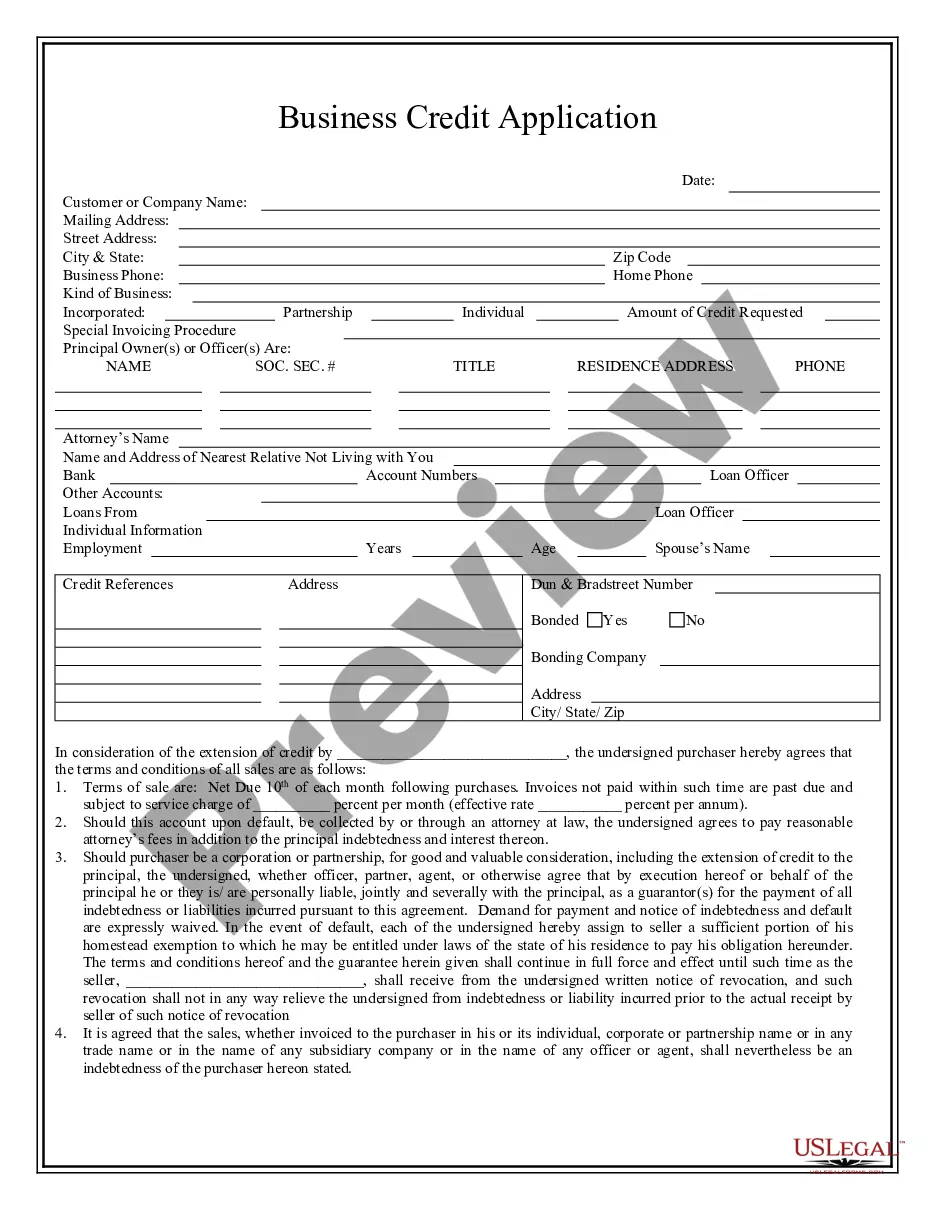

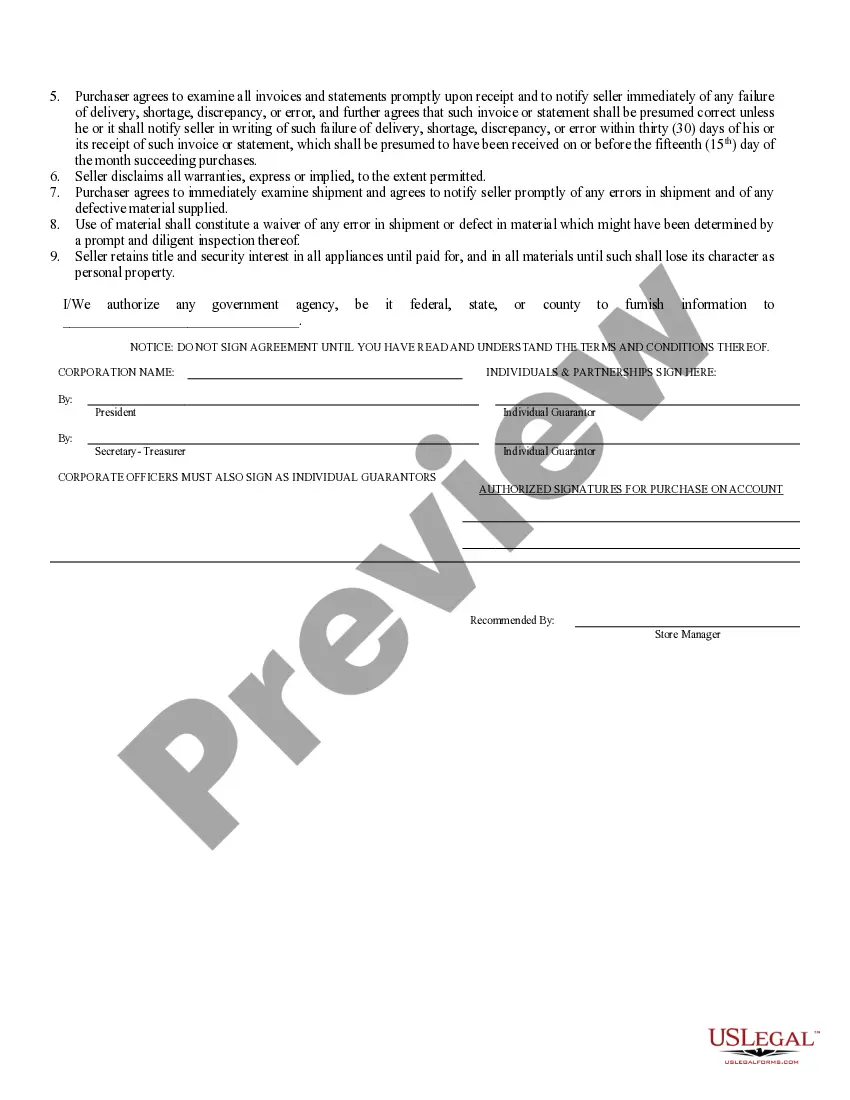

Title: The North Charleston South Carolina Business Credit Application: A Detailed Overview Introduction: The North Charleston South Carolina Business Credit Application is a crucial tool for businesses operating in the vibrant city of North Charleston. This document allows local businesses to apply for credit from financial institutions, enabling them to access funds and expand their operations. In this article, we will delve into the key features, importance, and types of business credit applications available in North Charleston, South Carolina. 1. Understanding the Significance of Business Credit Application: The North Charleston Business Credit Application serves as a formal request by businesses to financial institutions or lenders, seeking credit options to support their working capital needs, expansion plans, or investment requirements. It plays a pivotal role in establishing the creditworthiness, credibility, and financial stability of the business in the eyes of lending institutions. 2. Key Components of North Charleston Business Credit Application: A. Business Information: Applicants are required to provide vital business details such as legal name, address, contact information, ownership structure, industry classification, and years in operation. B. Financial Information: Financial details, including income statements, balance sheets, cash flow statements, and tax returns, are necessary to assess the financial health and repayment capacity of the business. C. Purpose of Credit: Applicants need to specify the purpose for which credit is sought, such as purchasing inventory, equipment, or real estate, expanding operations, or meeting working capital requirements. D. Collateral: Some credit applications may require applicants to provide information about collateral assets that can secure the credit facility, such as real estate, machinery, or inventory. E. Personal Information: In cases where the business owner(s) or the authorized representative(s) act as guarantors, personal information, including social security numbers and personal financial statements, may be required. 3. Types of North Charleston Business Credit Applications: A. Small Business Administration (SBA) Loans: SBA loans are popular credit options among businesses. These loans, partially guaranteed by the SBA, offer low-interest rates, longer repayment terms, and favorable terms and conditions. B. Traditional Bank Loans: Traditional bank loans are offered by local financial institutions and require a comprehensive credit application process. These loans typically have varying interest rates, repayment terms, and collateral requirements. C. Lines of Credit: Lines of credit provide businesses with access to a predetermined amount of funds that can be