Title: Allentown Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate: A Comprehensive Guide Description: In Allentown, Pennsylvania, individuals and organizations may find themselves in need of financial assistance to fulfill their personal or business obligations. To facilitate these loan transactions, the concept of an Allentown Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate arises as a reliable and legally-binding tool. An Unsecured Installment Payment Promissory Note for Fixed Rate is a written agreement that establishes a formal commitment between a lender and a borrower. This document outlines the loan's terms and conditions, ensuring that both parties comprehend their rights and responsibilities throughout the repayment process. Keywords: Allentown Pennsylvania, unsecured, installment payment, promissory note, fixed rate. Types of Allentown Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate: 1. Personal Unsecured Installment Payment Promissory Note for Fixed Rate: Designed for individuals seeking financial assistance for personal needs such as medical bills, education expenses, home renovations, or debt consolidation. This note enables the borrower to make regular payments over a predetermined period until the loan is fully repaid. 2. Business Unsecured Installment Payment Promissory Note for Fixed Rate: Targeting small-scale businesses and startups in Allentown, Pennsylvania, this promissory note type offers financial flexibility to cover business-related expenses, invest in equipment, or expand operations. Entrepreneurs can repay the borrowed funds over a fixed period, easing the burden on cash flow. 3. Real Estate Unsecured Installment Payment Promissory Note for Fixed Rate: Specifically designed for real estate transactions in Allentown, Pennsylvania, this promissory note type enables buyers to secure financing for purchasing residential or commercial properties without providing collateral. The agreed-upon terms include a fixed interest rate, installment payments, and a specified repayment term. 4. Student Loan Unsecured Installment Payment Promissory Note for Fixed Rate: Catering to students pursuing higher education in Allentown, Pennsylvania, this promissory note type allows borrowers to obtain financial assistance for tuition fees, books, and living expenses. By agreeing to fixed rate installment payments, students can fulfill their educational goals without the immediate financial strain. 5. Medical Expense Unsecured Installment Payment Promissory Note for Fixed Rate: Created to assist individuals in Allentown, Pennsylvania, facing unanticipated medical expenses, this promissory note provides a practical way to cover hospital bills, surgeries, medications, or specialized treatments. Borrowers can comfortably repay the medical debt in regular installments with a fixed interest rate. By understanding these diverse types of Allentown Pennsylvania Unsecured Installment Payment Promissory Notes for Fixed Rate, borrowers can choose the most suitable option based on their specific financial needs. It is always recommended consulting with legal and financial professionals to ensure compliance with local regulations and make informed decisions.

Allentown Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate

State:

Pennsylvania

City:

Allentown

Control #:

PA-NOTE-2

Format:

Word;

