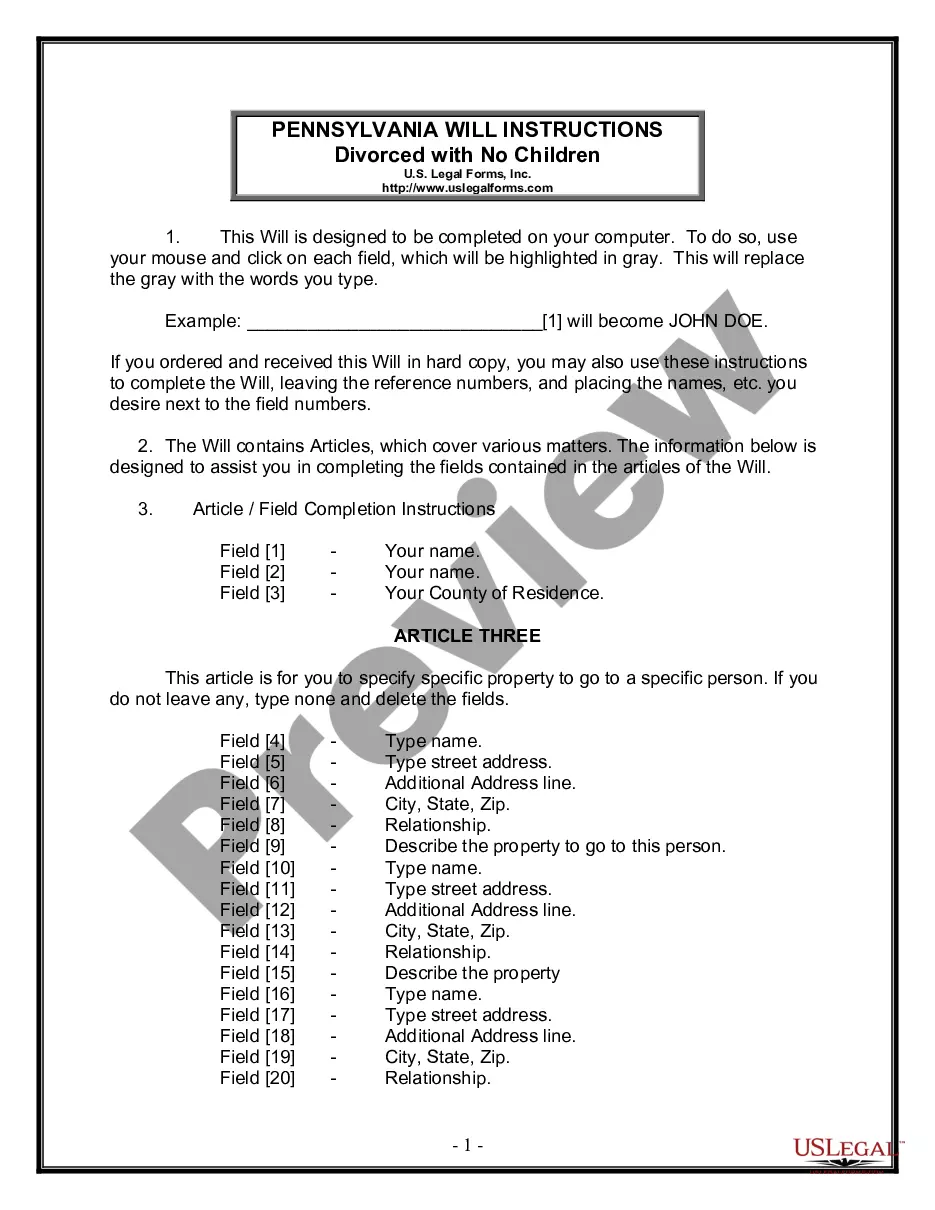

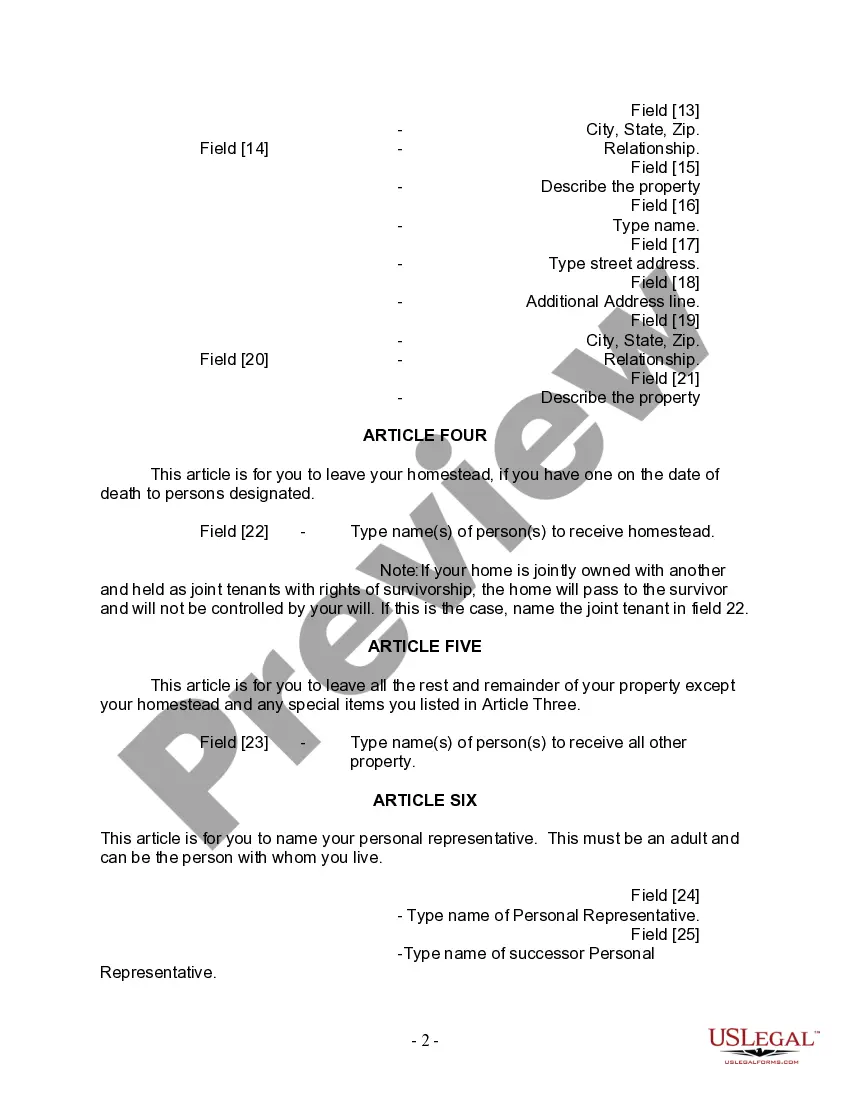

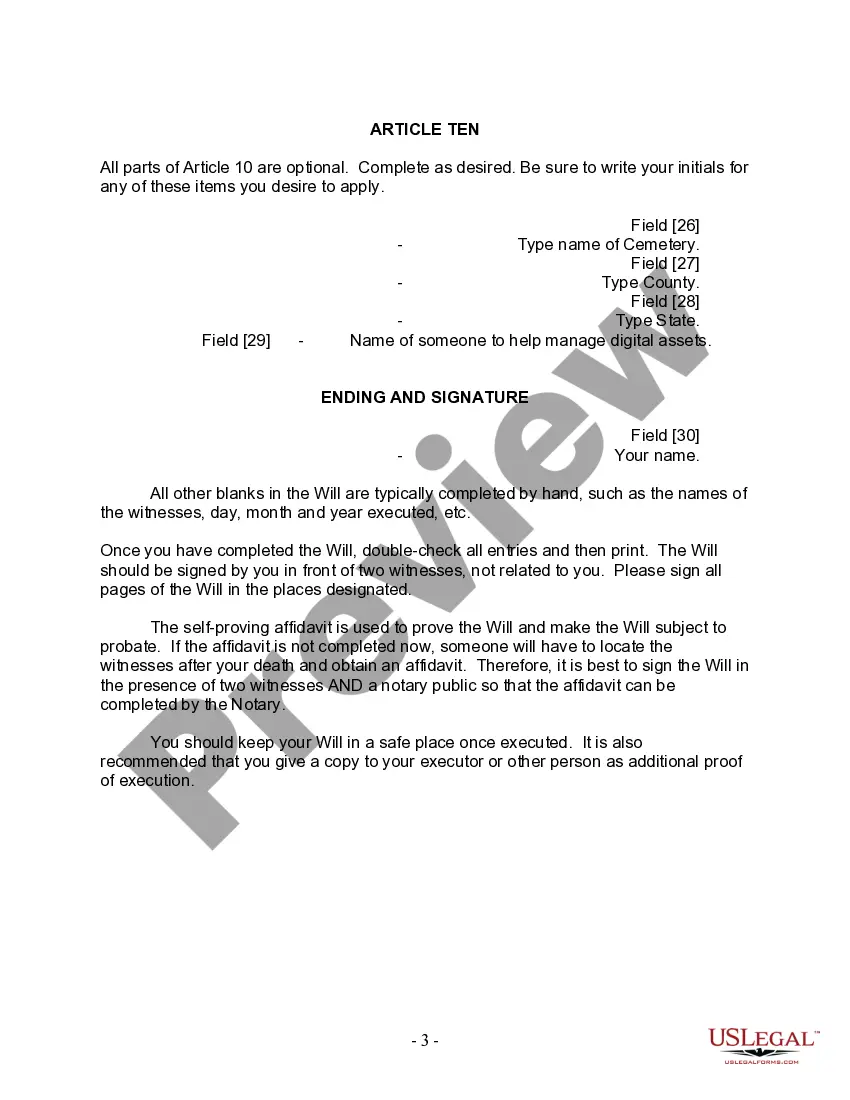

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Philadelphia Pennsylvania Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legally binding document designed to outline the distribution of assets and the wishes of a divorced individual who is not remarried and has no children after their passing. This form allows them to maintain control over their estate and ensure it is distributed according to their preferences. Keywords: Philadelphia, Pennsylvania, legal, last will and testament form, divorced person, not remarried, no children. The Philadelphia Pennsylvania Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children can be tailored to suit various specific needs and circumstances. Different variations or types of this form may include: 1. Basic Last Will and Testament: This is the standard form that allows the individual to name an executor, appoint beneficiaries, and specify the distribution of assets, including property, finances, and personal belongings. 2. Detailed Financial Last Will and Testament: This variant of the form provides more specific instructions regarding the handling of financial assets, including bank accounts, investments, retirement funds, and any outstanding debts or liabilities. 3. Digital Assets Last Will and Testament: In this digital age, it is important to consider the management of online accounts, subscriptions, and even social media profiles. This specialized form allows the individual to designate someone to handle their digital presence after their passing. 