The Legal Last Will and Testament Form with Instructions you have found, is for a single person (never married) with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

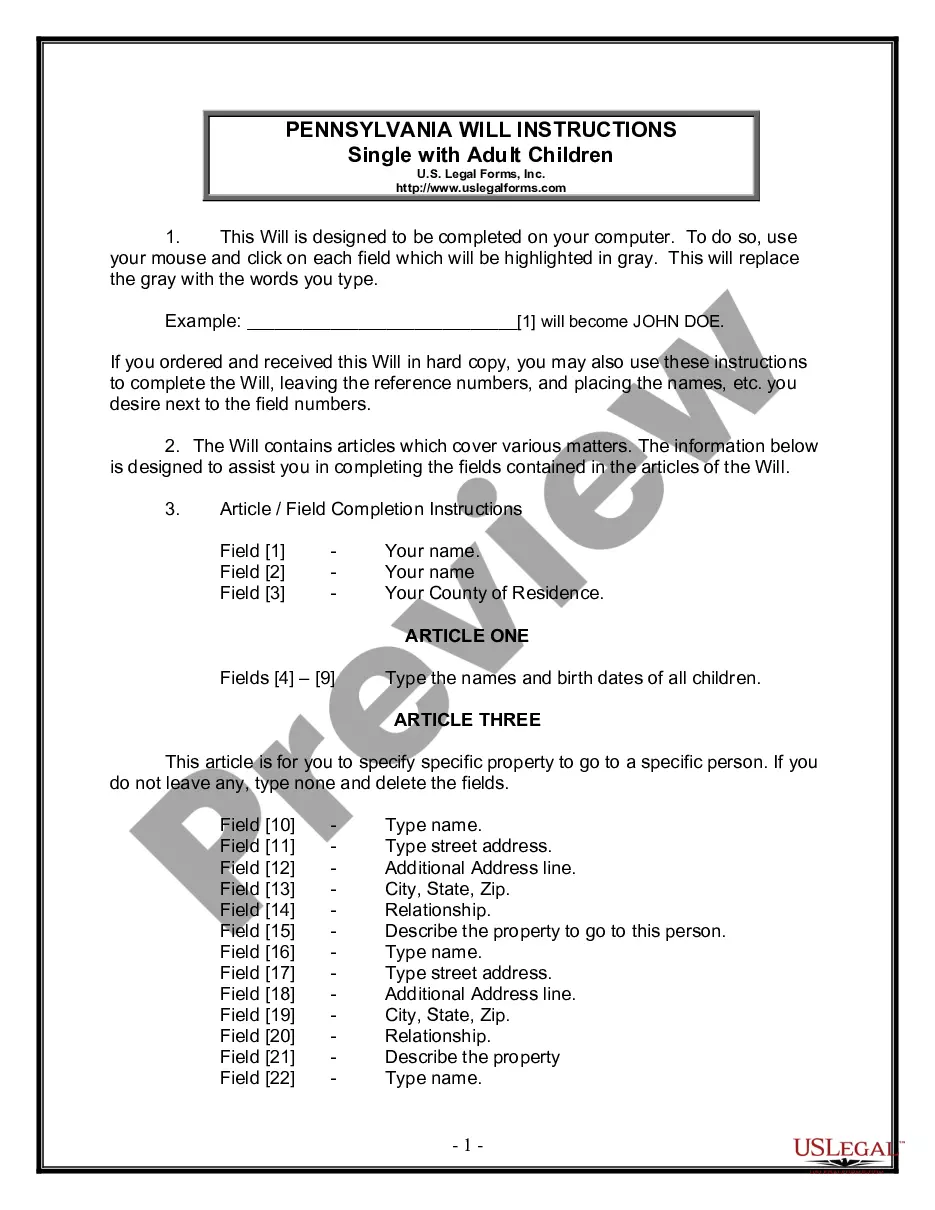

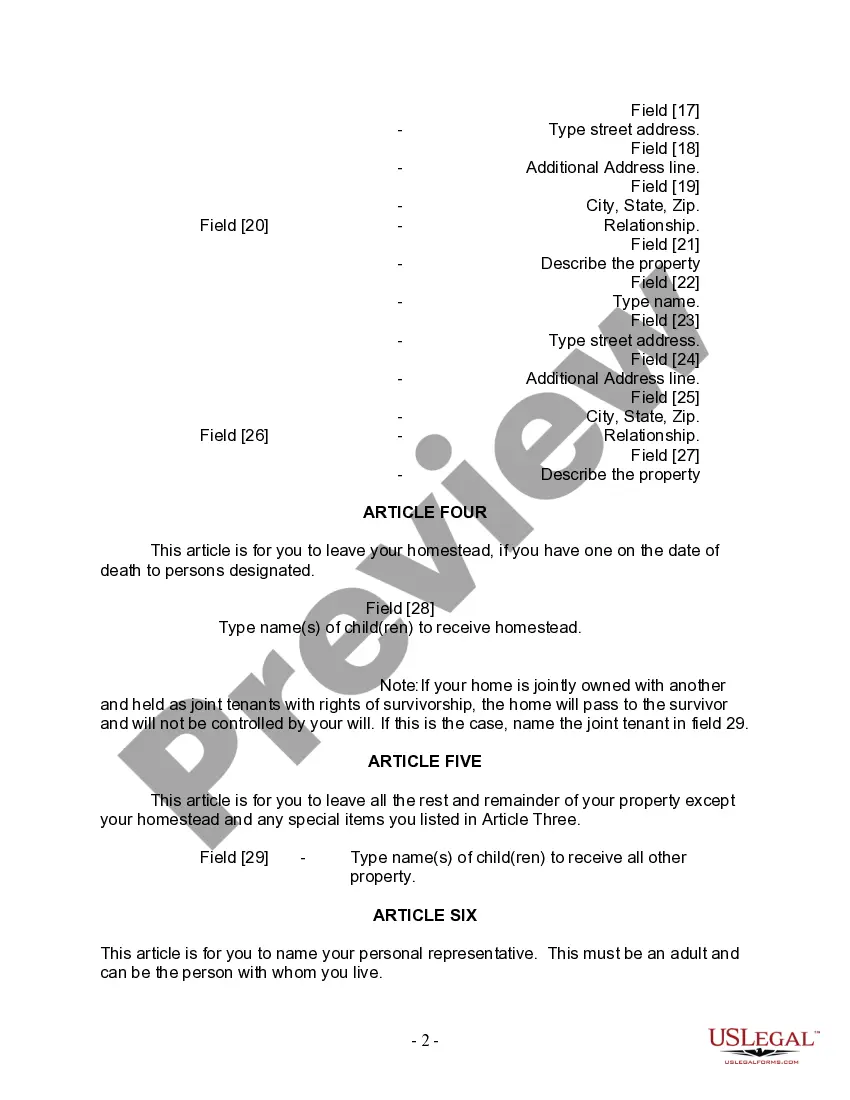

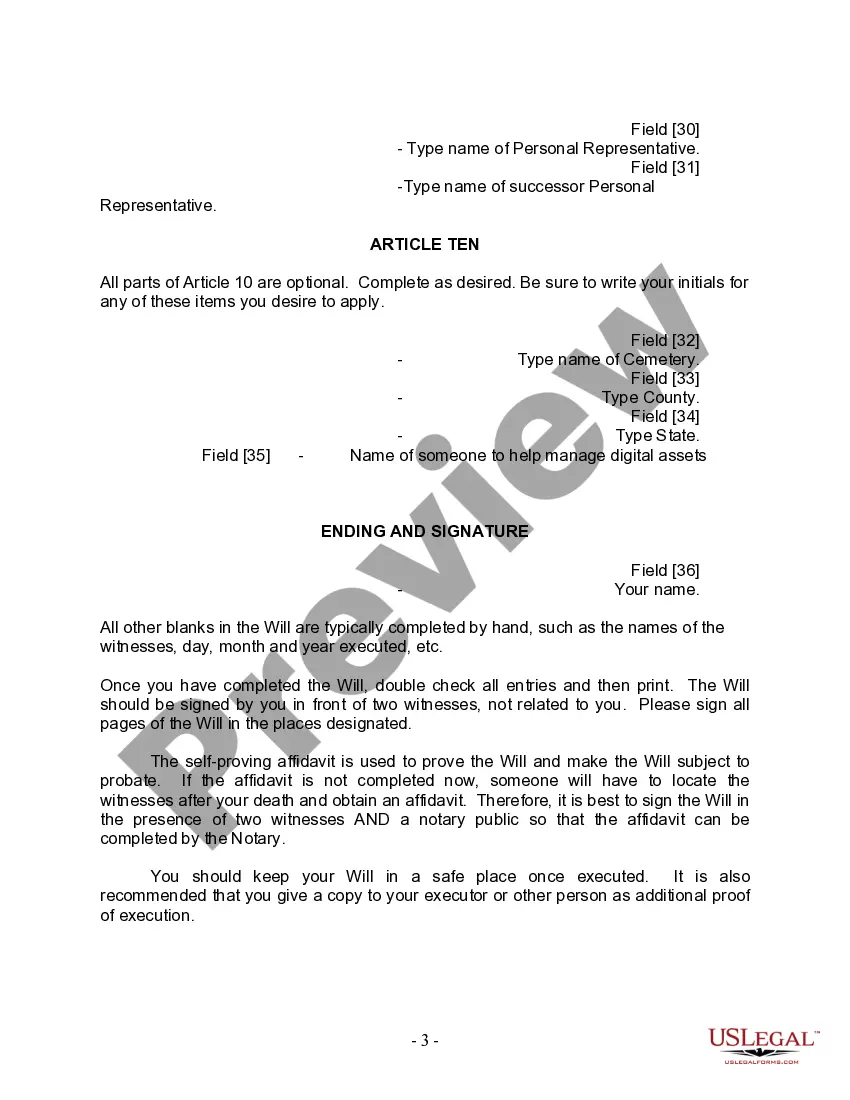

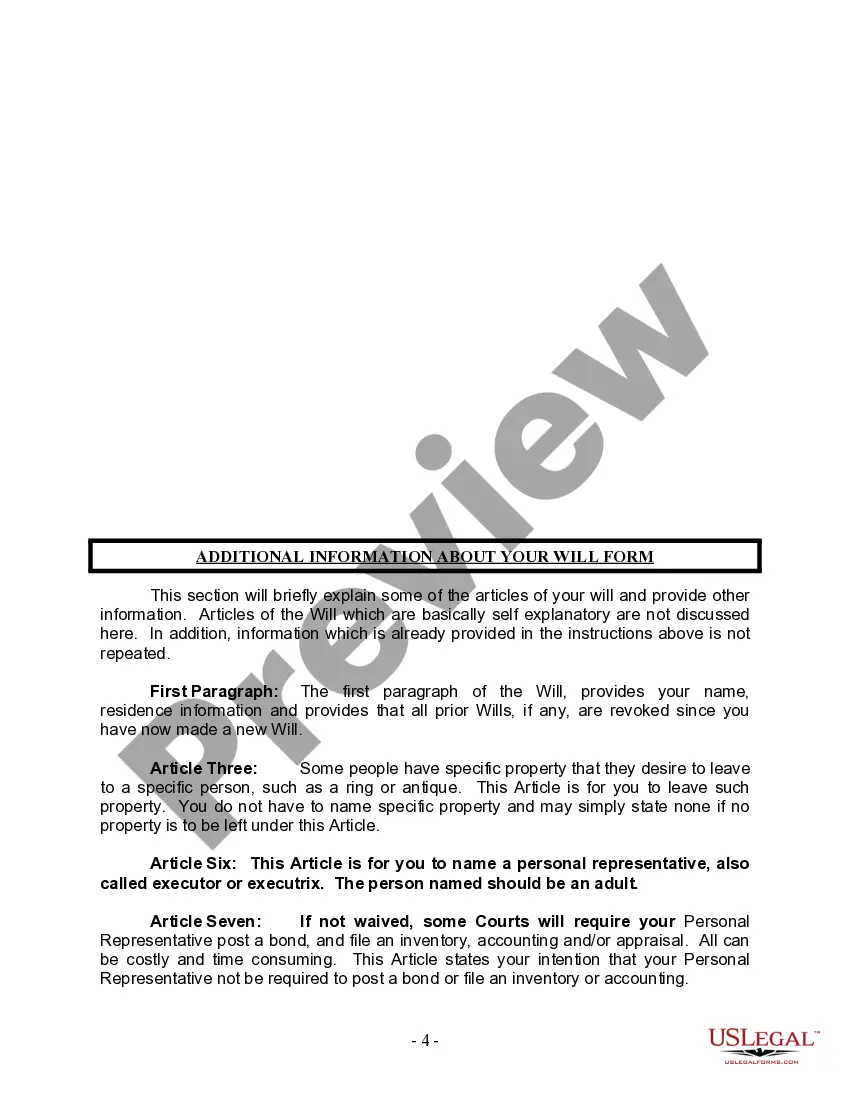

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. A Philadelphia Pennsylvania Legal Last Will and Testament Form for Single Person with Adult Children is a legally-binding document that allows an individual living in Philadelphia, Pennsylvania, who has adult children, to outline their final wishes and specify how their assets and property should be distributed after their demise. This form is essential as it ensures that the individual's wishes are respected and that their estate is handled according to their preferences. The Philadelphia Pennsylvania Legal Last Will and Testament Form for Single Person with Adult Children typically includes the following key components: 1. Personal Information: This section collects the personal information of the testator (the individual creating the will), including their full legal name, address, and any other relevant identification details. 2. Executor Appointment: Here, the testator can appoint an executor, who will be responsible for managing the estate and carrying out the instructions outlined in the will. The executor should be someone the testator trusts, and their name, contact information, and alternate executor (if any) need to be specified. 