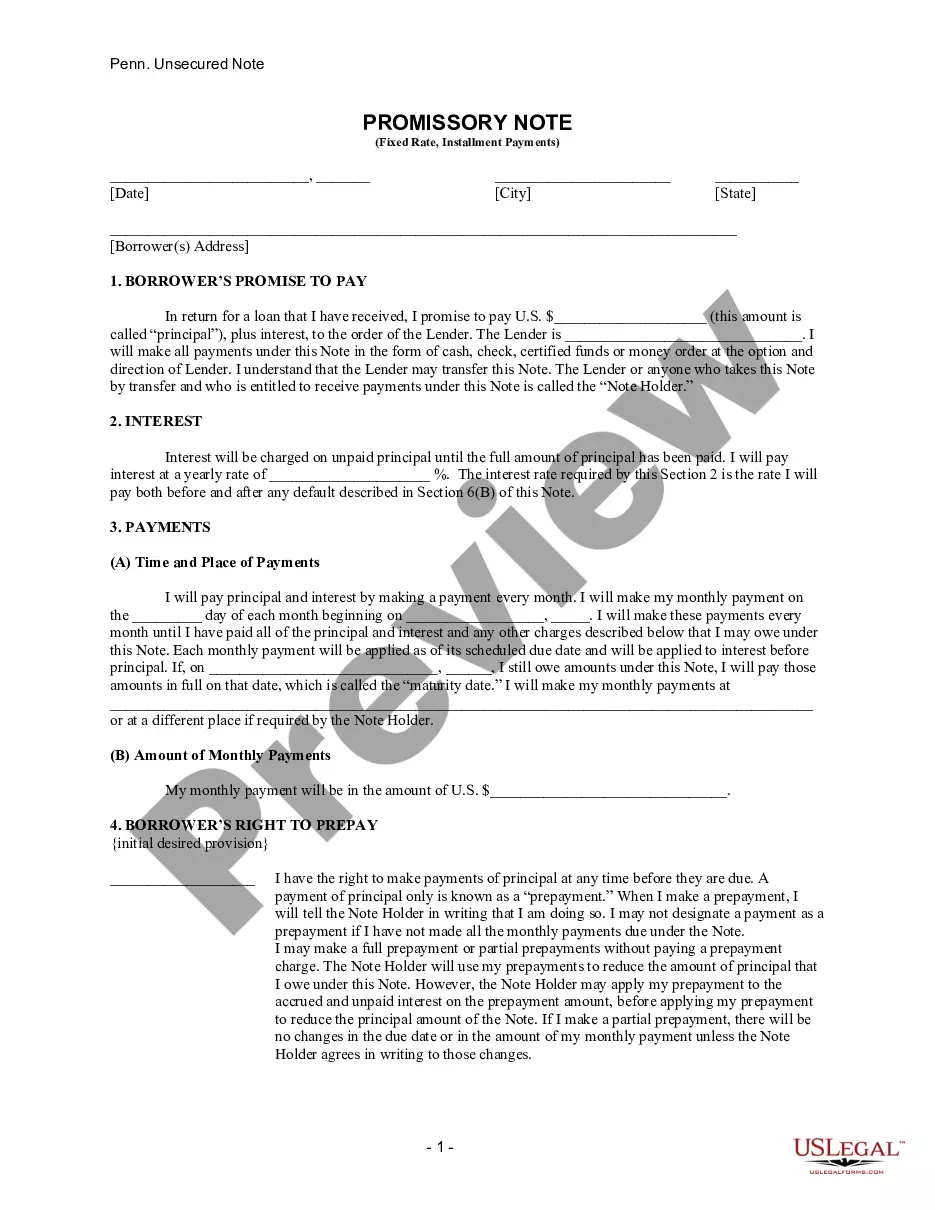

Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Pennsylvania Unsecured Installment Payment Promissory Note For Fixed Rate?

Utilize the US Legal Forms and gain immediate access to any template you require.

Our user-friendly website, featuring a vast collection of templates, facilitates finding and acquiring virtually any document sample you need.

You can download, complete, and sign the Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate in just a few minutes instead of spending hours online searching for a suitable template.

Using our catalog is a fantastic approach to enhance the security of your form submissions.

If you don’t have an account yet, follow the instructions below.

Locate the form you need. Ensure it is the template you are looking for: verify its title and description, and utilize the Preview feature if available. Otherwise, use the Search field to find the suitable one.

- Our knowledgeable legal experts routinely review all documents to ensure that the forms are applicable for a specific state and adhere to new laws and regulations.

- How can you obtain the Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate.

- If you have an account, simply Log In to your profile.

