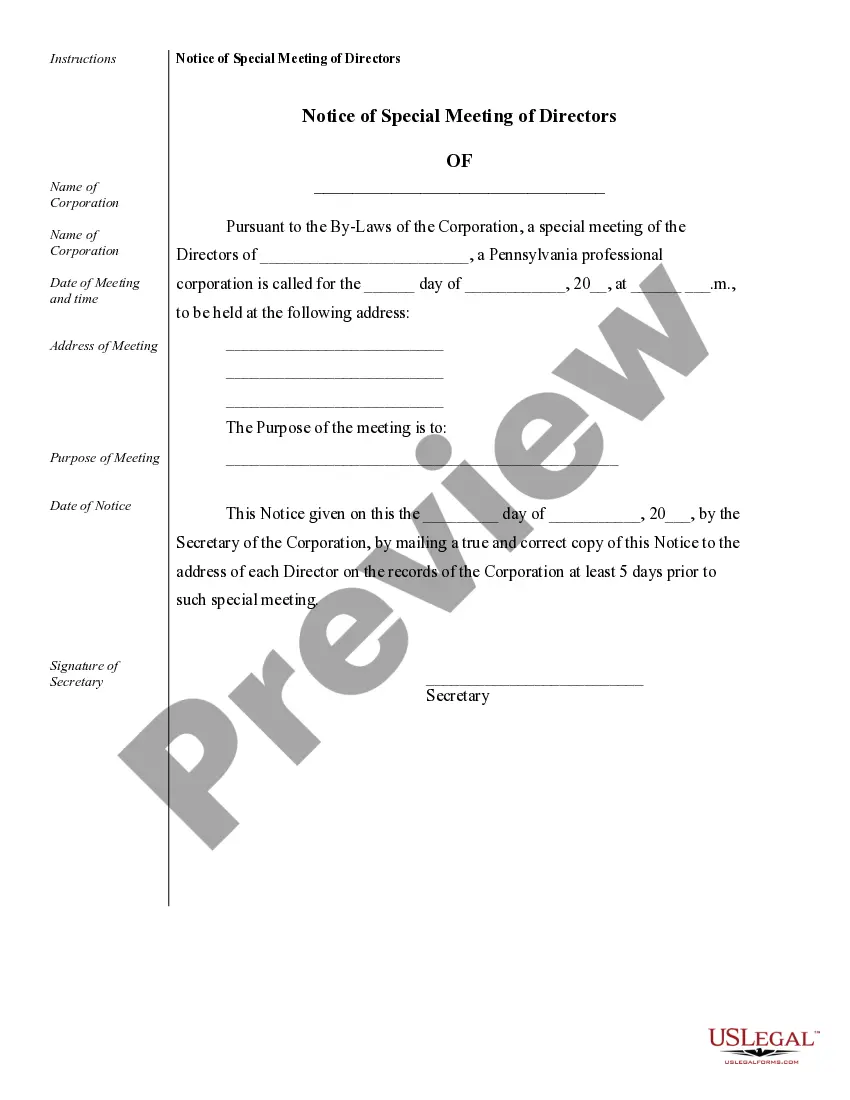

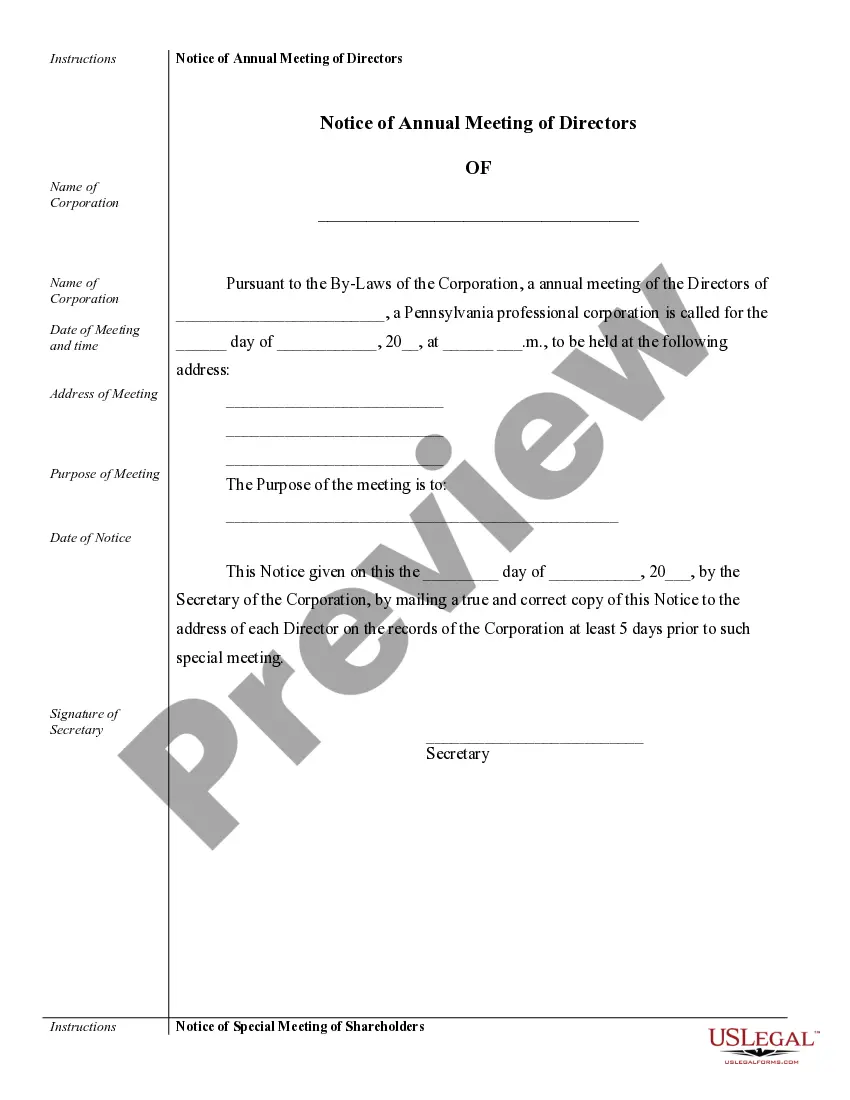

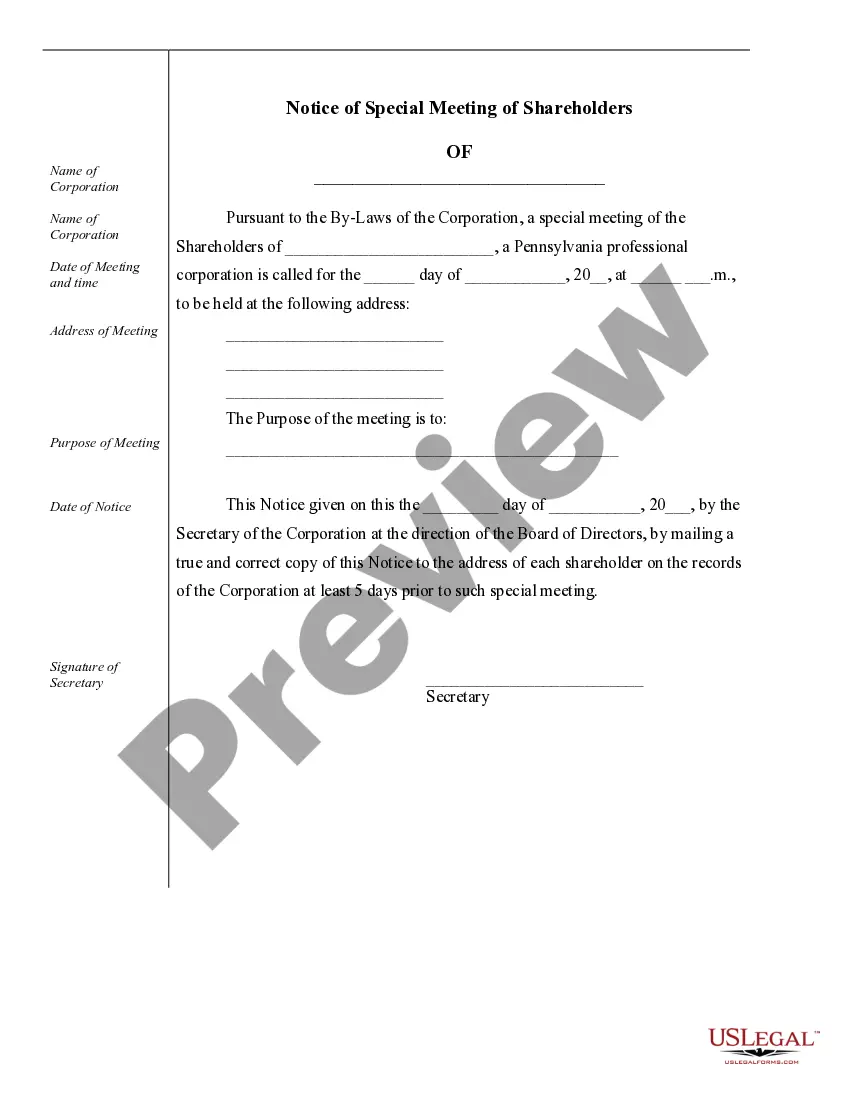

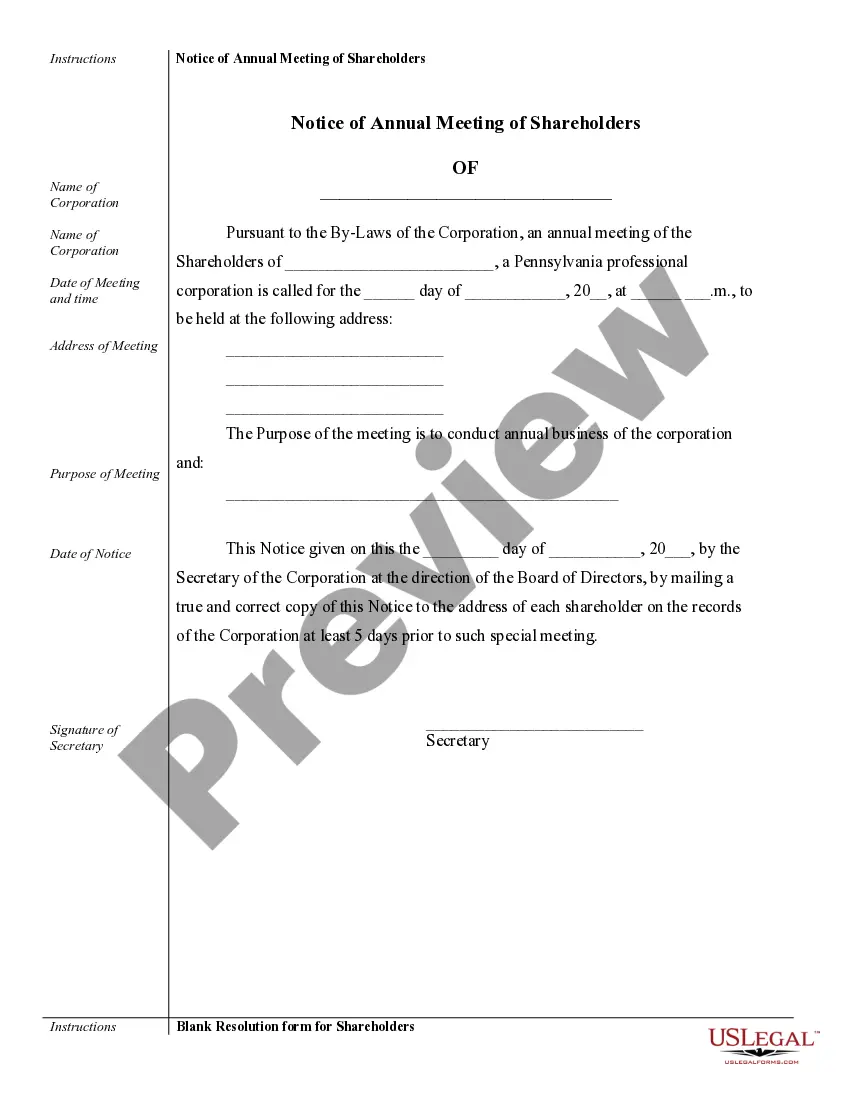

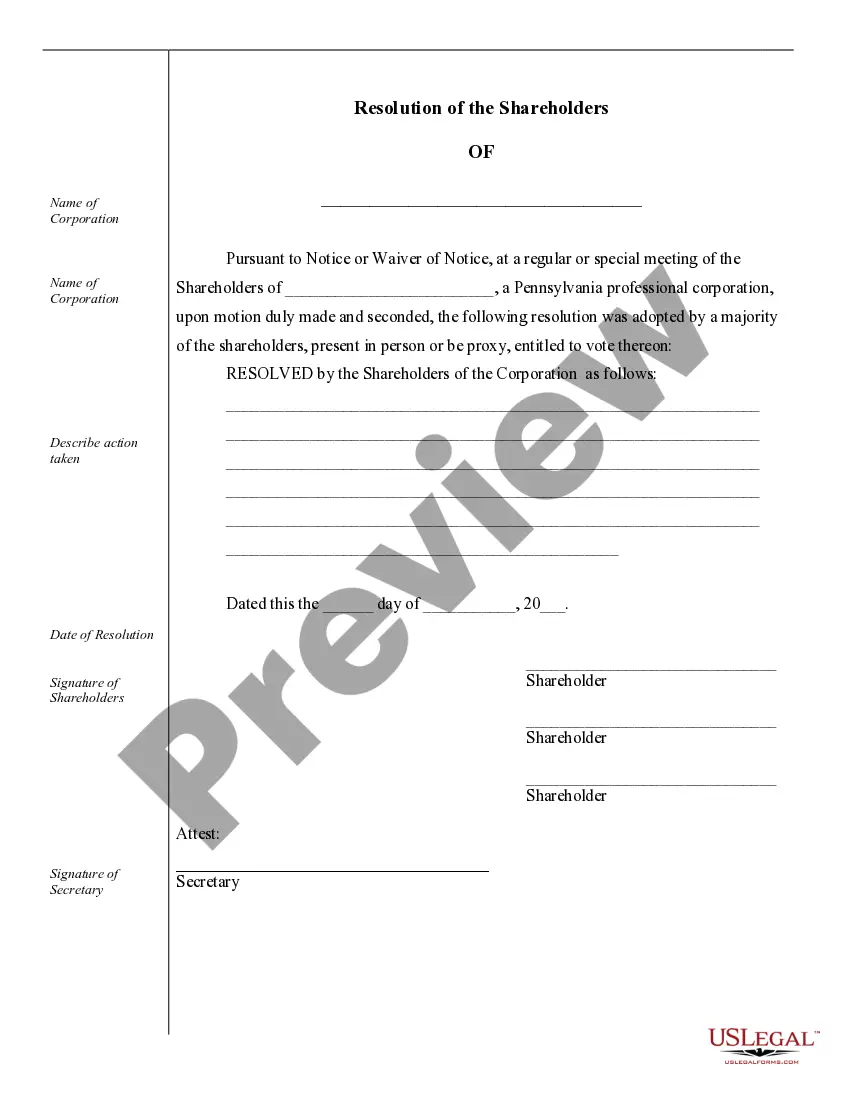

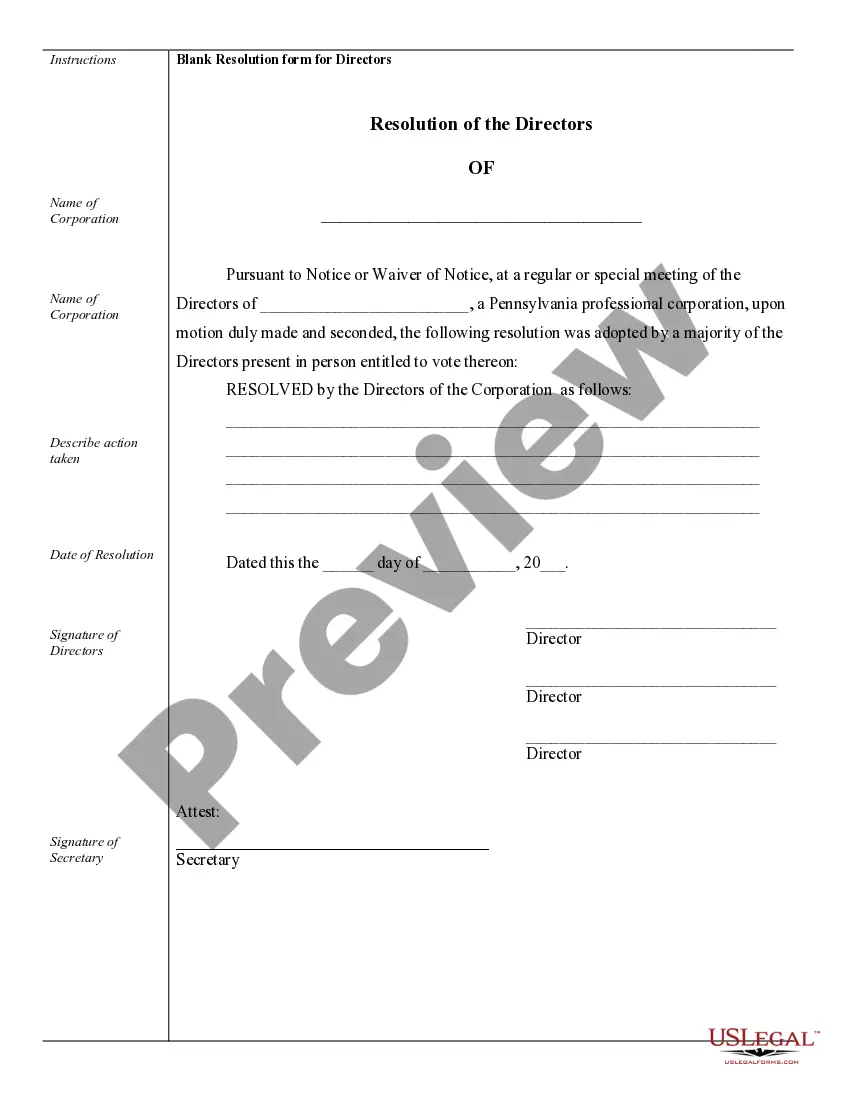

Allentown Sample Corporate Records for a Pennsylvania Professional Corporation consist of various documents that help maintain legal compliance, record essential information, and ensure smooth operations within the corporation. These records play a crucial role in documenting crucial business details and maintaining transparency among stakeholders. Below are some key types of Allentown Sample Corporate Records