Allentown Pennsylvania Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser

Description

How to fill out Pennsylvania Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

No matter the social or career standing, completing legal paperwork is an unfortunate requirement in today's society.

Frequently, it’s nearly impossible for someone lacking a legal background to create these kinds of documents from scratch, primarily due to the intricate language and legal subtleties they encompass.

This is where US Legal Forms proves beneficial.

Ensure the form you have selected is tailored to your locality since the laws of one state or area do not apply to another state or area.

Examine the form and review a brief overview (if available) of scenarios the document can be utilized for.

- Our service provides an extensive repository with over 85,000 ready-to-use state-specific documents applicable for virtually any legal situation.

- US Legal Forms also serves as an invaluable resource for associates or legal advisors who seek to enhance their time efficiency using our DIY papers.

- Whether you need the Allentown Pennsylvania Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser or any other document that is valid in your jurisdiction, with US Legal Forms, everything is easily accessible.

- Here’s how to acquire the Allentown Pennsylvania Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser in a matter of minutes using our reliable service.

- If you are already a member, simply Log In to your account to retrieve the correct form.

- However, if you are new to our platform, make sure to follow these steps before obtaining the Allentown Pennsylvania Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser.

Form popularity

FAQ

Yes, a new Power of Attorney typically overrides an old one unless the document states otherwise. This ensures that any updates to your authority or preferences are respected. To avoid confusion in your real estate dealings in Allentown, Pennsylvania, it’s important to specify any changes clearly in your new POA documentation.

In Pennsylvania, a Power of Attorney remains effective until it is revoked, the principal passes away, or a specified expiration date occurs. This duration provides flexibility for ongoing transactions, such as real estate purchases in Allentown, Pennsylvania. It's essential to review your specific situation with a qualified professional to ensure that your POA aligns with your real estate goals.

Yes, you can create your own special power of attorney. However, it is vital to clearly articulate the powers you wish to grant and ensure that the document meets Pennsylvania requirements. While creating your own can save costs, it is recommended to use templates or resources from uslegalforms to ensure all legal language is accurate, especially for real estate transactions in Allentown, Pennsylvania.

Limited power of attorney and specific power of attorney often mean the same thing, focusing on specific tasks or timeframes. However, limited power of attorney generally refers to any confined set of powers, while specific power of attorney is typically more narrowly defined for particular situations, such as real estate transactions. When preparing your document, clearly outline the exact powers you wish to grant in the context of your Allentown Pennsylvania real estate dealings.

The best person to be a power of attorney is someone you trust implicitly. This individual should act in your best interest, possess a good understanding of real estate transactions, and handle matters responsibly. Typically, family members or close friends with experience in financial affairs can effectively serve in this role. Consider using uslegalforms to help select the right template for this important decision.

The simple answer is - no - you do not need an attorney to buy or sell a home in Pennsylvania. There is no legal requirement that an attorney be involved in any stage of the transaction.

Generally, there are no formalities for POAs and they may be given orally or in writing. However, if the act which the Principal requires the Agent to perform has certain prescribed formalities, then the POA will need to comply with the same formalities.

Every state is different, in Pennsylvania, an attorney can prepare a deed and when there is title insurance issued a settlement firm may prepare deed as well. Your deed must be recorded as quickly as possible in the land record's office (Recorder of Deeds) of your County.

There is no legal requirement to be represented by an attorney when buying or selling real estate. However, having an attorney review documents and/or conduct settlement can be a big advantage in a real estate transaction, and is more affordable than many people realize.

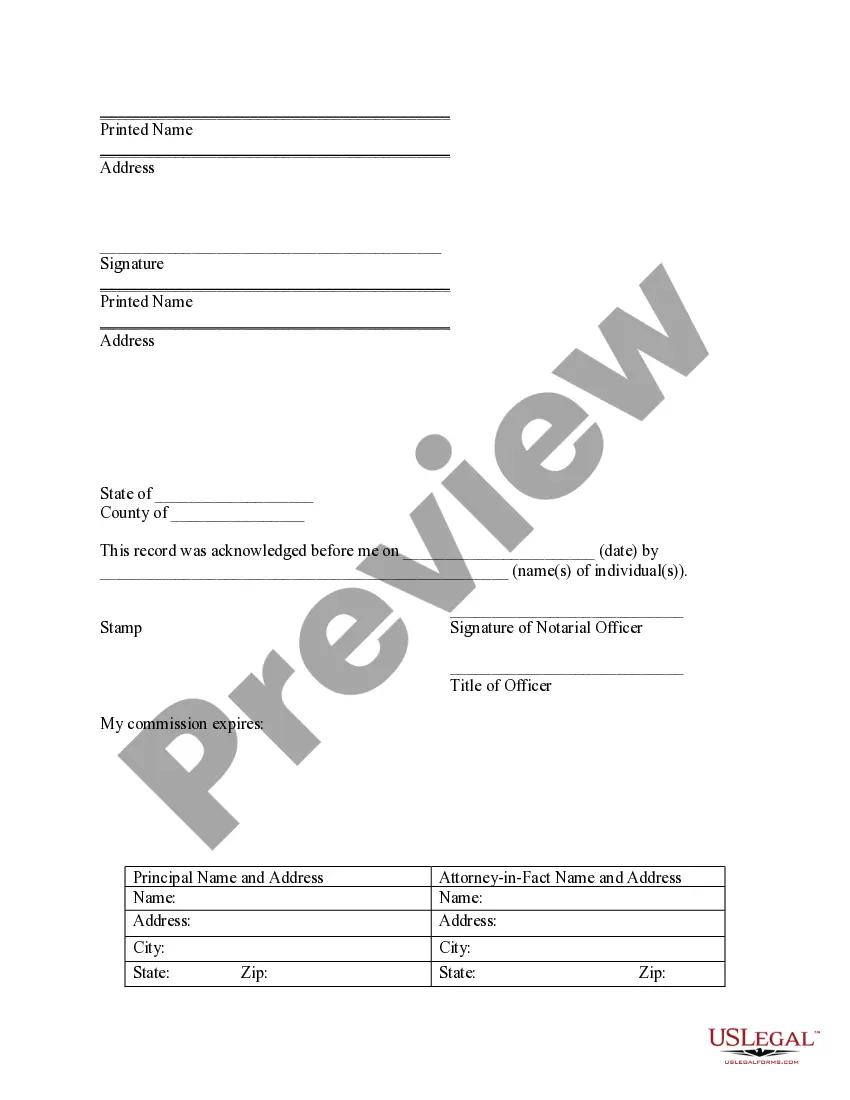

Pennsylvania law requires that POAs must be signed by the principal and witnessed by two people who are ages 18 or older. The document must also be dated and notarized. If the principal cannot write, he or she is allowed to sign the document by using a mark or by asking someone else to sign the POA for him or her.