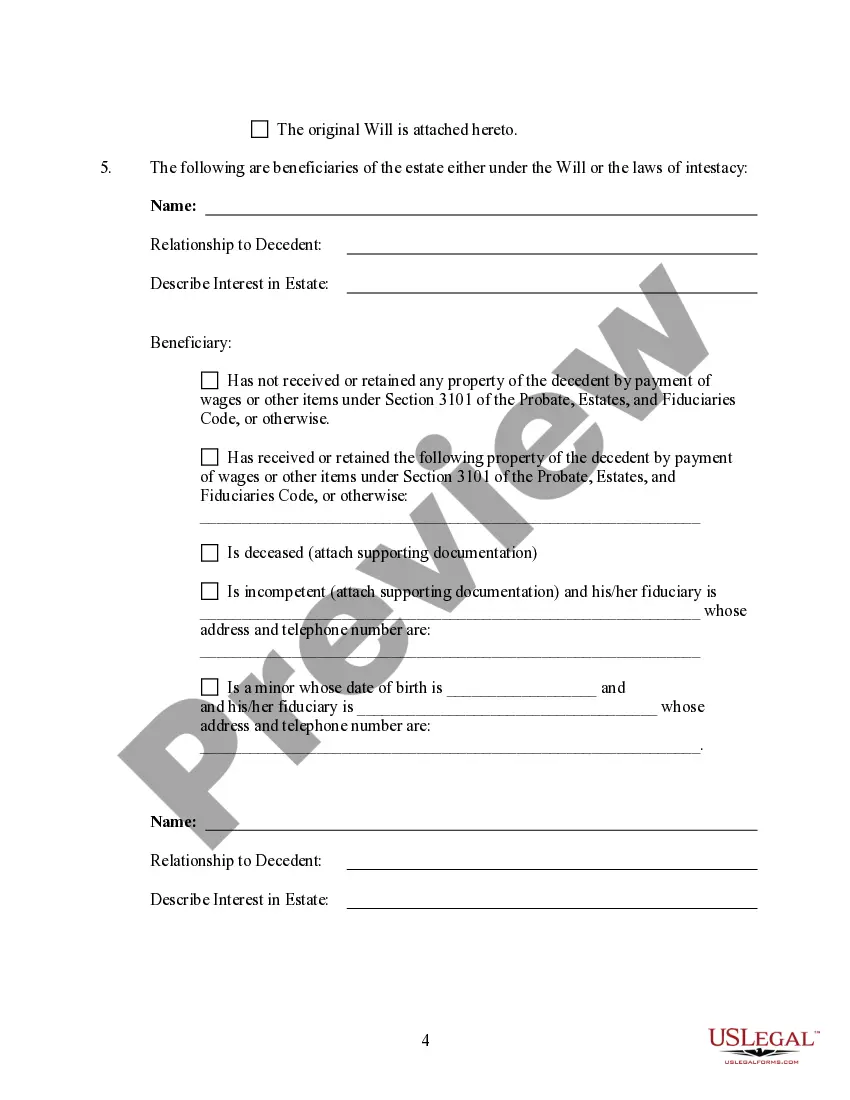

Under Pennsylvania statute, where as estate is valued at less than $25,000, an interested party may petition the court and the court may, in its discretion, with or without appraisement, and with such notice as the court shall direct, and whether or not letters have been issued or a will probated, may direct distribution of the property.

Pennsylvania Requirements:

Pennsylvania requirements are set forth in the statutes below.

DECEDENTS, ESTATES AND FIDUCIARIES (Title 20)

Chapter 31. Dispositions Independent Of Letters; Family Exemption; Probate Of Wills And Grant Of Letters.

Subchapter A. Dispositions Independent Of Letters.

§ 3101. Payments to family and funeral directors.

