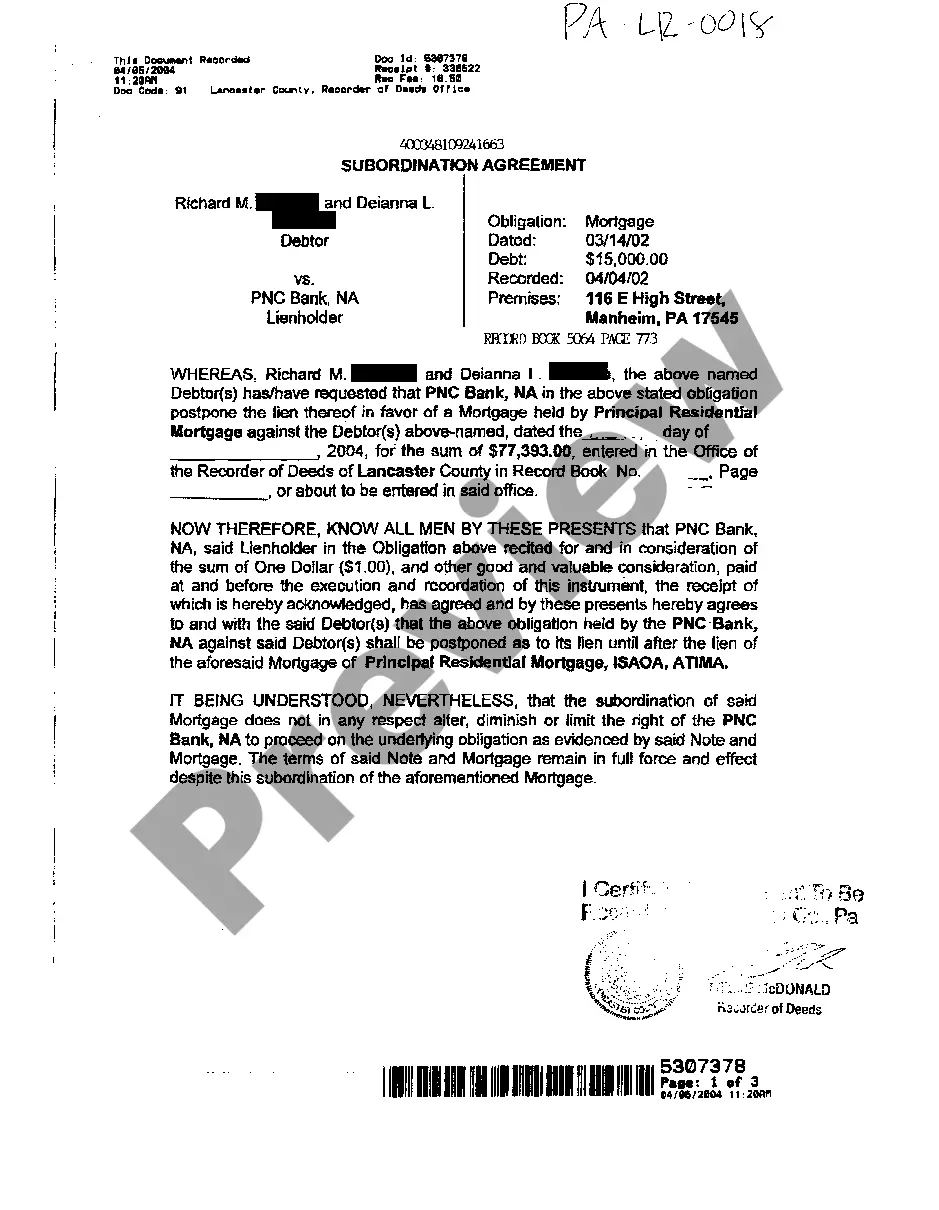

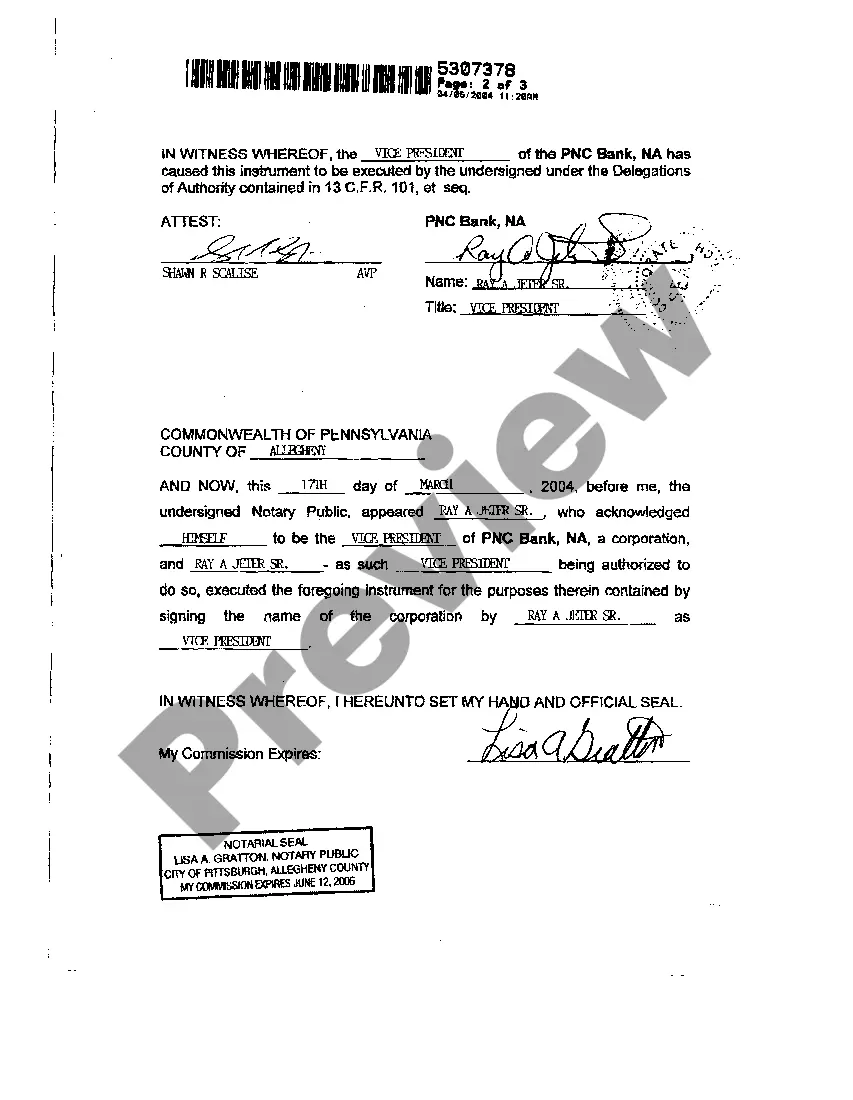

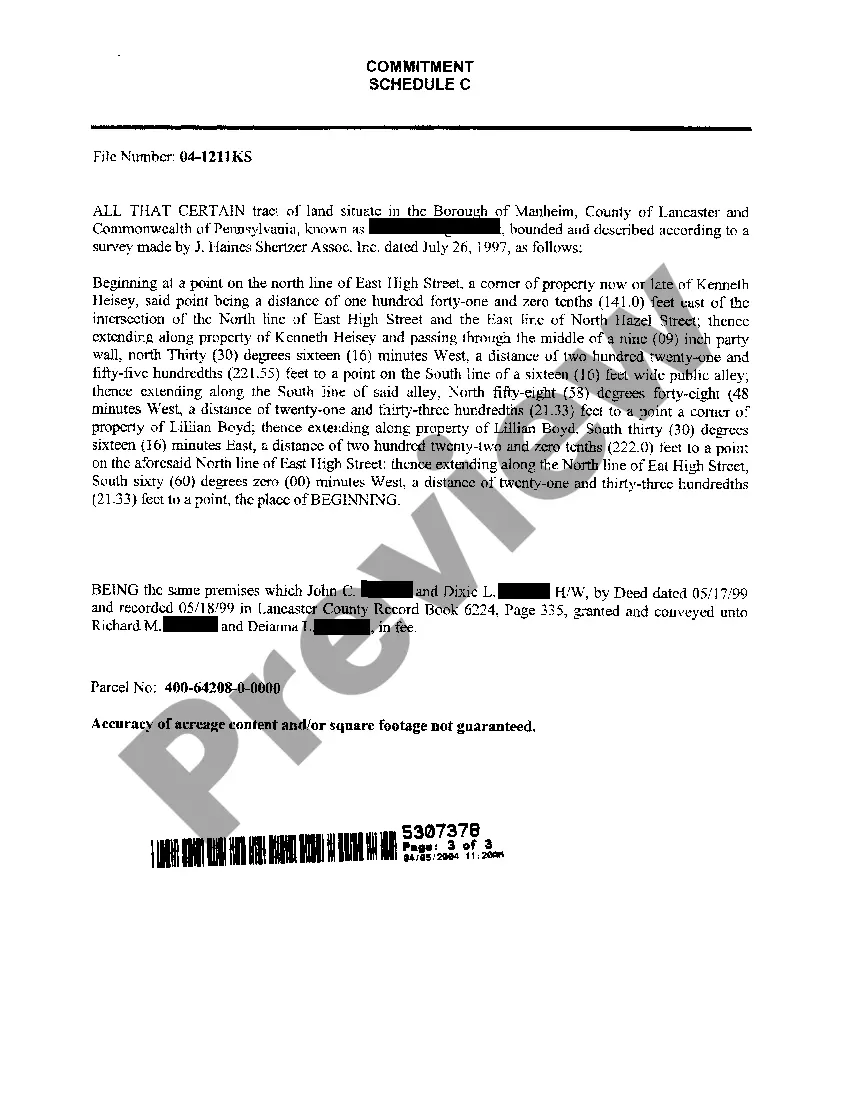

Allentown Pennsylvania Subordination Agreement of Mortgage is a legal document used in real estate transactions to establish the priority of mortgages on a property. In this agreement, one lender agrees to lower the priority of their mortgage lien to allow another lender's mortgage to take precedence. This is often done to facilitate a refinancing or a new loan on the property. The purpose of the subordination agreement is to protect the interests of the lenders involved and ensure that they have a clear understanding of their respective priority rights. It specifies the order in which each mortgage will be paid off in case of a foreclosure or sale of the property. There are several types of Allentown Pennsylvania Subordination Agreement of Mortgage, including: 1. First Mortgage Subordination Agreement: This type of agreement is used when there is an existing first mortgage on the property, and the lender agrees to subordinate their lien to a new mortgage that will be placed on the property. 2. Second Mortgage Subordination Agreement: In this case, there is already a first mortgage on the property, and the lender of a second mortgage agrees to subordinate their lien to the first mortgage. 