3. Beneficiary Designation: This section allows the testator to allocate their assets and property to specific individuals, known as beneficiaries. In this case, as a single person with adult children, the testator can name their children as primary beneficiaries. They can also choose to designate secondary beneficiaries or contingent beneficiaries, who will inherit the assets if the primary beneficiaries pass away before the testator or are unable to inherit. 4. Asset Distribution: In this portion, the testator can detail how they want their assets, which include but are not limited to real estate properties, financial accounts, investments, personal belongings, and any other valuable possessions, to be divided among the beneficiaries. The testator can specify percentages or specific items for each beneficiary, or they can opt for an even distribution. 5. Guardianship: If the single person with adult children has minor children or dependent adults, they can name guardians to care for them after the testator's death. This section allows the testator to indicate their preferred guardians and any specific instructions related to the welfare and upbringing of their children or dependents. 6. Residual Clause: A residual clause covers any remaining assets or property not explicitly mentioned in the will. It ensures that any undisclosed or newly acquired assets are distributed according to the testator's overall intentions. It is important to note that there may be different versions of the Philadelphia Pennsylvania Legal Last Will and Testament Form for single individuals with adult children, depending on specific circumstances. For example, there could be separate forms for those with minor children, individuals with no children, or individuals with stepchildren or adopted children. Each form caters to the unique needs and circumstances of the testator, allowing them to tailor their will precisely to their situation.