that are typically required for a Pennsylvania Professional Corporation: 1. Articles of Incorporation: This document outlines important details about the corporation, such as its name, purpose, registered office address, shares of stock, and the names of initial directors and officers. It is a legal requirement to file Articles of Incorporation with the Pennsylvania Department of State. 2. Bylaws: Bylaws lay out the internal rules and regulations that govern the corporation's management and operation. They typically include information about shareholder meetings, director responsibilities, voting procedures, and corporate decision-making processes. 3. Meeting Minutes: Meeting Minutes serve as an official record of board meetings and shareholders' meetings. They document discussions, decisions, and votes on important matters like the appointment or removal of officers and directors, significant financial transactions, and changes to the corporation's bylaws. 4. Stock Ledgers: Stock ledgers maintain an up-to-date record of shareholders and the ownership of shares in the corporation. These records are vital in determining voting rights, dividends, and ownership interests. 5. Resolutions: Resolutions are written records of formal decisions made by the board of directors or shareholders. These resolutions may pertain to topics including the issuance of stock, appointment of officers, adoption of major policies, or significant business transactions. 6. Financial Statements: Financial statements comprise documents that outline the corporation's financial performance, including income statements, balance sheets, and cash flow statements. These records provide transparency about the corporation's financial health and are essential for tax compliance and financial reporting purposes. 7. Stock Certificates: Stock certificates are legal documents that represent ownership of shares in the corporation. These certificates are issued to shareholders and serve as evidence of their ownership interest in the company. 8. Annual Reports: As per Pennsylvania law, professional corporations are required to file annual reports with the state. These reports provide updates on the corporation's principal office address, registered agent, officers, and directors. Maintaining and organizing these Allentown Sample Corporate Records properly is essential to ensure legal compliance, protect the corporation's interests, and provide transparency for shareholders and stakeholders. Proactively maintaining accurate and up-to-date records is vital to avoid any potential legal issues and to demonstrate responsible corporate governance.

