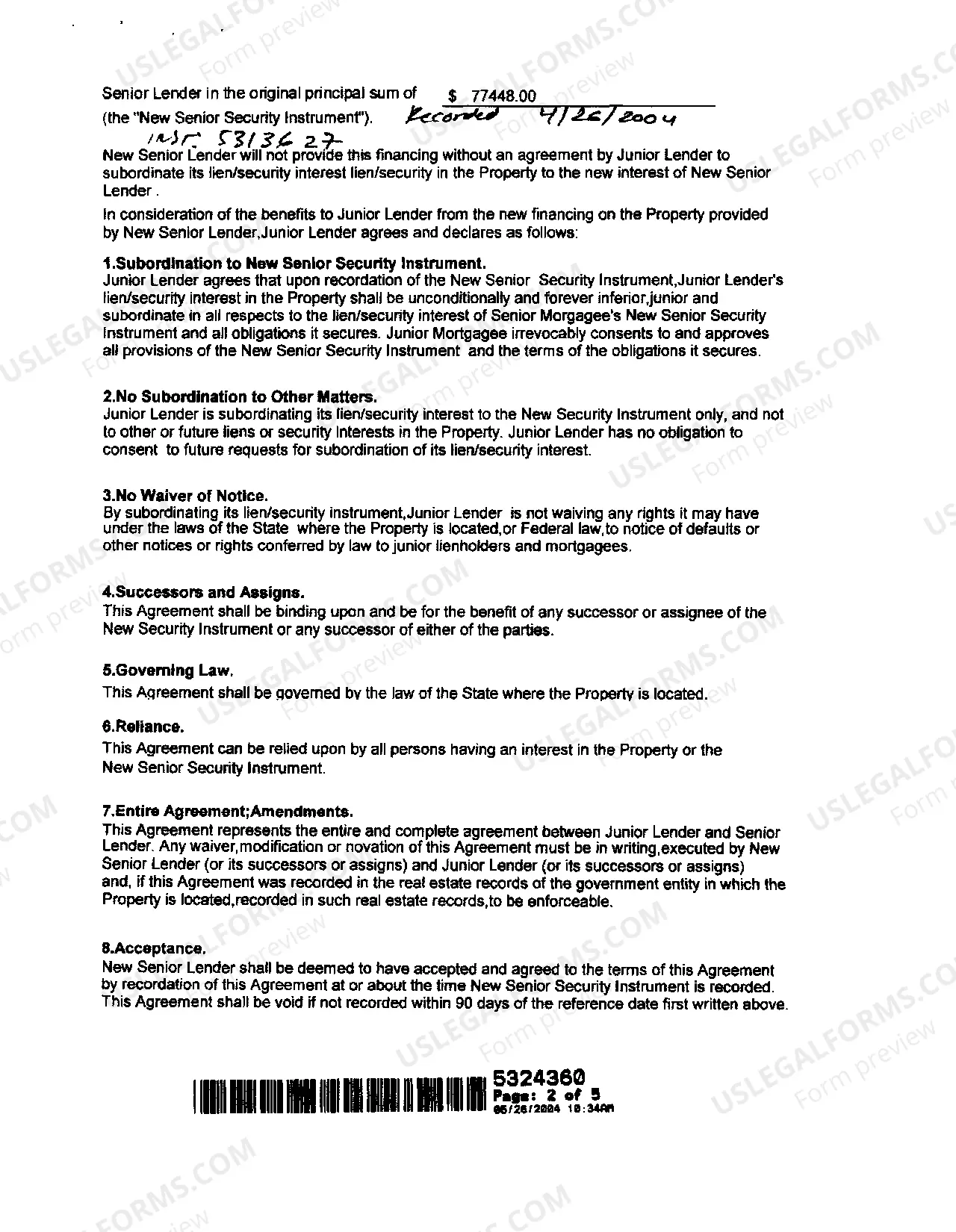

A Pittsburgh Pennsylvania Subordination Agreement by Junior Lender to New Senior Security Instrument is a legal document that outlines the terms and conditions by which a junior lender agrees to subordinate their interest to a new senior security instrument. This agreement is commonly used in real estate transactions where there are multiple loans or liens on a property. In such cases, a junior lender holds a secondary position in terms of priority behind a senior lender. However, when a new senior security instrument is put in place, it becomes necessary to modify the existing loan agreements to reflect the changes in priority. This is where the Pittsburgh Pennsylvania Subordination Agreement comes into play. This agreement ensures that the junior lender acknowledges and agrees to their new subordinate position in relation to the senior lender. It also defines the rights and obligations of each party involved, providing protection and clarity for all parties. Different types of Pittsburgh Pennsylvania Subordination Agreements can be categorized based on the specific circumstances they address. Some common types include: 1. Subordination Agreement for a Second Mortgage: This type of agreement is used when there is a second mortgage on a property, and the junior lender agrees to subordinate their lien to a new senior security instrument, often in the form of a refinanced first mortgage. 2. Subordination Agreement for Construction Loans: In construction projects, there may be multiple loans involved at different stages. Here, a junior lender who has provided funds for a specific construction phase agrees to subordinate their lien to a new senior security instrument that covers the entire project. 3. Subordination Agreement for Home Equity Line of Credit (HELOT): This type of agreement is used when there is an existing HELOT on a property, and the junior lender agrees to subordinate their interest to a new senior security instrument, such as a refinanced mortgage or a new loan. 4. Subordination Agreement for Commercial Real Estate Loans: Commercial real estate transactions often involve multiple loans or liens. In this case, a junior lender agrees to subordinate their lien to a new senior security instrument, which may be a refinanced loan or a new loan altogether. It is important to consult with legal professionals specializing in real estate law to draft and execute a Pittsburgh Pennsylvania Subordination Agreement by Junior Lender to New Senior Security Instrument accurately. This ensures compliance with all relevant laws and protects the rights and interests of all parties involved.