A Philadelphia Pennsylvania Legal Last Will and Testament Form for Single Person with Adult Children is a legally-binding document that allows an individual living in Philadelphia, Pennsylvania, who has adult children, to outline their final wishes and specify how their assets and property should be distributed after their demise. This form is essential as it ensures that the individual's wishes are respected and that their estate is handled according to their preferences. The Philadelphia Pennsylvania Legal Last Will and Testament Form for Single Person with Adult Children typically includes the following key components: 1. Personal Information: This section collects the personal information of the testator (the individual creating the will), including their full legal name, address, and any other relevant identification details. 2. Executor Appointment: Here, the testator can appoint an executor, who will be responsible for managing the estate and carrying out the instructions outlined in the will. The executor should be someone the testator trusts, and their name, contact information, and alternate executor (if any) need to be specified. 3. Beneficiary Designation: This section allows the testator to allocate their assets and property to specific individuals, known as beneficiaries. In this case, as a single person with adult children, the testator can name their children as primary beneficiaries. They can also choose to designate secondary beneficiaries or contingent beneficiaries, who will inherit the assets if the primary beneficiaries pass away before the testator or are unable to inherit. 4. Asset Distribution: In this portion, the testator can detail how they want their assets, which include but are not limited to real estate properties, financial accounts, investments, personal belongings, and any other valuable possessions, to be divided among the beneficiaries. The testator can specify percentages or specific items for each beneficiary, or they can opt for an even distribution. 5. Guardianship: If the single person with adult children has minor children or dependent adults, they can name guardians to care for them after the testator's death. This section allows the testator to indicate their preferred guardians and any specific instructions related to the welfare and upbringing of their children or dependents. 6. Residual Clause: A residual clause covers any remaining assets or property not explicitly mentioned in the will. It ensures that any undisclosed or newly acquired assets are distributed according to the testator's overall intentions. It is important to note that there may be different versions of the Philadelphia Pennsylvania Legal Last Will and Testament Form for single individuals with adult children, depending on specific circumstances. For example, there could be separate forms for those with minor children, individuals with no children, or individuals with stepchildren or adopted children. Each form caters to the unique needs and circumstances of the testator, allowing them to tailor their will precisely to their situation.