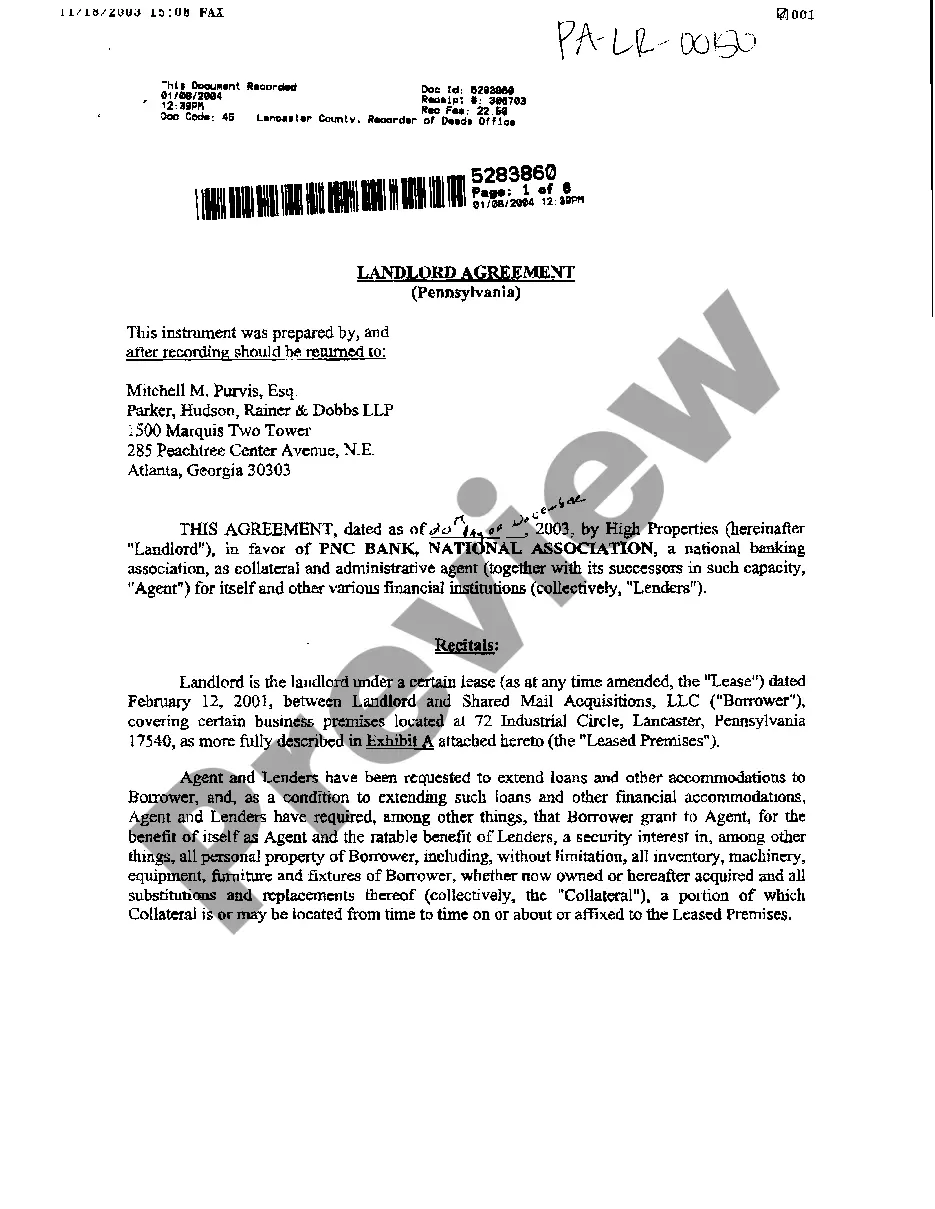

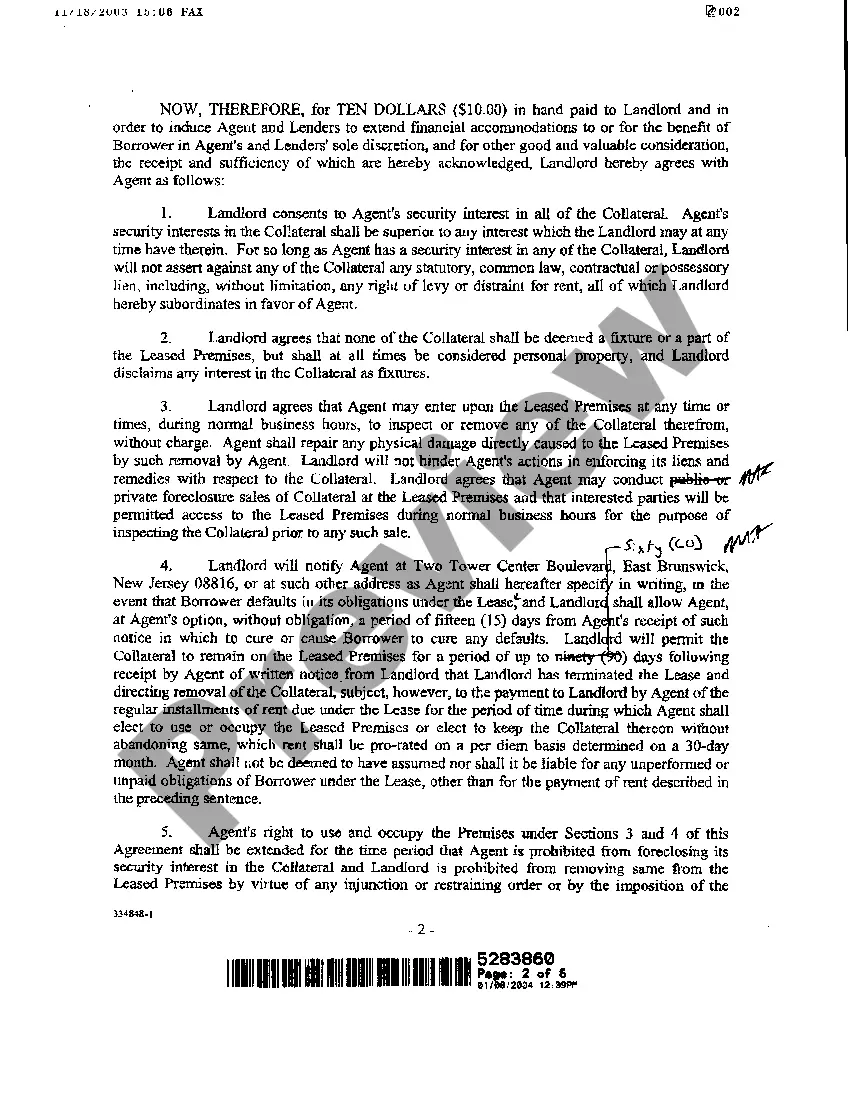

A Philadelphia Pennsylvania Landlord Agreement for Security Interest in Collateral for Loan is a legally binding document that outlines the terms and conditions between a landlord and a tenant in cases where the tenant pledges collateral as security for a loan. This agreement serves as a safeguard for the landlord's interests, as they may have significant financial investment at stake in the property being rented out. Keywords: Philadelphia Pennsylvania, landlord agreement, security interest, collateral, loan. There may be different types of Philadelphia Pennsylvania Landlord Agreements for Security Interest in Collateral for Loans based on the specific nature of the collateral being offered. Here are some possible variations: 1. Real Estate Collateral Agreement: This type of agreement is commonly used when the tenant offers their property as collateral for a loan. The terms and conditions within this agreement would be specific to real estate, addressing aspects such as property valuation, title transfer, and foreclosure procedures in case of default. 2. Personal Property Collateral Agreement: In cases where the tenant pledges personal belongings, such as vehicles, jewelry, or valuable assets, as collateral, a specific agreement can be formulated. This agreement would outline the details of these assets, appraisal methods, and the transfer of ownership in the event of loan default. 3. Financial Collateral Agreement: This agreement comes into play when a tenant pledges financial assets like stocks, bonds, or savings accounts as collateral. It may include provisions for the monitoring and valuation of these assets, as well as the transfer or liquidation process in the event of default. 