Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership

Description

How to fill out Pennsylvania Warranty Deed From Individual To A Family Limited Partnership?

If you have previously utilized our service, sign in to your account and retrieve the Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership onto your device by clicking the Download button. Verify that your subscription is active. If it’s not, renew it according to your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to acquire your document.

You have ongoing access to each document you have purchased: you can locate it in your profile under the My documents section whenever you need to revisit it. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or business requirements!

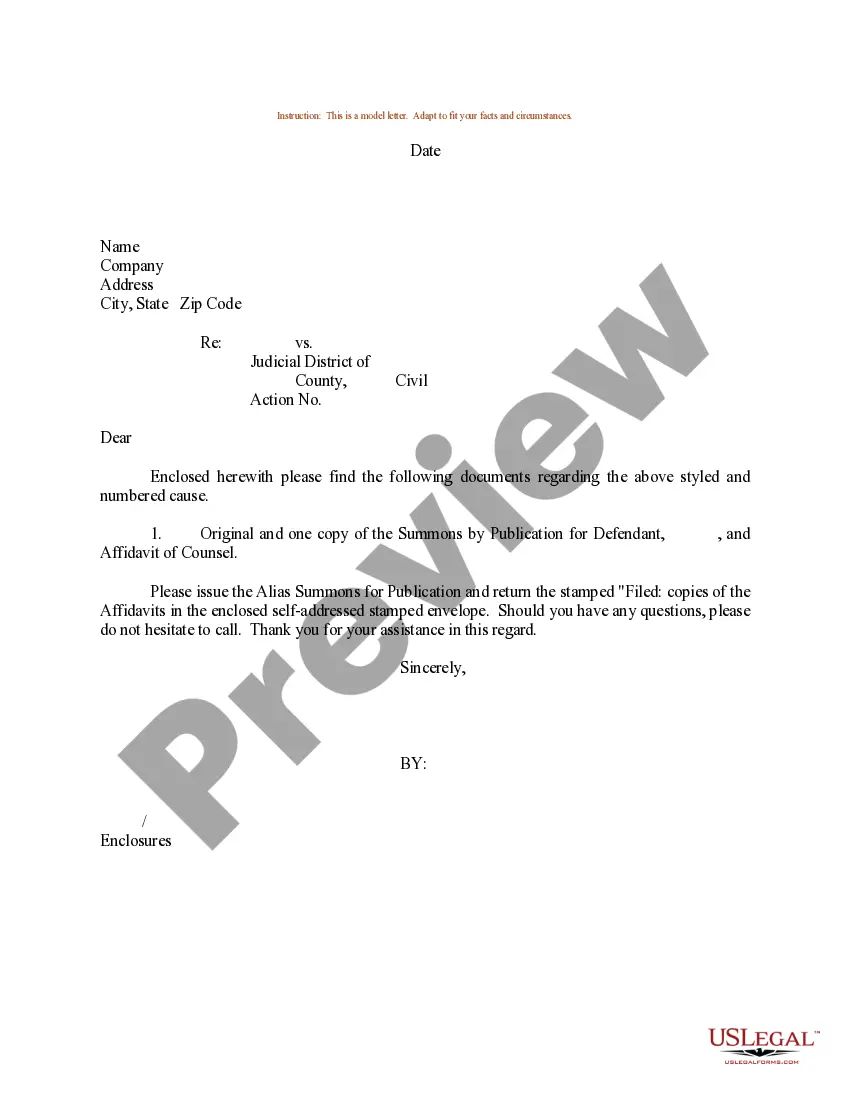

- Make sure you’ve located a suitable document. Browse the description and utilize the Preview feature, if accessible, to determine if it suits your requirements. If it doesn’t align with your needs, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or use the PayPal method to finalize the acquisition.

- Retrieve your Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership. Choose the file format for your document and store it on your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Yes, you can transfer a warranty deed, typically done through a new deed that conveys ownership to another party. This transfer allows the new owner to enjoy the same protections offered by the original warranty deed. Ensure to follow the correct procedures, as improper transfers can lead to issues down the line. Consulting a service like USLegalForms can help streamline this process for a Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership.

To transfer a house deed to a family member in Pennsylvania, start by preparing a deed that specifies the transfer details. You will need to sign the deed in front of a notary public. Once signed, file the deed with the county recorder of deeds to make the transfer official. This process is crucial for a smooth transition, especially when dealing with a Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership.

Yes, a warranty deed can be transferred between parties. The process involves the current owner executing a new warranty deed to the intended recipient. This ensures that the same ownership rights and protections are passed along. If you are considering this in relation to a Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership, make sure to follow the legal procedures carefully.

While a warranty deed offers strong protection for buyers, it does have some disadvantages. One downside is that it holds the seller accountable for any defects in the title, which can lead to potential legal disputes. Additionally, if issues arise after the conveyance, the new owner may face challenges in seeking compensation from the previous owner. Therefore, understanding the implications of a Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership is crucial.

To form a family limited partnership in Philadelphia, Pennsylvania, you need to decide on the partnership's structure. Begin by drafting a partnership agreement that outlines ownership interests and responsibilities. After that, register your partnership with the state by filing the necessary forms and paying the required fees. Consider consulting with a legal professional for assistance with your Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership.

To transfer a deed in Philadelphia, you will need to complete a Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership. First, gather all necessary documents, including the current deed and the details of the family limited partnership. You can then fill out the warranty deed form, ensuring you include all required information. After finalizing the document, submit it to the Philadelphia Department of Records for recording, which will officially change the ownership.

Transferring a deed in Philadelphia, PA, involves filling out a deed form and having it notarized. Next, you'll need to file it with the Department of Records. Consider utilizing platforms like USLegalForms to facilitate the preparation of your Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership, making the transfer seamless and efficient.

While you can transfer a deed in Pennsylvania without a lawyer, it is often a good idea to seek legal counsel. A lawyer can assist you with the specific details and paperwork required, especially for transactions involving a Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership. This expertise can help prevent future legal issues.

In Pennsylvania, it is not mandatory to have an attorney for transferring a deed. Nonetheless, consulting a legal professional can clarify the nuances involved in the transfer process. This is particularly true when dealing with a Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership, where understanding state laws can be beneficial.

To transfer a property deed in Philadelphia, you will need to complete a deed form and have it signed in the presence of a notary public. Afterward, you must file this deed with the Philadelphia Department of Records. Using resources like USLegalForms can streamline the process of preparing the Philadelphia Pennsylvania Warranty Deed from Individual to a Family Limited Partnership, ensuring accuracy and compliance.