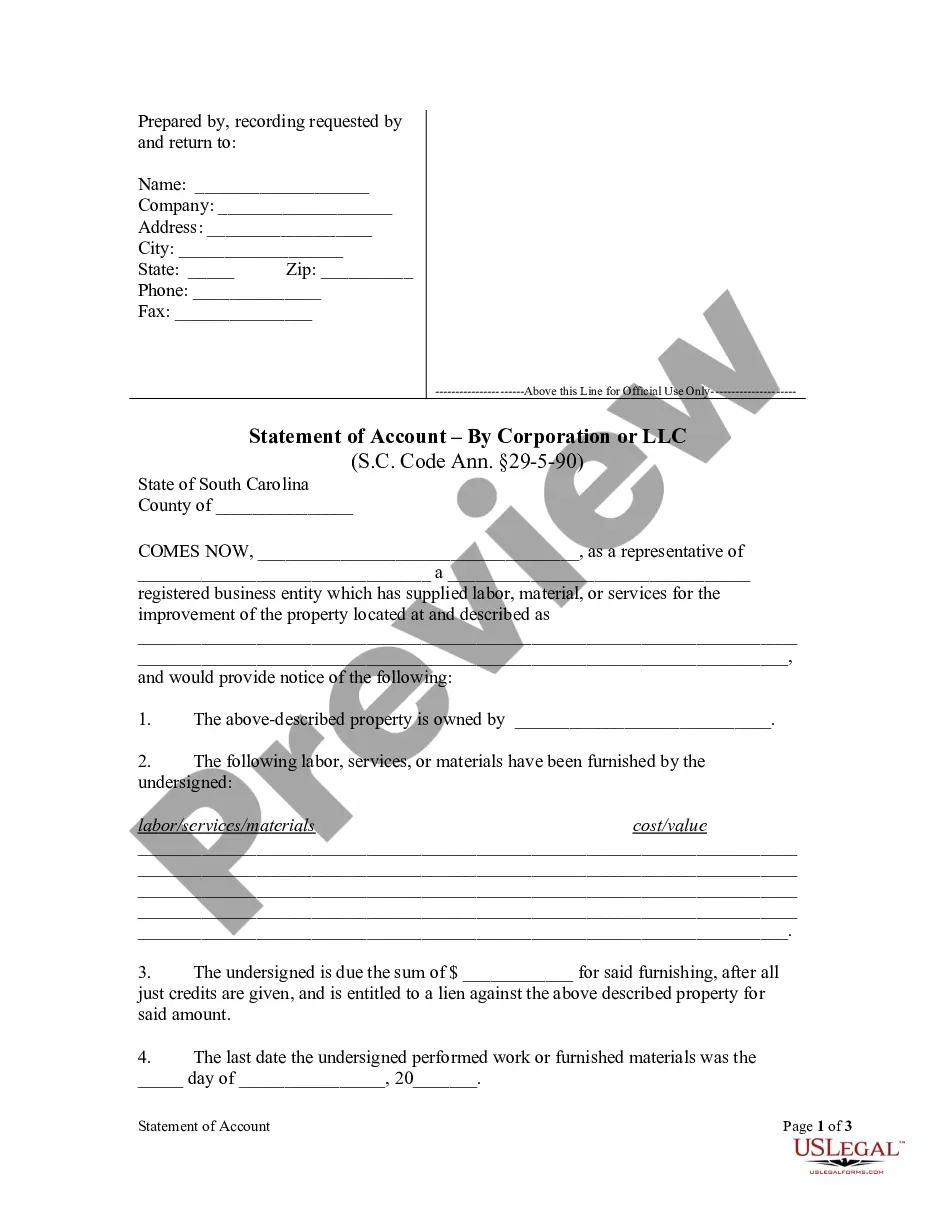

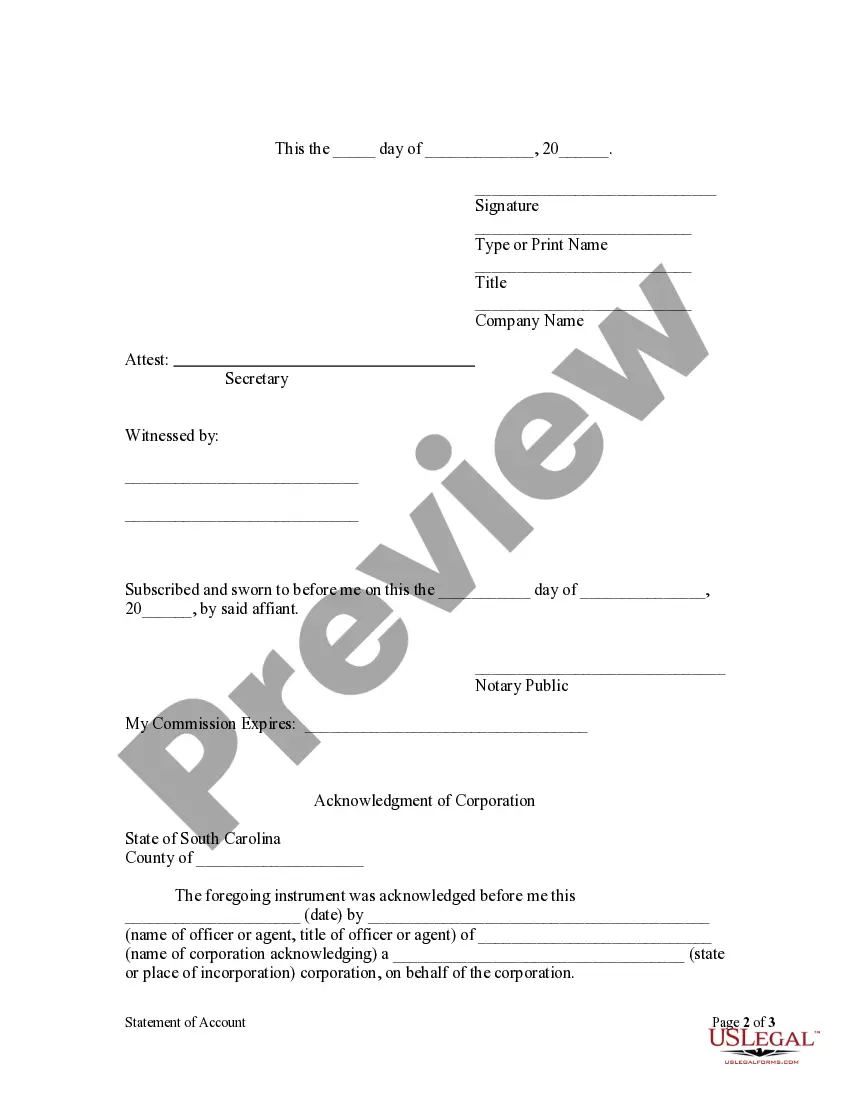

A lien shall be dissolved unless the person desiring to avail himself thereof, within ninety days after he ceases to labor on or furnish labor or materials for such building or structure, serves upon the owner or, in the event the owner cannot be found, upon the person in possession and files in the office of the register of deeds or clerk of court of the county in which the building or structure is situated a statement of a just and true account of the amount due him, with all just credits given, together with a description of the property intended to be covered by the lien sufficiently accurate for identification, with the name of the owner of the property, if known, which certificate shall be subscribed and sworn to by the person claiming the lien or by someone in his behalf and shall be recorded in a book kept for the purpose by the register or clerk who shall be entitled to the same fees therefor as for recording mortgages of equal length.

The North Charleston South Carolina Statement of Account by Corporation is a comprehensive financial document that provides an in-depth summary of a corporation's financial transactions, debts, and credits. It is a vital tool used by businesses in North Charleston, South Carolina, to track their financial health and monitor their monetary activities. Keywords: North Charleston South Carolina, Statement of Account, Corporation, financial transactions, debts, credits, financial health, monetary activities. The North Charleston South Carolina Statement of Account by Corporation consists of several sections, each highlighting critical aspects of the corporation's financial status. These sections include: 1. Balance Sheet: This section provides an overview of the corporation's assets, liabilities, and equity at a specific point in time. It showcases the company's financial position, including cash on hand, accounts receivable, inventories, property, and investments. Liabilities such as loans, accounts payable, and outstanding debts are also listed. 2. Income Statement: The income statement showcases the corporation's revenues, expenses, and overall profitability during a specific period. It details the sales revenue, cost of goods sold, operating expenses, and net income or loss generated by the business operations. This section helps the corporation assess its revenue streams and expenses, enabling strategic decision-making. 3. Cash Flow Statement: The cash flow statement highlights the inflows and outflows of cash within the corporation over a specific period. It captures the sources of cash, including operating activities, investing activities, and financing activities. It provides crucial insights into how the corporation manages its cash position and analyzes its ability to generate and utilize cash effectively. 4. Accounts Receivable/Payable: This section focuses specifically on the corporation's outstanding payments owed by customers (accounts receivable) and its obligations to suppliers and creditors (accounts payable). It tracks the aging of accounts receivable and payable, indicating the corporation's ability to collect and make payments promptly. 