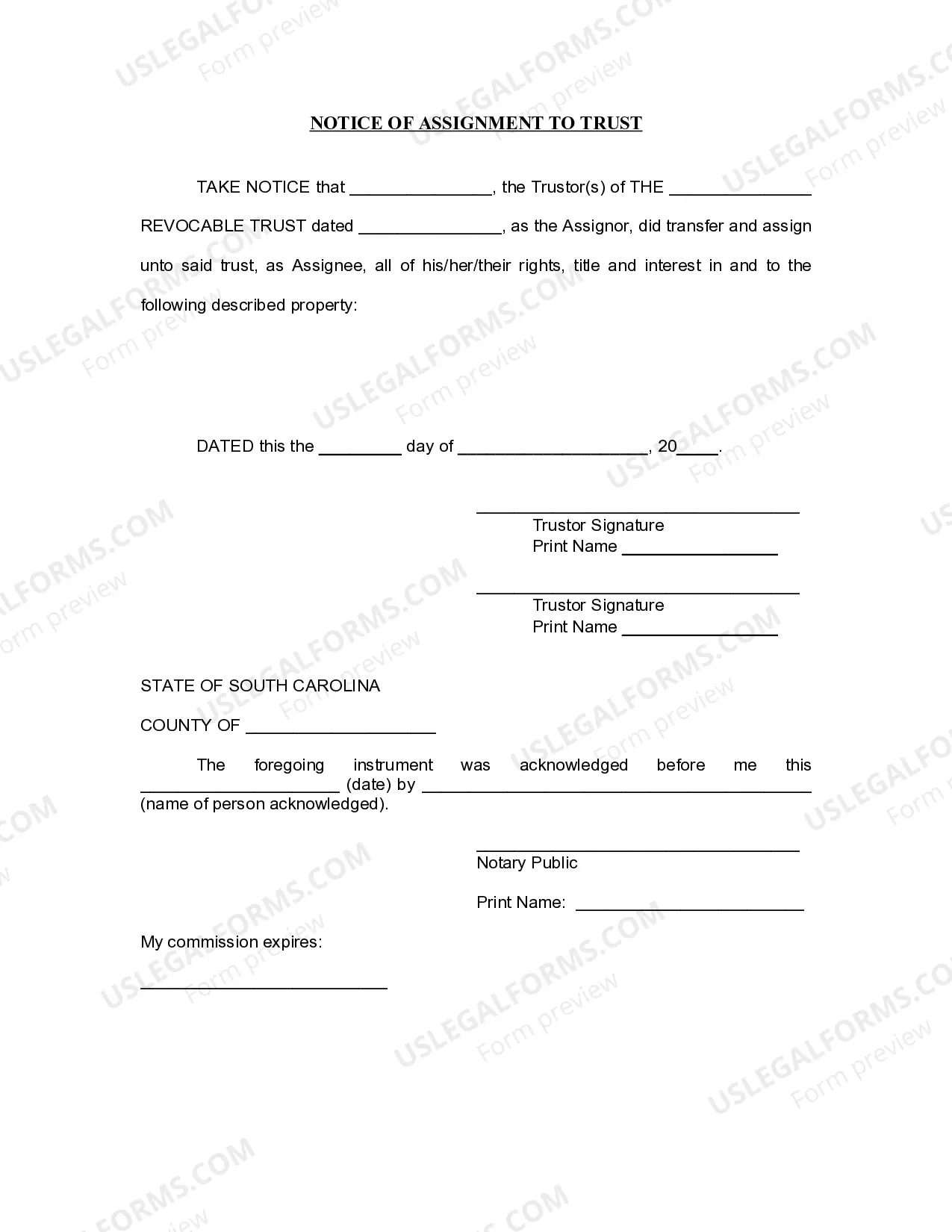

The North Charleston South Carolina Notice of Assignment to Living Trust is a legal document that outlines the transfer of ownership and control of assets to a living trust in the city of North Charleston, South Carolina. This document is crucial for individuals who wish to establish a living trust and ensure a smooth transition of their assets to their chosen beneficiaries. A living trust is a popular estate planning tool used to manage and distribute one's assets during their lifetime and after their death. By creating a living trust, individuals can avoid the probate process, maintain privacy, and have more control over their assets. The North Charleston South Carolina Notice of Assignment to Living Trust serves as a formal notification to relevant parties that the creator of the trust, known as the granter, has transferred specific assets to their living trust. These assets may include real estate properties, bank accounts, investments, and personal belongings. By drafting and filing this notice, the granter effectively changes the ownership of the assigned assets from their individual name to the name of the trust. This legal transfer ensures that the assets are managed and distributed according to the granter's wishes as specified in the trust document. Different types of North Charleston South Carolina Notice of Assignment to Living Trust may include: 1. Real Estate Notice of Assignment: This type of notice specifically deals with the transfer of real estate properties from the granter to the living trust. 2. Financial Assets Notice of Assignment: This notice focuses on the transfer of financial assets such as bank accounts, stocks, bonds, and other investment accounts to the living trust. 3. Personal Property Notice of Assignment: This type of notice pertains to the transfer of personal belongings such as vehicles, jewelry, artwork, furniture, and other valuable items to the living trust. By utilizing the North Charleston South Carolina Notice of Assignment to Living Trust, individuals can ensure that their assets are protected, managed, and distributed in accordance with their desires. It is important to consult with an experienced estate planning attorney to properly draft and execute this notice to ensure its validity and effectiveness.

North Charleston South Carolina Notice of Assignment to Living Trust

Description

How to fill out North Charleston South Carolina Notice Of Assignment To Living Trust?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for legal solutions that, as a rule, are very expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the North Charleston South Carolina Notice of Assignment to Living Trust or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the North Charleston South Carolina Notice of Assignment to Living Trust adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the North Charleston South Carolina Notice of Assignment to Living Trust is suitable for your case, you can select the subscription plan and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!