North Charleston South Carolina Financial Account Transfer to Living Trust is a legal process that allows individuals in North Charleston, South Carolina to transfer their financial accounts into a living trust. A living trust is a legal entity created to hold assets during an individual's lifetime and distribute them upon their death, while avoiding probate. When going through a financial account transfer to a living trust in North Charleston, there are different types of transfers that can take place based on the specific requirements and circumstances of the individual. These include: 1. Real estate transfer: This involves transferring ownership of real estate properties such as residential homes, commercial buildings, or vacant land into the living trust. The living trust becomes the new legal owner, providing various benefits such as asset protection and streamlined distribution upon the individual's death. 2. Bank account transfer: Individuals can transfer their personal savings accounts, checking accounts, certificates of deposit (CDs), or money market accounts into the living trust. By doing so, the trust becomes the new account holder, allowing for seamless management and distribution of funds as outlined in the trust document. 3. Investment account transfer: The transfer of investment accounts, including stocks, bonds, mutual funds, and brokerage accounts, into a living trust helps ensure that the assets within these accounts are protected, managed, and smoothly transferred to beneficiaries upon the individual's passing. 4. Retirement account transfer: Certain retirement accounts like IRAs (Individual Retirement Accounts) or 401(k)s can also be transferred to a living trust, but this process must be handled with caution. Special care is needed to avoid potential tax implications or penalties associated with such transfers. 5. Life insurance policy transfer: Although life insurance policies cannot be transferred directly to a living trust, the trust can be named as the beneficiary. Upon the individual's death, the insurance proceeds will be distributed according to the trust's provisions, providing added flexibility and control over those assets. Assistance from a qualified estate planning attorney is crucial to navigate the complexities of the North Charleston South Carolina Financial Account Transfer to Living Trust process. They can provide personalized guidance, prepare the necessary legal documents, and ensure compliance with state laws and regulations. Overall, the North Charleston South Carolina Financial Account Transfer to Living Trust empowers individuals to protect their financial assets, avoid probate, and efficiently pass on their wealth to their chosen beneficiaries. It offers a comprehensive estate planning solution that can provide peace of mind and safeguard their financial legacy.

North Charleston South Carolina Financial Account Transfer to Living Trust

Description

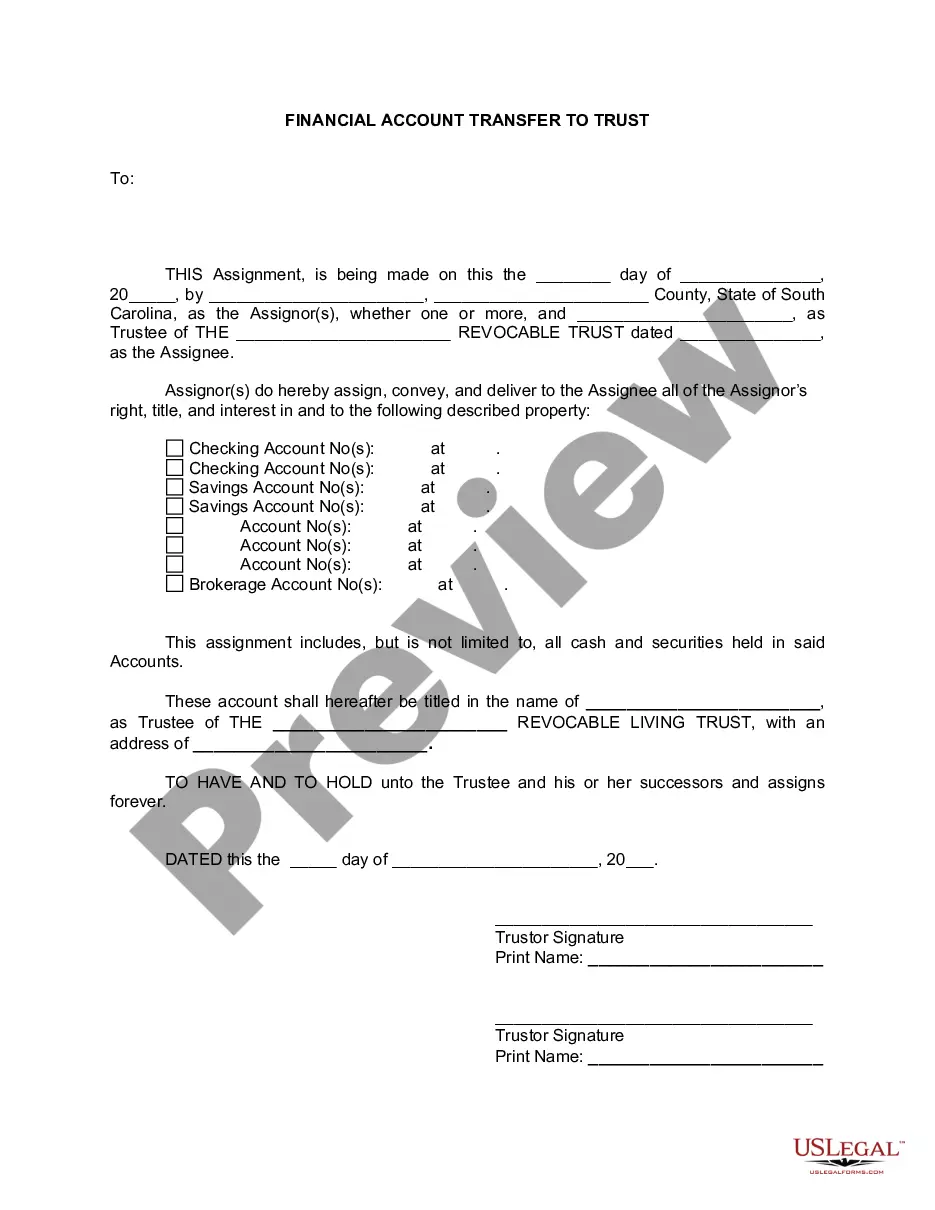

How to fill out North Charleston South Carolina Financial Account Transfer To Living Trust?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the North Charleston South Carolina Financial Account Transfer to Living Trust becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the North Charleston South Carolina Financial Account Transfer to Living Trust takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the North Charleston South Carolina Financial Account Transfer to Living Trust. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!