Philadelphia Annual Minutes for a Pennsylvania Professional Corporation

Description

How to fill out Annual Minutes For A Pennsylvania Professional Corporation?

Locating authenticated forms that adhere to your local regulations may be challenging unless you access the US Legal Forms library.

This is an online assortment of over 85,000 legal documents catering to both personal and professional purposes as well as various real-life situations.

All the files are correctly categorized by usage area and jurisdiction, making it straightforward to find the Philadelphia Annual Minutes for a Pennsylvania Professional Corporation in no time.

Input your credit card information or utilize your PayPal account to finalize the payment for the service.

- Ensure to Review the Preview mode and form description.

- Confirm that you’ve chosen the appropriate one that aligns with your requirements and fully meets your local jurisdiction standards.

- Look for another form if necessary.

- If you notice any discrepancies, use the Search tab above to discover the accurate one. If it fits your needs, proceed to the subsequent step.

- Purchase the document.

Form popularity

FAQ

To obtain a copy of your Articles of Incorporation in Pennsylvania, you can visit the Pennsylvania Department of State's website. They provide online access to important corporation documents, allowing you to request copies with ease. Utilizing services like USLegalForms can simplify the process of securing Philadelphia Annual Minutes for a Pennsylvania Professional Corporation, helping you stay compliant and organized. Make sure to have your corporation's details handy to expedite the request.

Yes, you need to renew your LLC every year in Pennsylvania. This includes filing annual reports and paying any required fees, thereby ensuring compliance with state regulations. Focusing on Philadelphia Annual Minutes for a Pennsylvania Professional Corporation can help you stay organized and meet your filing obligations. Regularly managing your documents can save you time and avoid unnecessary penalties.

The Pennsylvania certificate of annual registration is a document that confirms your corporation has complied with state requirements, including the filing of annual minutes and fees. This certificate serves as proof that your business is in good standing and eligible to operate. Maintaining appropriate Philadelphia Annual Minutes for a Pennsylvania Professional Corporation is a key aspect of this process, preventing complications with state authorities. For assistance, you might consider using platforms like US Legal Forms, which provide tools and templates designed to help you navigate these requirements.

To register an out-of-state business in Pennsylvania, you need to obtain a Certificate of Authority from the Pennsylvania Department of State. This involves submitting your business’s legal name, designation type, and a completed application form. It's essential to also file your Philadelphia Annual Minutes for a Pennsylvania Professional Corporation, which helps maintain your business's standing in the state. Consulting a service like US Legal Forms can simplify this process and ensure compliance with all legal requirements.

Many states across the U.S. require annual reports from corporations, including Delaware, California, and New York. Each state has its regulations regarding the format and content of these reports. Compliance with these requirements is essential to maintain good standing and avoid penalties. If you need clarification on these requirements, the Philadelphia Annual Minutes for a Pennsylvania Professional Corporation can provide valuable insights.