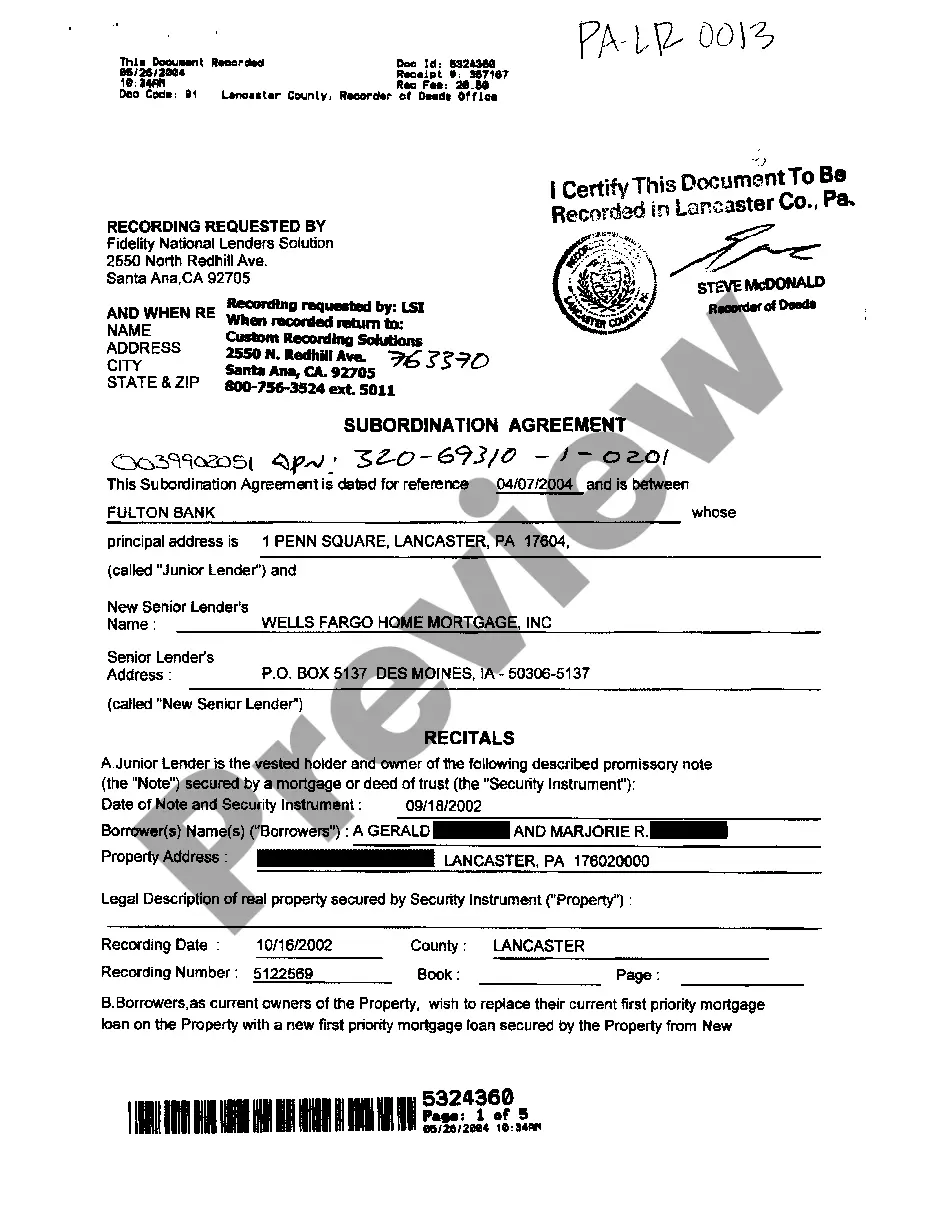

Pittsburgh Pennsylvania Subordination Agreement by Junior Lender to New Senior Security Instrument

State:

Pennsylvania

City:

Pittsburgh

Control #:

PA-LR-0013

Format:

PDF

Instant download

This form is available by subscription

Description

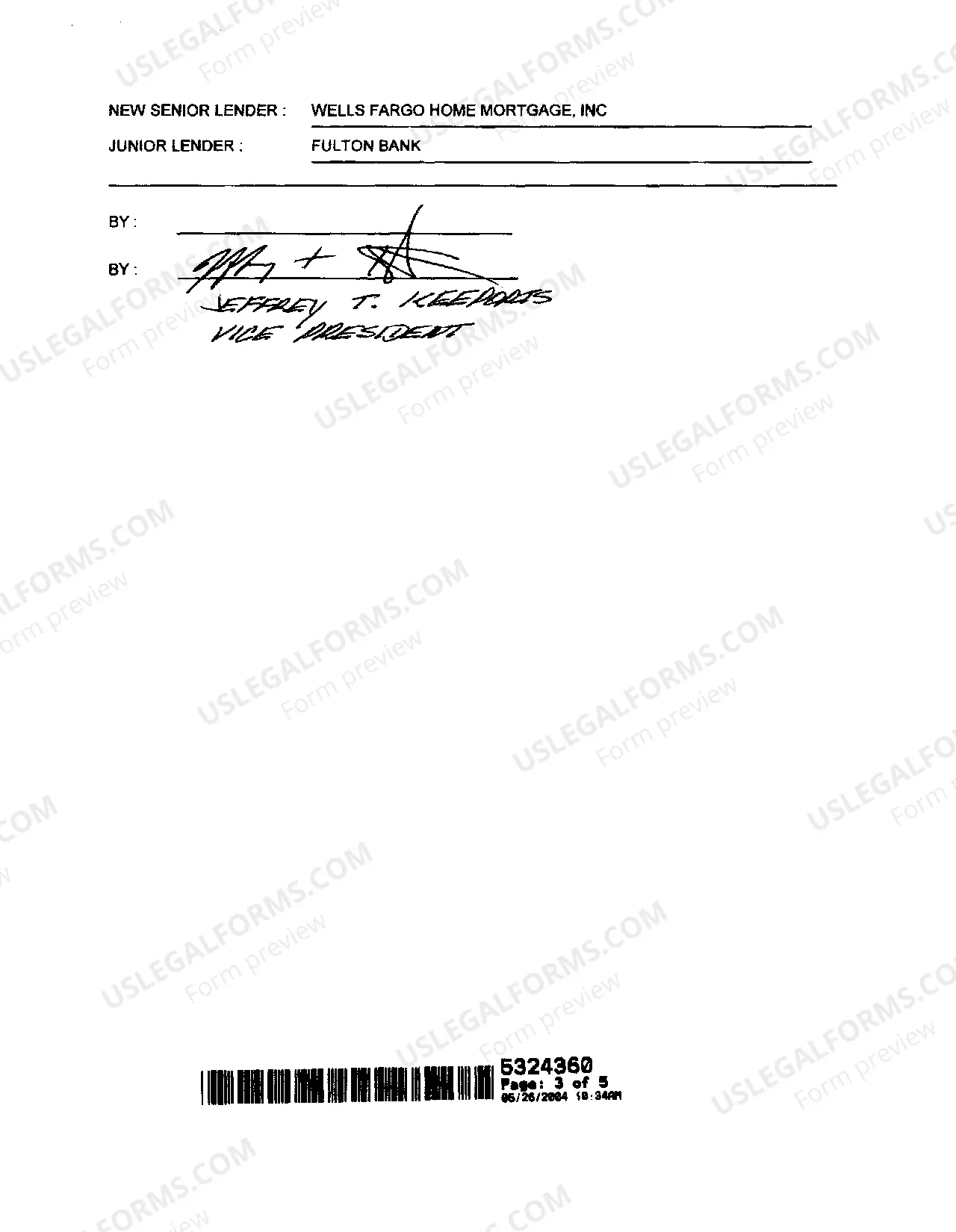

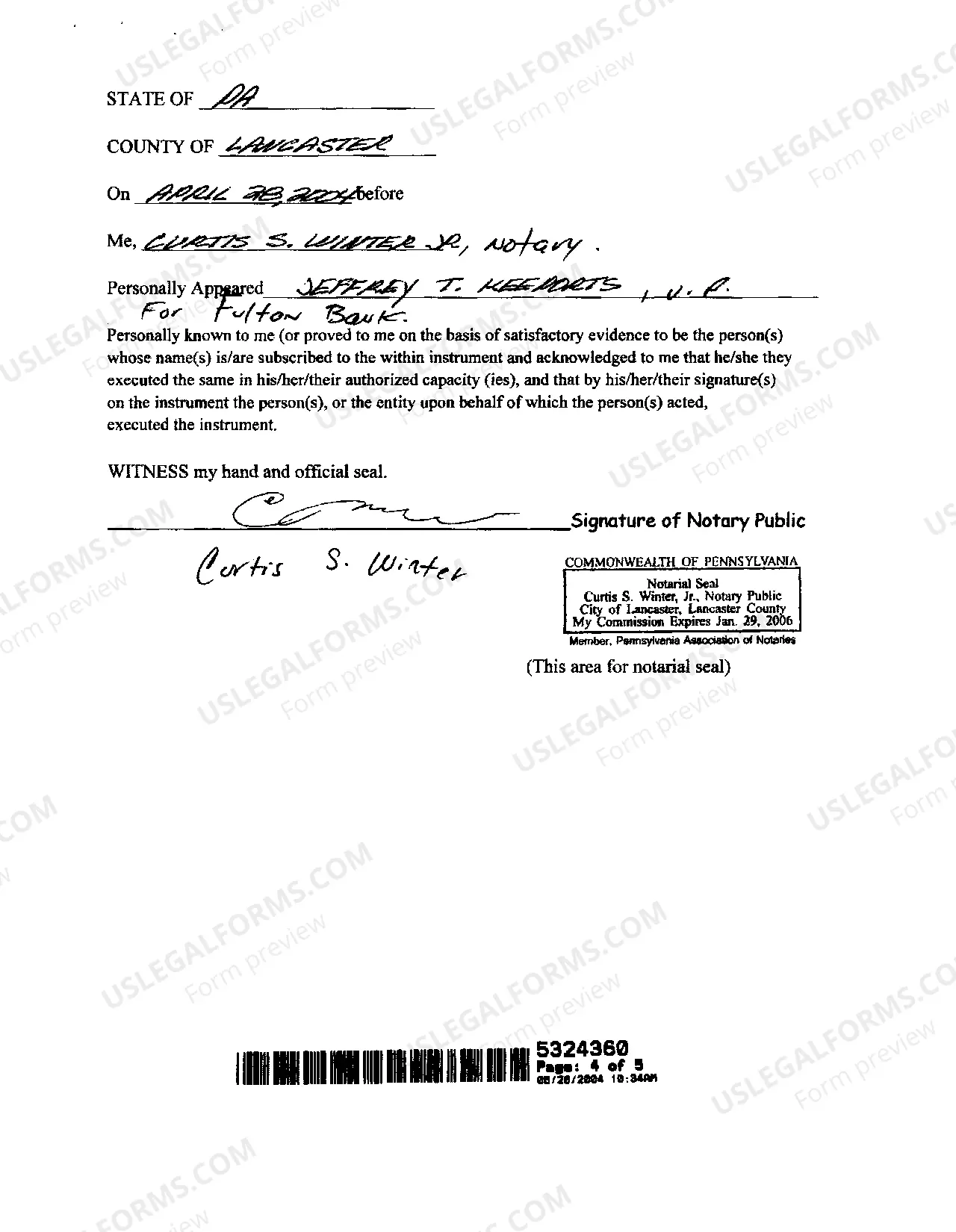

Subordination Agreement by Junior Lender to New Senior Security Instrument

A Pittsburgh Pennsylvania Subordination Agreement by Junior Lender to New Senior Security Instrument is a legal document that outlines the terms and conditions by which a junior lender agrees to subordinate their interest to a new senior security instrument. This agreement is commonly used in real estate transactions where there are multiple loans or liens on a property. In such cases, a junior lender holds a secondary position in terms of priority behind a senior lender. However, when a new senior security instrument is put in place, it becomes necessary to modify the existing loan agreements to reflect the changes in priority. This is where the Pittsburgh Pennsylvania Subordination Agreement comes into play. This agreement ensures that the junior lender