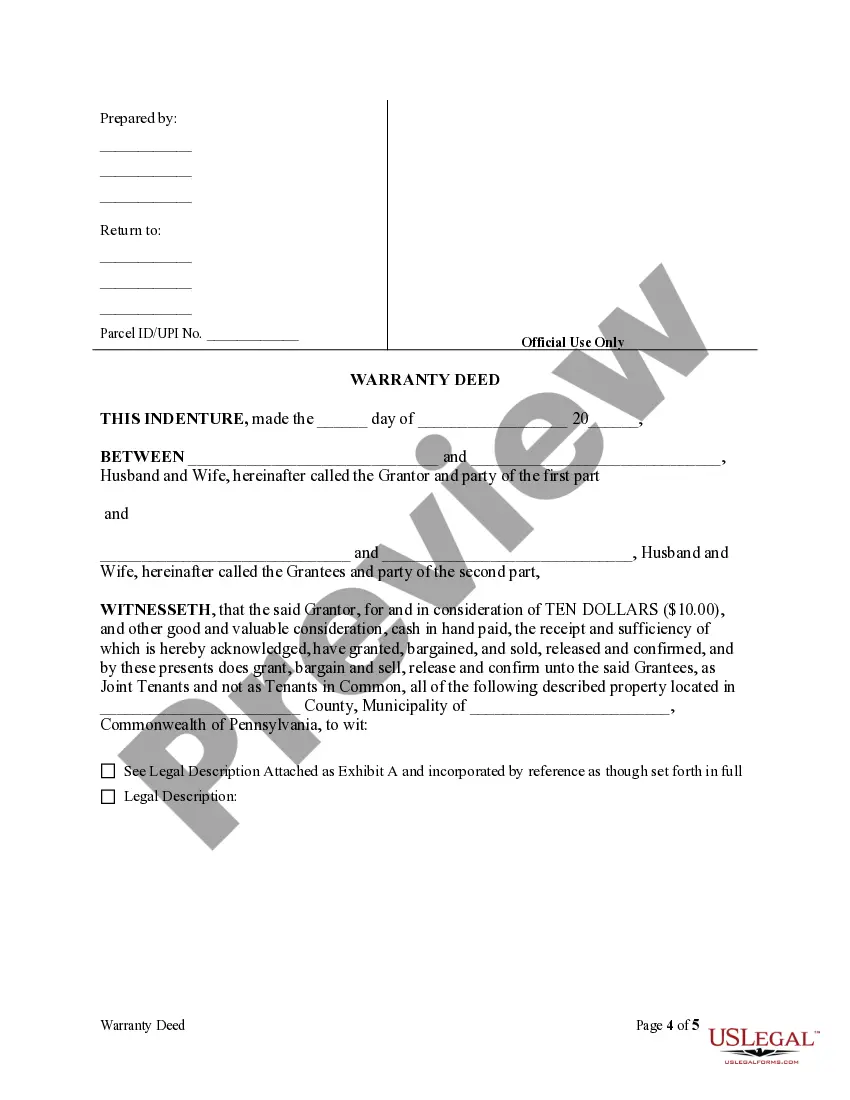

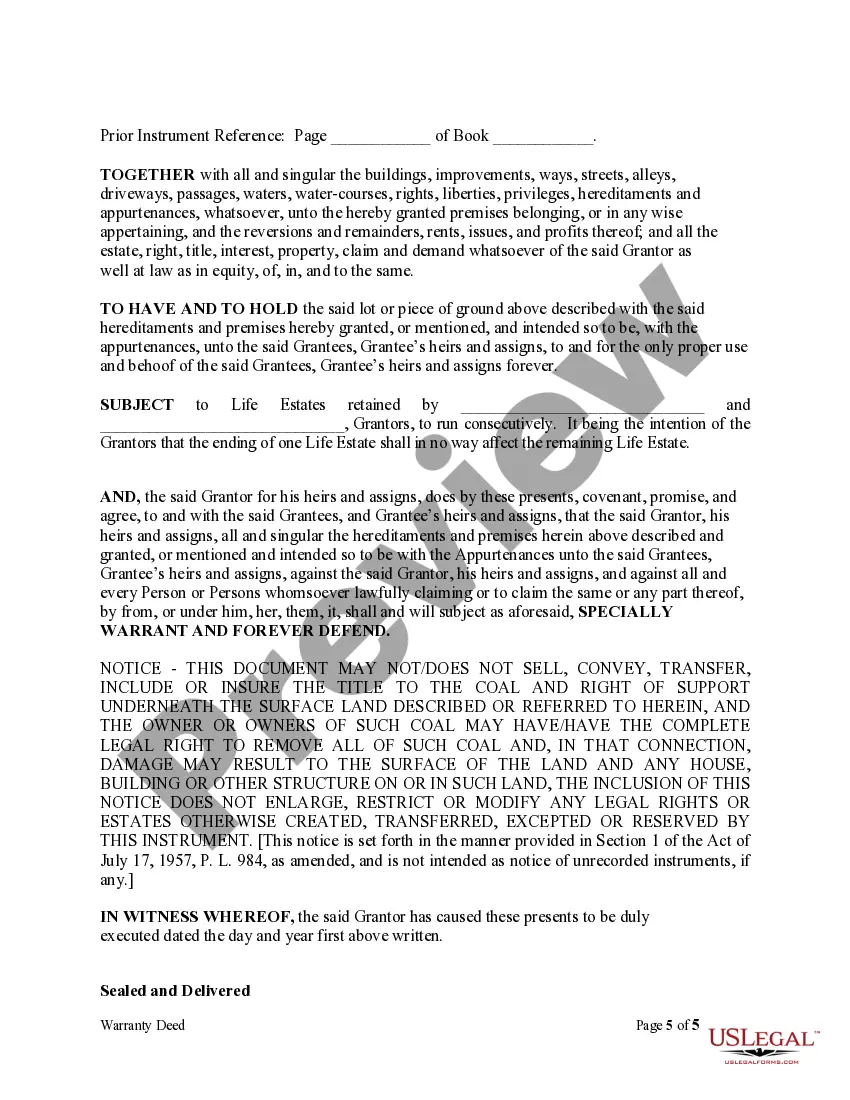

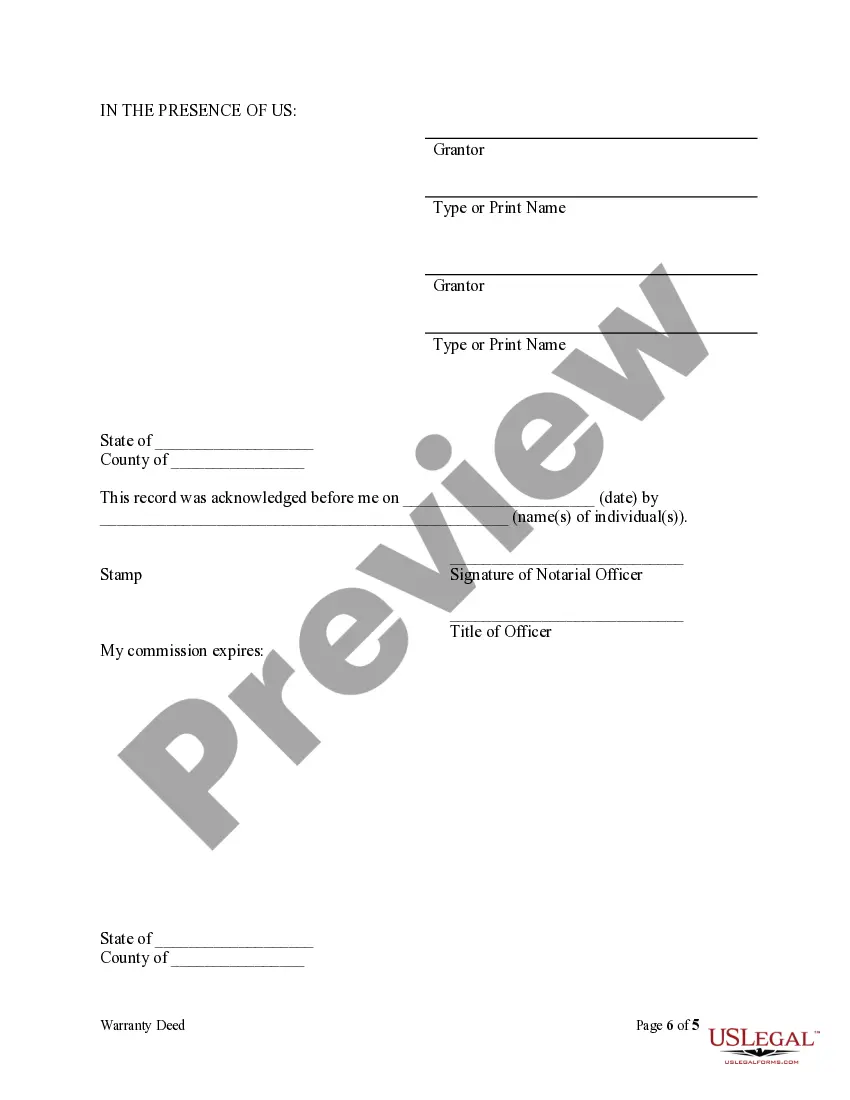

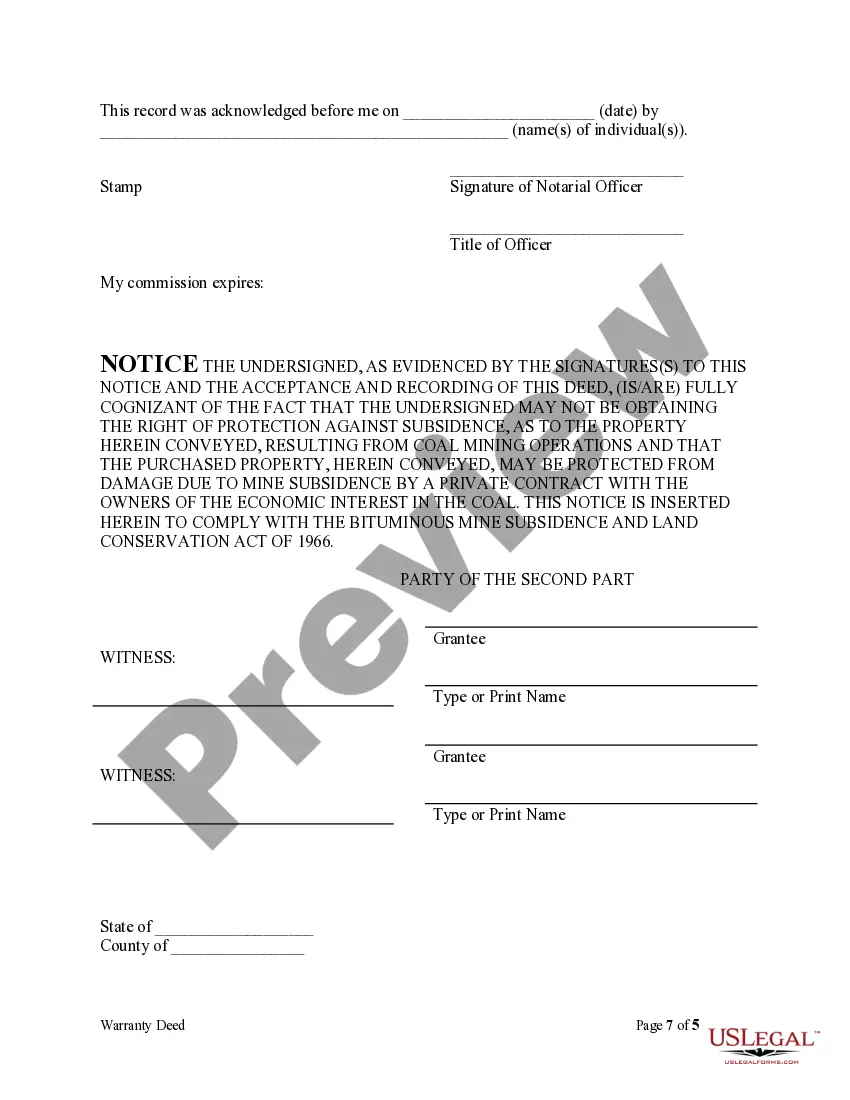

The Allentown Pennsylvania Warranty Deed for Husband and Wife to Husband and Wife as Joint Tenants with Granters Reserving Life Estate is a legal document that transfers ownership of a property from a husband and wife to the same husband and wife while reserving a life estate for the granters. This type of deed establishes a joint tenancy with rights of survivorship between the married couple, meaning that if one spouse passes away, the other automatically becomes the sole owner of the property. A life estate, on the other hand, grants the granters the right to live in or use the property for the duration of their lives. Once the granters no longer occupy the property, full ownership passes to the surviving spouse. It is important to note that the life estate typically cannot be transferred or sold without the consent of all parties involved. There are two main types of Allentown Pennsylvania Warranty Deeds for Husband and Wife to Husband and Wife as Joint Tenants with Granters Reserving Life Estate: 1. General Allentown Pennsylvania