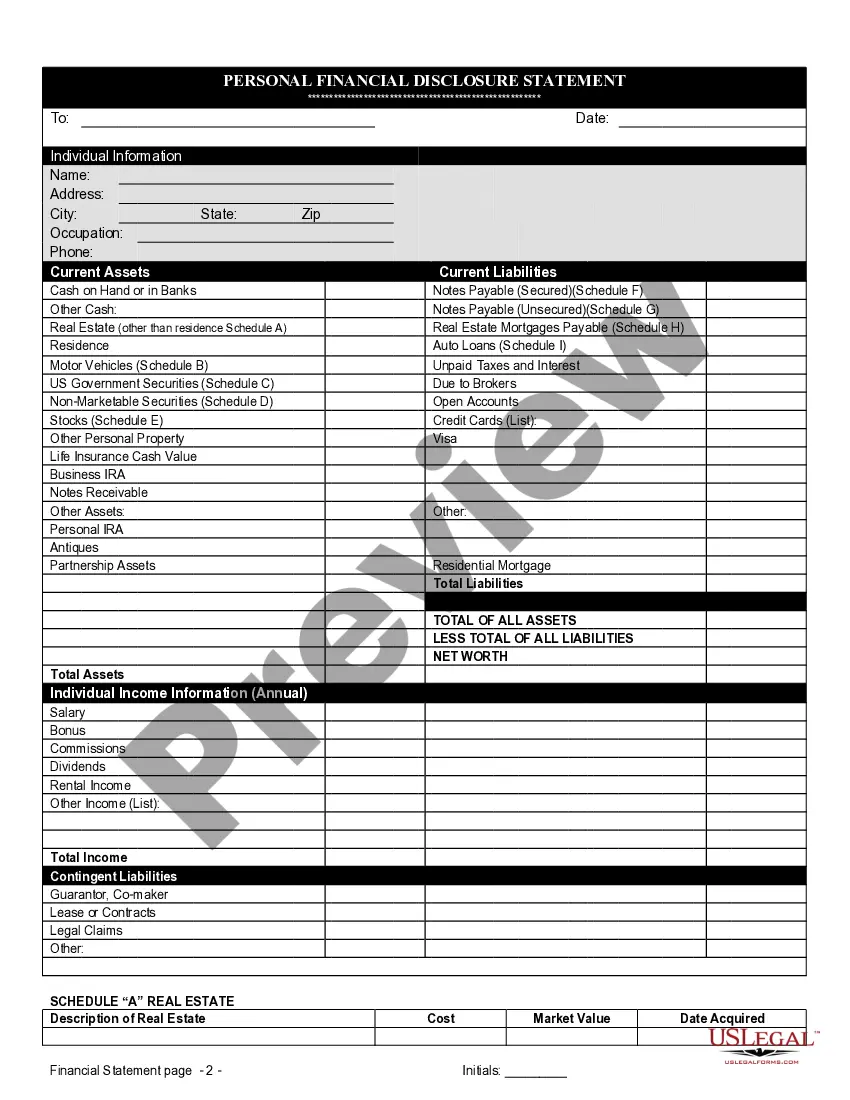

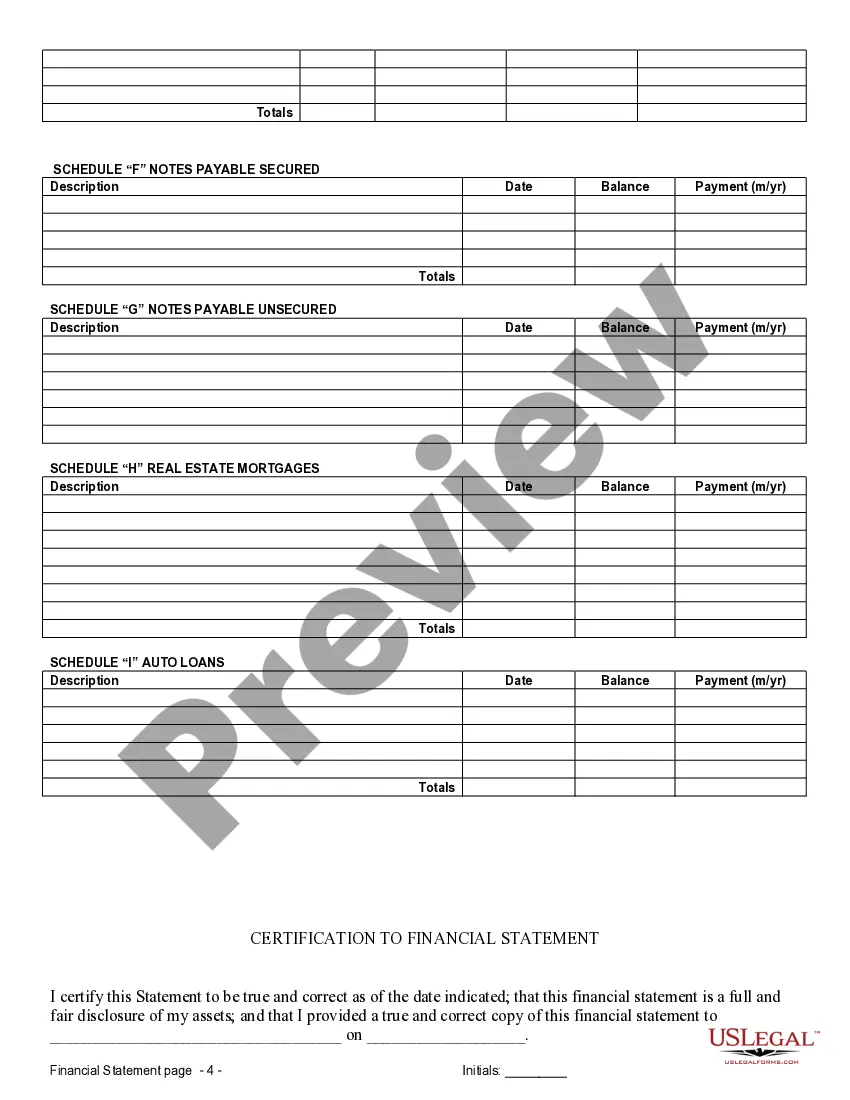

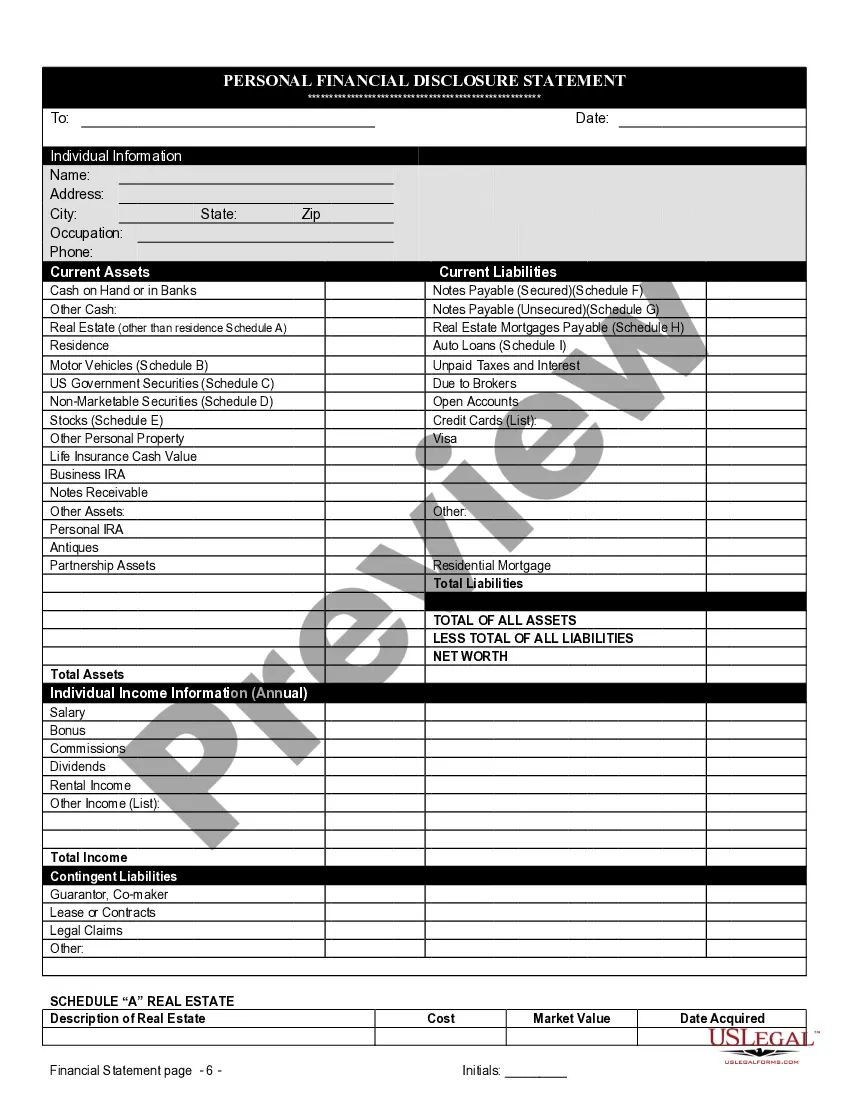

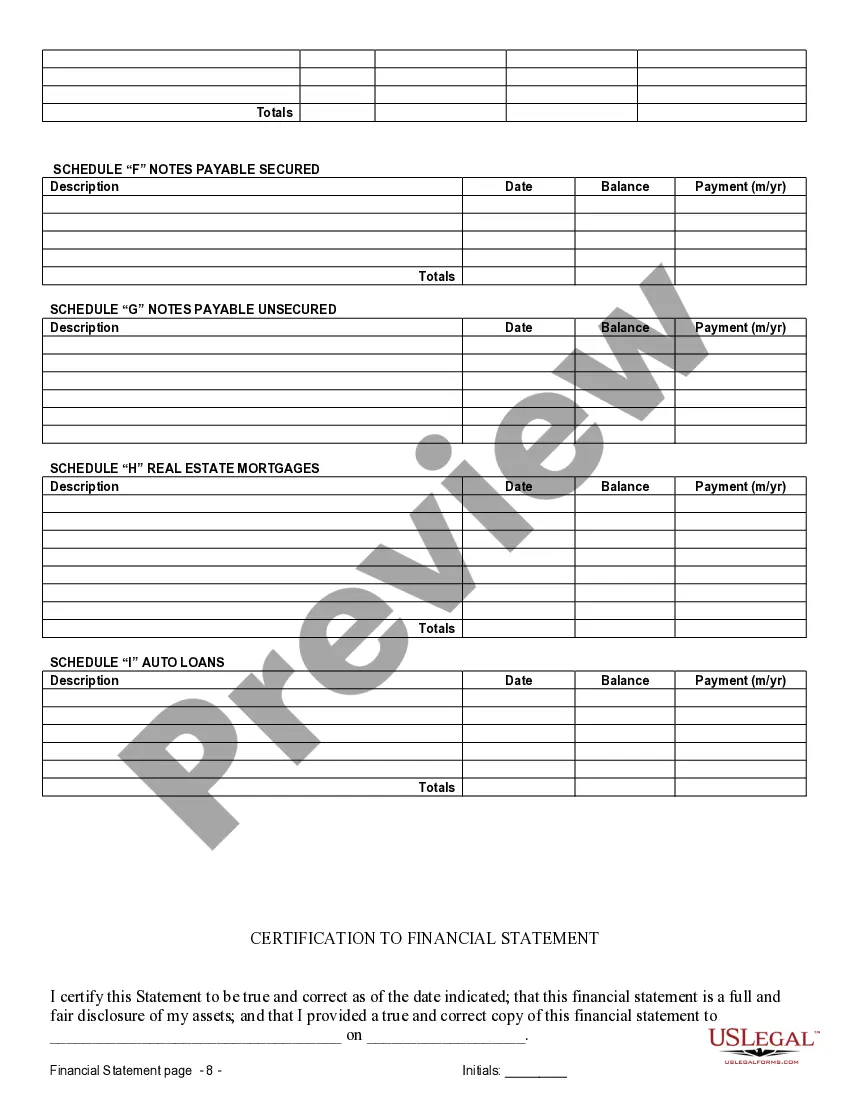

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

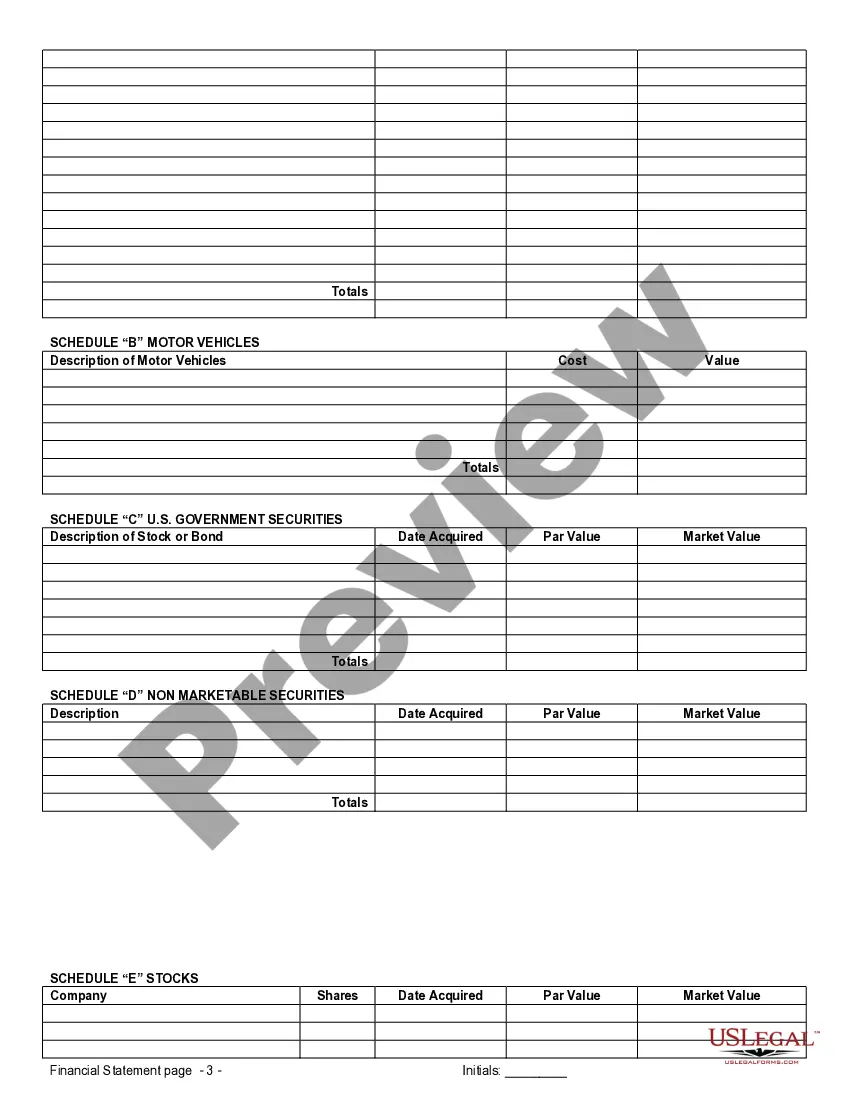

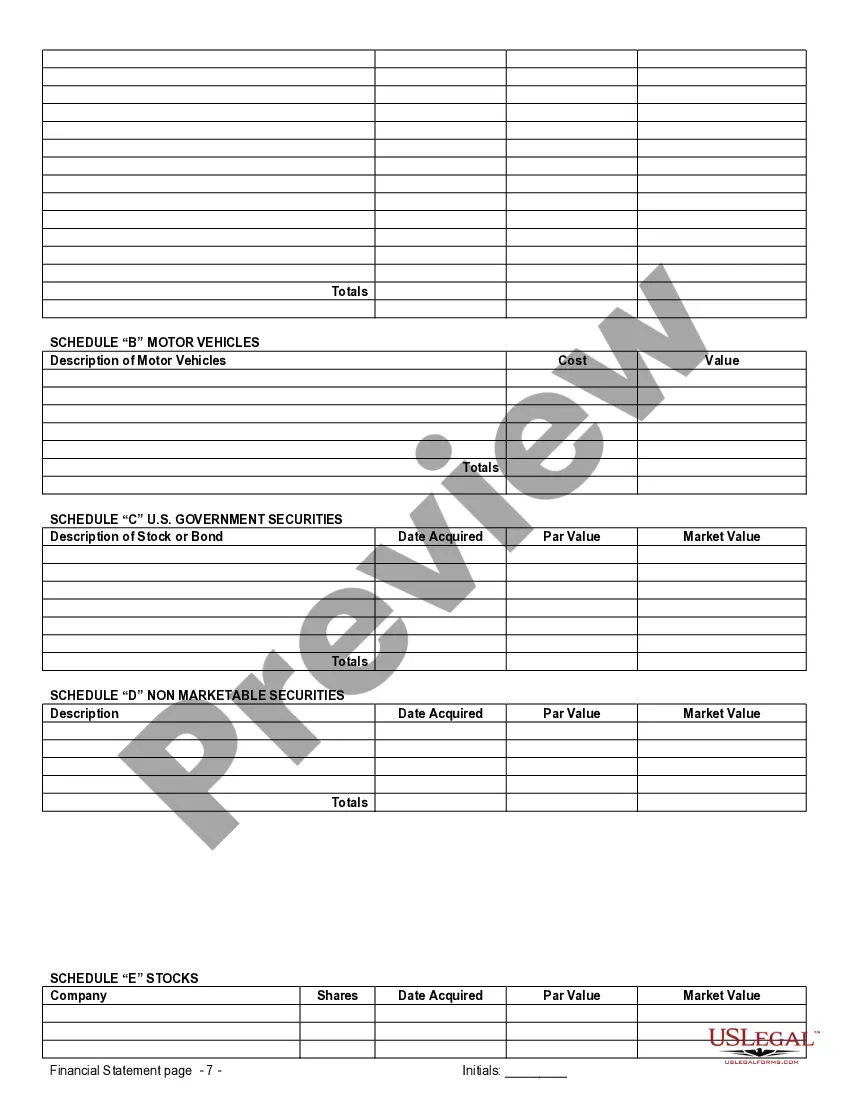

When entering into a prenuptial or premarital agreement in North Charleston, South Carolina, it is important to understand the significance of financial statements. Financial statements provide a thorough overview of an individual's financial standing, including assets, liabilities, income, and expenses. These documents are crucial in establishing transparency and ensuring both parties are aware of each other's financial situation before entering into a marriage contract. There are different types of financial statements that may be applicable to a prenuptial or premarital agreement in North Charleston, South Carolina. Let's explore each of them in detail: 1. Personal Balance Sheet: This financial statement lists an individual's assets, such as property, investments, bank accounts, vehicles, and personal belongings. It also includes liabilities such as mortgages, loans, credit card debt, and any other financial obligations. 