withdrawn on demand. They are suitable for short-term working capital needs or to manage fluctuating cash flows. D. Business Credit Cards: Business credit card applications are commonly used by small businesses to manage day-to-day expenses and build credit history. They offer convenience, flexibility, and often come with rewards programs. Conclusion: The North Charleston South Carolina Business Credit Application holds immense importance for businesses seeking financial support and growth opportunities. By providing accurate and detailed information, businesses can increase their chances of obtaining credit facilities tailored to their specific needs. Whether through SBA loans, traditional bank loans, lines of credit, or business credit cards, the availability of diverse credit options further enhances the growth prospects for businesses in the dynamic city of North Charleston, South Carolina.

North Charleston South Carolina Business Credit Application

Description

How to fill out North Charleston South Carolina Business Credit Application?

Benefit from the US Legal Forms and get immediate access to any form sample you require. Our beneficial platform with a huge number of templates allows you to find and get virtually any document sample you will need. It is possible to save, complete, and sign the North Charleston South Carolina Business Credit Application in just a couple of minutes instead of surfing the Net for many hours seeking a proper template.

Using our catalog is a great strategy to increase the safety of your form submissions. Our professional lawyers regularly check all the documents to make sure that the templates are appropriate for a particular state and compliant with new laws and regulations.

How can you get the North Charleston South Carolina Business Credit Application? If you have a subscription, just log in to the account. The Download button will appear on all the documents you look at. Moreover, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction below:

- Open the page with the form you need. Make certain that it is the form you were hoping to find: check its name and description, and use the Preview function when it is available. Otherwise, use the Search field to find the appropriate one.

- Start the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order with a credit card or PayPal.

- Export the file. Select the format to get the North Charleston South Carolina Business Credit Application and revise and complete, or sign it according to your requirements.

US Legal Forms is among the most extensive and trustworthy template libraries on the internet. We are always ready to assist you in virtually any legal procedure, even if it is just downloading the North Charleston South Carolina Business Credit Application.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!