Warranty Deed for Husband and Wife to Husband and Wife as Joint Tenants with Granters Reserving Life Estate: This type of deed is used when the husband and wife wish to transfer ownership of a property they own jointly and retain a life estate. 2. Special Allentown Pennsylvania Warranty Deed for Husband and Wife to Husband and Wife as Joint Tenants with Granters Reserving Life Estate: This type of deed is used when the husband and wife wish to transfer ownership of a specific property, such as a house or a piece of land, and retain a life estate. In both cases, the warranty deed ensures that the property being transferred is free of any liens or encumbrances that could affect the title. It also provides legal protections to the new owners, stating that the granters will defend the title against any claims or lawsuits. Overall, the Allentown Pennsylvania Warranty Deed for Husband and Wife to Husband and Wife as Joint Tenants with Granters Reserving Life Estate is a legal instrument that allows a married couple to transfer ownership of a property while reserving a life estate for themselves. Speaking to a qualified attorney or a real estate professional is recommended to ensure accuracy and compliance with applicable laws.

Allentown Pennsylvania Warranty Deed for Husband and Wife to Husband and Wife as Joint Tenants with Grantors Reserving Life Estate

Description

How to fill out Allentown Pennsylvania Warranty Deed For Husband And Wife To Husband And Wife As Joint Tenants With Grantors Reserving Life Estate?

Benefit from the US Legal Forms and obtain immediate access to any form you need. Our beneficial website with thousands of documents allows you to find and get virtually any document sample you want. It is possible to save, fill, and certify the Allentown Pennsylvania Warranty Deed for Husband and Wife to Husband and Wife as Joint Tenants with Grantors Reserving Life Estate in a few minutes instead of surfing the Net for many hours trying to find an appropriate template.

Using our catalog is a superb way to increase the safety of your record filing. Our experienced lawyers on a regular basis check all the documents to make sure that the forms are relevant for a particular state and compliant with new acts and regulations.

How can you obtain the Allentown Pennsylvania Warranty Deed for Husband and Wife to Husband and Wife as Joint Tenants with Grantors Reserving Life Estate? If you have a subscription, just log in to the account. The Download button will appear on all the samples you look at. In addition, you can get all the previously saved records in the My Forms menu.

If you don’t have an account yet, stick to the tips listed below:

- Find the template you require. Make certain that it is the form you were seeking: check its title and description, and make use of the Preview feature when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the saving process. Click Buy Now and select the pricing plan you like. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Save the document. Pick the format to obtain the Allentown Pennsylvania Warranty Deed for Husband and Wife to Husband and Wife as Joint Tenants with Grantors Reserving Life Estate and change and fill, or sign it for your needs.

US Legal Forms is one of the most extensive and reliable form libraries on the web. We are always happy to assist you in any legal process, even if it is just downloading the Allentown Pennsylvania Warranty Deed for Husband and Wife to Husband and Wife as Joint Tenants with Grantors Reserving Life Estate.

Feel free to take advantage of our form catalog and make your document experience as convenient as possible!