Philadelphia Sample Corporate Records for a Pennsylvania Professional Corporation are essential documents that provide comprehensive information about the company's activities, structure, and financial status. These records play a crucial role in ensuring transparency, compliance with legal regulations, and proper management of the corporation. Here, we will discuss relevant keywords while highlighting various types of Philadelphia Sample Corporate Records that are commonly maintained for a Pennsylvania Professional Corporation. 1. Articles of Incorporation: The Articles of Incorporation are one of the key records and legal documents created during the formation of a Pennsylvania Professional Corporation. They contain vital information such as the corporation's name, purpose, registered agent, and the number of authorized shares. 2. Bylaws: Bylaws are essential corporate records that outline the internal governance rules and operating procedures for the Pennsylvania Professional Corporation. They provide a blueprint for managing the corporation and cover areas such as the roles and responsibilities of directors and officers, meeting procedures, voting rights, and shareholder rights. 3. Meeting Minutes: Meeting Minutes document the proceedings and decisions made during board meetings or shareholder meetings. They serve as a record of discussions, resolutions, and voting outcomes. These records demonstrate compliance, decision-making transparency, and can be used as evidence in legal matters. 4. Shareholder Records: Shareholder Records maintain important information about the shareholders holding ownership interest in the Pennsylvania Professional Corporation. These records include the names, contact details, ownership percentages, and history of share transfers for each shareholder. 5. Stock Ledgers: Stock Ledgers provide a detailed record of the corporation's shares and their allocation to individual shareholders. This record tracks the issuance, transfer, and cancellation of stock certificates and helps ensure accurate ownership documentation. 6. Financial Statements: Financial Statements are critical records that present a comprehensive overview of the corporation's financial health. They include the balance sheet, income statement, cash flow statement, and notes to financial statements. These records allow stakeholders and regulatory authorities to assess the corporation's financial performance and compliance. 7. Tax Filings: Philadelphia Sample Corporate Records for a Pennsylvania Professional Corporation should include copies of the corporation's tax filings. This includes federal, state, and local income tax returns, providing a history of the corporation's tax compliance and payment status. 8. Contracts and Agreements: Comprehensive records of contracts and agreements entered into by the Pennsylvania Professional Corporation should be maintained. These include employment contracts, lease agreements, partnership agreements, client contracts, and any other legally binding agreements. 9. Licenses and Permits: Records should be kept of all licenses and permits obtained by the corporation to operate legally in Philadelphia and Pennsylvania. This includes professional licenses, trade licenses, and permits required for specific activities or operations. 10. Regulatory and Compliance Documents: Records related to compliance with specific regulations should be maintained. This may include documents demonstrating adherence to industry-specific regulations, permits for regulated activities, and documentation of ongoing compliance efforts. By diligently maintaining these Philadelphia Sample Corporate Records for a Pennsylvania Professional Corporation, the corporation ensures transparency, legal compliance, and efficient management. These records provide a comprehensive history of the corporation's activities and its compliance with relevant laws and regulations.

Philadelphia Form Certificate

State:

Pennsylvania

County:

Philadelphia

Control #:

PA-PC-CR

Format:

Word;