5. Tax Statements: This part entails the corporation's tax-related activities, including information on income taxes paid, tax deductions, credits, and any applicable tax liabilities. It assists the corporation in ensuring compliance with tax regulations and strategies for optimizing tax payments. Different Types of North Charleston South Carolina Statement of Account by Corporation: 1. Monthly Statement: A statement produced monthly, providing a snapshot of the corporation's financial status at the end of each month. It offers regular updates on financial performance and assists in monitoring trends and identifying potential issues quickly. 2. Annual Statement: A statement produced annually, offering a comprehensive overview of the corporation's financial position throughout the fiscal year. It includes the corporation's financial highlights, achievements, and challenges faced during the year. 3. Interim Statement: This statement is prepared at specific intervals, typically quarterly, between the annual statements. It provides a condensed summary of the corporation's financial performance during the given period. Interim statements allow for regular assessment and adjustment of financial strategies. 4. Audited Statement: In certain cases, corporations may choose to have their statements of accounts audited by independent accounting firms. An audited statement provides an additional level of credibility and verification, ensuring the accuracy and compliance of the financial information presented. In summary, the North Charleston South Carolina Statement of Account by Corporation is a crucial financial document that outlines a corporation's financial status and activities. By analyzing the various sections within the statement, businesses can assess their financial health, identify areas of improvement, and make informed decisions for future growth.The North Charleston South Carolina Statement of Account by Corporation is a comprehensive financial document that provides an in-depth summary of a corporation's financial transactions, debts, and credits. It is a vital tool used by businesses in North Charleston, South Carolina, to track their financial health and monitor their monetary activities. Keywords: North Charleston South Carolina, Statement of Account, Corporation, financial transactions, debts, credits, financial health, monetary activities. The North Charleston South Carolina Statement of Account by Corporation consists of several sections, each highlighting critical aspects of the corporation's financial status. These sections include: 1. Balance Sheet: This section provides an overview of the corporation's assets, liabilities, and equity at a specific point in time. It showcases the company's financial position, including cash on hand, accounts receivable, inventories, property, and investments. Liabilities such as loans, accounts payable, and outstanding debts are also listed. 