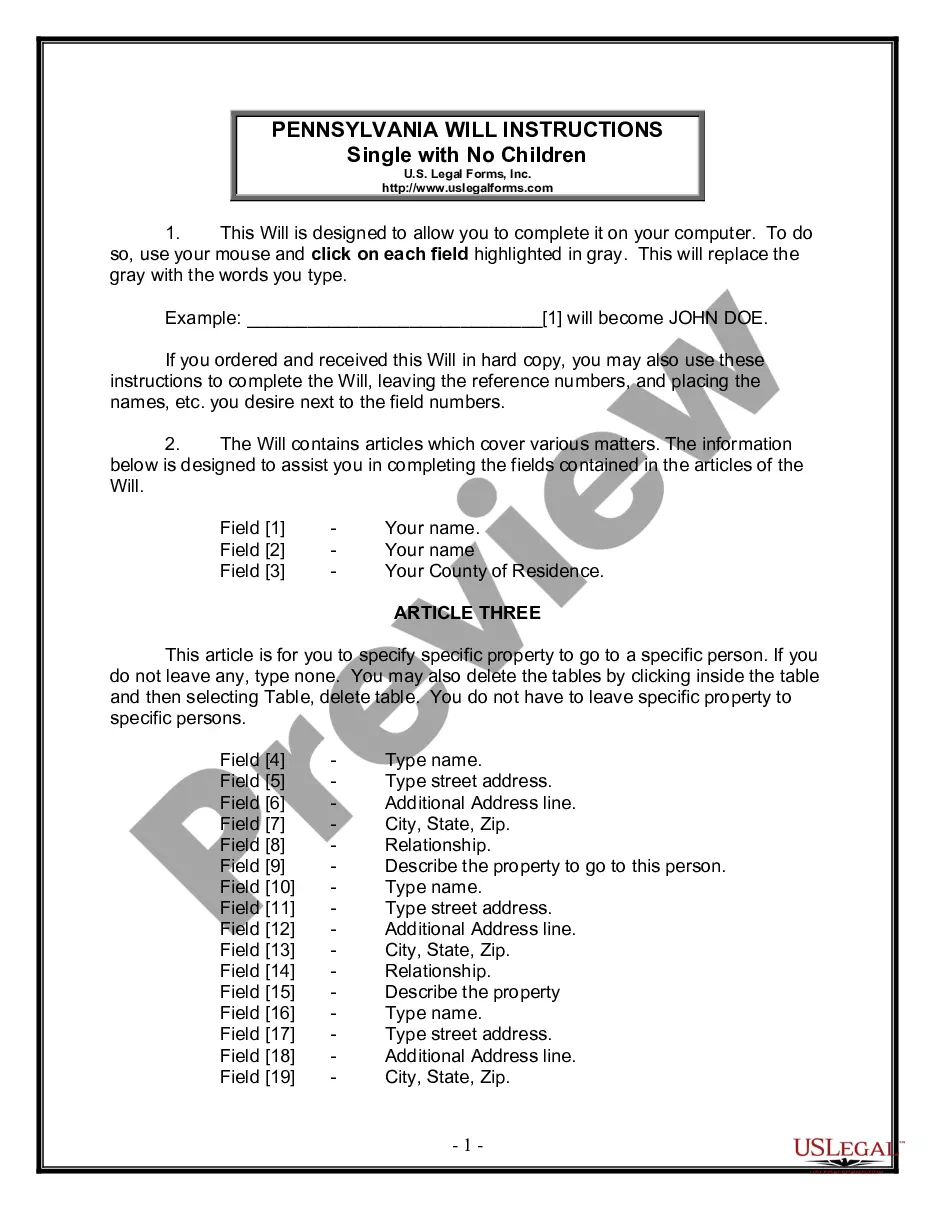

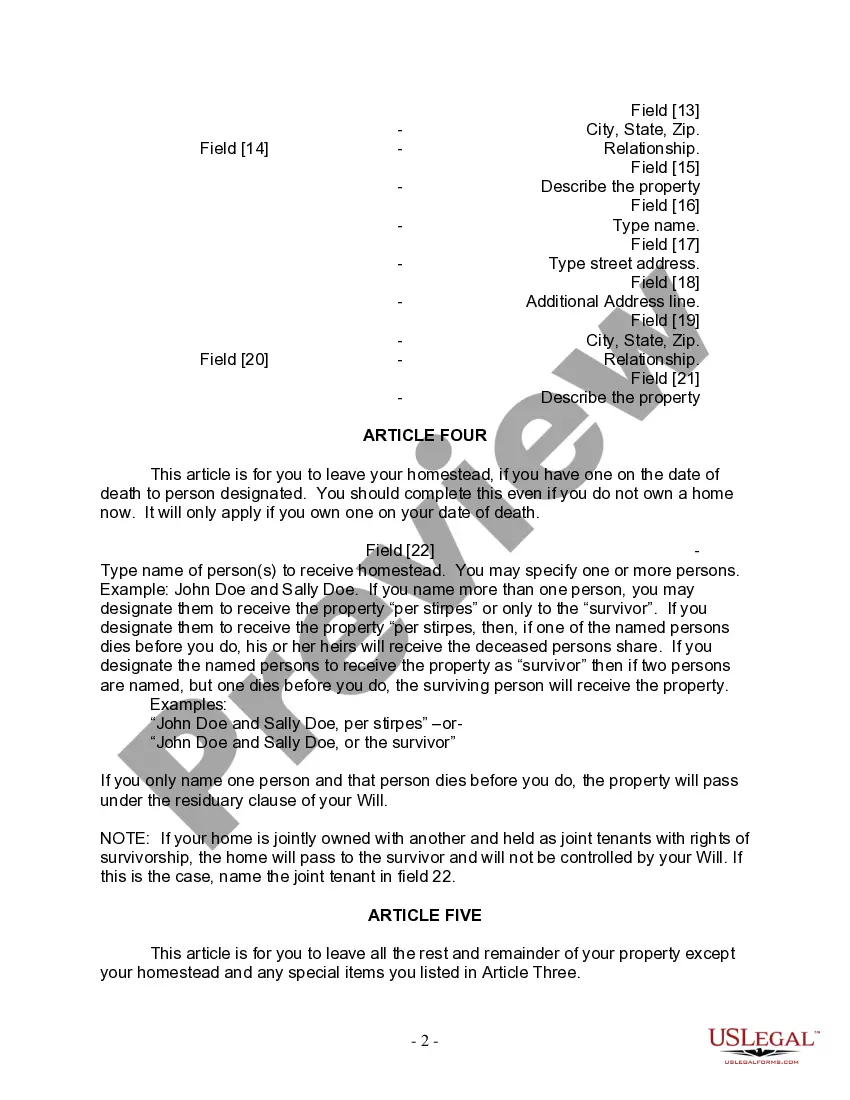

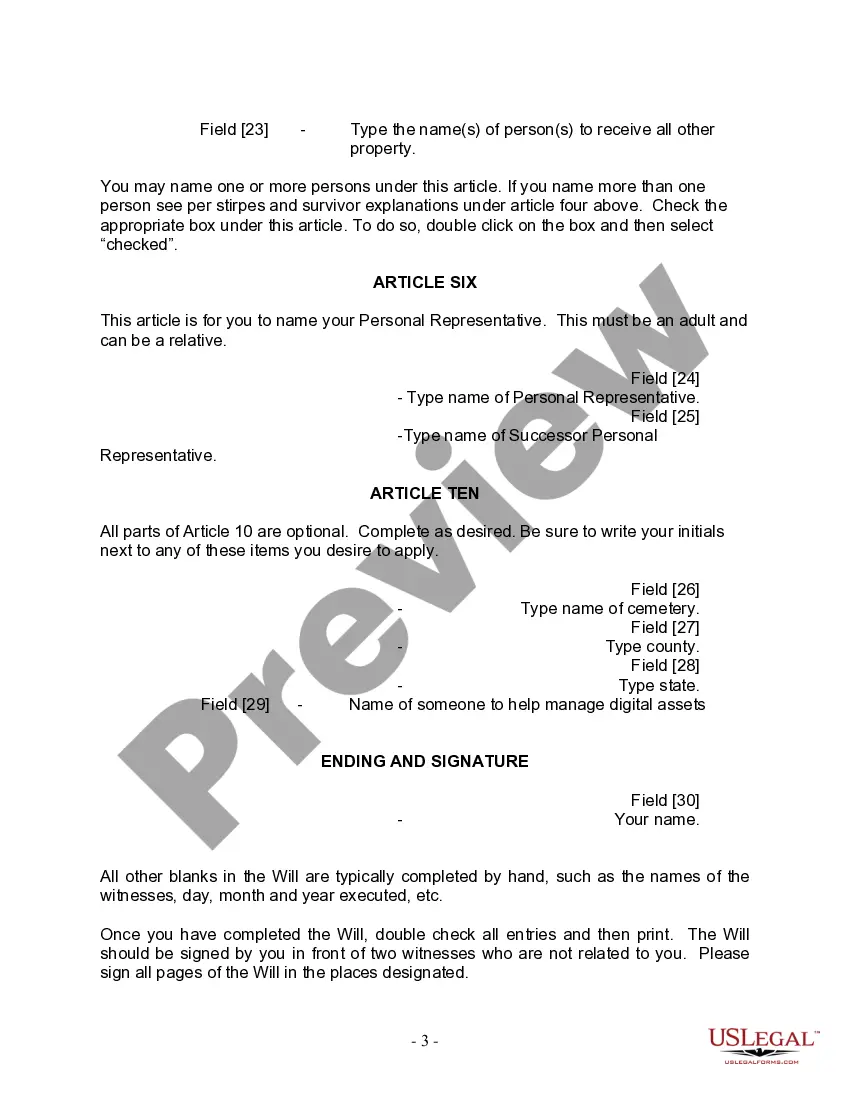

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Allegheny Pennsylvania Legal Last Will and Testament Form for Single Person with No Children is a legal document designed to outline the wishes and distribution of assets for individuals who are single and have no children. This legally binding instrument allows individuals to have control over their estate after their passing, ensuring that their property, possessions, and assets are distributed according to their preferences. The Allegheny Pennsylvania Legal Last Will and Testament Form for Single Person with No Children is individual-specific and accounts for the unique circumstances of single individuals without children. It enables individuals to clearly state their beneficiaries, specify detailed instructions for asset distribution, appoint an executor to oversee the estate, and address any outstanding debts or obligations. The form contains various sections that encompass important aspects of estate planning, such as: 1. Personal Information: This section requires the individual to provide their full legal name, address, and contact details. These details help establish the identity of the testator (the person creating the will) and ensure accuracy in legal proceedings. 2. Appointment of Executor: The testator has the option to appoint an executor responsible for managing the estate's administration and ensuring that the instructions outlined in the will are followed precisely. The executor should be someone trustworthy, capable, and legally qualified to fulfill these duties effectively. 3. Asset Distribution: This section enables the testator to specify how their assets and properties should be distributed after their passing. It includes provisions for personal items, real estate, bank accounts, investments, stocks, and any other property owned by the testator. 4. Beneficiaries: The testator can clearly indicate the individuals or organizations (charities, trusts, etc.) they wish to benefit from their estate. Detailed instructions, including the percentage or specific amounts, can be provided to ensure the desired distribution. 