acknowledges and agrees to their new subordinate position in relation to the senior lender. It also defines the rights and obligations of each party involved, providing protection and clarity for all parties. Different types of Pittsburgh Pennsylvania Subordination Agreements can be categorized based on the specific circumstances they address. Some common types include: 1. Subordination Agreement for a Second Mortgage: This type of agreement is used when there is a second mortgage on a property, and the junior lender agrees to subordinate their lien to a new senior security instrument, often in the form of a refinanced first mortgage. 2. Subordination Agreement for Construction Loans: In construction projects, there may be multiple loans involved at different stages. Here, a junior lender who has provided funds for a specific construction phase agrees to subordinate their lien to a new senior security instrument that covers the entire project. 3. Subordination Agreement for Home Equity Line of Credit (HELOT): This type of agreement is used when there is an existing HELOT on a property, and the junior lender agrees to subordinate their interest to a new senior security instrument, such as a refinanced mortgage or a new loan. 4. Subordination Agreement for Commercial Real Estate Loans: Commercial real estate transactions often involve multiple loans or liens. In this case, a junior lender agrees to subordinate their lien to a new senior security instrument, which may be a refinanced loan or a new loan altogether. It is important to consult with legal professionals specializing in real estate law to draft and execute a Pittsburgh Pennsylvania Subordination Agreement by Junior Lender to New Senior Security Instrument accurately. This ensures compliance with all relevant laws and protects the rights and interests of all parties involved.

Free preview

How to fill out Pittsburgh Pennsylvania Subordination Agreement By Junior Lender To New Senior Security Instrument?