2. Income Statement: Also known as a profit and loss statement, an income statement provides an overview of an individual's income and expenditures. It outlines the sources of income, including employment, investments, or any other financial gains, as well as the expenses related to housing, transportation, education, and lifestyle. 3. Bank Statements: These statements highlight an individual's financial transactions, including deposits, withdrawals, and any other activity within their bank accounts. Bank statements offer a comprehensive view of spending habits and cash flow, indicating any financial responsibility or potential concerns. 4. Tax Returns: Tax returns provide insights into an individual's annual income, deductions, and credits. They also reflect any potential tax liabilities, deductions claimed, and other financial details relevant to the Internal Revenue Service (IRS). Reviewing tax returns can help determine an individual's financial stability and their approach towards tax compliance. 5. Investment Portfolio Statements: If an individual possesses any investment accounts, such as stocks, mutual funds, retirement plans, or other securities, investment portfolio statements capture the details of those investments. These statements outline the holdings, gains, losses, and overall performance of the investment portfolio, providing further clarity on an individual's financial resources. In a prenuptial or premarital agreement, these financial statements play a key role in establishing the financial expectations and responsibilities of each party within the marriage. By understanding each other's financial standing and commitments, couples can make informed decisions about asset division, spousal support, and other financial aspects in the event of a divorce or separation. Remember, when creating North Charleston South Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement, it is essential to consult with a legal professional who specializes in family law to ensure compliance with local regulations and to protect your rights and interests.When entering into a prenuptial or premarital agreement in North Charleston, South Carolina, it is important to understand the significance of financial statements. Financial statements provide a thorough overview of an individual's financial standing, including assets, liabilities, income, and expenses. These documents are crucial in establishing transparency and ensuring both parties are aware of each other's financial situation before entering into a marriage contract. There