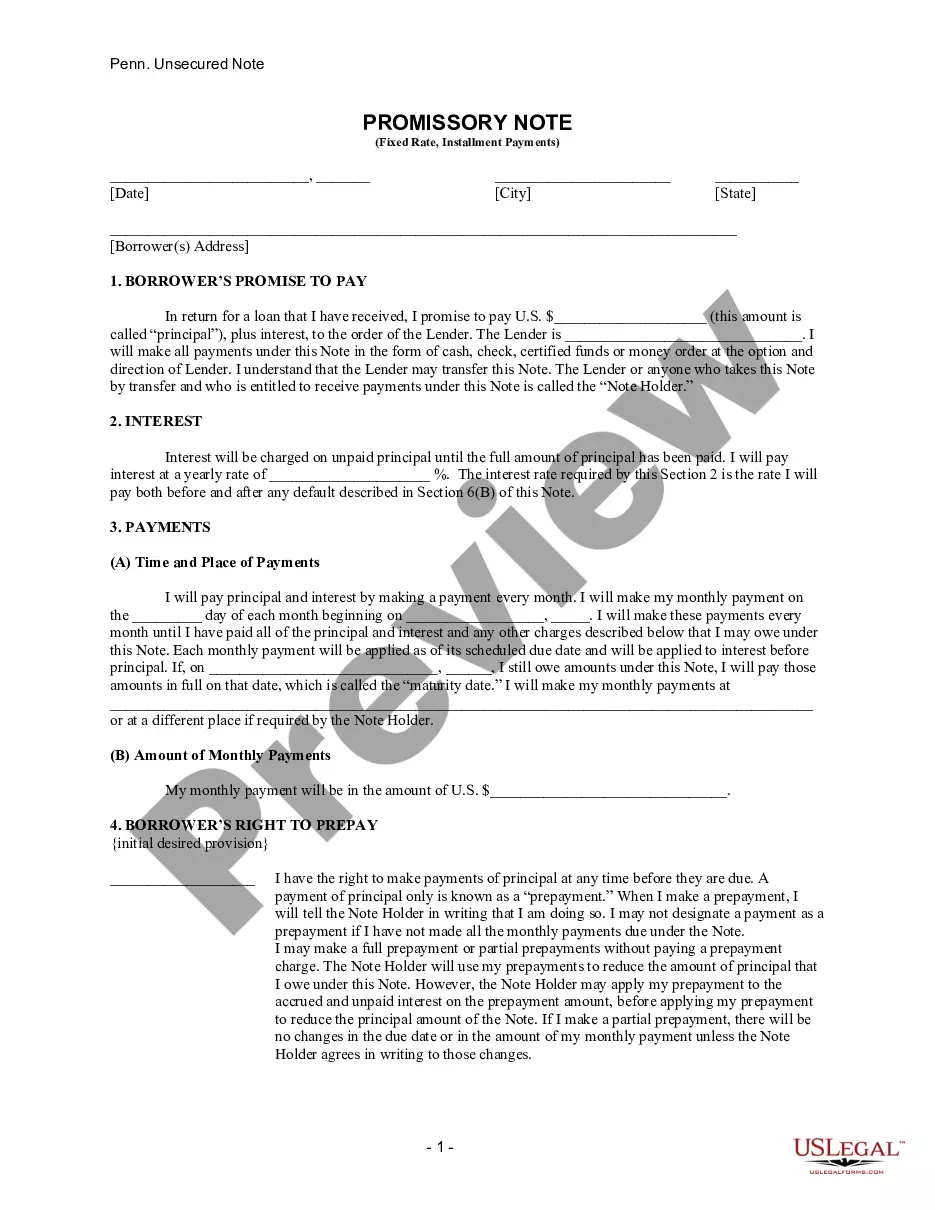

Allegheny Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate refers to a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Allegheny County, Pennsylvania. This type of promissory note is specifically designed for unsecured loans, which means that the borrower does not have to provide collateral to secure the loan. The Allegheny Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate includes important information such as the names and contact details of the borrower and the lender, the loan amount, the interest rate, and the repayment schedule. This document protects the rights of both parties involved in the loan agreement, ensuring that both the borrower and the lender are aware of their obligations and responsibilities. Typically, there are several types of Allegheny Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate, each catering to specific loan arrangements or borrower requirements. These variations include: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for personal loans between individuals, such as loans between family members or close friends. 2. Business Loan Promissory Note: This promissory note is specifically designed for loans involving businesses, including small business loans or loans between commercial entities. 3. Student Loan Promissory Note: This variation is specific to educational loans and is used when individuals are borrowing money for educational purposes, such as tuition fees or living expenses during their studies. 4. Medical Loan Promissory Note: This type of promissory note is utilized when individuals require financial assistance for medical expenses, such as surgeries, treatments, or medical equipment. 