4. Charitable Last Will and Testament: If the individual wishes to leave a portion of their estate or specific assets to charitable organizations or causes close to their heart, this form allows them to do so. 5. Trust-focused Last Will and Testament: This form enables the individual to establish a trust, designating a trustee to manage the assets and distribute them to the specified beneficiaries in a controlled manner, potentially providing certain tax advantages and protection against legal challenges. It's crucial to consult with an attorney or legal professional to ensure that the specific Last Will and Testament form chosen aligns with the applicable laws in Philadelphia, Pennsylvania, and meets the individual's unique circumstances and requirements.

The Philadelphia Pennsylvania Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legally binding document designed to outline the distribution of assets and the wishes of a divorced individual who is not remarried and has no children after their passing. This form allows them to maintain control over their estate and ensure it is distributed according to their preferences. Keywords: Philadelphia, Pennsylvania, legal, last will and testament form, divorced person, not remarried, no children. The Philadelphia Pennsylvania Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children can be tailored to suit various specific needs and circumstances. Different variations or types of this form may include: 1. Basic Last Will and Testament: This is the standard form that allows the individual to name an executor, appoint beneficiaries, and specify the distribution of assets, including property, finances, and personal belongings. 2. Detailed Financial Last Will and Testament: This variant of the form provides more specific instructions regarding the handling of financial assets, including bank accounts, investments, retirement funds, and any outstanding debts or liabilities. 3. Digital Assets Last Will and Testament: In this digital age, it is important to consider the management of online accounts, subscriptions, and even social media profiles. This specialized form allows the individual to designate someone to handle their digital presence after their passing. 4. Charitable Last Will and Testament: If the individual wishes to leave a portion of their estate or specific assets to charitable organizations or causes close to their heart, this form allows them to do so. 5. Trust-focused Last Will and Testament: This form enables the individual to establish a trust, designating a trustee to manage the assets and distribute them to the specified beneficiaries in a controlled manner, potentially providing certain tax advantages and protection against legal challenges. It's crucial to consult with an attorney or legal professional to ensure that the specific Last Will and Testament form chosen aligns with the applicable laws in Philadelphia, Pennsylvania, and meets the individual's unique circumstances and requirements.