5. Debts and Obligations: The form allows the testator to address any outstanding debts, loans, or obligations they may have, ensuring they are appropriately settled from the estate's assets before distribution to beneficiaries. Some additional types of Allegheny Pennsylvania Legal Last Will and Testament Forms for Single Person with No Children may include variants such as: 1. Simple Last Will and Testament: This basic form is suitable for individuals with uncomplicated estate situations, limited assets, and straightforward beneficiary designations. 2. Pour-Over Will: This form is combined with a living trust and "pours over" any assets not already included in the trust into it, providing a higher level of control and management. 3. Living Will: While not specifically related to asset distribution, a living will allows individuals to express their healthcare preferences and desires regarding medical treatment if they become unable to communicate or make decisions. It is important to consult with an estate planning attorney or legal expert to ensure the Allegheny Pennsylvania Legal Last Will and Testament Form for Single Person with No Children accurately reflects an individual's specific needs and adheres to all applicable state laws.

The Allegheny Pennsylvania Legal Last Will and Testament Form for Single Person with No Children is a legal document designed to outline the wishes and distribution of assets for individuals who are single and have no children. This legally binding instrument allows individuals to have control over their estate after their passing, ensuring that their property, possessions, and assets are distributed according to their preferences. The Allegheny Pennsylvania Legal Last Will and Testament Form for Single Person with No Children is individual-specific and accounts for the unique circumstances of single individuals without children. It enables individuals to clearly state their beneficiaries, specify detailed instructions for asset distribution, appoint an executor to oversee the estate, and address any outstanding debts or obligations. The form contains various sections that encompass important aspects of estate planning, such as: 1. Personal Information: This section requires the individual to provide their full legal name, address, and contact details. These details help establish the identity of the testator (the person creating the will) and ensure accuracy in legal proceedings. 