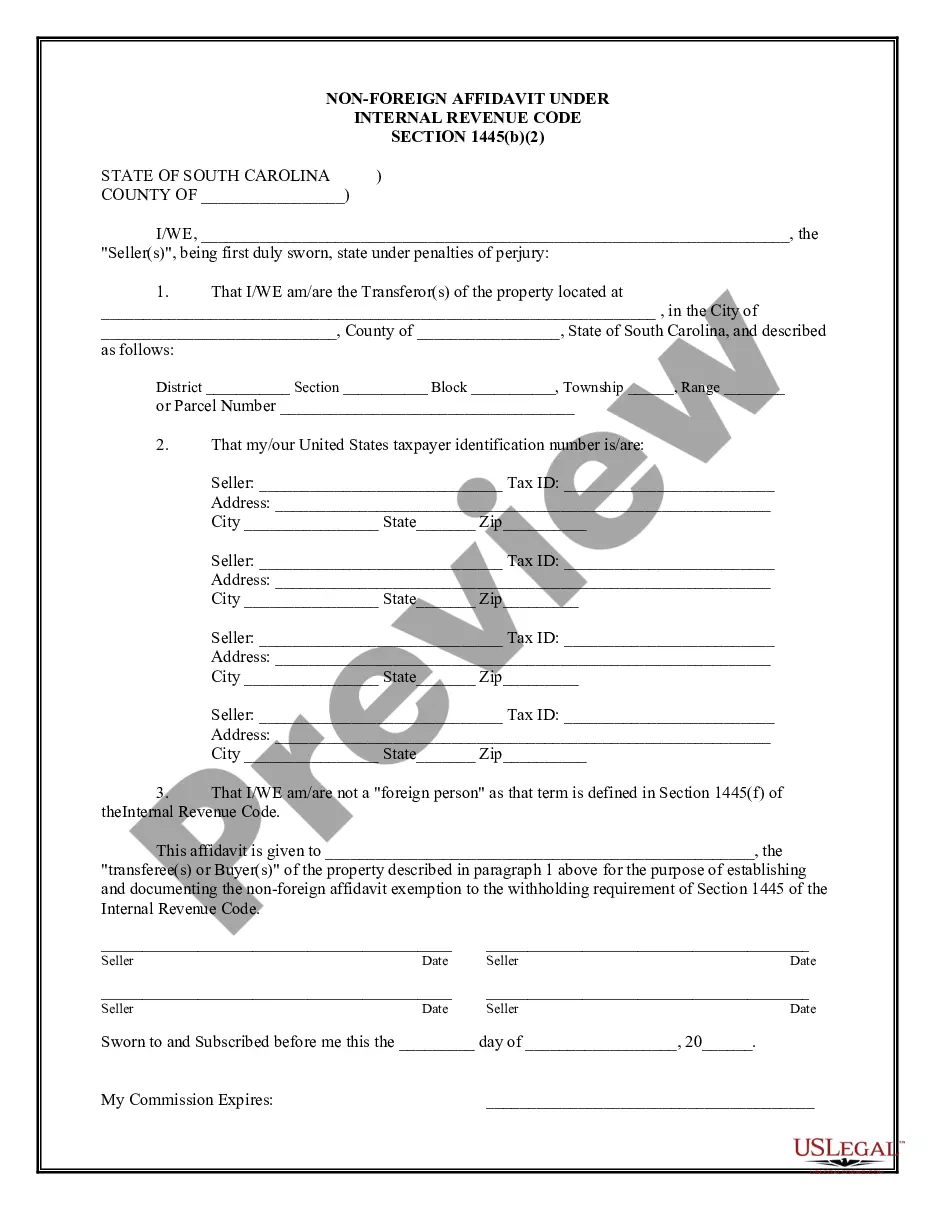

A non-foreign affidavit under IRC 1445 is a legal document utilized in North Charleston, South Carolina, to certify the individual or entity's non-foreign status for tax purposes. This affidavit is crucial in real estate transactions involving the sale or disposition of U.S. real property interests by non-U.S. persons. The purpose of the North Charleston South Carolina Non-Foreign Affidavit Under IRC 1445 is to comply with the Internal Revenue Code (IRC) Section 1445, which requires the purchaser or transferee to withhold tax on the transfer of a U.S. real property interest. This section aims to ensure that the tax obligations of non-U.S. individuals or entities are fulfilled before the transfer takes place. This affidavit serves as a declaration by the seller or transferor that they are not a foreign person or entity, as defined by the IRC and the relevant regulations. By completing this affidavit, the seller certifies their U.S. status, enabling the purchaser or transferee to rely on the affidavit and not withhold any tax from the transaction. Different types of North Charleston, South Carolina Non-Foreign Affidavit Under IRC 1445 may include variations based on specific situations or requirements. For instance, if the seller or transferor is a non-U.S. individual, they would need to complete an affidavit to declare their non-foreign status under IRC 1445. Similarly, if the seller or transferor is a non-U.S. entity, such as a corporation or partnership, a different type of affidavit would be required to establish their non-foreign status under IRC 1445. The North Charleston South Carolina Non-Foreign Affidavit Under IRC 1445 is an important document that protects both the buyer and the seller in real estate transactions involving non-U.S. persons. It ensures that the necessary tax obligations are met, providing clarity and transparency throughout the process. Compliance with IRC 1445 is vital to avoid any potential penalties or disputes related to the sale or disposition of U.S. real property interests. In conclusion, the North Charleston South Carolina Non-Foreign Affidavit Under IRC 1445 is a legal instrument used in real estate transactions involving non-U.S. individuals or entities. Its purpose is to certify the non-foreign status of the seller or transferor, ensuring compliance with the tax obligations outlined in IRC Section 1445. Different types of affidavits may exist based on the specific circumstances of the seller or transferor, such as whether they are an individual or an entity.