Rich Text

Instant download

Description

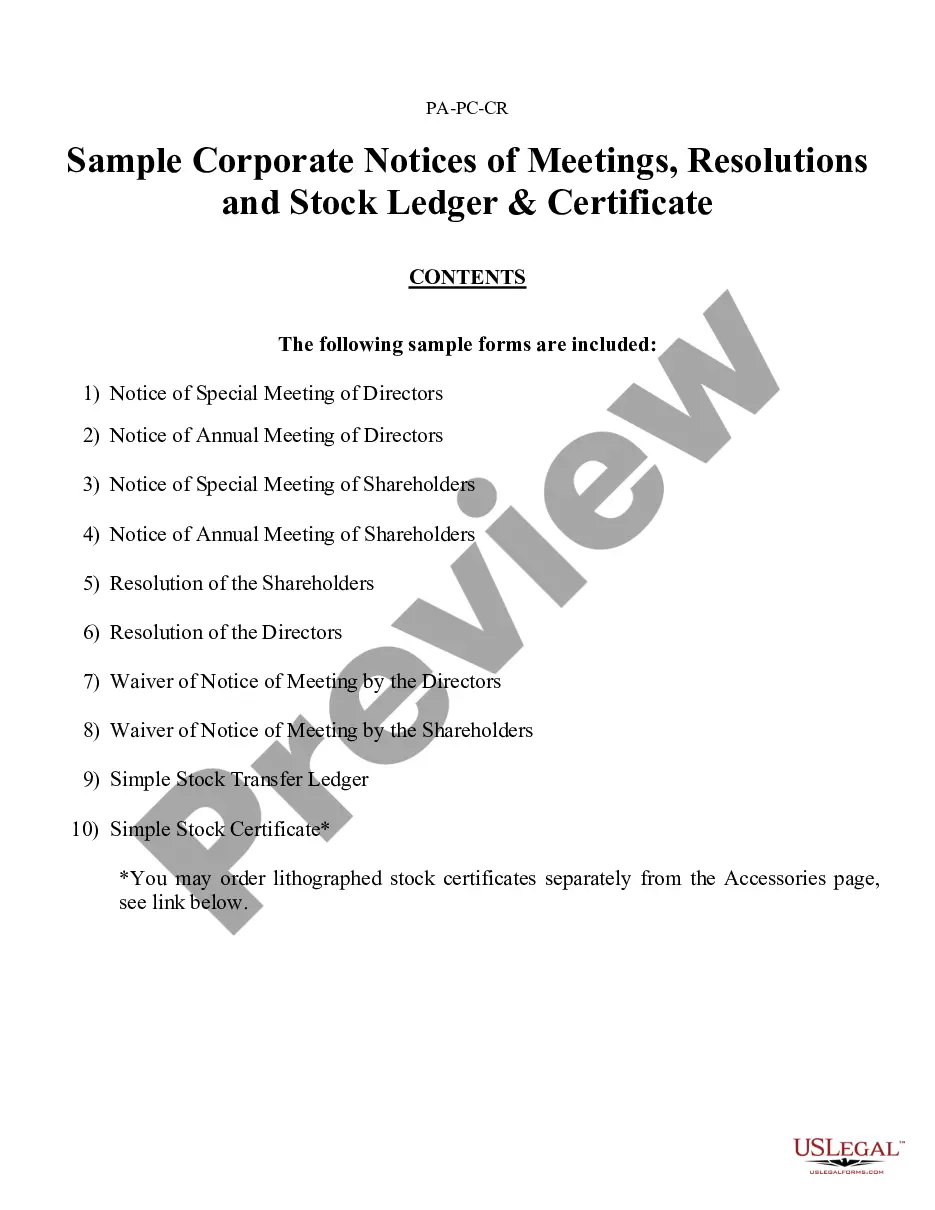

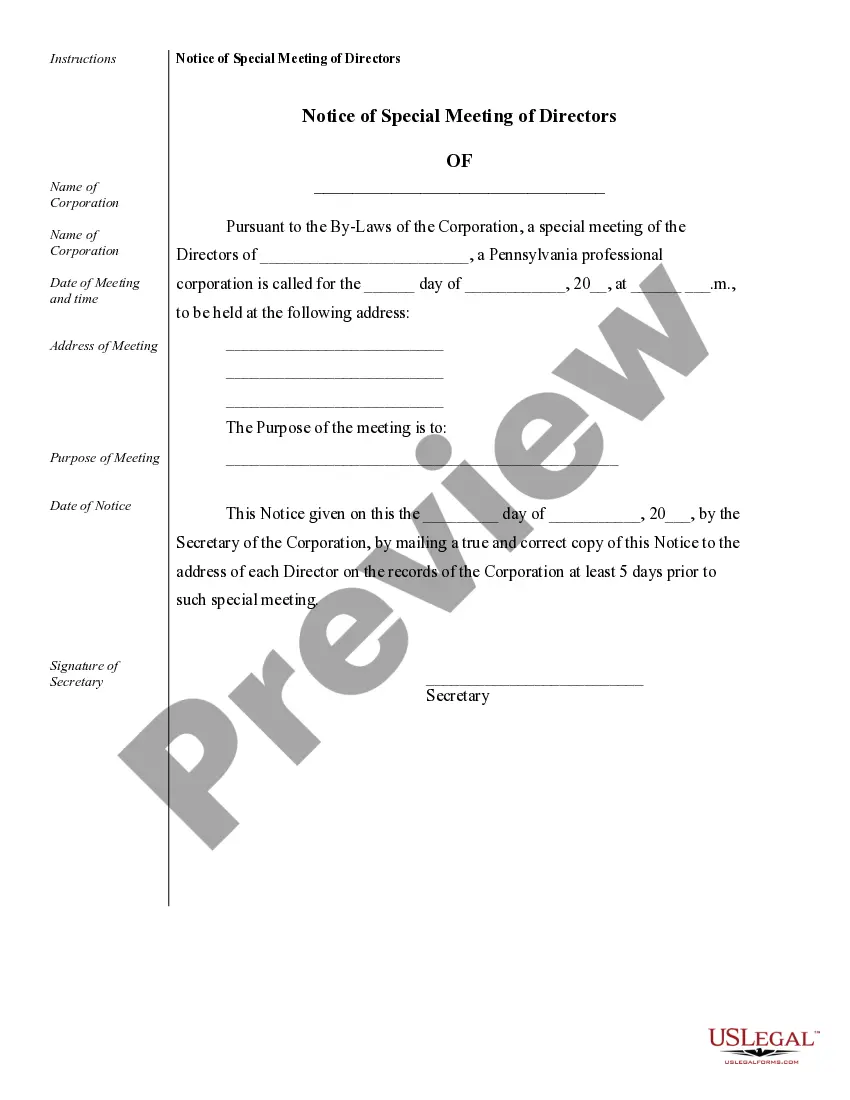

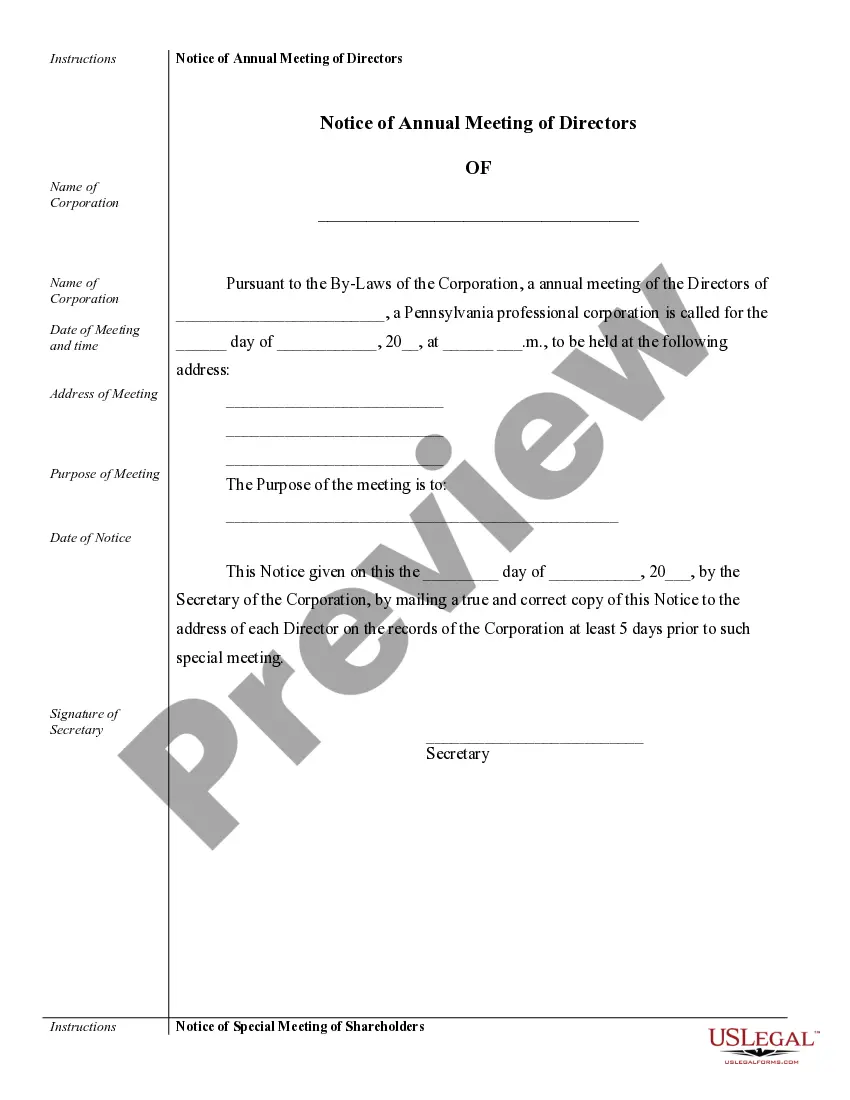

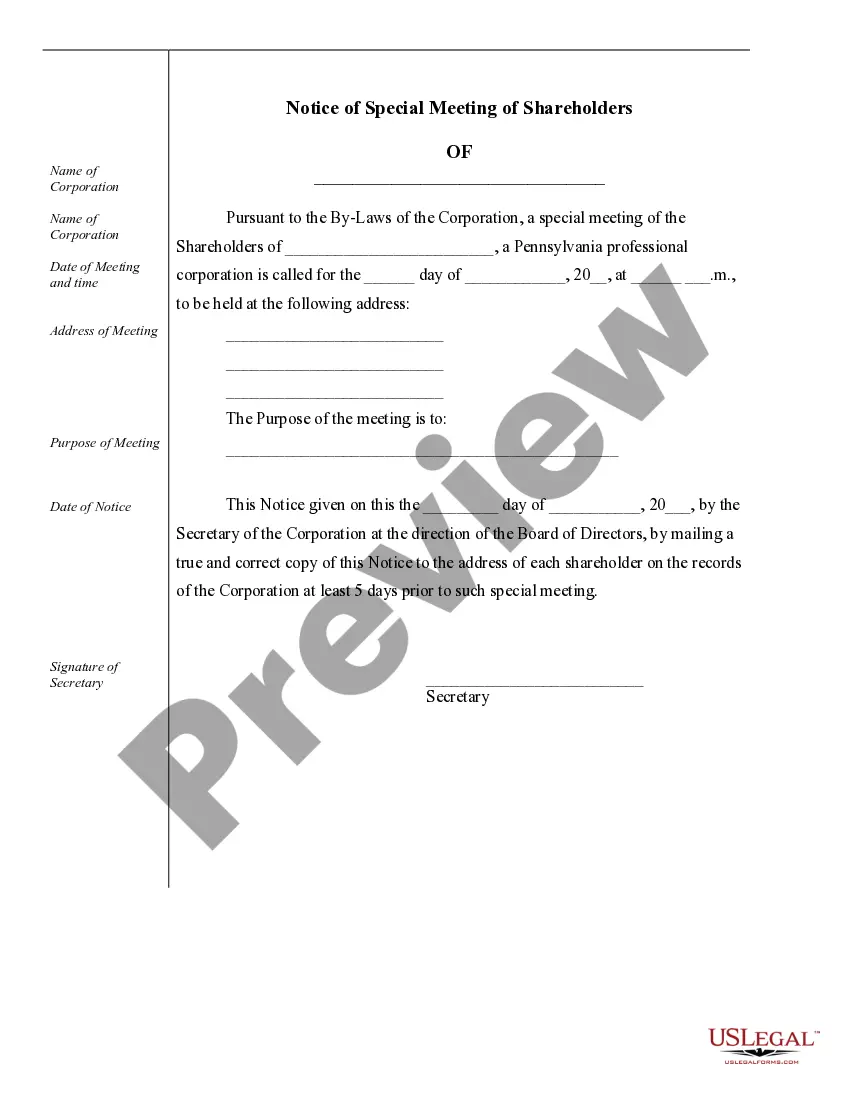

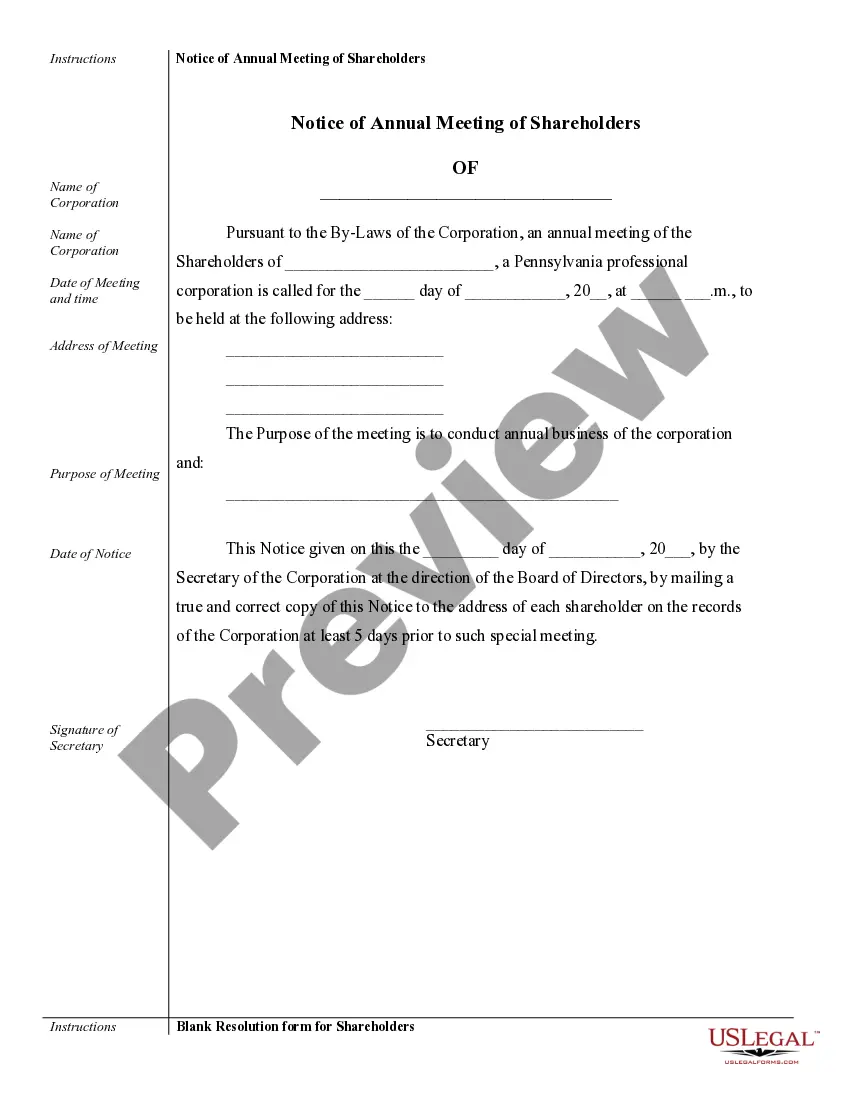

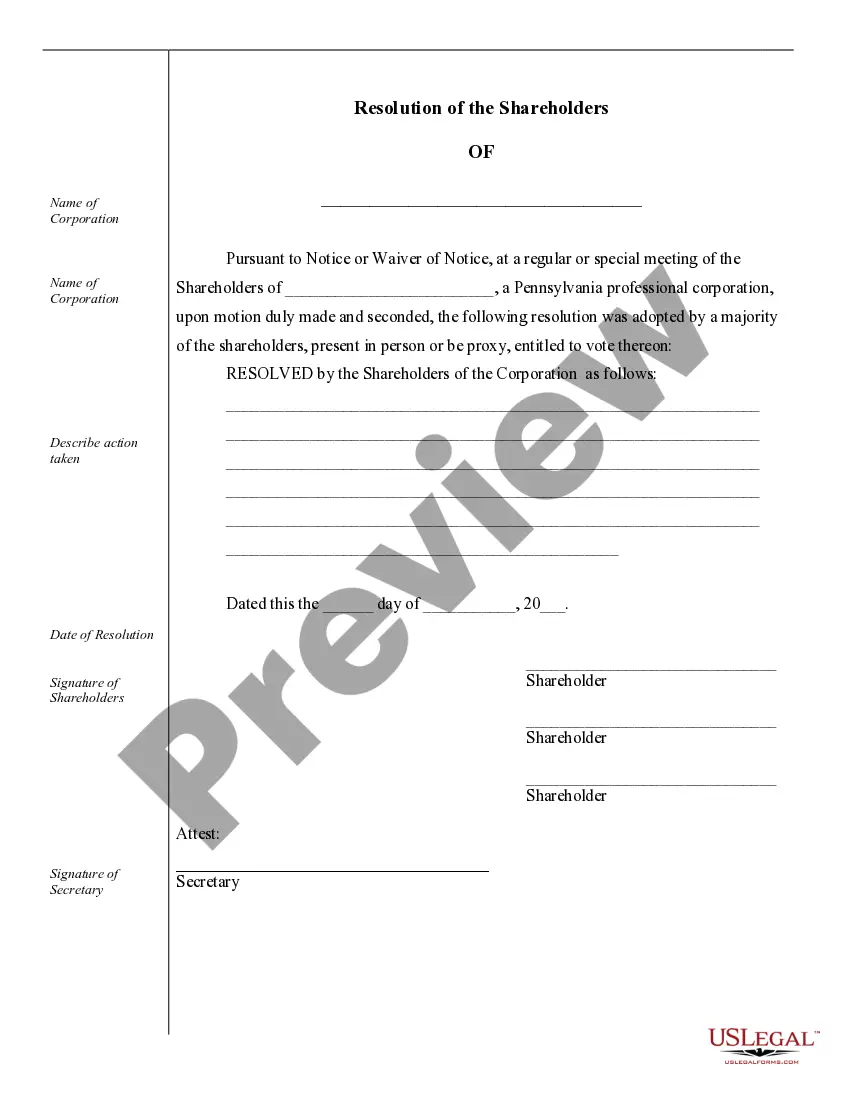

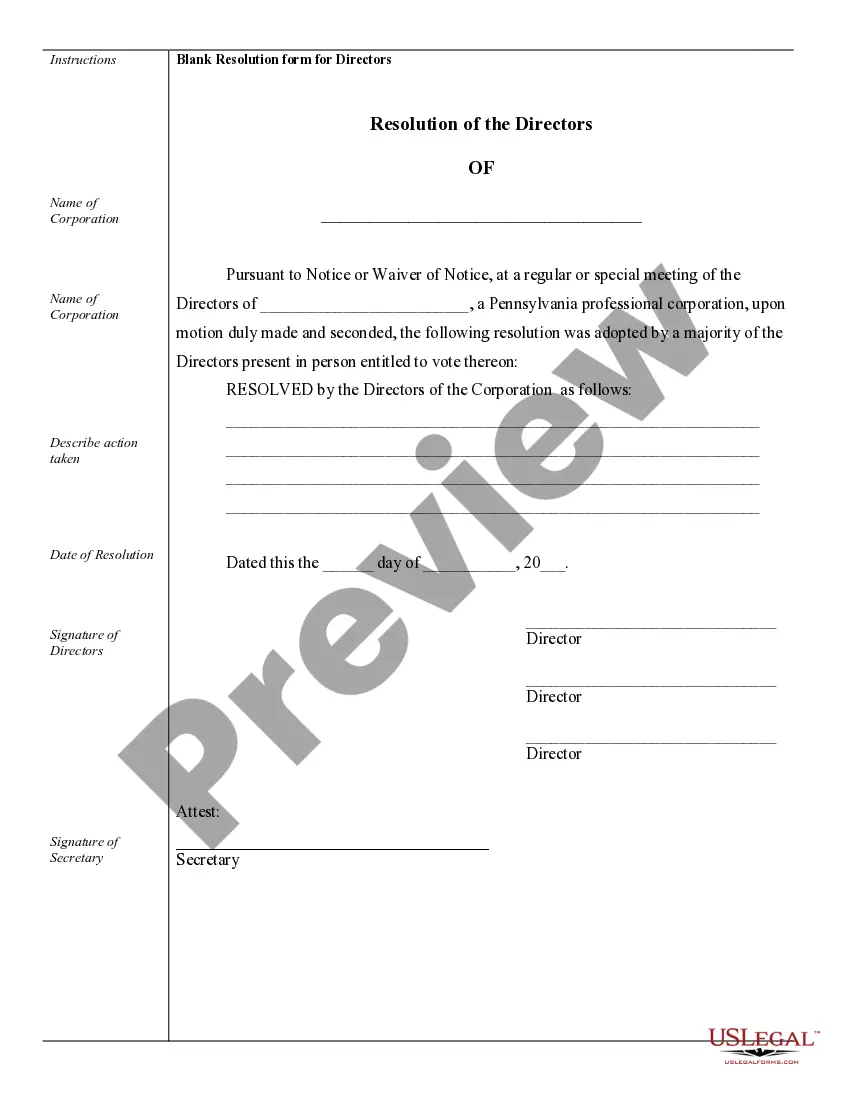

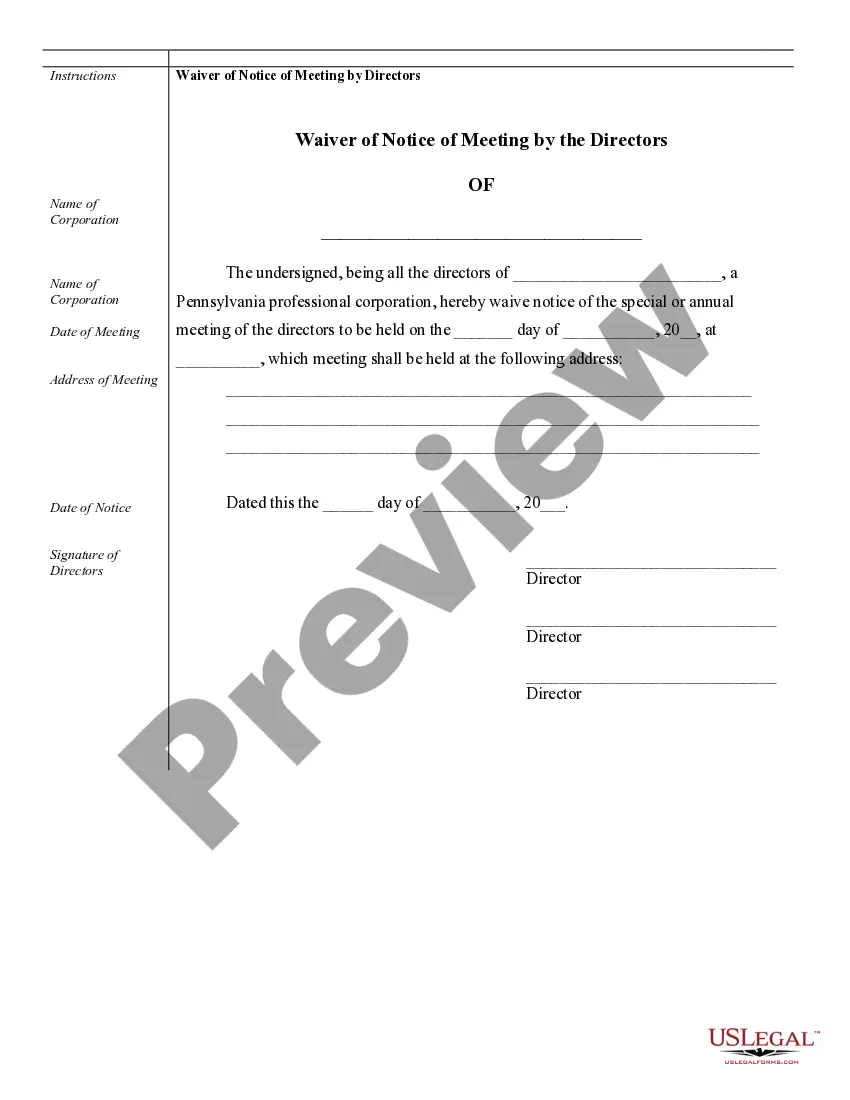

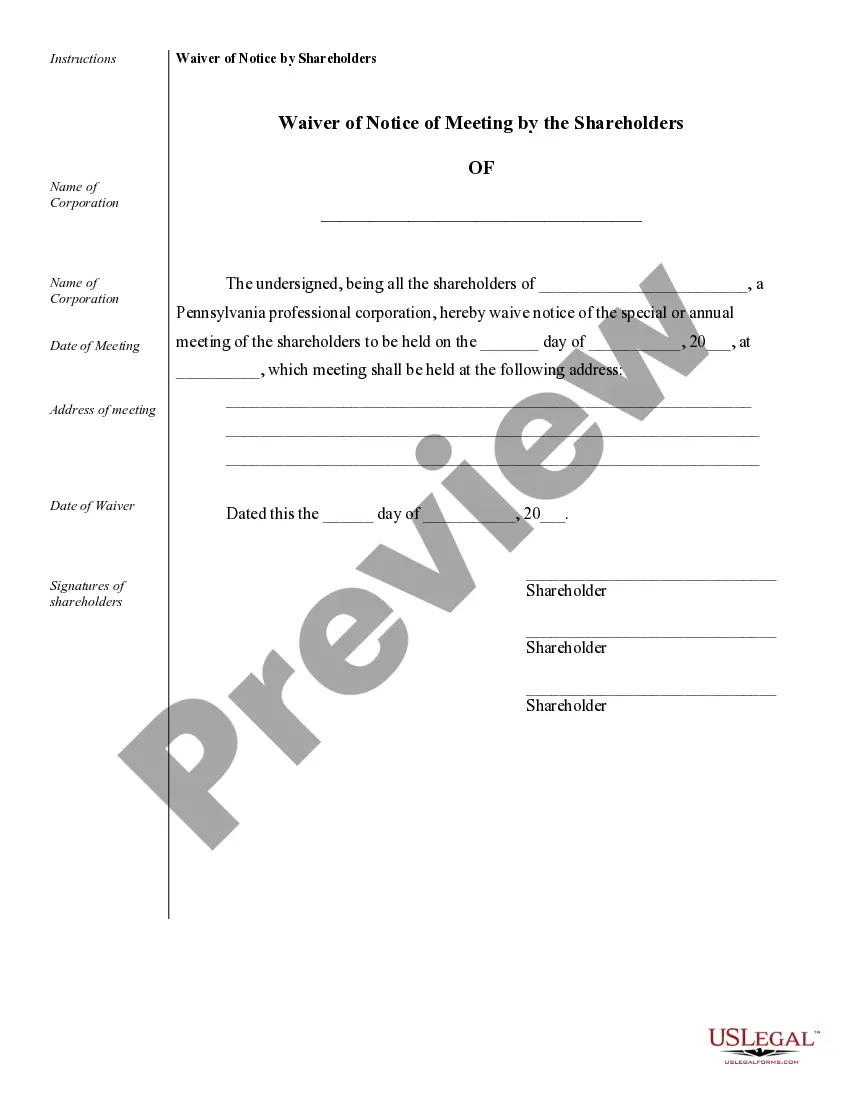

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Philadelphia Sample Corporate Records for a Pennsylvania Professional Corporation are essential documents that provide comprehensive information about the company's activities, structure, and financial status. These records play a