3. Third Mortgage Subordination Agreement: This type of agreement comes into play when there are already two existing mortgages on the property. The lender of a third mortgage agrees to subordinate their lien to both the first and second mortgages. The Allentown Pennsylvania Subordination Agreement of Mortgage typically includes essential information such as the names of the lenders involved, the property's address, the principal amount of each mortgage, and the terms and conditions of the subordination. It must be signed by all parties involved, including the property owner. Overall, the Allentown Pennsylvania Subordination Agreement of Mortgage is a crucial legal document that protects the interests of lenders and ensures transparency in mortgage priority. It allows for the smooth processing of new loans and refinancing transactions while safeguarding the financial rights of all parties involved.

Allentown Pennsylvania Subordination Agreement of Mortgage

Description

How to fill out Allentown Pennsylvania Subordination Agreement Of Mortgage?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person with no law education to draft this sort of papers cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our service provides a massive catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you want the Allentown Pennsylvania Subordination Agreement of Mortgage or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Allentown Pennsylvania Subordination Agreement of Mortgage in minutes using our trusted service. If you are already an existing customer, you can proceed to log in to your account to download the needed form.

Nevertheless, in case you are unfamiliar with our platform, make sure to follow these steps before obtaining the Allentown Pennsylvania Subordination Agreement of Mortgage:

- Ensure the form you have found is specific to your area considering that the rules of one state or county do not work for another state or county.

- Preview the document and read a short description (if available) of cases the document can be used for.

- In case the one you chosen doesn’t meet your needs, you can start again and search for the suitable document.

- Click Buy now and pick the subscription plan you prefer the best.

- with your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Allentown Pennsylvania Subordination Agreement of Mortgage once the payment is completed.

You’re good to go! Now you can proceed to print out the document or fill it out online. Should you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.