5. Auto Loan Promissory Note: This promissory note is used in car financing, allowing individuals to purchase vehicles through loans with fixed interest rates and installment payment plans. All variations of the Allegheny Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate serve to legally bind the borrower to repay the loan amount with fixed interest over a predetermined period. It is crucial for both parties to carefully read and understand the terms and conditions outlined in the promissory note before entering into the loan agreement. It is advisable to consult a legal professional to ensure that the promissory note adheres to all applicable laws and regulations in Allegheny County, Pennsylvania.

Allegheny Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Allegheny Pennsylvania Unsecured Installment Payment Promissory Note For Fixed Rate?

We always strive to reduce or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney services that, as a rule, are very expensive. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of a lawyer. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Allegheny Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Allegheny Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Allegheny Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate is proper for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the document in any suitable format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!

Form popularity

FAQ

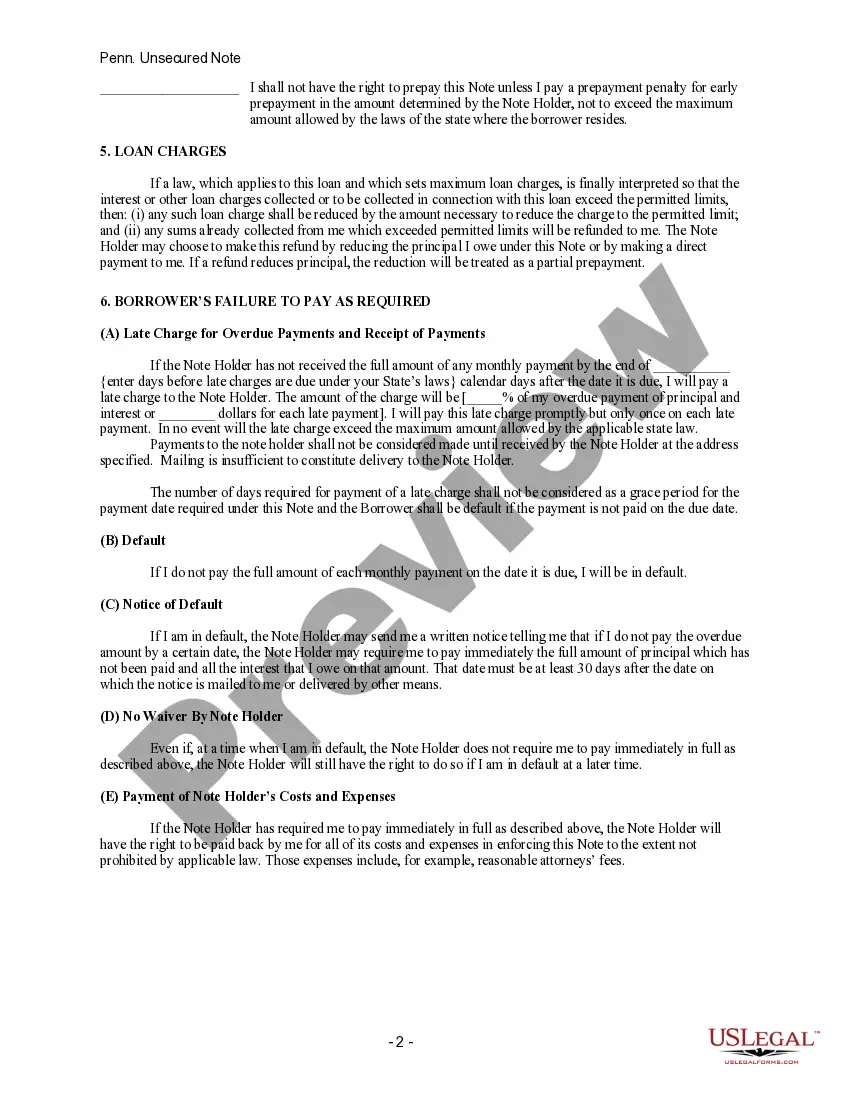

Some promissory notes require the payment of the full amount owed, plus interest, on a certain date. If the promissory note requires that periodic payments be made, such as quarterly, monthly, or even weekly, it is called an installment promissory note.

