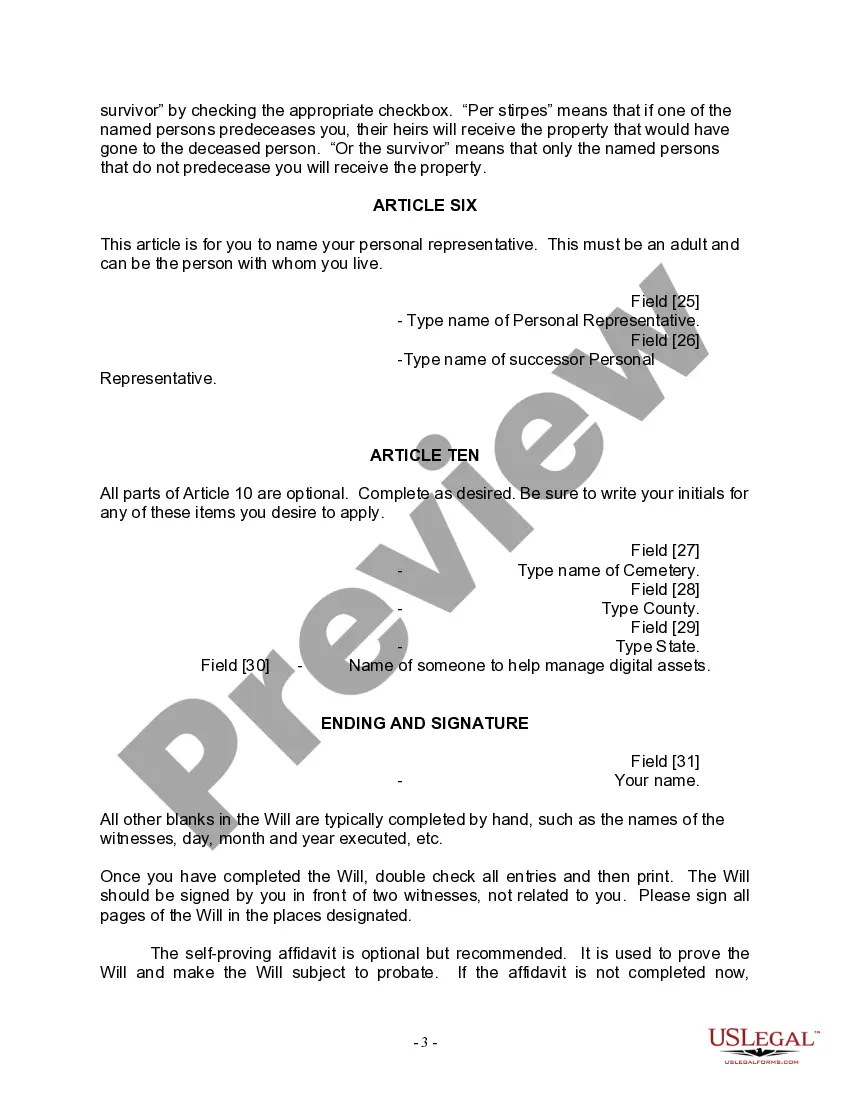

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

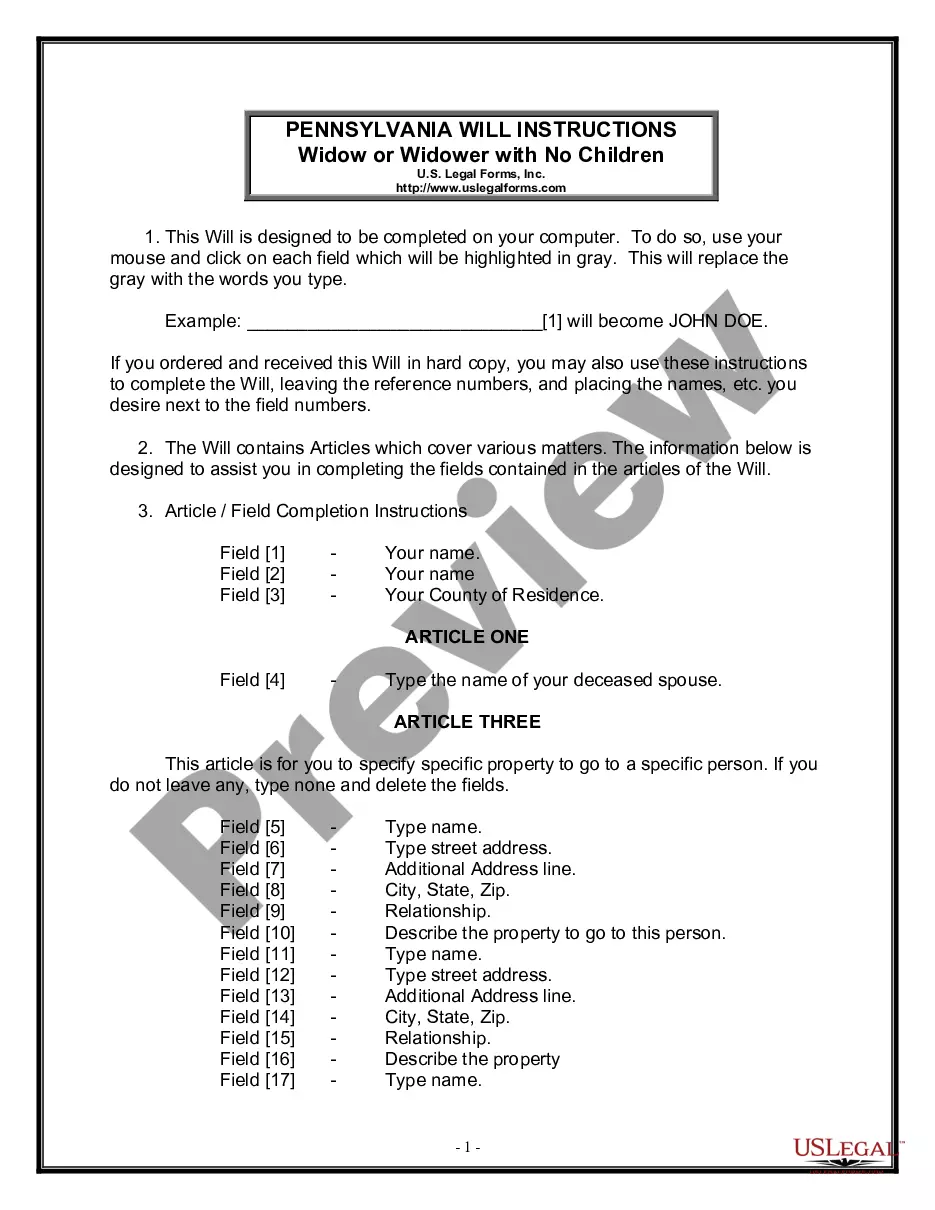

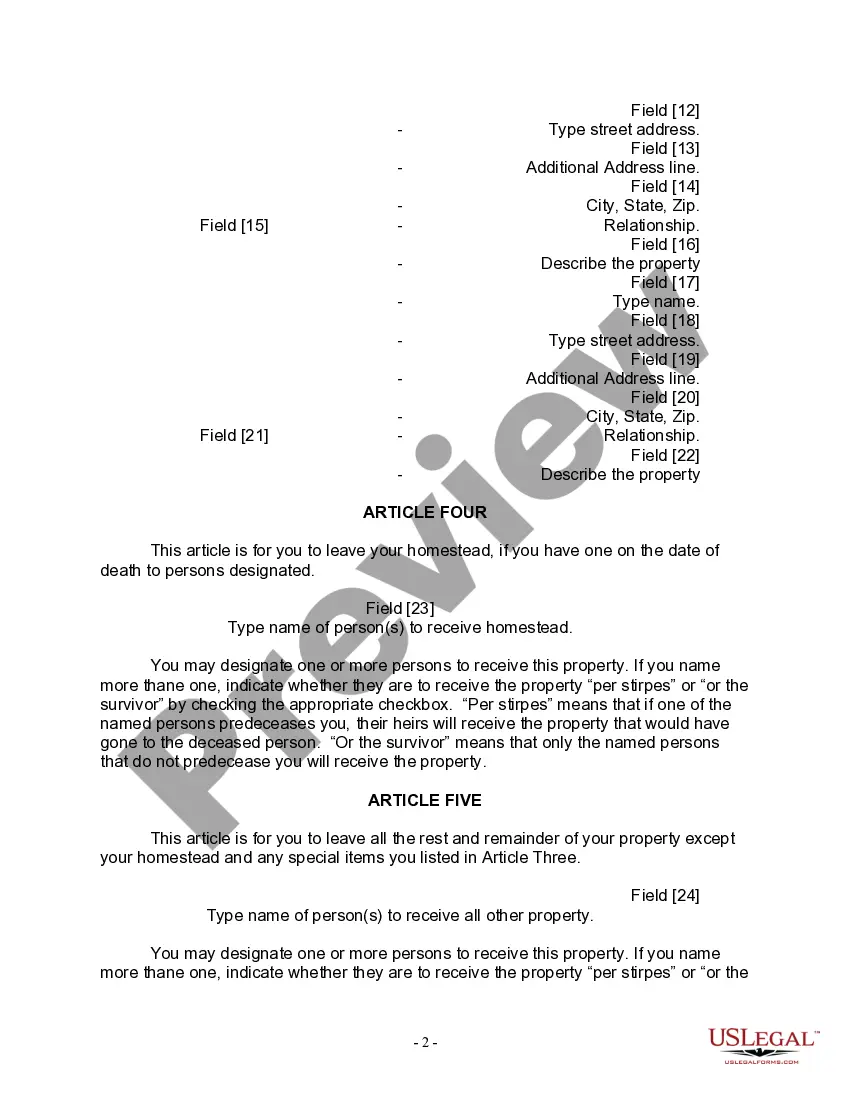

The Allentown Pennsylvania Legal Last Will Form for a Widow or Widower with no Children is a crucial legal document that allows individuals to outline their wishes on how their assets and estate should be distributed after their demise. This legally binding form ensures that the individual's final wishes are respected, avoiding potential disputes and confusion among family members and beneficiaries. The Allentown Pennsylvania Legal Last Will Form for a Widow or Widower with no Children is specifically designed for individuals who are widowed with no children and would like to have control over the distribution of their estate. Although the form is tailored to this particular circumstance, it is essential to consult an attorney to ensure that all legal requirements are met and to address any specific concerns or unique aspects of