crucial role in ensuring transparency, compliance with legal regulations, and proper management of the corporation. Here, we will discuss relevant keywords while highlighting various types of Philadelphia Sample Corporate Records that are commonly maintained for a Pennsylvania Professional Corporation. 1. Articles of Incorporation: The Articles of Incorporation are one of the key records and legal documents created during the formation of a Pennsylvania Professional Corporation. They contain vital information such as the corporation's name, purpose, registered agent, and the number of authorized shares. 2. Bylaws: Bylaws are essential corporate records that outline the internal governance rules and operating procedures for the Pennsylvania Professional Corporation. They provide a blueprint for managing the corporation and cover areas such as the roles and responsibilities of directors and officers, meeting procedures, voting rights, and shareholder rights. 3. Meeting Minutes: Meeting Minutes document the proceedings and decisions made during board meetings or shareholder meetings. They serve as a record of discussions, resolutions, and voting outcomes. These records demonstrate compliance, decision-making transparency, and can be used as evidence in legal matters. 4. Shareholder Records: Shareholder Records maintain important information about the shareholders holding ownership interest in the Pennsylvania Professional Corporation. These records include the names, contact details, ownership percentages, and history of share transfers for each shareholder. 5. Stock Ledgers: Stock Ledgers provide a detailed record of the corporation's shares and their allocation to individual shareholders. This record tracks the issuance, transfer, and cancellation of stock certificates and helps ensure accurate ownership documentation. 6. Financial Statements: Financial Statements are critical records that present a comprehensive overview of the corporation's financial health. They include the balance sheet, income statement, cash flow statement, and notes to financial statements. These records