2. Income Statement: The income statement showcases the corporation's revenues, expenses, and overall profitability during a specific period. It details the sales revenue, cost of goods sold, operating expenses, and net income or loss generated by the business operations. This section helps the corporation assess its revenue streams and expenses, enabling strategic decision-making. 3. Cash Flow Statement: The cash flow statement highlights the inflows and outflows of cash within the corporation over a specific period. It captures the sources of cash, including operating activities, investing activities, and financing activities. It provides crucial insights into how the corporation manages its cash position and analyzes its ability to generate and utilize cash effectively. 4. Accounts Receivable/Payable: This section focuses specifically on the corporation's outstanding payments owed by customers (accounts receivable) and its obligations to suppliers and creditors (accounts payable). It tracks the aging of accounts receivable and payable, indicating the corporation's ability to collect and make payments promptly. 5. Tax Statements: This part entails the corporation's tax-related activities, including information on income taxes paid, tax deductions, credits, and any applicable tax liabilities. It assists the corporation in ensuring compliance with tax regulations and strategies for optimizing tax payments. Different Types of North Charleston South Carolina Statement of Account by Corporation: 1. Monthly Statement: A statement produced monthly, providing a snapshot of the corporation's financial status at the end of each month. It offers regular updates on financial performance and assists in monitoring trends and identifying potential issues quickly. 2. Annual Statement: A statement produced annually, offering a comprehensive overview of the corporation's financial position throughout the fiscal year. It includes the corporation's financial highlights, achievements, and challenges faced during the year. 3. Interim Statement: This statement is prepared at specific intervals, typically quarterly, between the annual statements. It provides a condensed summary of the corporation's financial performance during the given period. Interim statements allow for regular assessment and adjustment of financial strategies. 4. Audited Statement: In certain cases, corporations may choose to have their statements of accounts audited by independent accounting firms. An audited statement provides an additional level of credibility and verification, ensuring the accuracy and compliance of the financial information presented. In summary, the North Charleston South Carolina Statement of Account by Corporation is a crucial financial document that outlines a corporation's financial status and activities. By analyzing the various sections within the statement, businesses can assess their financial health, identify areas of improvement, and make informed decisions for future growth.