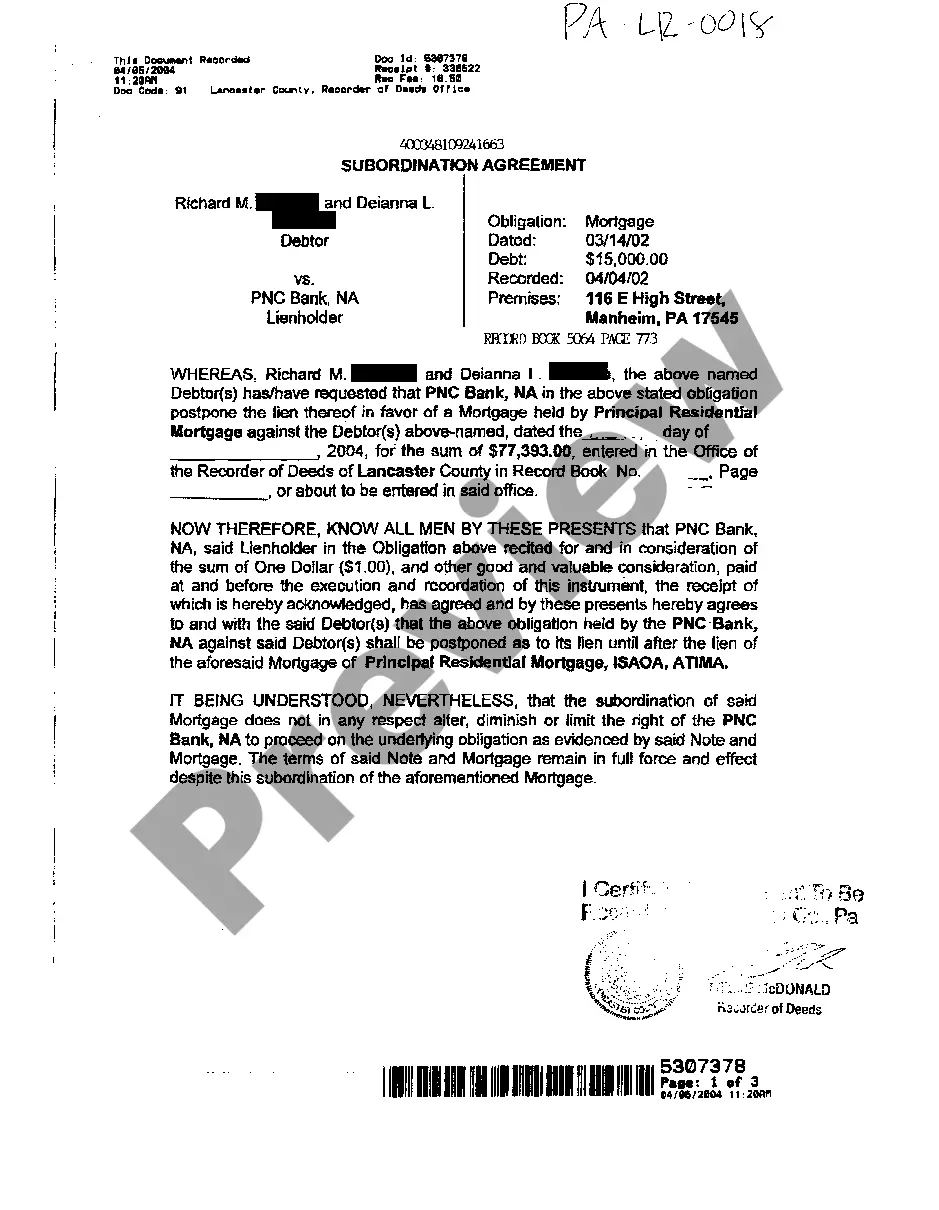

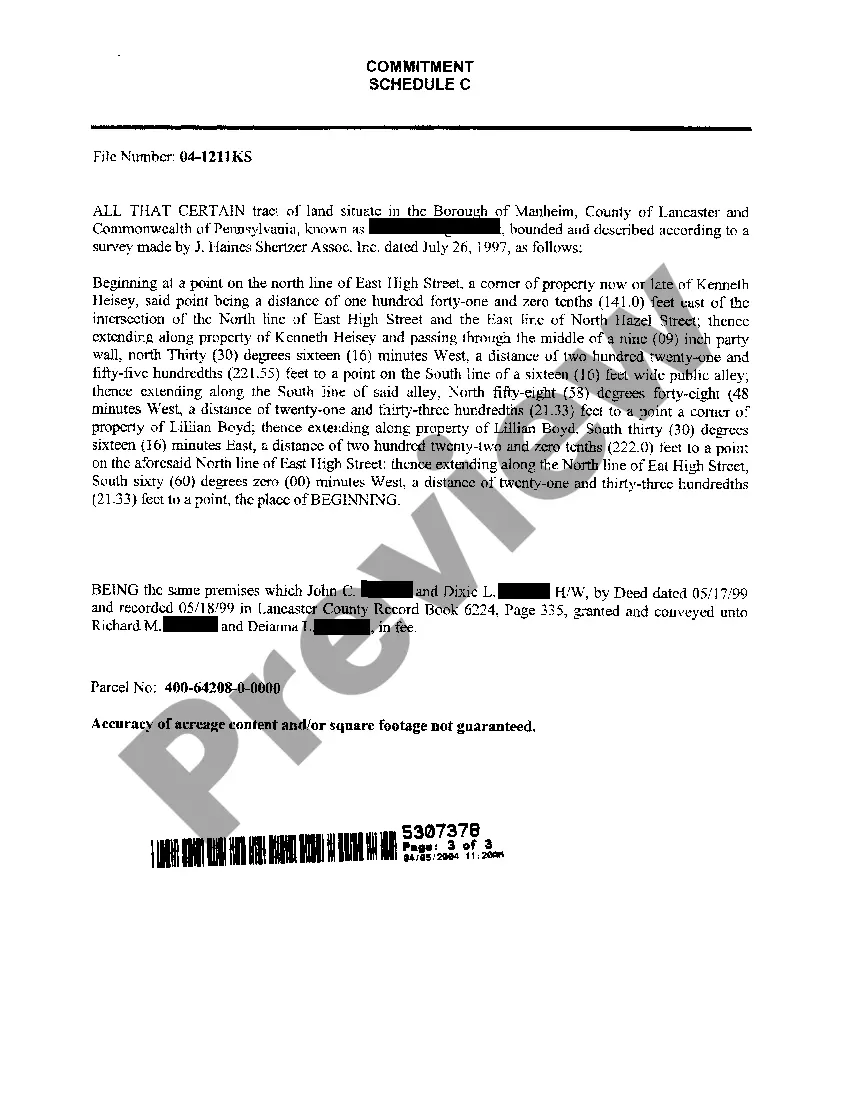

A subordination agreement is a legal document that rearranges the priority of two or more mortgages on a property. In Allegheny, Pennsylvania, the Allegheny Pennsylvania Subordination Agreement of Mortgage is an important legal instrument that outlines the terms and conditions under which a mortgage lien may be subordinated to another lien on the same property. This agreement is crucial in situations where there are multiple mortgages or liens on a property, and it becomes necessary to determine the order of priority. The Allegheny Pennsylvania Subordination Agreement of Mortgage ensures that all parties involved in a mortgage transaction are aware of the respective priorities of their liens. Typically, this agreement is used when a homeowner wants to obtain a second mortgage or a home equity line of credit (HELOT) while having an existing primary mortgage. By signing this subordination agreement, the homeowner allows the second lender to have a higher priority lien on the property, thus lowering the risk for both lenders involved. Different types of Allegheny Pennsylvania Subordination Agreements may exist based on the specific circumstances and parties involved. For example: 1. First Mortgage Subordination Agreement: This agreement is used when a primary mortgage lender agrees to subordinate its lien to a new mortgage or a HELOT. This ensures that the new lender will have a priority claim on the property in case of default or foreclosure. 2. Second Mortgage Subordination Agreement: In this scenario, the second mortgage lender agrees to subordinate its lien to a subsequent mortgage. This type of agreement typically benefits the homeowner who is seeking additional financing. 3. Construction Loan Subordination Agreement: This agreement is common in situations where a borrower has a construction loan but seeks long-term financing afterward. The construction lender agrees to subordinate their lien once the new mortgage is obtained, allowing the permanent lender to have the primary claim. 