2. Appointment of Executor: The testator has the option to appoint an executor responsible for managing the estate's administration and ensuring that the instructions outlined in the will are followed precisely. The executor should be someone trustworthy, capable, and legally qualified to fulfill these duties effectively. 3. Asset Distribution: This section enables the testator to specify how their assets and properties should be distributed after their passing. It includes provisions for personal items, real estate, bank accounts, investments, stocks, and any other property owned by the testator. 4. Beneficiaries: The testator can clearly indicate the individuals or organizations (charities, trusts, etc.) they wish to benefit from their estate. Detailed instructions, including the percentage or specific amounts, can be provided to ensure the desired distribution. 5. Debts and Obligations: The form allows the testator to address any outstanding debts, loans, or obligations they may have, ensuring they are appropriately settled from the estate's assets before distribution to beneficiaries. Some additional types of Allegheny Pennsylvania Legal Last Will and Testament Forms for Single Person with No Children may include variants such as: 1. Simple Last Will and Testament: This basic form is suitable for individuals with uncomplicated estate situations, limited assets, and straightforward beneficiary designations. 2. Pour-Over Will: This form is combined with a living trust and "pours over" any assets not already included in the trust into it, providing a higher level of control and management. 3. Living Will: While not specifically related to asset distribution, a living will allows individuals to express their healthcare preferences and desires regarding medical treatment if they become unable to communicate or make decisions. It is important to consult with an estate planning attorney or legal expert to ensure the Allegheny Pennsylvania Legal Last Will and Testament Form for Single Person with No Children accurately reflects an individual's specific needs and adheres to all applicable state laws.