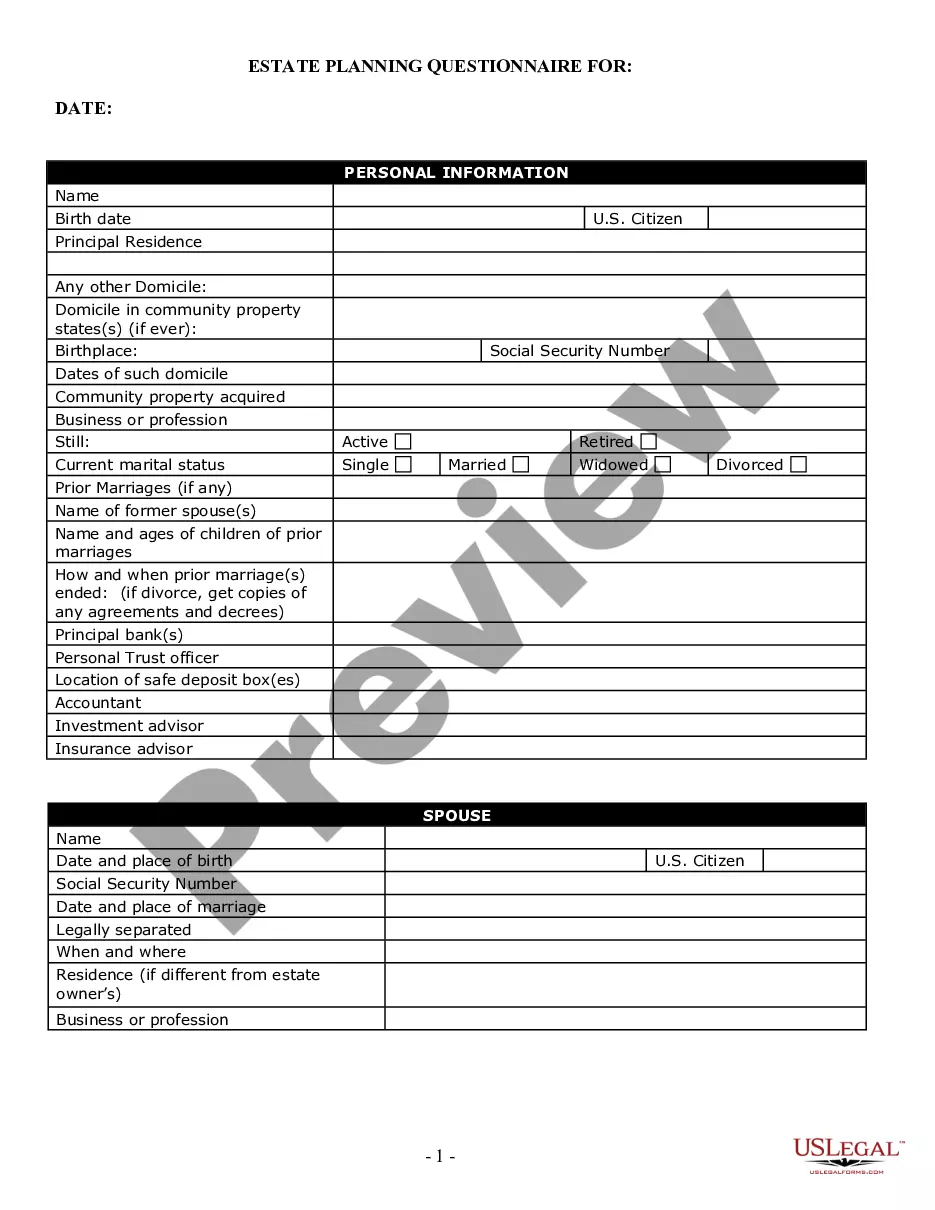

Pittsburgh Pennsylvania Estate Planning Questionnaire and Worksheets are essential tools that guide individuals in effectively planning their estate. These documents assist residents of Pittsburgh, Pennsylvania, in organizing their assets, identifying beneficiaries, and making crucial decisions related to their estate plan. By utilizing these questionnaires and worksheets, individuals can gain a comprehensive understanding of their financial situation and outline their wishes for the distribution of their assets after their passing. Some key components covered in the Pittsburgh Pennsylvania Estate Planning Questionnaire and Worksheets may include: 1. Personal Information: These documents capture essential personal details such as the individual's name, address, contact information, and marital status. 2. Asset Inventory: The questionnaire helps individuals identify and list their assets, which may include real estate properties, vehicles, bank accounts, investment portfolios, retirement accounts, life insurance policies, valuable personal items, and any other significant possessions. 3. Debts and Liabilities: Individuals also have the opportunity to disclose any outstanding debts or liabilities that need to be settled upon their passing. This can include mortgages, loans, credit card debts, or any other financial obligations. 4. Beneficiary Designations: Pittsburgh Pennsylvania Estate Planning Questionnaire and Worksheets allow individuals to specify their desired beneficiaries for each of their assets. This information empowers them to choose who will inherit which asset, ensuring their wishes are carried out accurately. 5. Guardianship Designations: For parents with minor children, these tools often include sections to designate guardianship in case both parents pass away or become unable to care for their children. This ensures that suitable individuals are named to assume responsibility for the children's upbringing. 6. Healthcare Directives: Many Pittsburgh Pennsylvania Estate Planning Questionnaire and Worksheets also provide sections to record healthcare directives such as the appointment of a healthcare proxy or the creation of a living will. These directives outline an individual's preferences for medical treatments or end-of-life care. 7. Power of Attorney: These documents may include sections that cover powers of attorney, allowing individuals to authorize someone they trust to make financial or legal decisions on their behalf in case of incapacitation. It's essential to note that various estate planning professionals or legal firms may offer customized versions of the Pittsburgh Pennsylvania Estate Planning Questionnaire and Worksheets, tailored to meet specific needs or preferences. However, the fundamental purpose remains the same: to gather detailed information and assist individuals in creating a comprehensive estate plan that reflects their wishes and protects their assets.

Pittsburgh Estate Planning

Description

How to fill out Pittsburgh Pennsylvania Estate Planning Questionnaire And Worksheets?

If you are searching for a relevant form, it’s difficult to find a more convenient service than the US Legal Forms site – one of the most considerable libraries on the internet. With this library, you can get thousands of document samples for company and individual purposes by categories and states, or keywords. Using our advanced search option, discovering the newest Pittsburgh Pennsylvania Estate Planning Questionnaire and Worksheets is as elementary as 1-2-3. Moreover, the relevance of each document is proved by a team of skilled attorneys that regularly check the templates on our website and update them based on the newest state and county requirements.

If you already know about our platform and have a registered account, all you need to receive the Pittsburgh Pennsylvania Estate Planning Questionnaire and Worksheets is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have opened the form you require. Look at its information and make use of the Preview option (if available) to check its content. If it doesn’t suit your needs, use the Search field at the top of the screen to discover the proper record.

- Confirm your choice. Choose the Buy now option. Following that, pick your preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your credit card or PayPal account to complete the registration procedure.

- Get the template. Pick the file format and save it on your device.

- Make changes. Fill out, revise, print, and sign the acquired Pittsburgh Pennsylvania Estate Planning Questionnaire and Worksheets.

Each template you add to your account does not have an expiration date and is yours forever. You can easily gain access to them via the My Forms menu, so if you want to receive an extra version for enhancing or printing, you may come back and save it again at any moment.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Pittsburgh Pennsylvania Estate Planning Questionnaire and Worksheets you were seeking and thousands of other professional and state-specific templates on one website!