allow stakeholders and regulatory authorities to assess the corporation's financial performance and compliance. 7. Tax Filings: Philadelphia Sample Corporate Records for a Pennsylvania Professional Corporation should include copies of the corporation's tax filings. This includes federal, state, and local income tax returns, providing a history of the corporation's tax compliance and payment status. 8. Contracts and Agreements: Comprehensive records of contracts and agreements entered into by the Pennsylvania Professional Corporation should be maintained. These include employment contracts, lease agreements, partnership agreements, client contracts, and any other legally binding agreements. 9. Licenses and Permits: Records should be kept of all licenses and permits obtained by the corporation to operate legally in Philadelphia and Pennsylvania. This includes professional licenses, trade licenses, and permits required for specific activities or operations. 10. Regulatory and Compliance Documents: Records related to compliance with specific regulations should be maintained. This may include documents demonstrating adherence to industry-specific regulations, permits for regulated activities, and documentation of ongoing compliance efforts. By diligently maintaining these Philadelphia Sample Corporate Records for a Pennsylvania Professional Corporation, the corporation ensures transparency, legal compliance, and efficient management. These records provide a comprehensive history of the corporation's activities and its compliance with relevant laws and regulations.

Free preview

How to fill out Philadelphia Sample Corporate Records For A Pennsylvania Professional Corporation?

If you’ve already utilized our service before, log in to your account and save the Philadelphia Sample Corporate Records for a Pennsylvania Professional Corporation on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Ensure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Philadelphia Sample Corporate Records for a Pennsylvania Professional Corporation. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!