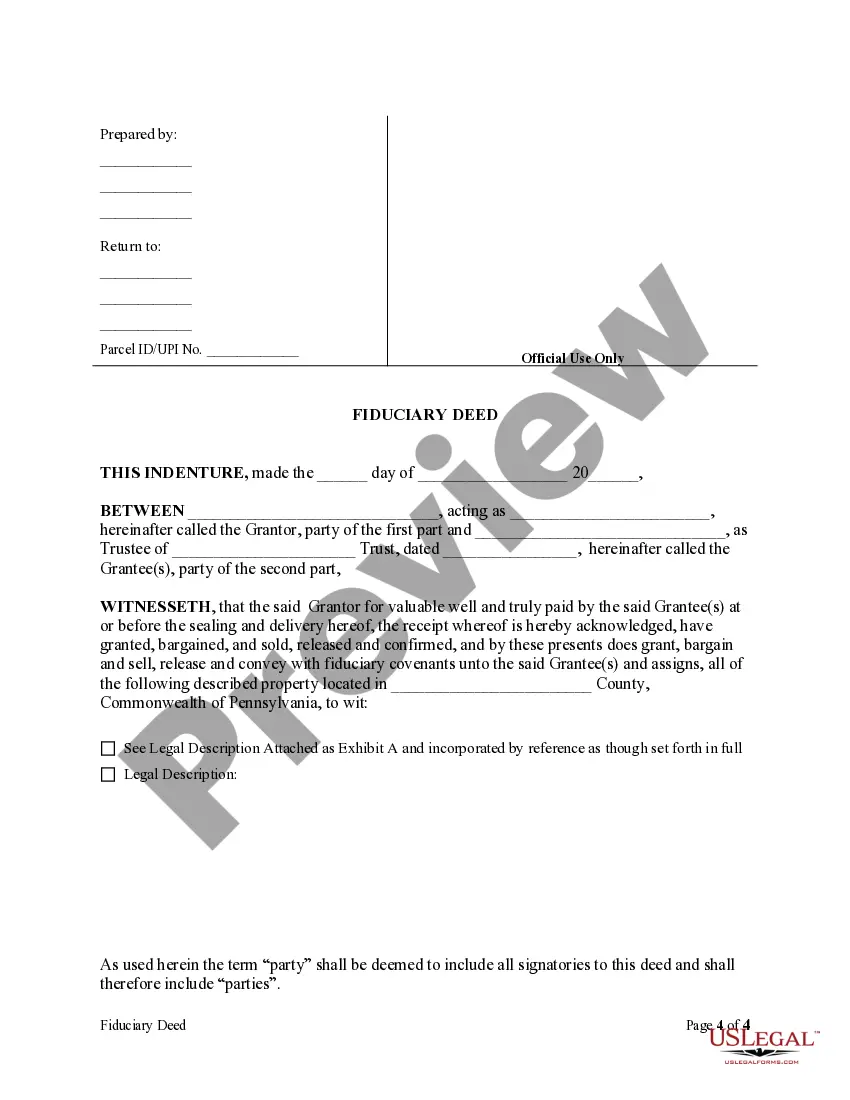

The Allentown Pennsylvania Fiduciary Deed is a legal document used by Executors, Trustees, Trustees, Administrators, and other Fiduciaries to transfer real estate property to beneficiaries or other designated parties. This deed serves as proof of the transfer of ownership from the fiduciary, who holds the property in trust, to the intended recipient. Executors are individuals appointed in a deceased person's will to administer the estate, while Trustees are responsible for managing trust assets on behalf of beneficiaries. Trustees are the creators of the trust, while Administrators handle the distribution of assets for individuals who pass away without a will. These fiduciaries have specific duties and powers regarding the property they are entrusted with, and the Allentown Pennsylvania Fiduciary Deed facilitates the proper transfer of this property. The Allentown Pennsylvania Fiduciary Deed typically includes relevant information such as the name and contact details of the fiduciary, the description of the property being transferred, and the identity of the beneficiary or recipient of the property. It also includes details regarding any encumbrances or liens on the property, if applicable. There are different types of Allentown Pennsylvania Fiduciary Deeds that may be used depending on the specific circumstances: 1. Executor's Fiduciary Deed: This type of deed is used when the Executor of a deceased person's estate transfers real estate property to the designated beneficiaries or heirs. 2. Trustee's Fiduciary Deed: This deed is employed when a Trustee, who manages a trust established by the Trust or, transfers ownership of real estate property held within the trust to the beneficiaries named in the trust agreement. 3. Trust or's Fiduciary Deed: A Trust or's Fiduciary Deed is used when the creator of a trust, known as the Trust or, transfers ownership of real estate property held within the trust to the Trustee for the trust's administration. 4. Administrator's Fiduciary Deed: This type of deed is utilized by Administrators to transfer real estate property of a deceased person who passed away without a will (intestate) to the rightful beneficiaries or heirs. Allentown Pennsylvania Fiduciary Deeds provide a legally binding mechanism for transferring property rights and protecting the interests of both the fiduciary and the beneficiary. It ensures compliance with Pennsylvania state laws and must be executed in accordance with the relevant legal requirements and procedures. Legal advice from a qualified attorney or legal professional is advisable when preparing and executing a Fiduciary Deed in Allentown, Pennsylvania, to navigate the complexities involved in such transactions.

Allentown Pennsylvania Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Allentown Pennsylvania Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person with no law education to draft such papers from scratch, mostly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms can save the day. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you want the Allentown Pennsylvania Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Allentown Pennsylvania Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries in minutes using our trustworthy platform. In case you are presently an existing customer, you can proceed to log in to your account to get the needed form.

Nevertheless, if you are new to our library, make sure to follow these steps prior to obtaining the Allentown Pennsylvania Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries:

- Be sure the form you have found is specific to your location considering that the regulations of one state or area do not work for another state or area.

- Preview the document and read a brief description (if available) of scenarios the document can be used for.

- If the one you picked doesn’t meet your requirements, you can start over and look for the needed form.

- Click Buy now and choose the subscription option that suits you the best.

- with your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Allentown Pennsylvania Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries as soon as the payment is through.

You’re good to go! Now you can proceed to print out the document or fill it out online. In case you have any problems locating your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.