- The Download button will be active on all documents you examine.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

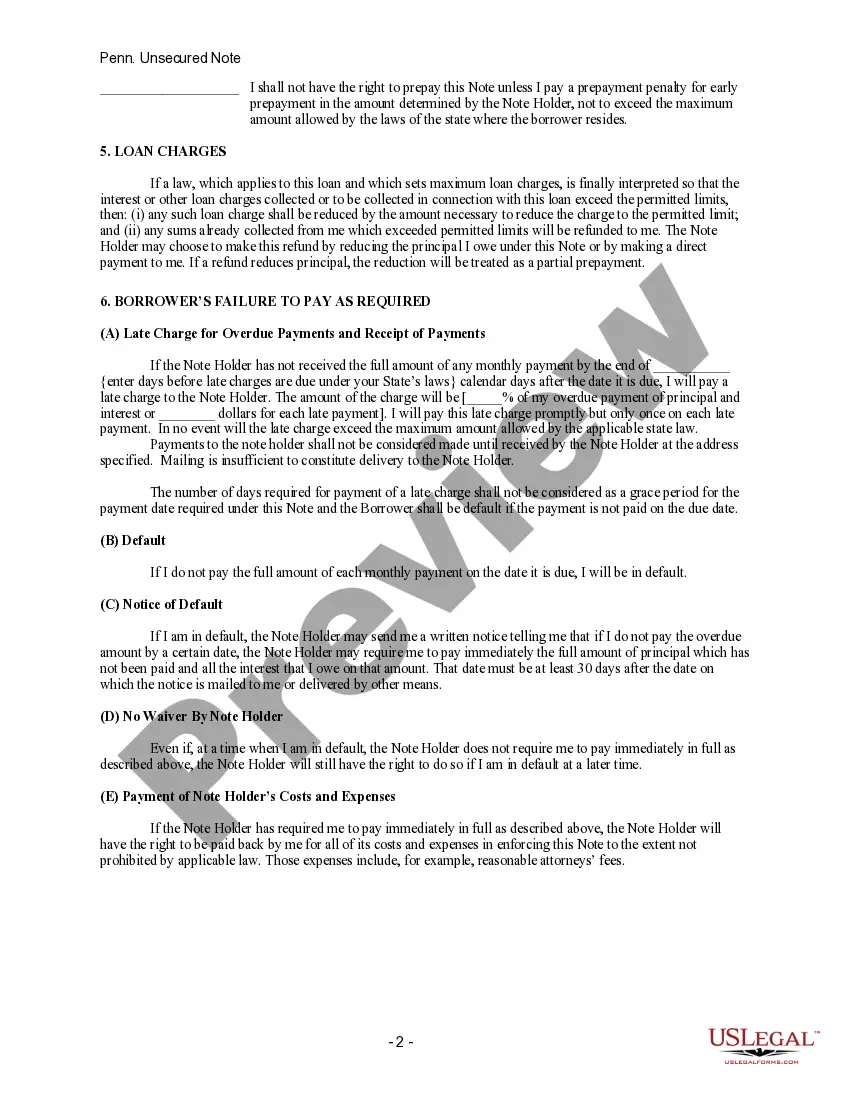

Filling out a promissory note involves providing accurate details regarding the borrower and lender. You should include the amount borrowed, interest rate, and repayment terms in a Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate. Be sure to specify the payment schedule and any penalties for late payments. Tools available on US Legal Forms help you format the document correctly for your needs.

You can request a copy of your promissory note from the lender or institution that issued it. If you used an online service like US Legal Forms to create your Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate, simply log in to your account to access your documents. Always keep a secure copy for your records.

Yes, a promissory note can be sold to a third party. This process allows the original lender to transfer their rights to receive payments. However, when dealing with a Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate, it's essential to review the terms to ensure a smooth sale.

You can obtain a Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate from various sources. Many online platforms, such as US Legal Forms, provide customizable templates that suit your needs. Additionally, local legal offices and financial institutions often offer promissory notes that comply with Pennsylvania laws.

When it comes to reporting a promissory note on your taxes, you must generally include any interest received as income. For a Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate, you'll likely report this interest on Schedule B of your tax return. It’s advisable to maintain proper records of your transactions throughout the year. USLegalForms can provide you with templates and resources to help you keep track of your interest income efficiently.

In Pennsylvania, notarization is not strictly required for a promissory note to be valid, but it is strongly recommended. A notarized Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate adds a layer of authenticity and helps prevent disputes down the line. Many lenders require notarization as a standard practice to ensure security and trust. Consider using USLegalForms to find accessible notarization services to secure your documents easily.

In Philadelphia, you generally file a promissory note at the county office responsible for property records, such as the Recorder of Deeds. Filing your Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate officially documents your agreement and can protect your rights as a lender. You should prepare multiple copies to keep for your records and submit to the office. Platforms like USLegalForms can guide you through proper filing techniques to ensure your documents are properly managed.

You can record a promissory note in the county where you reside or where the property related to the note is located. In Philadelphia, Pennsylvania, you typically go to the Recorder of Deeds office to file your Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate. Recording your note helps establish its legal priority and provides public notice of the debt. Utilizing a service like USLegalForms can simplify the recording process and ensure you meet all local requirements.

A properly drafted promissory note, including a Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate, is generally enforceable in court. However, for it to hold up legally, it must contain essential elements such as clear terms, signatures, and a defined repayment plan. By using a reliable platform like uslegalforms, you can ensure your promissory note adheres to legal standards and adequately protects your interests.

One major disadvantage of unsecured notes, such as a Philadelphia Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate, is the increased risk for lenders. Without collateral, lenders may face a greater chance of losing their investment if the borrower defaults. Additionally, borrowers with poor credit may encounter higher interest rates, making repayment more challenging.