Rich Text

Instant download

Description

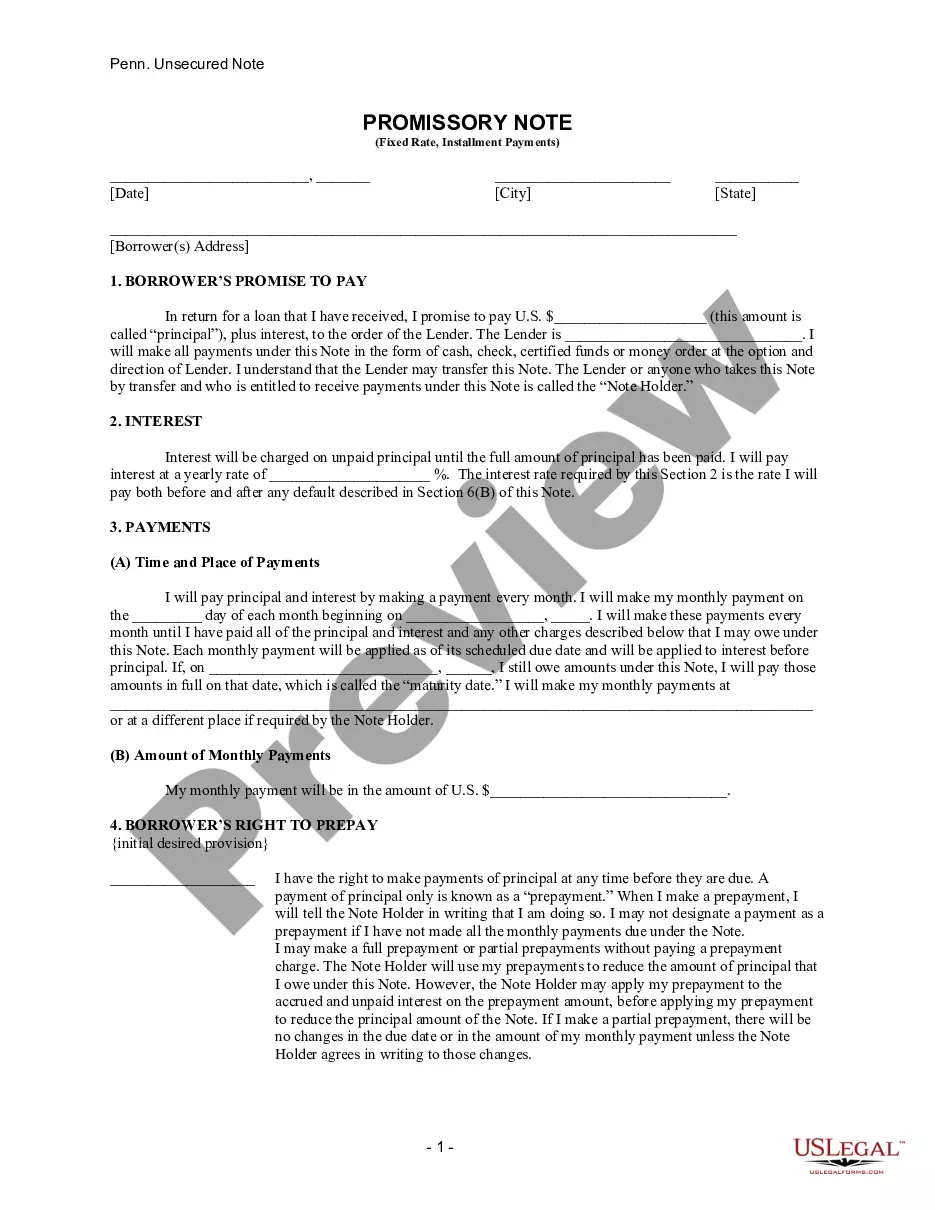

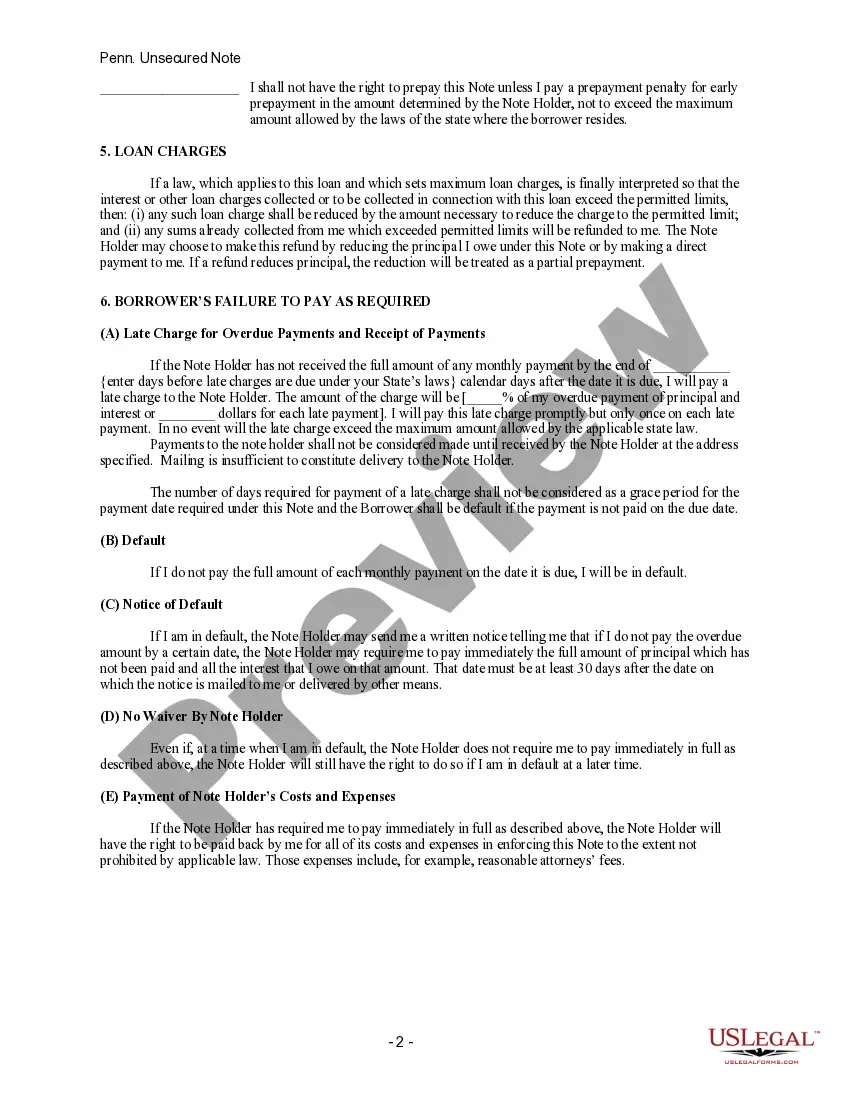

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Title: Allentown Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate: A Comprehensive Guide Description: In Allentown, Pennsylvania, individuals and organizations may find themselves in need of financial assistance to fulfill their personal or business obligations. To facilitate these loan transactions, the concept of an Allentown Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate arises as a reliable and legally-binding tool. An Unsecured Installment Payment Promissory Note for Fixed Rate is a written agreement that establishes a formal commitment between a lender and a borrower. This document outlines the loan's terms and conditions, ensuring that both parties comprehend their rights and responsibilities throughout the repayment process. Keywords: Allentown Pennsylvania, unsecured, installment payment, promissory note, fixed rate. Types of Allentown Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate: 1. Personal Unsecured Installment Payment Promissory Note for Fixed Rate: Designed for individuals seeking financial assistance for personal needs such as medical bills, education expenses, home renovations, or debt consolidation. This note enables the borrower to make regular payments over a predetermined period until the loan is fully repaid. 2. Business Unsecured Installment Payment Promissory Note for Fixed Rate: Targeting small-scale businesses and startups in Allentown, Pennsylvania, this promissory note type offers financial flexibility to cover business-related expenses, invest in equipment, or expand operations. Entrepreneurs can repay the borrowed funds over a fixed period, easing the burden on cash flow. 3. Real Estate Unsecured Installment Payment Promissory Note for Fixed