(a) Wages, salary or employee benefits.--Any employer of a person dying domiciled in this Commonwealth at any time after the death of the employee, whether or not a personal representative has been appointed, may pay wages, salary or any employee benefits due the deceased in an amount not exceeding $5,000 to the spouse, any child, the father or mother, or any sister or brother (preference being given in the order named) of the deceased employee. Any employer making such a payment shall be released to the same extent as if payment had been made to a duly appointed personal representative of the decedent and he shall not be required to see to the application thereof. Any person to whom payment is made shall be answerable therefor to anyone prejudiced by an improper distribution.

(b) Deposit account.--Any bank, savings association, savings and loan association, building and loan association, credit union or other savings organization, at any time after the death of a depositor, member or certificate holder, shall pay the amount on deposit or represented by the certificate, when the total standing to the credit of the decedent in that institution does not exceed $10,000, to the spouse, any child, the father or mother or any sister or brother (preference being given in the order named) of the deceased depositor, member or certificate holder, provided that a receipted funeral bill or an affidavit, executed by a licensed funeral director which sets forth that satisfactory arrangements for payment of funeral services have been made, is presented. Any bank, association, credit union or other savings organization making such a payment shall be released to the same extent as if payment had been made to a duly appointed personal representative of the decedent and it shall not be required to see to the application thereof. Any person to whom payment is made shall be answerable therefor to anyone prejudiced by an improper distribution.

(c) Patient's care account.--When the decedent was a qualified recipient of medical assistance from the Department of Public Welfare, 1 the facility in which he was a patient may make payment of funds, if any, remaining in the patient's care account, for the decedent's burial expenses to a licensed funeral director in an amount not exceeding $10,000 whether or not a personal representative has been appointed. After the payment of decedent's burial expenses, the facility may pay the balance of decedent's patient's care account, as long as the payments, including the payment for burial expenses, does not exceed $10,000, to the spouse, any child, the father or mother or any sister or brother (preference being given in the order named) of the deceased patient. Any facility making such a payment shall be released to the same extent as if payment had been made to a duly appointed personal representative of the decedent and it shall not be required to see to the application thereof. Any licensed funeral director or other person to whom payment is made shall be answerable therefor to anyone prejudiced by an improper distribution.

(d) Life insurance payable to estate.--Any insurance company which upon the death of an individual residing in this Commonwealth owes his estate a total amount of $11,000 or less under any policy of life, endowment, accident or health insurance, or under any annuity or pure endowment contract, may at any time after 60 days following his death pay all or any part of that amount to the spouse, any child, the father or mother or any sister or brother of the decedent (preference being given in the order named) provided that at the time of the payment no written claim for that money has been received at the office of the company specified in the policy or contract for the receipt of claims from any duly appointed personal representative of the decedent. Any insurance company making any payment in accordance with this section to an adult may rely on the affidavit of any of the persons named in this subsection concerning the existence and relationship of these persons and shall be released to the same extent as if payment had been made to a duly appointed personal representative of the decedent and the insurance company shall not be required to see to the application thereof. Any person to whom payment is made shall be answerable therefor to anyone prejudiced by an improper distribution.

(e) Unclaimed property.--

(1) In any case where property or funds owned by an individual who has died a resident of this Commonwealth have been reported to the Commonwealth and are in the custody of the State Treasurer as unclaimed or abandoned property, the State Treasurer, at any time after the death of the individual, shall be authorized under this section to distribute the property or to pay the amount being held in custody where all of the following conditions are present:

(i) The amount of the funds or the value of the property is $11,000 or less.

(ii) The person claiming the property or the funds is the surviving spouse, child, mother or father, or sister or brother of the decedent, with preference given in that order.

(iii) A personal representative of the decedent has not been appointed or five years have 2 lapsed since the appointment of a personal representative of the decedent.

