Allegheny Pennsylvania Estate Planning Questionnaire and Worksheets

Description

How to fill out Pennsylvania Estate Planning Questionnaire And Worksheets?

We consistently strive to mitigate or evade legal repercussions when handling intricate legal or financial issues.

To achieve this, we seek legal remedies that, typically, are quite expensive.

Nonetheless, not all legal situations are equally intricate. Many can be managed independently.

US Legal Forms is a web-based repository of current DIY legal documents encompassing everything from wills and power of attorney to incorporation articles and petition forms for dissolution.

The procedure is equally simple for newcomers to the site! You can establish your account within moments.

- Our platform empowers you to manage your affairs without the necessity of consulting an attorney.

- We provide access to legal document templates that are not always available to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Utilize US Legal Forms whenever you need to acquire and download the Allegheny Pennsylvania Estate Planning Questionnaire and Worksheets or any other form with ease and security.

Form popularity

FAQ

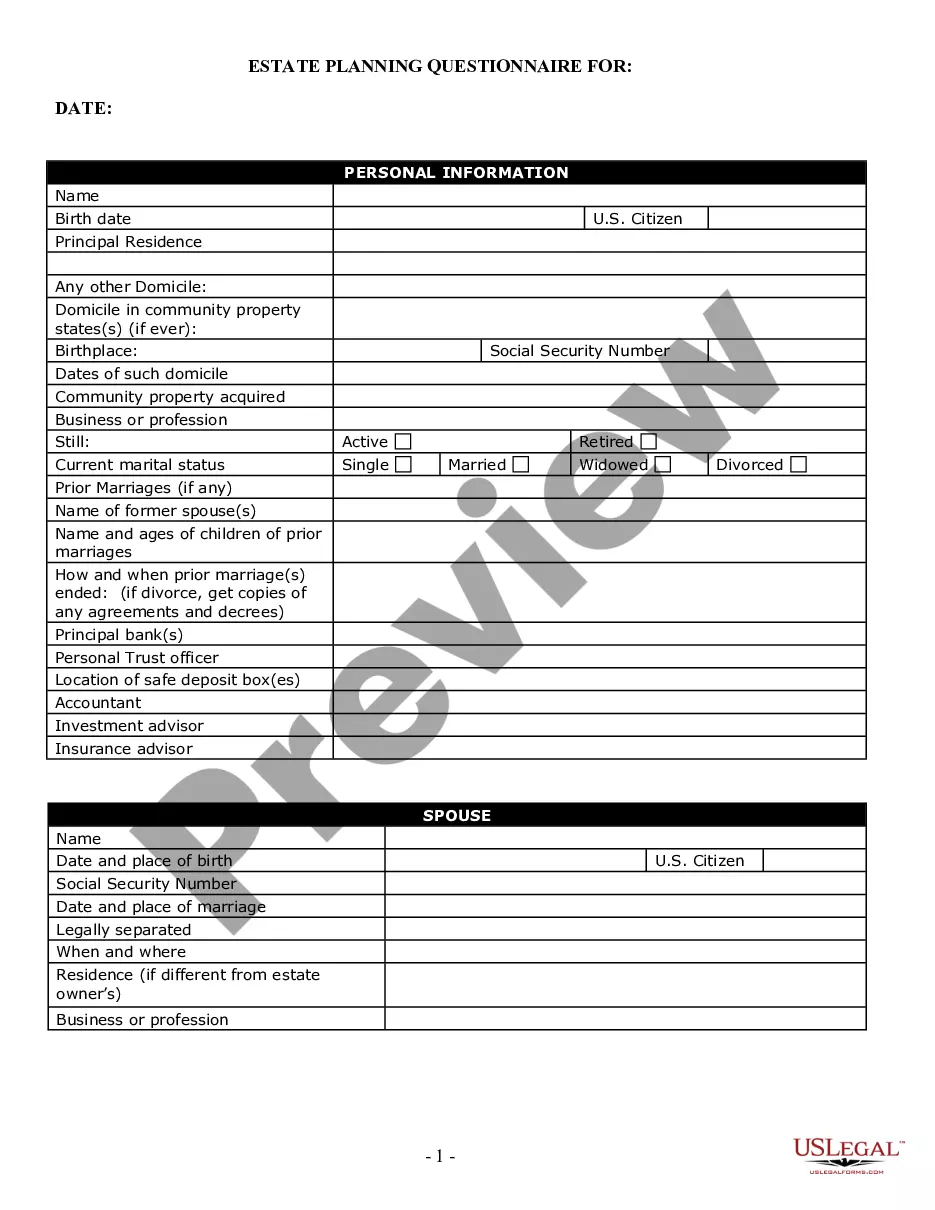

When embarking on your estate planning journey, a crucial step is to ask the right questions. Consider inquiries such as: What assets do I own, and how do I wish to distribute them? Additionally, who do I want to manage my estate in the event of my passing? Utilizing the Allegheny Pennsylvania Estate Planning Questionnaire and Worksheets can help you organize your thoughts and provide clarity. By answering these questions, you can ensure your estate plan aligns with your personal goals and family needs.

An estate planning questionnaire is a tool designed to collect vital information regarding your assets, beneficiaries, and intentions for your estate. This document serves as a guide to help you articulate your wishes clearly and effectively. Utilizing the Allegheny Pennsylvania Estate Planning Questionnaire and Worksheets can streamline this process, ensuring you address all important aspects of your estate plan.

The 5 D's of estate planning consist of Death, Disability, Divorce, Departure, and Disagreement. These factors highlight essential scenarios that should be addressed in your plan to ensure smooth transitions and reduced stress for your loved ones. By incorporating the 5 D's into your estate planning process, you can create a robust strategy with the help of the Allegheny Pennsylvania Estate Planning Questionnaire and Worksheets.

In Pennsylvania, certain assets can be exempt from probate, including life insurance policies, retirement accounts, and property held in joint tenancy. Typically, assets with designated beneficiaries avoid probate, allowing for a simpler transfer process. Familiarizing yourself with these exemptions can enhance your estate planning, and the Allegheny Pennsylvania Estate Planning Questionnaire and Worksheets can help you identify and categorize these assets effectively.

The estate planning process typically includes seven key steps: assessing your needs, gathering your assets, considering your beneficiaries, creating the necessary documents, choosing your executor, reviewing your plan regularly, and communicating your wishes. Each step is crucial in ensuring your estate plan meets your goals and addresses your family's needs. The Allegheny Pennsylvania Estate Planning Questionnaire and Worksheets can serve as an effective tool to navigate these steps seamlessly.

The 5 by 5 rule in estate planning refers to a provision in trust law that allows a beneficiary to withdraw amounts from a trust up to the greater of $5,000 or 5% of the trust’s value in any given year. This rule provides flexibility for beneficiaries while preserving the integrity of the trust. Understanding this rule can help you make better decisions when completing the Allegheny Pennsylvania Estate Planning Questionnaire and Worksheets, tailoring your estate plan to your needs.

Filling out an estate planning questionnaire is a straightforward process. Begin by gathering your important financial and personal information, such as assets, debts, and family details. Use the Allegheny Pennsylvania Estate Planning Questionnaire and Worksheets to guide you through this, ensuring you cover all necessary topics. This organized approach will provide clarity and help you make informed decisions.