Rate: Specifically designed for real estate transactions in Allentown, Pennsylvania, this promissory note type enables buyers to secure financing for purchasing residential or commercial properties without providing collateral. The agreed-upon terms include a fixed interest rate, installment payments, and a specified repayment term. 4. Student Loan Unsecured Installment Payment Promissory Note for Fixed Rate: Catering to students pursuing higher education in Allentown, Pennsylvania, this promissory note type allows borrowers to obtain financial assistance for tuition fees, books, and living expenses. By agreeing to fixed rate installment payments, students can fulfill their educational goals without the immediate financial strain. 5. Medical Expense Unsecured Installment Payment Promissory Note for Fixed Rate: Created to assist individuals in Allentown, Pennsylvania, facing unanticipated medical expenses, this promissory note provides a practical way to cover hospital bills, surgeries, medications, or specialized treatments. Borrowers can comfortably repay the medical debt in regular installments with a fixed interest rate. By understanding these diverse types of Allentown Pennsylvania Unsecured Installment Payment Promissory Notes for Fixed Rate, borrowers can choose the most suitable option based on their specific financial needs. It is always recommended consulting with legal and financial professionals to ensure compliance with local regulations and make informed decisions.

Free preview

How to fill out Allentown Pennsylvania Unsecured Installment Payment Promissory Note For Fixed Rate?

If you’ve already utilized our service before, log in to your account and download the Allentown Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make certain you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Allentown Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!