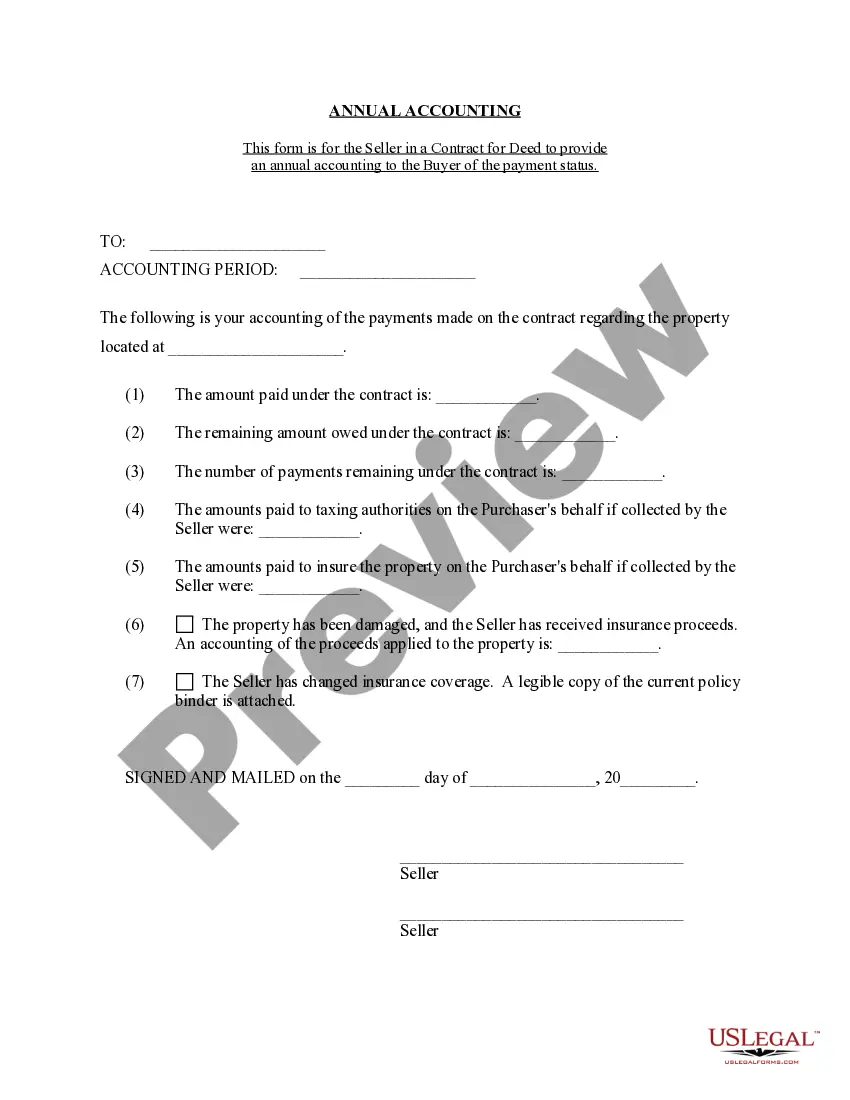

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

North Charleston South Carolina Contract for Deed Seller's Annual Accounting Statement provides a comprehensive overview of the financial transactions and expenses related to a property being sold through a contract for deed agreement in North Charleston, South Carolina. This statement allows the seller, who acts as the lender in this type of real estate transaction, to provide transparency and accountability to the buyer in terms of the financial aspects of the agreement. In a North Charleston South Carolina Contract for Deed Seller's Annual Accounting Statement, the seller provides a detailed breakdown of the income received from the buyer, including the principal payments, interest payments, and any other fees stipulated in the contract. This statement also includes a summary of any expenses incurred by the seller, such as property taxes, insurance, and maintenance costs. By providing an annual accounting statement, the seller ensures that the buyer is kept informed about the financial status of the contract for deed, helping to maintain trust and transparency throughout the agreement. It allows the buyer to monitor their progress in building equity in the property and ensures that all financial obligations are being met. In North Charleston, South Carolina, there may be different types of Contract for Deed Seller's Annual Accounting Statements, depending on the specific terms and conditions outlined in the agreement. These variations may include: 1. Basic Annual Accounting Statement: This statement provides a general overview of the income received and expenses incurred by the seller over the course of one year. It includes details such as the total principal and interest payments received, as well as any costs related to property taxes and insurance. 2. Detailed Annual Accounting Statement: This statement offers a more in-depth breakdown of the financial transactions and expenses associated with the contract for deed. It provides a comprehensive summary of all income sources, including principal and interest payments, late fees, and any other charges. Additionally, it includes an itemized list of expenses, such as property taxes, insurance premiums, repairs, and maintenance costs. 3. Advanced Annual Accounting Statement: This type of statement goes beyond the basic and detailed formats, providing additional information and financial analysis. It may include graphs or charts to illustrate the buyer's progress in building equity or tracking the outstanding balance. Moreover, it can incorporate explanations or clarifications for any financial matters, ensuring the buyer's complete understanding of the statement. The North Charleston South Carolina Contract for Deed Seller's Annual Accounting Statement serves as a crucial tool for both the seller and the buyer in monitoring and documenting the financial aspects of their contract for deed agreement. It ensures transparency, aids in financial planning, and contributes to a smooth and successful transaction.North Charleston South Carolina Contract for Deed Seller's Annual Accounting Statement provides a comprehensive overview of the financial transactions and expenses related to a property being sold through a contract for deed agreement in North Charleston, South Carolina. This statement allows the seller, who acts as the lender in this type of real estate transaction, to provide transparency and accountability to the buyer in terms of the financial aspects of the agreement. In a North Charleston South Carolina Contract for Deed Seller's Annual Accounting Statement, the seller provides a detailed breakdown of the income received from the buyer, including the principal payments, interest payments, and any other fees stipulated in the contract. This statement also includes a summary of any expenses incurred by the seller, such as property taxes, insurance, and maintenance costs. By providing an annual accounting statement, the seller ensures that the buyer is kept informed about the financial status of the contract for deed, helping to maintain trust and transparency throughout the agreement. It allows the buyer to monitor their progress in building equity in the property and ensures that all financial obligations are being met. In North Charleston, South Carolina, there may be different types of Contract for Deed Seller's Annual Accounting Statements, depending on the specific terms and conditions outlined in the agreement. These variations may include: 1. Basic Annual Accounting Statement: This statement provides a general overview of the income received and expenses incurred by the seller over the course of one year. It includes details such as the total principal and interest payments received, as well as any costs related to property taxes and insurance. 2. Detailed Annual Accounting Statement: This statement offers a more in-depth breakdown of the financial transactions and expenses associated with the contract for deed. It provides a comprehensive summary of all income sources, including principal and interest payments, late fees, and any other charges. Additionally, it includes an itemized list of expenses, such as property taxes, insurance premiums, repairs, and maintenance costs. 3. Advanced Annual Accounting Statement: This type of statement goes beyond the basic and detailed formats, providing additional information and financial analysis. It may include graphs or charts to illustrate the buyer's progress in building equity or tracking the outstanding balance. Moreover, it can incorporate explanations or clarifications for any financial matters, ensuring the buyer's complete understanding of the statement. The North Charleston South Carolina Contract for Deed Seller's Annual Accounting Statement serves as a crucial tool for both the seller and the buyer in monitoring and documenting the financial aspects of their contract for deed agreement. It ensures transparency, aids in financial planning, and contributes to a smooth and successful transaction.