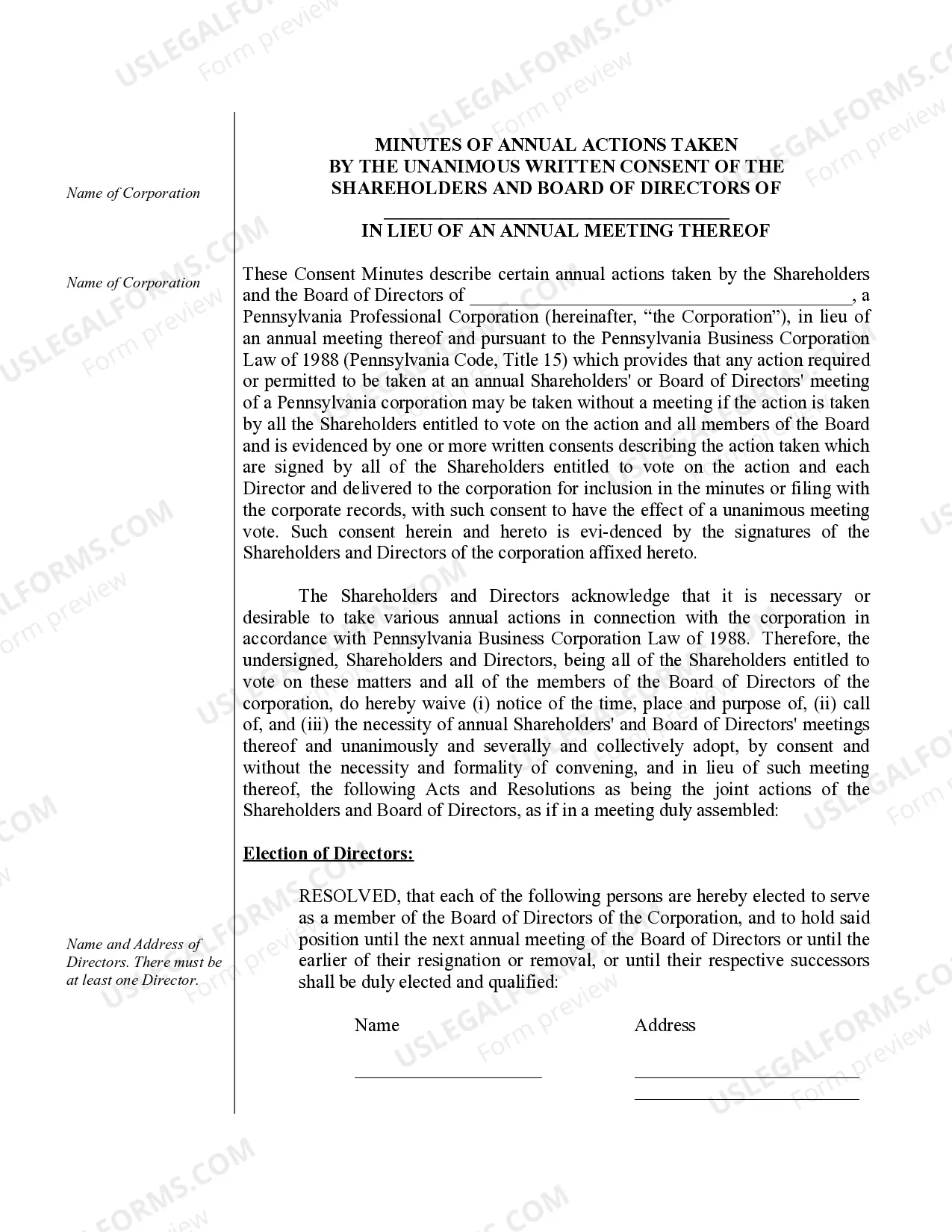

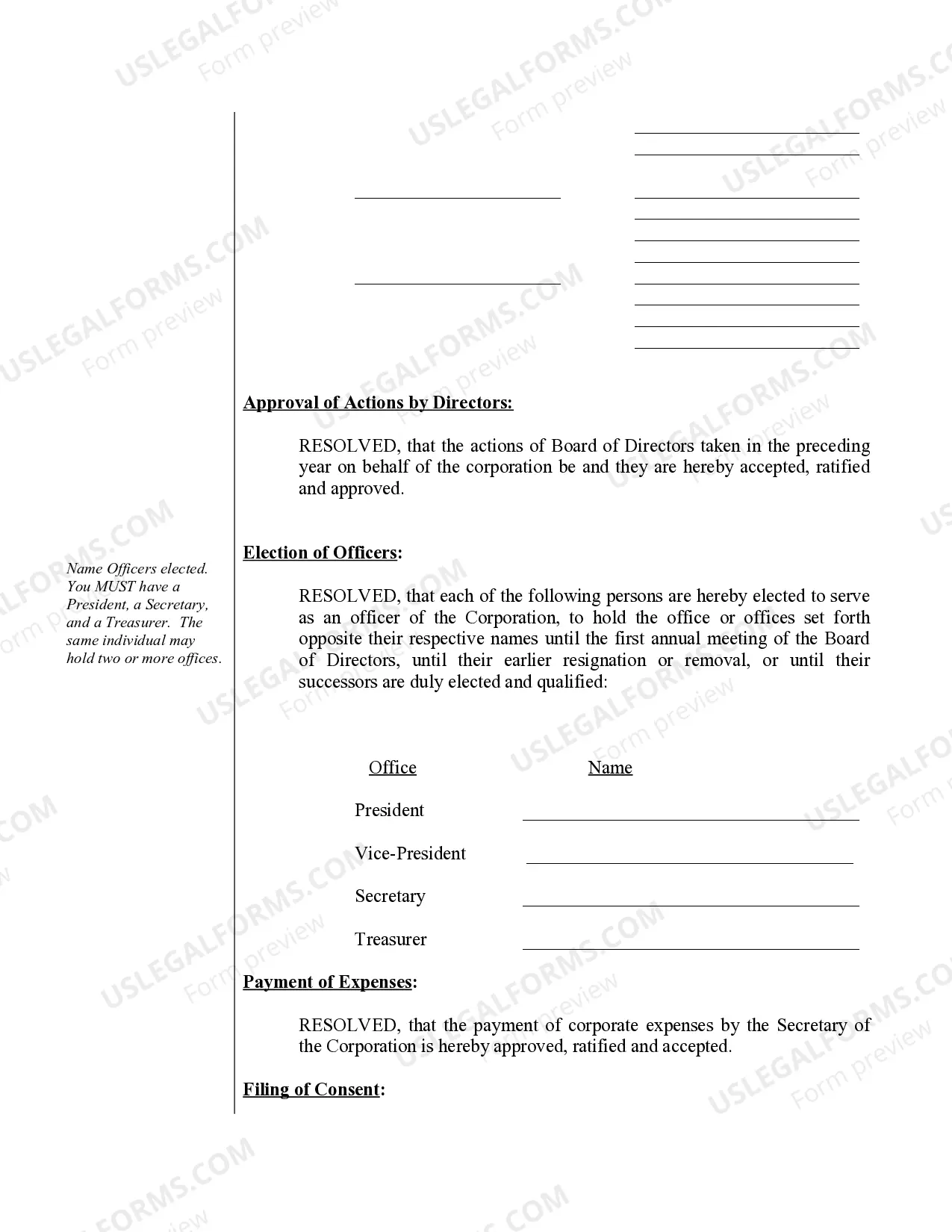

In Pennsylvania, a professional corporation is a business entity formed by licensed professionals to provide specialized services. This structure provides liability protection for its owners while allowing them to work within their licensed fields. It often requires compliance with various state laws governing professional practices. Leveraging tools like the Philadelphia Annual Minutes for a Pennsylvania Professional Corporation can assist in maintaining compliance and organization.

While professional corporations offer limited liability and credibility, they include disadvantages such as increased administrative burdens and legal restrictions. These corporations must adhere to stringent regulations concerning governance and operations. Moreover, the formation process can be more complicated compared to other business structures. To smoothly navigate these challenges, utilizing services like Philadelphia Annual Minutes for a Pennsylvania Professional Corporation can be beneficial.

Yes, Pennsylvania mandates that corporations, including professional corporations, submit annual reports. These reports verify that the corporation is operating legally and upholding its commitments to stakeholders. It's essential for maintaining your corporation's active status in the state. For efficient management of these reports, consider the Philadelphia Annual Minutes for a Pennsylvania Professional Corporation to facilitate your compliance process.

An S-Corp is a tax designation that allows profits to pass through to shareholders, avoiding double taxation, while a professional corporation is a specific type of legal entity for professional services. Professional corporations can elect S-Corp status but must adhere to unique regulations tied to their professional services. Choosing the best structure depends on your business goals and tax considerations. Utilizing the Philadelphia Annual Minutes for a Pennsylvania Professional Corporation can help clarify these distinctions and keep your business compliant.

A professional corporation offers specific legal protections and is structured for licensed professionals, while an LLC usually caters to a broader range of business types. The professional corporation often has stricter regulations regarding ownership and management, aligning with state laws governing professional licenses. On the other hand, accountability and flexibility are hallmarks of an LLC, appealing to many entrepreneurs. Keep in mind, both structures can benefit from implementing Philadelphia Annual Minutes for a Pennsylvania Professional Corporation for ease of compliance.