Allentown Sample Corporate Records for a Pennsylvania Professional Corporation

State:

Pennsylvania

City:

Allentown

Control #:

PA-PC-CR

Format:

Word;

Rich Text

Instant download

Description

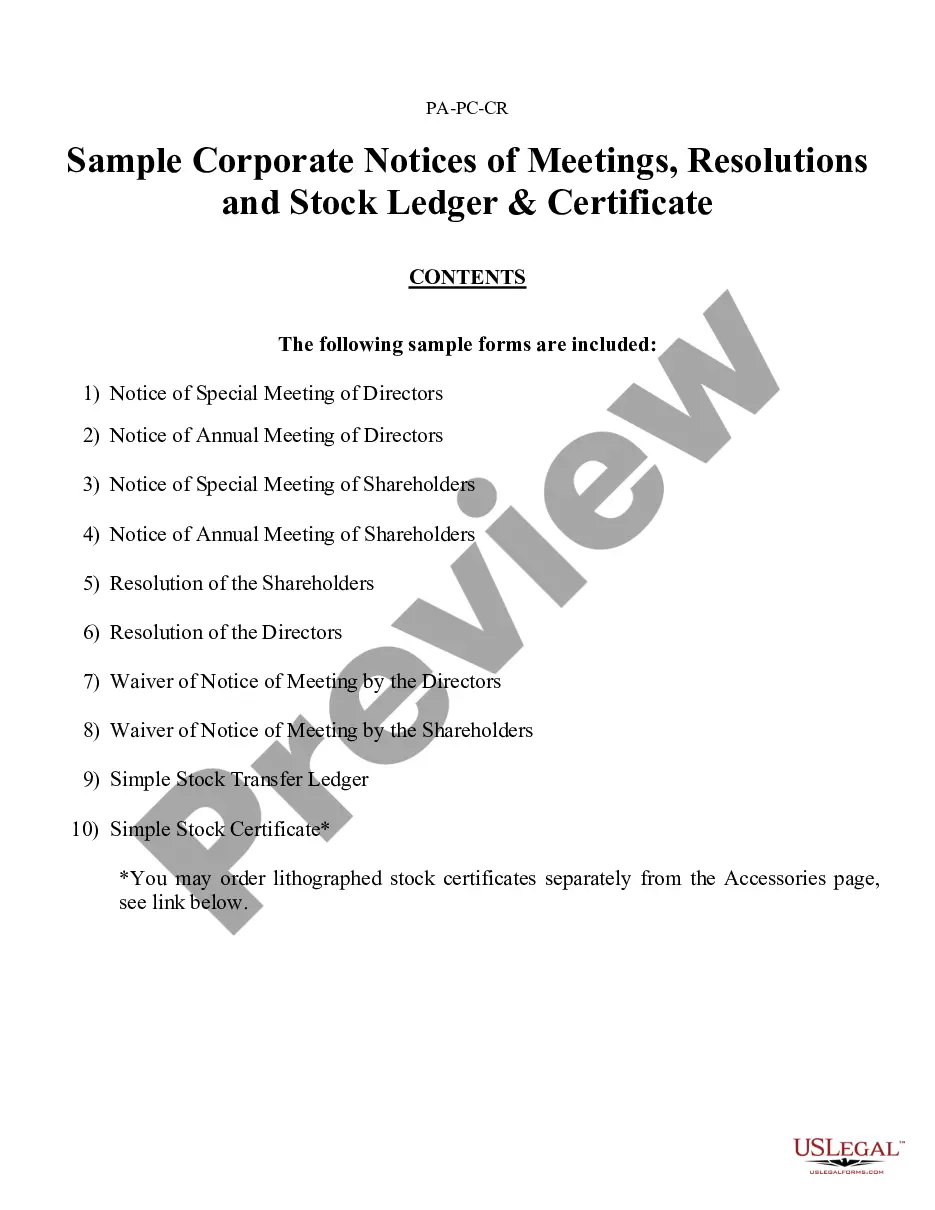

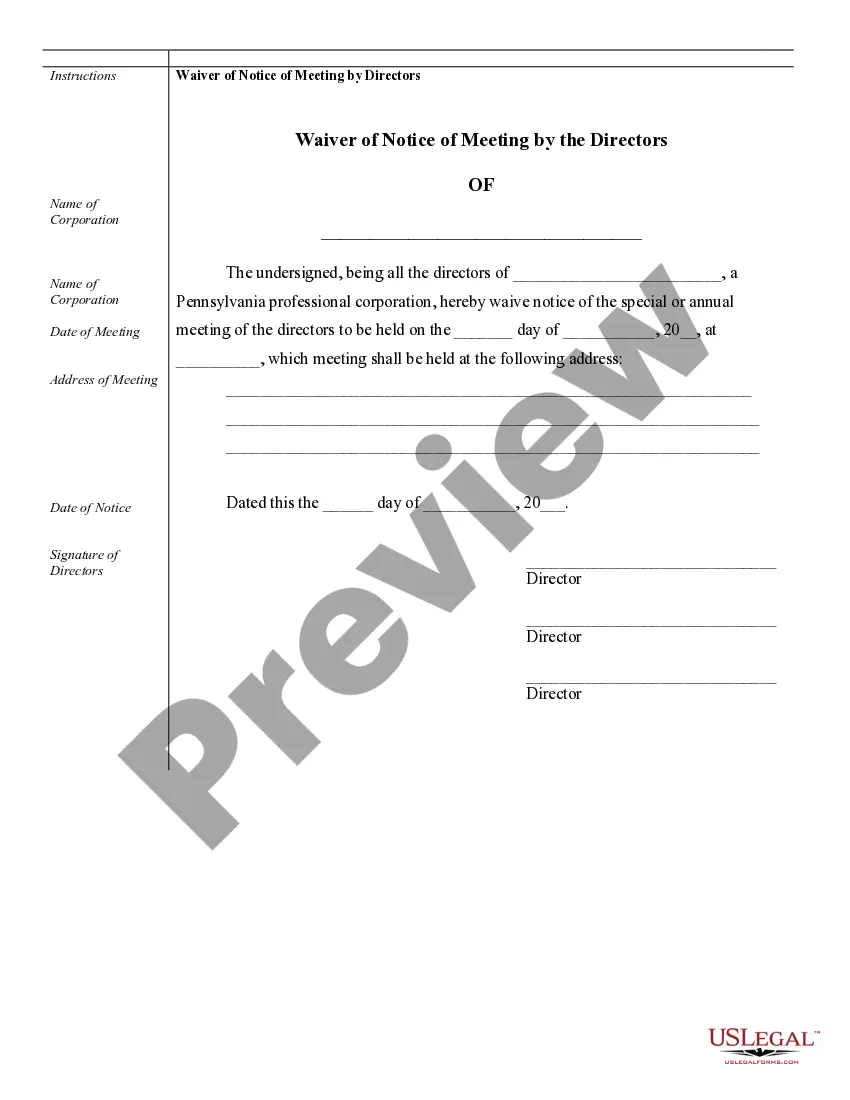

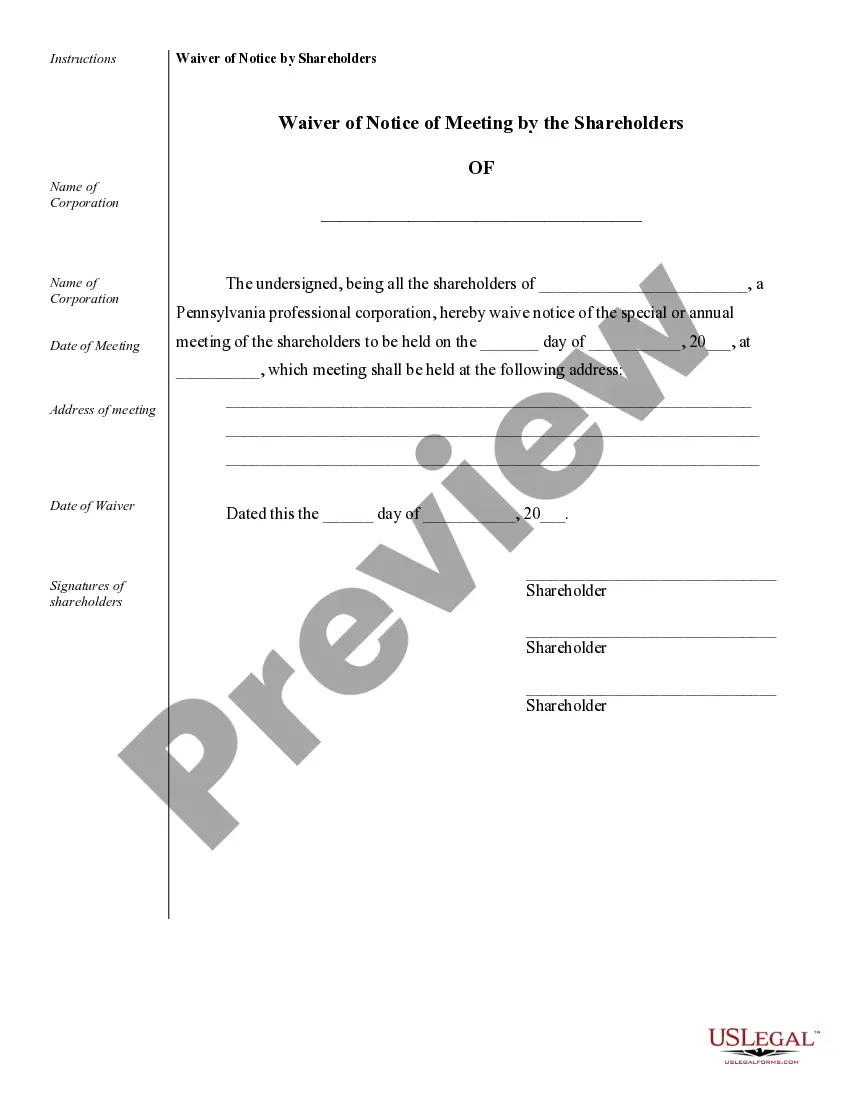

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Allentown Sample Corporate Records for a Pennsylvania Professional Corporation consist of various documents that help maintain legal compliance, record essential information, and ensure smooth operations within the corporation. These records play a crucial role in documenting crucial business details and maintaining transparency among stakeholders. Below are some key types of Allentown Sample Corporate Records that are typically required for a Pennsylvania Professional Corporation: 1. Articles of Incorporation: This document outlines important details about the corporation, such as its name, purpose, registered office address, shares of stock, and the names of initial directors and officers. It is a legal requirement to file Articles of Incorporation with the Pennsylvania Department of State. 