4. Intellectual Property Collateral Agreement: When a tenant has intellectual property rights, such as patents, trademarks, or copyrights, they may pledge these assets as collateral. This type of agreement would focus on the specifics of the intellectual property, including registration details, licensing, and the transfer process if default occurs. In all these variations, the Philadelphia Pennsylvania Landlord Agreement for Security Interest in Collateral for Loan would encompass essential elements such as the loan amount, interest rates, repayment schedule, default conditions, legal consequences, and dispute resolution mechanisms. When drafting or signing this agreement, it is crucial that both parties thoroughly review and understand its terms and seek legal advice if necessary. This ensures that the rights and obligations of each party are clearly defined and protected, minimizing the potential for disagreements and conflicts throughout the duration of the loan agreement.

Philadelphia Pennsylvania Landlord Agreement for Security Interest in Collateral for Loan

Description

How to fill out Philadelphia Pennsylvania Landlord Agreement For Security Interest In Collateral For Loan?

We always strive to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To do so, we sign up for legal services that, usually, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to legal counsel. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Philadelphia Pennsylvania Landlord Agreement for Security Interest in Collateral for Loan or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is equally easy if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Philadelphia Pennsylvania Landlord Agreement for Security Interest in Collateral for Loan adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Philadelphia Pennsylvania Landlord Agreement for Security Interest in Collateral for Loan would work for your case, you can choose the subscription option and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!