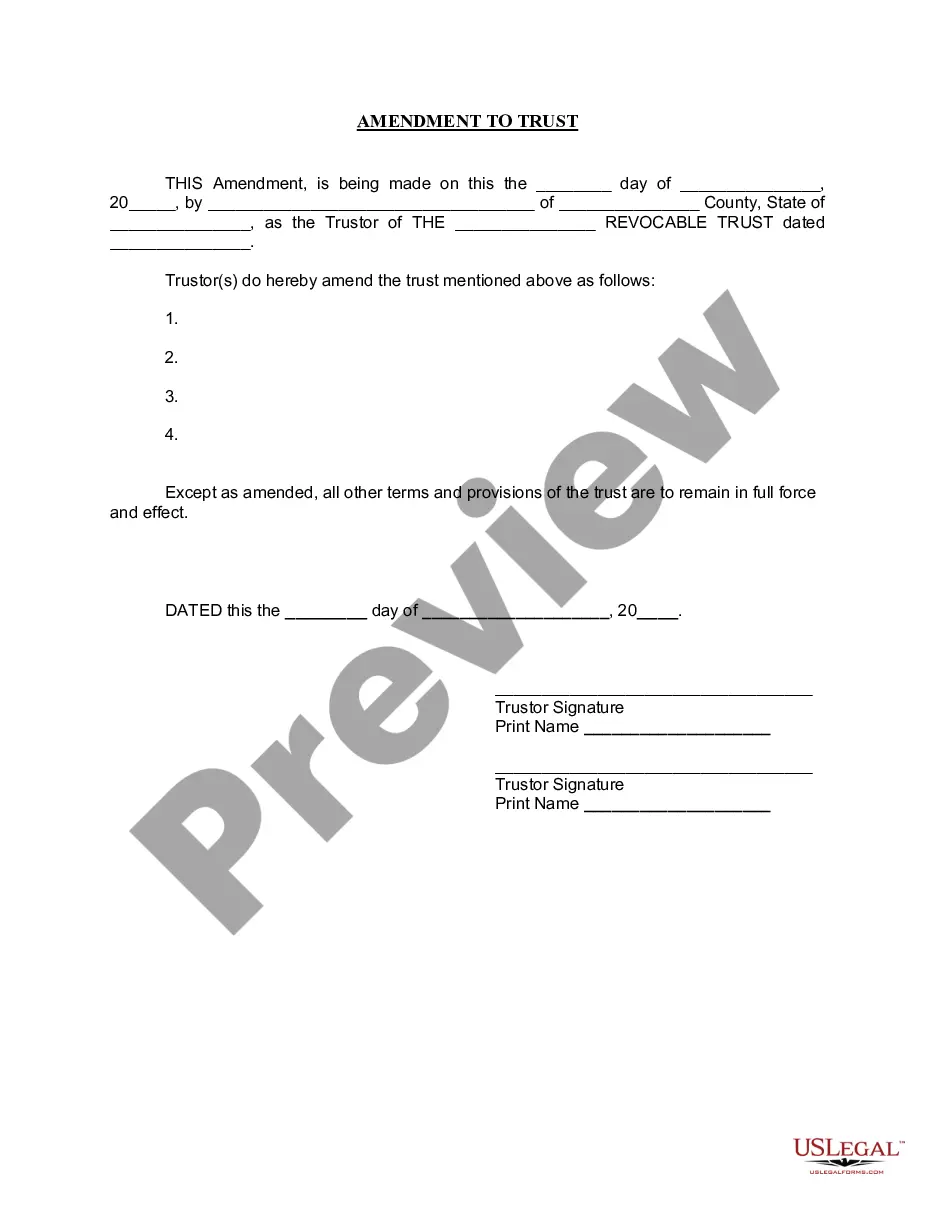

Title: Understanding the North Charleston South Carolina Amendment to Living Trust Introduction: In North Charleston, South Carolina, individuals often choose to establish a living trust as part of their estate planning strategy. A living trust is a legal document that allows individuals to control their assets during their lifetime and ensure the smooth transfer of their assets to their beneficiaries upon their death. In certain situations, individuals may need to make changes or amendments to their living trust. This article aims to provide a comprehensive overview of the North Charleston South Carolina Amendment to Living Trust, its purpose, and different types. 1. What is a Living Trust Amendment? A living trust amendment is a legal instrument that allows individuals to modify or update their existing living trust while maintaining its integrity. With this amendment, individuals can add, revoke, or alter certain provisions within the trust to reflect changed circumstances, preferences, or legal requirements. 2. Purpose of a North Charleston South Carolina Amendment to Living Trust: The primary purpose of a North Charleston South Carolina Amendment to Living Trust is to ensure that individuals' living trusts remain up to date and effective. Some common reasons for amending a living trust include changes in personal circumstances, beneficiaries' situations, or adjusting to evolving tax laws. 3. Key Elements in the North Charleston South Carolina Amendment to Living Trust: a. Amendment Language: The amendment should clearly state the intent to modify specific provisions of the original living trust. b. Trustee Information: The amendment may include the identification of the trustee(s) responsible for implementing the changes. c. Sections to be Amended: Precisely identify the sections or clauses to be amended, added, or removed in the original living trust. d. Effective Date: Specify the date when the amendment will become effective (usually the date of signing). 4. Different Types of North Charleston South Carolina Amendment to Living Trust: a. Beneficiary Amendment: This type of amendment allows individuals to add or remove beneficiaries, modify their shares or percentages, or include contingent beneficiaries. b. Asset Amendment: In this type of amendment, individuals can update the assets included in the trust by adding or removing properties, investments, or other assets. c. Administrative Amendment: Administrative amendments aim to update administrative details, such as changing the Trustee, Successor Trustee, or updating powers or responsibilities assigned to individuals involved. d. Tax Provision Amendment: When tax laws change, individuals may need to amend their living trusts to align with new regulations, ensuring maximum protection of their assets from unnecessary tax burdens. Conclusion: The North Charleston South Carolina Amendment to Living Trust provides individuals with the flexibility to modify their living trusts as needed, ensuring their wishes are accurately reflected and their assets are protected. Whether updating beneficiaries, assets, administrative details, or tax provisions, consulting with an experienced attorney is crucial to navigate the legal requirements and ensure the amendment is valid and enforceable.

North Charleston South Carolina Amendment to Living Trust

Description

How to fill out North Charleston South Carolina Amendment To Living Trust?

Do you need a reliable and inexpensive legal forms provider to buy the North Charleston South Carolina Amendment to Living Trust? US Legal Forms is your go-to option.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of separate state and county.

To download the document, you need to log in account, locate the required form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the North Charleston South Carolina Amendment to Living Trust conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the document is intended for.

- Start the search over in case the form isn’t suitable for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the North Charleston South Carolina Amendment to Living Trust in any available format. You can get back to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal papers online for good.