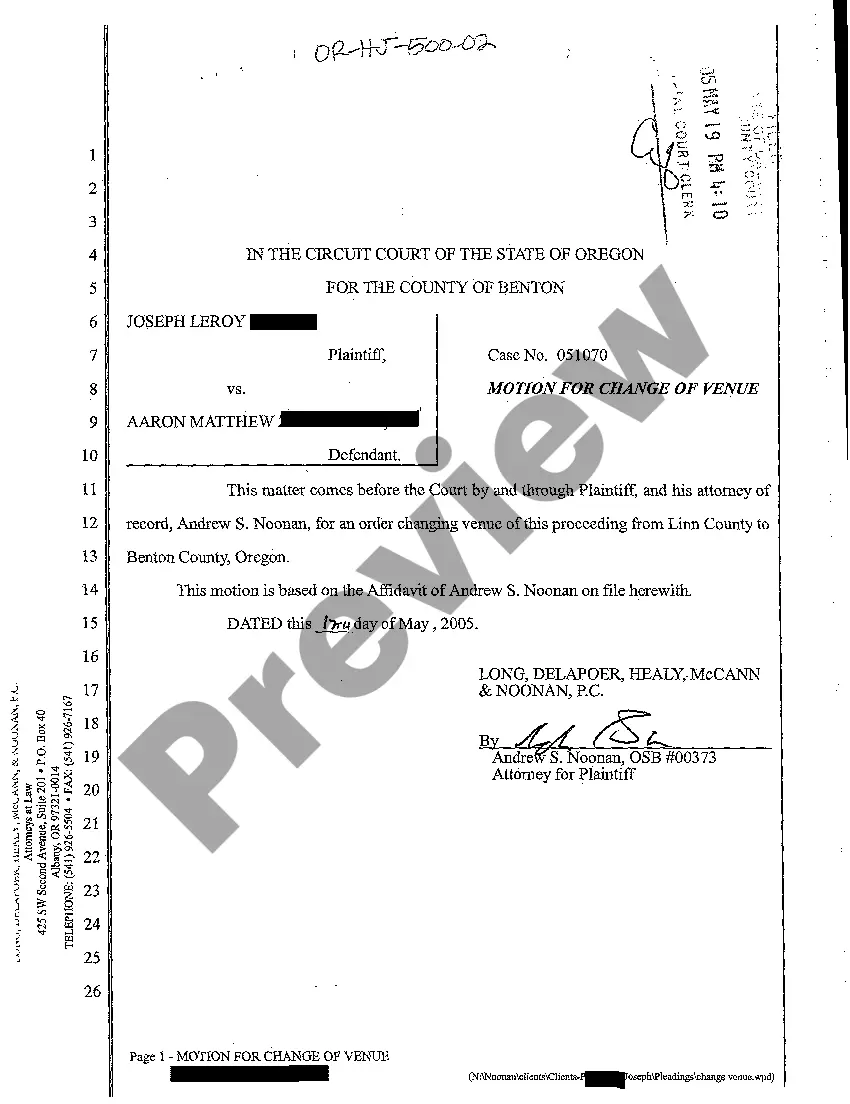

Pittsburgh, Pennsylvania UCC1 Financing Statement is a legal document used to secure a creditor's interest in personal property collateral. This statement is governed by the Uniform Commercial Code (UCC) and plays a crucial role in business transactions where a debtor pledges their property to secure a loan. Keywords: Pittsburgh, Pennsylvania, UCC1 Financing Statement, legal document, creditor, personal property collateral, Uniform Commercial Code, debtor, loan. There are variations of UCC1 Financing Statements in Pittsburgh, Pennsylvania that cater to different types of transactions and collateral. These variations include: 1. UCC1 Financing Statement for Traditional Loans: This type of financing statement is commonly used when individuals or businesses obtain loans from commercial lenders, such as banks. It secures the creditor's interest in the borrower's personal property collateral, ensuring that the creditor has priority rights in case of default or bankruptcy. 2. UCC1 Financing Statement for Equipment Financing: This financing statement is specific to transactions involving equipment. It is often used when businesses or individuals need to secure loans for machinery, vehicles, or other tangible assets. By filing this statement, the creditor establishes their priority interest in the equipment, even if it changes hands or the debtor undergoes bankruptcy proceedings. 3. UCC1 Financing Statement for Inventory Financing: This type of financing statement is utilized when inventory is used as collateral for a loan. It is commonly used by retail businesses or manufacturers who need to secure funding using their inventory as collateral. By filing this statement, the creditor protects their interest in the inventory, allowing them to recover their investment in case of default. 4. UCC1 Financing Statement for Real Estate Financing: Although primarily used for personal property, UCC1 financing statements can sometimes be used in conjunction with real estate transactions. In Pittsburgh, Pennsylvania, this variation may be utilized to secure creditors' interest in mobile homes, manufactured housing, or leases related to such properties. While these are some common types of UCC1 Financing Statements in Pittsburgh, Pennsylvania, it is important to note that specific variations may exist depending on the nature of the transaction and the collateral involved.

Pittsburgh Pennsylvania UCC1 Financing Statement

Description

How to fill out Pittsburgh Pennsylvania UCC1 Financing Statement?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney services that, usually, are extremely expensive. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of a lawyer. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Pittsburgh Pennsylvania UCC1 Financing Statement or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally easy if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Pittsburgh Pennsylvania UCC1 Financing Statement complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Pittsburgh Pennsylvania UCC1 Financing Statement is suitable for your case, you can choose the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!