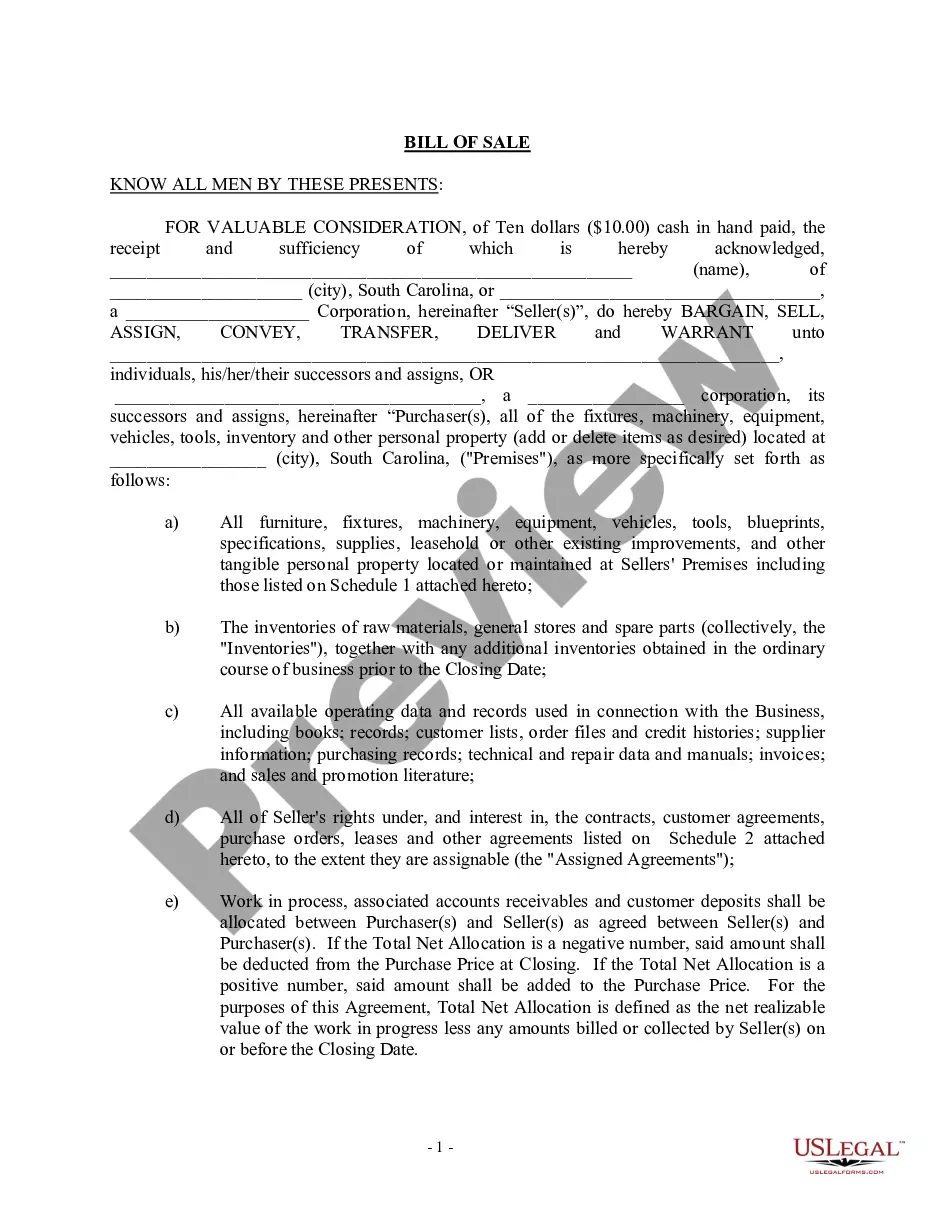

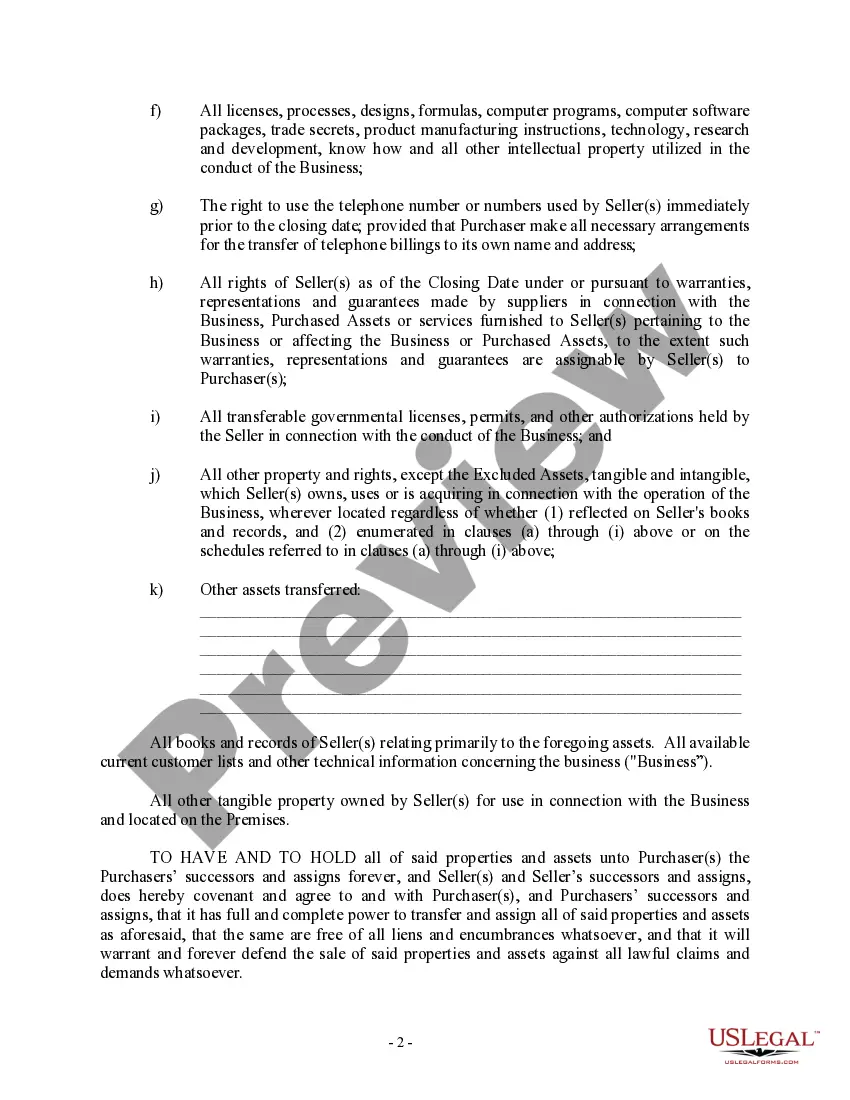

North Charleston South Carolina Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is a legal document that outlines the terms and conditions of transferring ownership of a business from one party to another. This bill of sale is essential to protect the rights and interests of the buyer and seller involved in the transaction. The North Charleston South Carolina Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller includes various key elements such as: 1. Parties Involved: The bill of sale identifies the individual or corporate seller who currently owns the business and the individual or corporate buyer who intends to acquire it. It includes their names, addresses, and contact information. 2. Business Description: The bill of sale provides a detailed description of the business being sold, including its name, address, and any other relevant information. It may also specify the nature of the business, such as a retail store, restaurant, or professional services' provider. 3. Assets and Liabilities: This document details the assets and liabilities being transferred as part of the business sale. It may include real estate, inventory, equipment, intellectual property, contracts, and any outstanding debts or obligations. 4. Purchase Price and Payment Terms: The bill of sale specifies the purchase price agreed upon by both parties and outlines the payment terms, including any down payment, installment payments, or financing arrangements. It may also mention whether the purchase price includes any additional costs or taxes. 5. Representations and Warranties: This section of the bill of sale highlights the representations and warranties made by both the seller and the buyer. It guarantees the seller's ownership rights and the accuracy of the business's financial records and representations made about the business's condition or performance. 6. Covenant Not to Compete: In some cases, the bill of sale may include a covenant not to compete clause, which restricts the seller from engaging in a similar business within a specified geographic area for a certain period after the sale. This helps protect the buyer's interests and prevent potential competition. 7. Governing Law: The bill of sale explicitly states that it is governed by the laws of the state of South Carolina, specifically in North Charleston, ensuring that any legal disputes arising from the agreement will be settled under the state's jurisdiction. Types of North Charleston South Carolina Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller may include: 1. Asset Purchase Agreement: This type of bill of sale focuses on the acquisition of specific assets of a business, rather than transferring the entire business. It allows the buyer to select certain assets while leaving behind any unwanted liabilities. 