Title: North Charleston South Carolina Assignment of Mortgage by Individual Mortgage Holder: A Comprehensive Overview Introduction: The North Charleston South Carolina Assignment of Mortgage by Individual Mortgage Holder is a legal document that plays a crucial role in the real estate industry. This detailed description aims to provide a comprehensive overview of the process, significance, and different types of assignment of mortgage in North Charleston, South Carolina. In this article, we will also highlight the essential keywords related to this topic, ensuring high relevancy for readers seeking specific information. Keywords: North Charleston South Carolina Assignment of Mortgage, individual mortgage holder, real estate, legal document, process, types. 1. Understanding the Assignment of Mortgage: The Assignment of Mortgage is a legal instrument used to transfer the ownership of a mortgage from the original lender (assignor) to a new party (assignee). In North Charleston, South Carolina, this process can be executed by an individual mortgage holder, also known as an individual investor. 2. Importance of the Assignment of Mortgage: The Assignment of Mortgage is vital in the real estate industry as it allows for the transfer of a mortgage loan, along with the associated rights and obligations, from one party to another. This enables individual mortgage holders to invest in mortgages and gain potential profits. 3. Process of Assignment of Mortgage in North Charleston, South Carolina: a. Agreement Preparation: The assignor and assignee negotiate and draft an Assignment of Mortgage agreement, detailing the terms and conditions of the mortgage transfer. b. Consent and Approval: Once the agreement is ready, it needs to be signed by both parties involved. In some cases, additional parties such as the original lender or the borrower may need to provide consent or approval. c. Recording: The Assignment of Mortgage is recorded in the appropriate office or agency, typically the county recorder's office in North Charleston, South Carolina, for public record purposes. 4. Types of Assignment of Mortgage in North Charleston, South Carolina: a. Full Assignment: In this type, the entire mortgage loan is transferred from the assignor to the assignee, including all rights, interests, and obligations. b. Partial Assignment: A partial assignment involves transferring a portion or specific interest in the mortgage loan to the assignee, while the assignor retains ownership of the remaining portion. c. Assignment of Security Interest: This type involves the assignment of the mortgage holder's security interest in the real property securing the loan, rather than the mortgage loan itself. d. Assignment of Note: Here, the mortgage holder transfers only the promissory note, which represents the borrower's debt obligation, without transferring the mortgage itself. Conclusion: The North Charleston South Carolina Assignment of Mortgage by Individual Mortgage Holder is a vital mechanism for the transfer of mortgage loans. This description emphasized the importance of this legal process and discussed its various types, including full assignment, partial assignment, assignment of security interest, and assignment of note. Familiarity with these concepts will aid individuals in understanding the intricacies of real estate transactions related to mortgage assignments in North Charleston, South Carolina. Keywords: North Charleston South Carolina, Assignment of Mortgage, individual mortgage holder, real estate, legal document, process, types, transfer, assignor, assignee, loan, ownership, rights, obligations, investor, profits.

North Charleston South Carolina Assignment of Mortgage by Individual Mortgage Holder