North Charleston South Carolina Non-Foreign Affidavit Under IRC 1445

Description

How to fill out North Charleston South Carolina Non-Foreign Affidavit Under IRC 1445?

Benefit from the US Legal Forms and obtain immediate access to any form you require. Our helpful platform with a large number of document templates allows you to find and get almost any document sample you require. It is possible to save, fill, and certify the North Charleston South Carolina Non-Foreign Affidavit Under IRC 1445 in just a couple of minutes instead of browsing the web for hours seeking the right template.

Using our collection is a great strategy to increase the safety of your document submissions. Our professional attorneys on a regular basis review all the documents to ensure that the templates are appropriate for a particular region and compliant with new acts and polices.

How can you get the North Charleston South Carolina Non-Foreign Affidavit Under IRC 1445? If you already have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. Additionally, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions below:

- Open the page with the form you require. Make sure that it is the form you were seeking: check its name and description, and take take advantage of the Preview function if it is available. Otherwise, use the Search field to find the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the file. Indicate the format to get the North Charleston South Carolina Non-Foreign Affidavit Under IRC 1445 and revise and fill, or sign it according to your requirements.

US Legal Forms is among the most significant and trustworthy form libraries on the web. We are always ready to help you in any legal case, even if it is just downloading the North Charleston South Carolina Non-Foreign Affidavit Under IRC 1445.

Feel free to take advantage of our form catalog and make your document experience as convenient as possible!

Form popularity

FAQ

foreign status affidavit is a declaration confirming that the property seller is a U.S. resident, as defined by IRC 1445. This affidavit is important in preventing withholding taxes on the sale proceeds for buyers in North Charleston, South Carolina. Such a statement assures buyers that they will not face unexpected tax liabilities. With our solutions, you can quickly generate your nonforeign status affidavit, ensuring a seamless real estate transaction.

To create a FIRPTA affidavit in North Charleston, South Carolina, you need to provide specific information, including the seller's name, tax identification number, and property details. The document must clearly state that the seller is not a foreign person. This information helps guarantee compliance with IRC 1445 regulations. Our services streamline the process, making it easy for you to generate a complete and accurate FIRPTA affidavit.

An affidavit of status is a legal document that verifies an individual's residency status, often used in real estate transactions. In the context of North Charleston, South Carolina, a non-foreign affidavit under IRC 1445 declares that the seller is not a foreign person. This declaration is crucial because it protects the buyer from potential withholding tax obligations. Our platform can assist in preparing this affidavit to ensure you meet all necessary requirements.

In North Charleston, South Carolina, a FIRPTA affidavit is typically provided by the seller of the property or their real estate attorney. This document serves to confirm the seller's non-foreign status under IRC 1445. It helps ensure that buyers are not subject to withholding taxes on the sale proceeds. You can easily create this document using our platform, ensuring compliance with local regulations.

foreign person affidavit serves as proof that an individual or entity is not classified as a foreign person under the IRC guidelines. Specifically, the North Charleston South Carolina NonForeign Affidavit Under IRC 1445 aligns with these regulations, safeguarding both buyers and sellers during property sales. This affidavit helps eliminate uncertainties regarding tax obligations, promoting a transparent sale. By utilizing this affidavit, you can navigate the real estate market with confidence.

foreign affidavit, particularly the North Charleston South Carolina NonForeign Affidavit Under IRC 1445, is a legal document that verifies an individual's status as a nonforeign entity. This affidavit ensures that the seller does not fall under the jurisdiction of certain tax withholding rules applicable to foreign entities. Consequently, it prevents potential tax complications during real estate transactions. Having this document streamlines the buying process and fosters trust between parties.

A FIRPTA certificate does not typically require notarization; however, local regulations may vary. To be safe, it is best to check with your real estate professional or legal advisor. Completing the North Charleston South Carolina Non-Foreign Affidavit Under IRC 1445 correctly ensures compliance and protects both the buyer and seller.

Form 8288 is prepared by the buyer of the real estate transaction who is responsible for withholding any required taxes. It is essential to ensure this form is completed correctly to avoid penalties. Consulting resources like USLegalForms can guide you through completing the form associated with the North Charleston South Carolina Non-Foreign Affidavit Under IRC 1445.

A FIRPTA notice must generally be sent to the designated IRS office location based on your state. For North Charleston, South Carolina, each transaction may have slightly different mailing requirements. You can find the most current information on the IRS website or consult with a tax professional to ensure proper compliance with the Non-Foreign Affidavit Under IRC 1445.

Section 1445 of the Internal Revenue Code defines the rules for withholding on the disposition of US real property interests by foreign persons. It requires buyers to withhold taxes from sellers who do not provide a non-foreign affidavit. Understanding this section is important for anyone involved in real estate transactions in North Charleston, South Carolina, which is why the Non-Foreign Affidavit Under IRC 1445 matters.

Interesting Questions

More info

PROTESTANT EPISCOPAL CHURCH IN UPPER SOUTH CAROLINA. (SATURDAY) — JANUARY 6, 2019 -. PROTESTANT EPISCOPAL CHURCH IN CAROLINA. PROTESTANT EPISCOPAL CHURCH IN UPPER SOUTH CAROLINA. (SATURDAY). The United States has joined the Treaty of Paris, committing and pledging “its great readiness to assist all its peoples in their efforts to achieve the goal of lasting peace in their neighborhood.” On January 18 a peace ceremony was held in San Salvador, Colombia at which the Secretary of State, Donald John Trump, officially received the official proclamation of Peace. It is in compliance with the United States- Colombia treaty (which, as we speak, is being implemented). At 4 pm, the peace ceremony was closed by the President of Colombia.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.