If you’ve already utilized our service before, log in to your account and download the Pittsburgh Pennsylvania Subordination Agreement by Junior Lender to New Senior Security Instrument on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

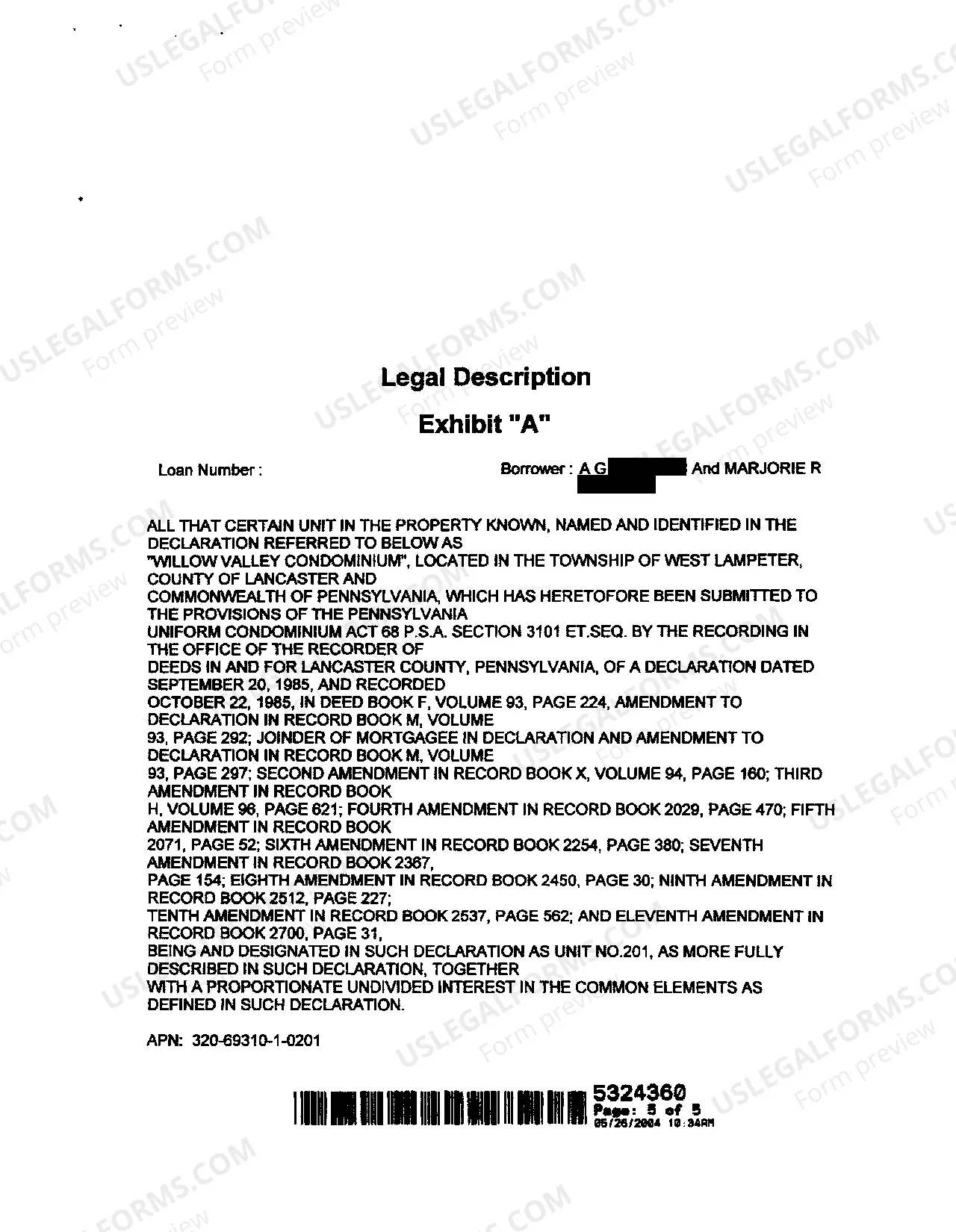

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Pittsburgh Pennsylvania Subordination Agreement by Junior Lender to New Senior Security Instrument. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!