2. Stock Purchase Agreement: In this type of bill of sale, the buyer purchases all the stock or shares of a corporation, acquiring complete ownership and control of the business. 3. Merger Agreement: A merger agreement bill of sale is used when two existing businesses agree to combine into one entity. It outlines the terms and conditions of the merger, including the allocation of assets and liabilities between the merging companies. In conclusion, the North Charleston South Carolina Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is a crucial legal document that ensures a smooth and legally binding transfer of business ownership. It protects both parties involved and sets clear terms and conditions for the transaction to take place.

North Charleston South Carolina Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out North Charleston South Carolina Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person without any law education to draft this sort of papers from scratch, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms can save the day. Our platform provides a massive collection with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time using our DYI forms.

Whether you want the North Charleston South Carolina Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the North Charleston South Carolina Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller in minutes using our trustworthy platform. In case you are already an existing customer, you can go on and log in to your account to get the needed form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps before downloading the North Charleston South Carolina Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller:

- Ensure the form you have found is specific to your location considering that the rules of one state or area do not work for another state or area.

- Review the form and read a brief outline (if available) of cases the paper can be used for.

- In case the form you picked doesn’t meet your requirements, you can start over and search for the necessary document.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your login information or register for one from scratch.

- Choose the payment gateway and proceed to download the North Charleston South Carolina Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller as soon as the payment is through.

You’re good to go! Now you can go on and print the form or complete it online. Should you have any issues locating your purchased forms, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.