Calculate interest for one year Next, calculate the interest charge for one year by multiplying the principal by the interest rate. In our example that math would yield $5,000 X 0.07 = $350. This is the annual interest charge for the note.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

Promissory Notes, Interest, and Usury A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

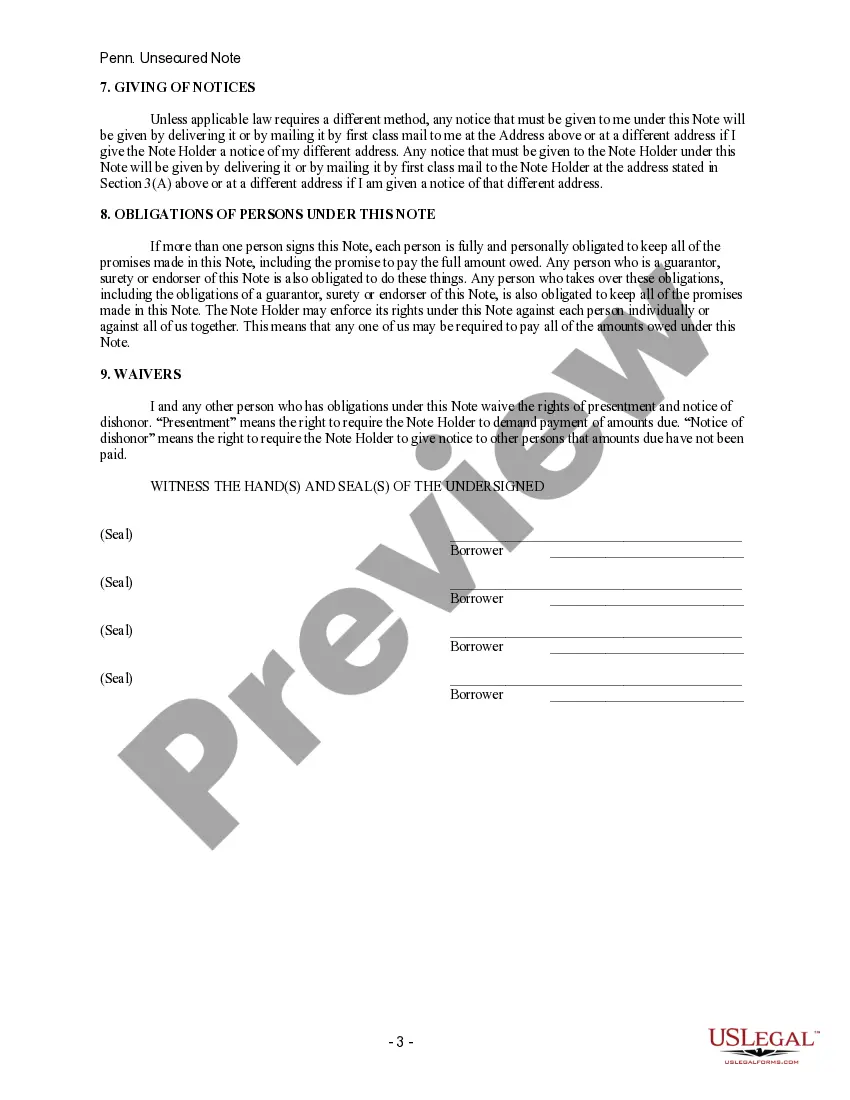

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

Unsecured Promissory Notes An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

There is no legal requirement for most promissory notes to be witnessed or notarized in Pennsylvania (promissory notes related to real estate may need to be notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

Based on discussions with professionals who buy and sell notes, the market rate of return for a privately held note typically ranges from 12% for a well collateralized note with a strong payment history to 25% for an uncollateralized note.