(2) Upon being presented <p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);">with a claim for property owned by a decedent, the State Treasurer shall require the person claiming the property to provide all of the following prior to distributing the property or paying the amount held in custody:<br style="box-sizing: border-box;" />

(i) A certified death certificate of the owner.<br style="box-sizing: border-box;" />

(ii) A sworn affidavit under the penalties of 18 Pa.C.S. § 4904 (relating to unsworn falsification to authorities) setting forth the relationship of the claimant to the decedent, the existence or nonexistence of a duly appointed personal representative of the decedent and any other persons that may be entitled under this section to make a claim to the decedent’s property.<br style="box-sizing: border-box;" />

(iii) Other information determined by the State Treasurer to be necessary in order to distribute property or pay funds under this section to the proper person.<br style="box-sizing: border-box;" />

(3) If the State Treasurer determines the claimant to be a person entitled to claim property of a decedent owner, the State Treasurer shall pay or distribute such property to the claimant and shall thereby be released to the same extent as if payment or distribution had been made to a duly appointed personal representative of the decedent and shall not be required to oversee the application of the payments made. Any claimant to whom payment is made shall be answerable therefore to anyone prejudiced by an improper distribution or payment.</p>

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);">1972, June 30, P.L. 508, No. 164, § 2, eff. July 1, 1972. Amended 1974, May 10, P.L. 282, No. 84, § 1, imd. effective; 1975, Dec. 19, P.L. 598, No. 168, § 1, imd. effective; 1976, July 9, P.L. 551, No. 135, § 15, imd. effective; 1980, July 11, P.L. 565, No. 118, § 3, effective in 60 days; 1982, Feb. 18, P.L. 45, No. 26, § 2, imd. effective; 1993, June 28, P.L. 181, No. 38, § 1, imd. effective; 1994, Dec. 1, P.L. 655, No. 102, § 3, effective in 60 days; 2002, June 28, P.L. 478, No. 80, § 1, imd. effective; 2013, July 2, P.L. 199, No. 35, § 1, effective in 60 days [Sept. 3, 2013].</p>

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);"><span style="box-sizing: border-box; font-weight: 600;">§ 3102. Settlement of small estates on petition.</span></p>