Description

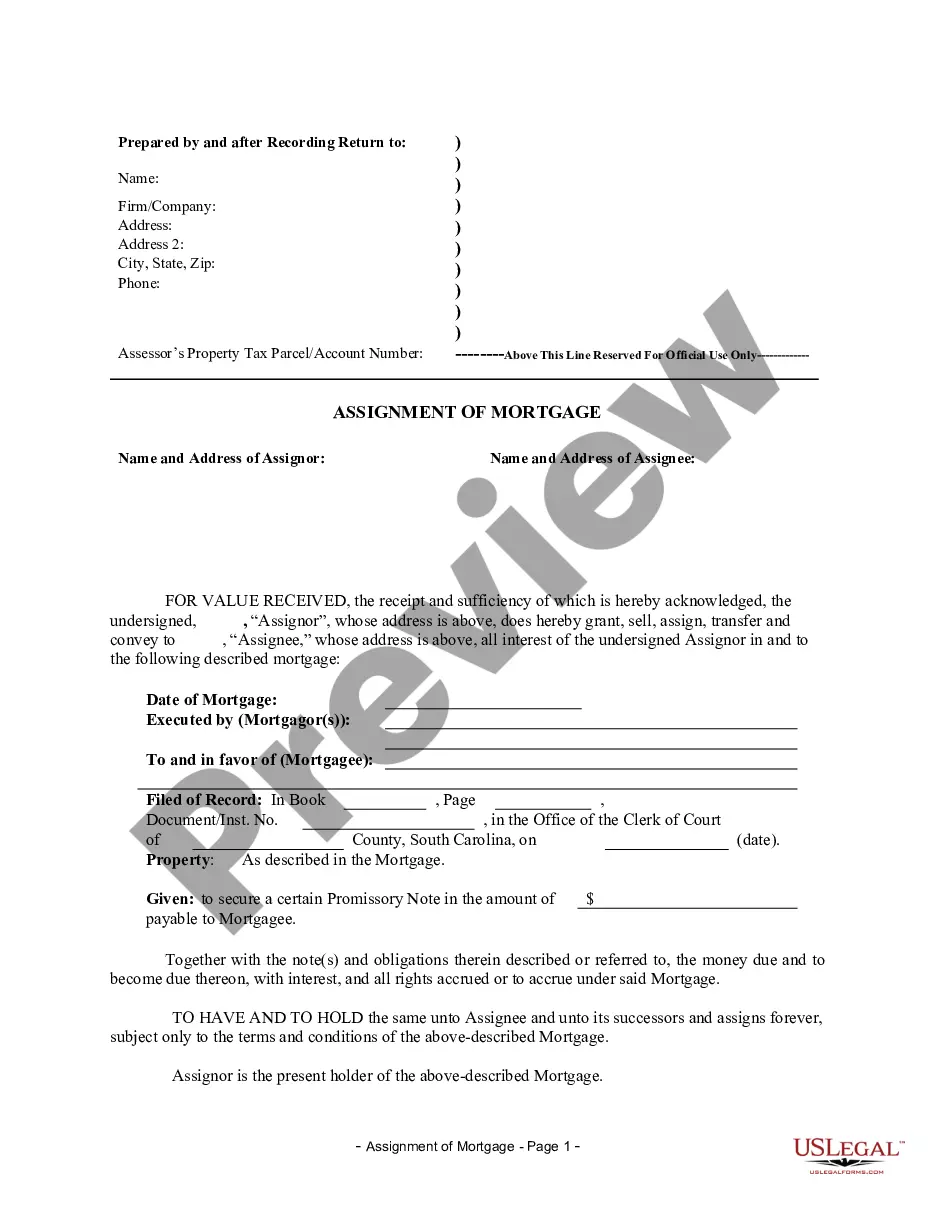

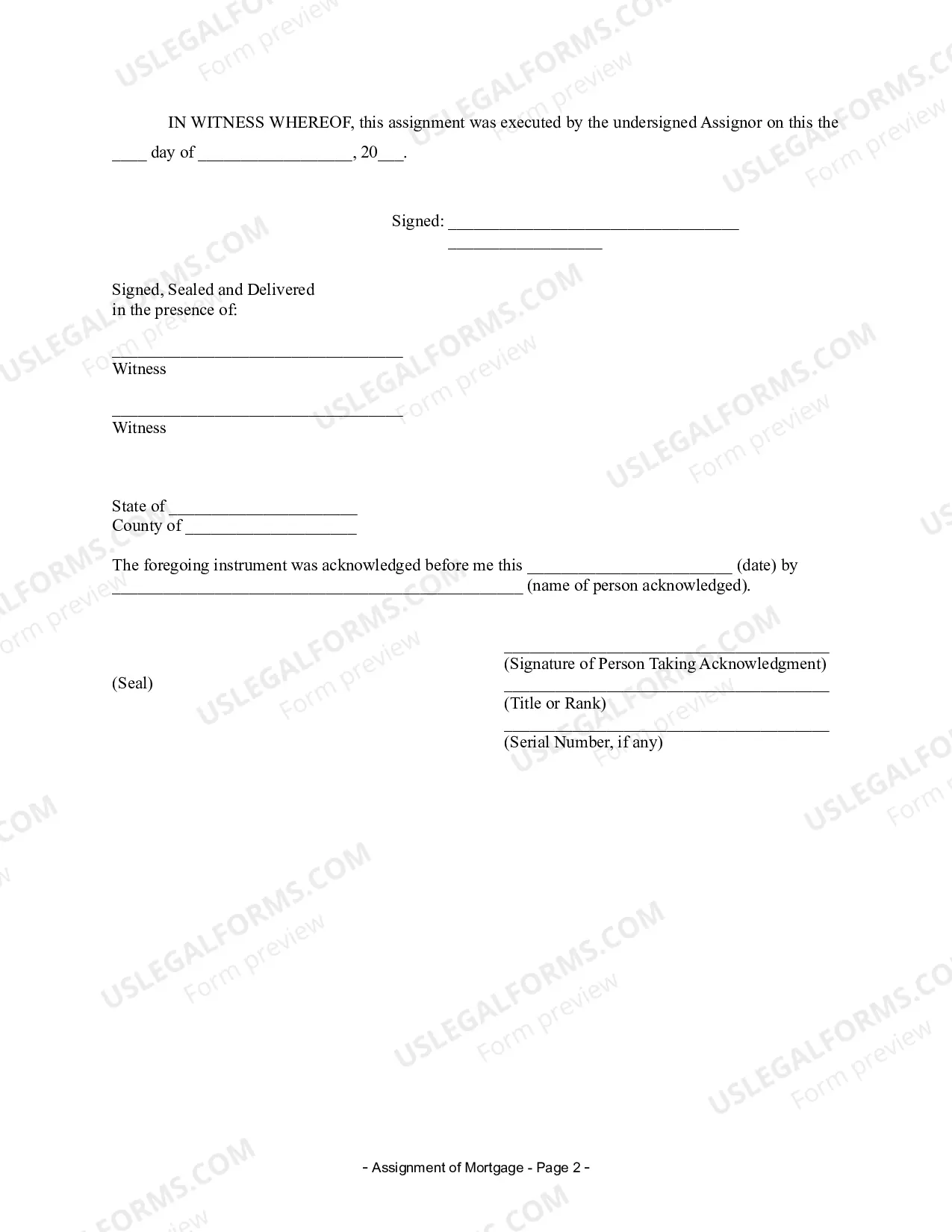

How to fill out North Charleston South Carolina Assignment Of Mortgage By Individual Mortgage Holder?

If you are searching for a valid form template, it’s extremely hard to find a more convenient service than the US Legal Forms site – one of the most comprehensive libraries on the internet. With this library, you can find a large number of document samples for business and individual purposes by types and regions, or keywords. With our high-quality search function, discovering the most recent North Charleston South Carolina Assignment of Mortgage by Individual Mortgage Holder is as elementary as 1-2-3. Moreover, the relevance of every document is confirmed by a team of professional lawyers that on a regular basis review the templates on our website and revise them based on the most recent state and county requirements.

If you already know about our platform and have a registered account, all you need to receive the North Charleston South Carolina Assignment of Mortgage by Individual Mortgage Holder is to log in to your profile and click the Download button.

If you make use of US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have discovered the sample you need. Check its description and make use of the Preview option (if available) to explore its content. If it doesn’t suit your needs, use the Search field at the top of the screen to get the appropriate file.

- Confirm your selection. Choose the Buy now button. Following that, select the preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Indicate the format and download it on your device.

- Make adjustments. Fill out, modify, print, and sign the obtained North Charleston South Carolina Assignment of Mortgage by Individual Mortgage Holder.

Every single template you add to your profile does not have an expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you need to have an extra version for enhancing or creating a hard copy, feel free to return and download it once more whenever you want.

Make use of the US Legal Forms professional catalogue to gain access to the North Charleston South Carolina Assignment of Mortgage by Individual Mortgage Holder you were looking for and a large number of other professional and state-specific templates on a single website!