2. Bylaws: Bylaws lay out the internal rules and regulations that govern the corporation's management and operation. They typically include information about shareholder meetings, director responsibilities, voting procedures, and corporate decision-making processes. 3. Meeting Minutes: Meeting Minutes serve as an official record of board meetings and shareholders' meetings. They document discussions, decisions, and votes on important matters like the appointment or removal of officers and directors, significant financial transactions, and changes to the corporation's bylaws. 4. Stock Ledgers: Stock ledgers maintain an up-to-date record of shareholders and the ownership of shares in the corporation. These records are vital in determining voting rights, dividends, and ownership interests. 5. Resolutions: Resolutions are written records of formal decisions made by the board of directors or shareholders. These resolutions may pertain to topics including the issuance of stock, appointment of officers, adoption of major policies, or significant business transactions. 6. Financial Statements: Financial statements comprise documents that outline the corporation's financial performance, including income statements, balance sheets, and cash flow statements. These records provide transparency about the corporation's financial health and are essential for tax compliance and financial reporting purposes. 7. Stock Certificates: Stock certificates are legal documents that represent ownership of shares in the corporation. These certificates are issued to shareholders and serve as evidence of their ownership interest in the company. 8. Annual Reports: As per Pennsylvania law, professional corporations are required to file annual reports with the state. These reports provide updates on the corporation's principal office address, registered agent, officers, and directors. Maintaining and organizing these Allentown Sample Corporate Records properly is essential to ensure legal compliance, protect the corporation's interests, and provide transparency for shareholders and stakeholders. Proactively maintaining accurate and up-to-date records is vital to avoid any potential legal issues and to demonstrate responsible corporate governance.

Free preview

How to fill out Allentown Sample Corporate Records For A Pennsylvania Professional Corporation?

If you’ve already utilized our service before, log in to your account and download the Allentown Sample Corporate Records for a Pennsylvania Professional Corporation on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Allentown Sample Corporate Records for a Pennsylvania Professional Corporation. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!