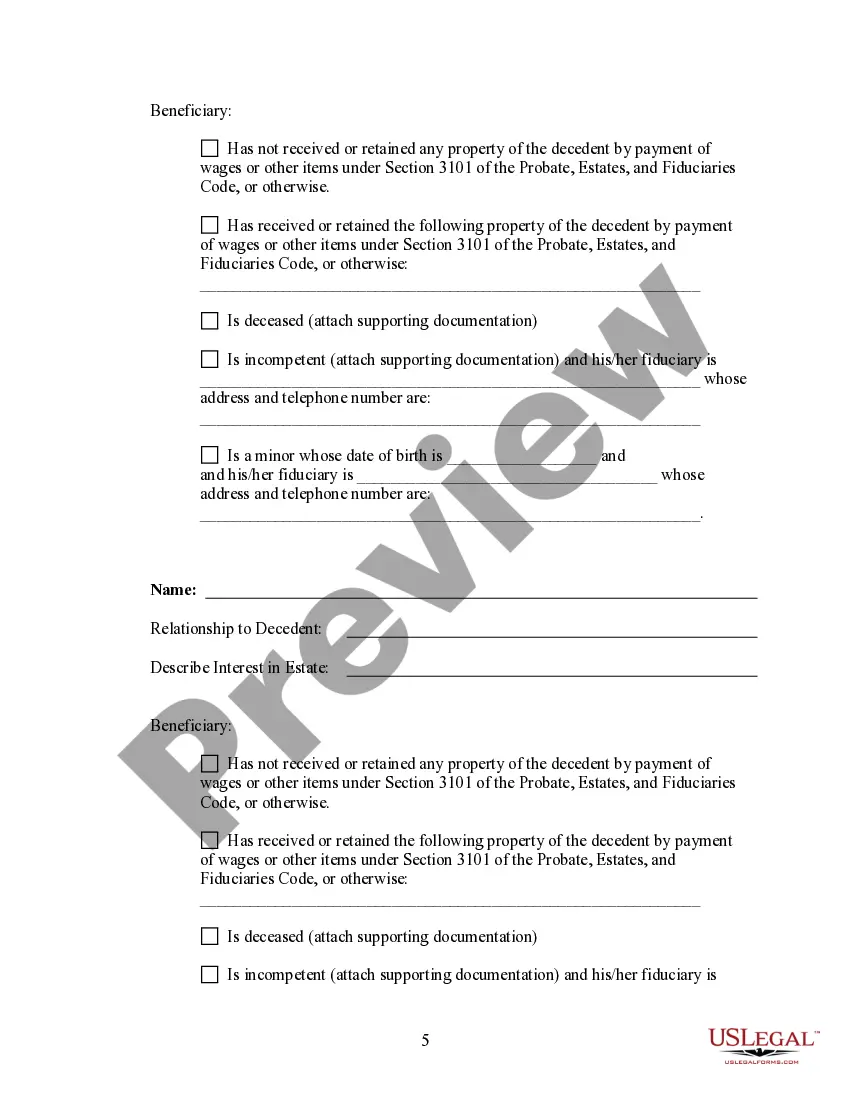

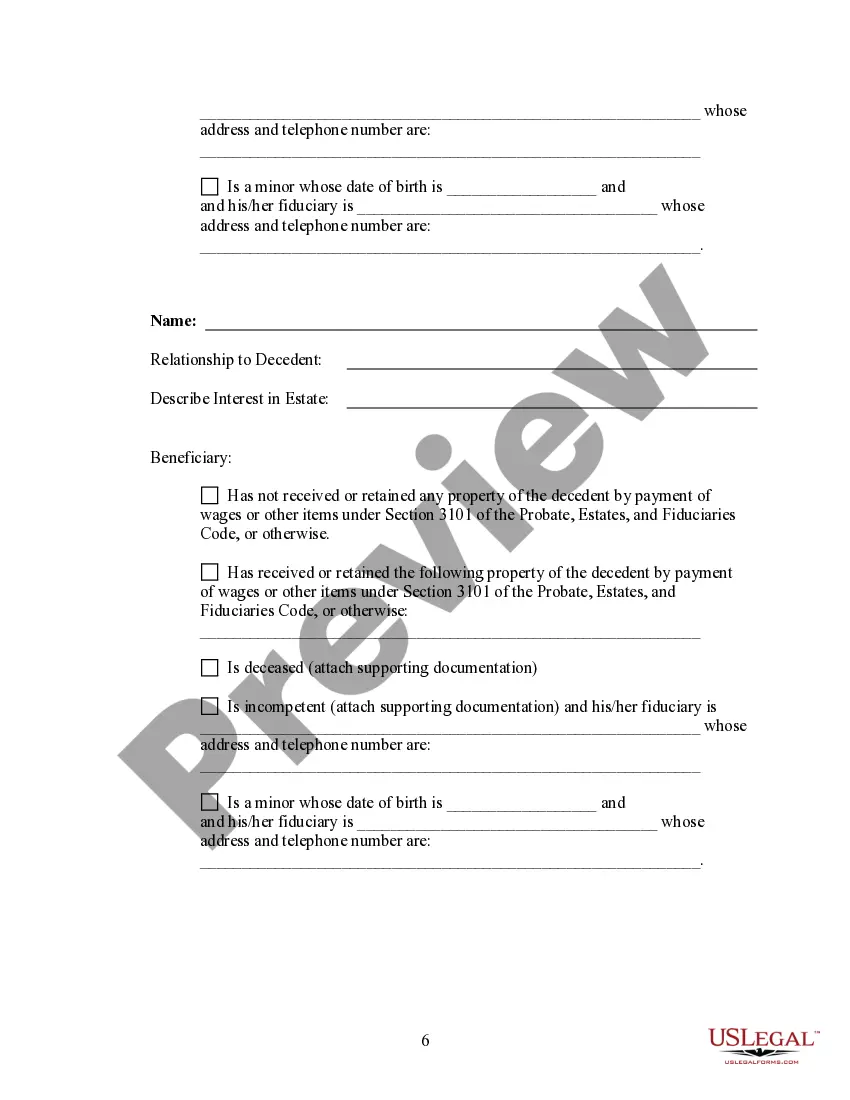

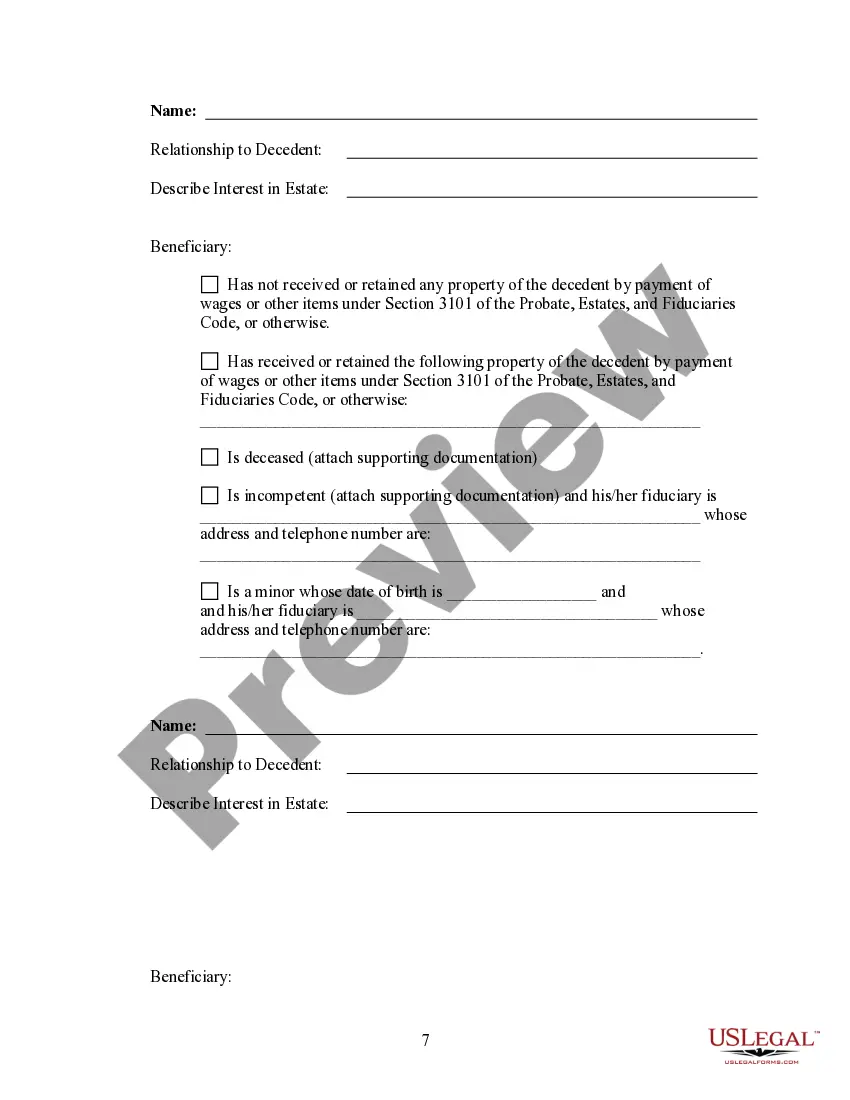

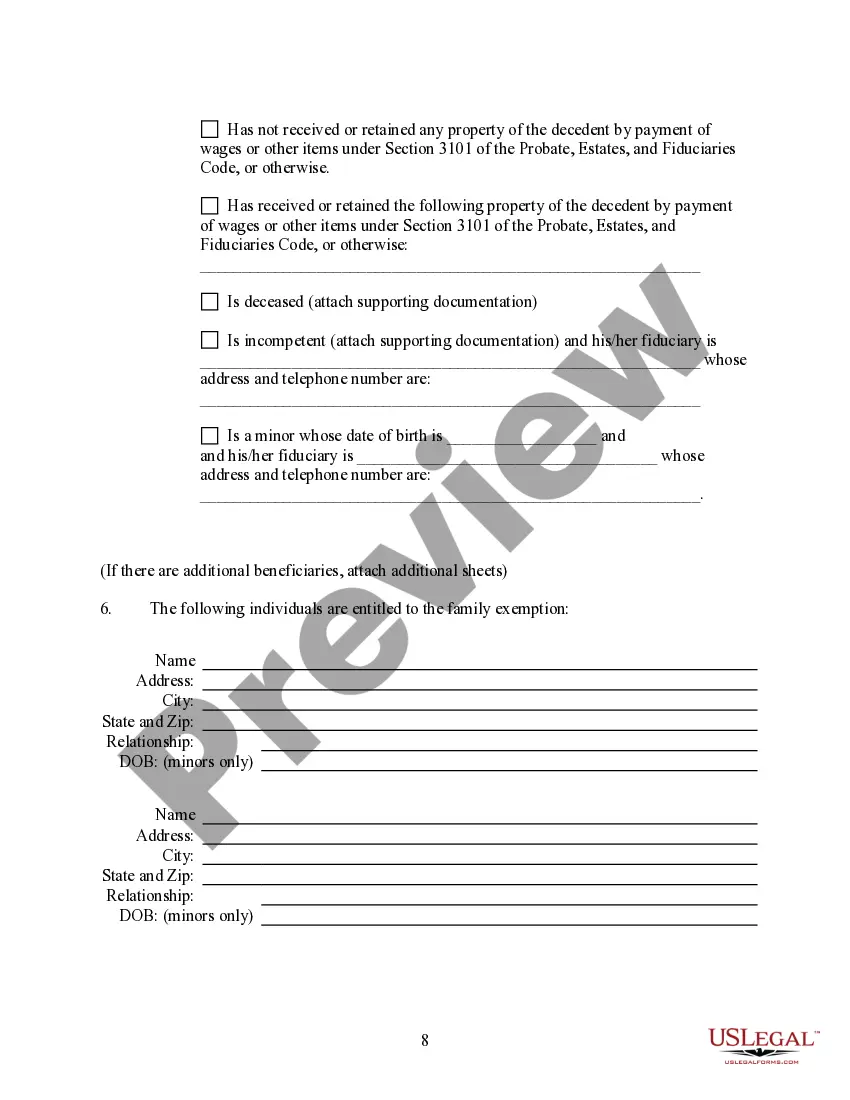

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);">When any person dies domiciled in the Commonwealth owning property (exclusive of real estate and of property payable under section 3101 (relating to payments to family and funeral directors), but including personal property claimed as the family exemption) of a gross value not exceeding $50,000, the orphans’ court division of the county wherein the decedent was domiciled at the time of his death, upon petition of any party in interest, in its discretion, with or without appraisement, and with such notice as the court shall direct, and whether or not letters have been issued or a will probated, may direct distribution of the property (including property not paid under section 3101) to the parties entitled thereto. The authority of the court to award distribution of personal property under this section shall not be restricted because of the decedent’s ownership of real estate, regardless of its value. The decree of distribution so made shall constitute sufficient authority to all transfer agents, registrars and others dealing with the property of the estate to recognize the persons named therein as entitled to receive the property to be distributed without administration, and shall in all respects have the same effect as a decree of distribution after an accounting by a personal representative. Within one year after such a decree of distribution has been made, any party in interest may file a petition to revoke it because an improper distribution has been ordered. If the court shall find that an improper distribution has been ordered, it shall revoke the decree and shall direct restitution as equity and justice shall require.</p>

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);">1972, June 30, P.L. 508, No. 164, § 2, eff. July 1, 1972. Amended 1974, Dec. 10, P.L. 867, No. 293, § 7; 1980, July 11, P.L. 565, No. 118, § 3, effective in 60 days; 1994, Dec. 1, P.L. 655, No. 102, § 3, effective in 60 days; 2013, July 2, P.L. 199, No. 35, § 1, effective in 60 days [Sept. 3, 2013].</p>