4. Intercreditor Agreement: Though not strictly a subordination agreement, an intercreditor agreement works in conjunction with a subordination agreement. It is used in cases where multiple lenders are involved, such as a combination of mortgage lenders and equity investors. The intercreditor agreement outlines the rights, priorities, and obligations of each party involved. In conclusion, the Allegheny Pennsylvania Subordination Agreement of Mortgage is a crucial legal instrument that helps determine the priority of mortgages or liens on a property. By signing this agreement, parties involved can properly structure their financial interests and secure their position in case of default or foreclosure. Different types of subordination agreements, such as first and second mortgage subordination agreements or construction loan subordination agreements, serve various purposes in Allegheny, Pennsylvania's real estate market.

Allegheny Pennsylvania Subordination Agreement of Mortgage

Description

How to fill out Allegheny Pennsylvania Subordination Agreement Of Mortgage?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone with no law education to create such paperwork from scratch, mostly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms can save the day. Our service provides a massive catalog with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you want the Allegheny Pennsylvania Subordination Agreement of Mortgage or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Allegheny Pennsylvania Subordination Agreement of Mortgage quickly using our trusted service. If you are already a subscriber, you can go ahead and log in to your account to download the appropriate form.

However, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the Allegheny Pennsylvania Subordination Agreement of Mortgage:

- Ensure the form you have found is suitable for your area because the rules of one state or area do not work for another state or area.

- Review the form and read a brief outline (if available) of scenarios the paper can be used for.

- In case the form you chosen doesn’t meet your requirements, you can start again and search for the needed document.

- Click Buy now and pick the subscription plan you prefer the best.

- with your login information or create one from scratch.

- Choose the payment method and proceed to download the Allegheny Pennsylvania Subordination Agreement of Mortgage as soon as the payment is through.

You’re all set! Now you can go ahead and print out the form or complete it online. Should you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.