are different types of financial statements that may be applicable to a prenuptial or premarital agreement in North Charleston, South Carolina. Let's explore each of them in detail: 1. Personal Balance Sheet: This financial statement lists an individual's assets, such as property, investments, bank accounts, vehicles, and personal belongings. It also includes liabilities such as mortgages, loans, credit card debt, and any other financial obligations. 2. Income Statement: Also known as a profit and loss statement, an income statement provides an overview of an individual's income and expenditures. It outlines the sources of income, including employment, investments, or any other financial gains, as well as the expenses related to housing, transportation, education, and lifestyle. 3. Bank Statements: These statements highlight an individual's financial transactions, including deposits, withdrawals, and any other activity within their bank accounts. Bank statements offer a comprehensive view of spending habits and cash flow, indicating any financial responsibility or potential concerns. 4. Tax Returns: Tax returns provide insights into an individual's annual income, deductions, and credits. They also reflect any potential tax liabilities, deductions claimed, and other financial details relevant to the Internal Revenue Service (IRS). Reviewing tax returns can help determine an individual's financial stability and their approach towards tax compliance. 5. Investment Portfolio Statements: If an individual possesses any investment accounts, such as stocks, mutual funds, retirement plans, or other securities, investment portfolio statements capture the details of those investments. These statements outline the holdings, gains, losses, and overall performance of the investment portfolio, providing further clarity on an individual's financial resources. In a prenuptial or premarital agreement, these financial statements play a key role in establishing the financial expectations and responsibilities of each party within the marriage. By understanding each other's financial standing and commitments, couples can make informed decisions about asset division, spousal support, and other financial aspects in the event of a divorce or separation. Remember, when creating North Charleston South Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement, it is essential to consult with a legal professional who specializes in family law to ensure compliance with local regulations and to protect your rights and interests.