your estate. This Allentown Pennsylvania Legal Last Will Form for a Widow or Widower with no Children typically includes the following key elements: 1. Property Distribution: The form allows the individual to specify how their assets, including real estate, investments, personal belongings, and any other property, should be distributed among named beneficiaries, charities, or organizations. 2. Executor Appointment: The individual can appoint an executor, who will be responsible for overseeing the distribution of the estate according to the provisions outlined in the will. An executor should be someone trustworthy and capable of handling the legal and financial aspects outlined in the will. 3. Alternate Beneficiaries: In the event that a named beneficiary predeceases the individual, the form may include provisions for alternate beneficiaries who will then inherit the assets. 4. Guardianship for Dependents: If there are any dependents, such as disabled individuals or pets, the will can designate a guardian who will assume responsibility for their care. 5. Digital Assets: With the ever-increasing importance of digital assets, the will may include instructions on how to handle online accounts, passwords, and any other digital property. It is important to note that there may be variations or additional clauses depending on the specific wishes of the individual, the size and complexity of the estate, and any other relevant factors. Consulting with an attorney experienced in estate planning is highly recommended ensuring that the will accurately reflects your intentions and is legally valid. Different types of Allentown Pennsylvania Legal Last Will Form for a Widow or Widower with no Children may include variations based on the degree of complexity and individual circumstances. These variations may address specific concerns such as charitable giving, trusts, and provisions for individuals with disabilities. An attorney can guide you through the process and help you choose the most suitable form for your particular needs.