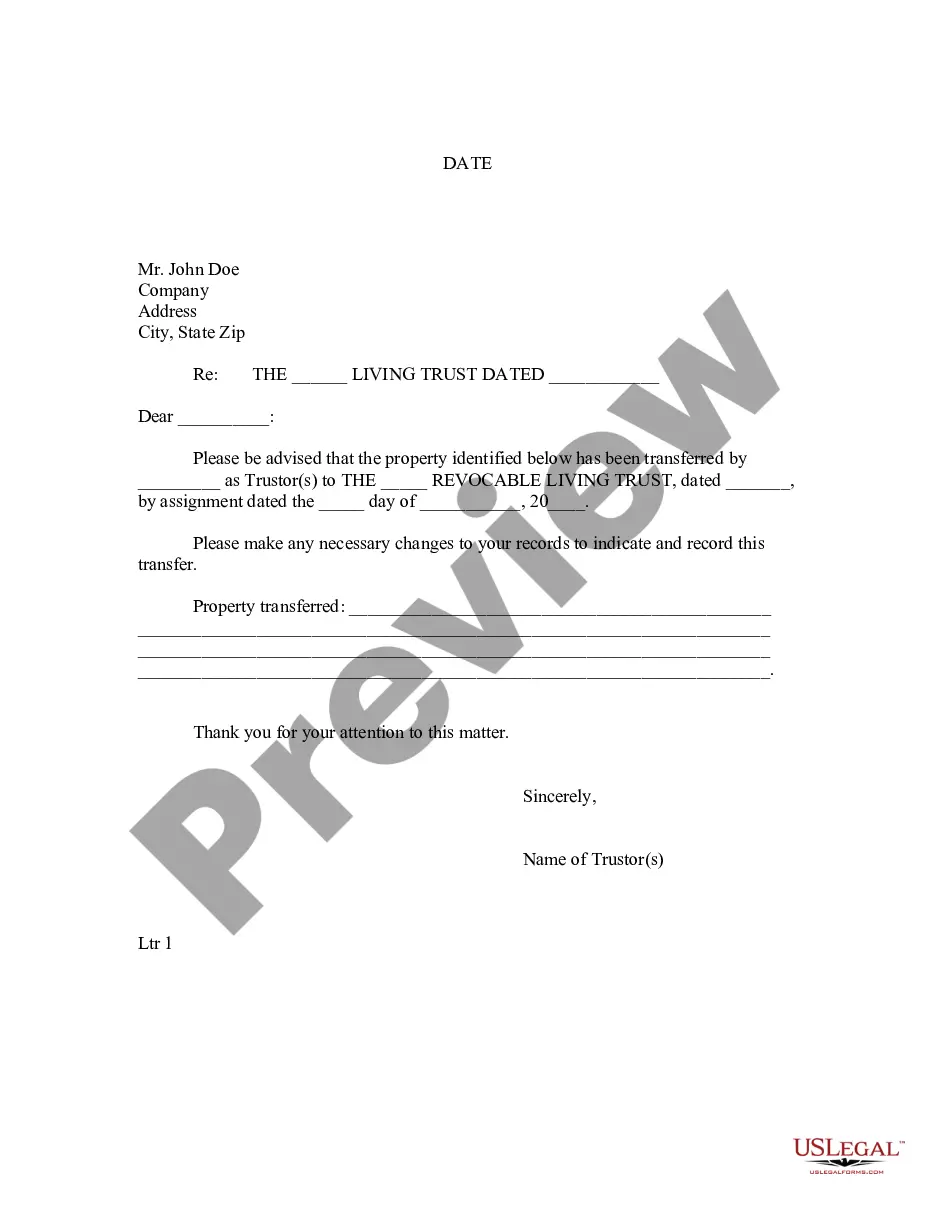

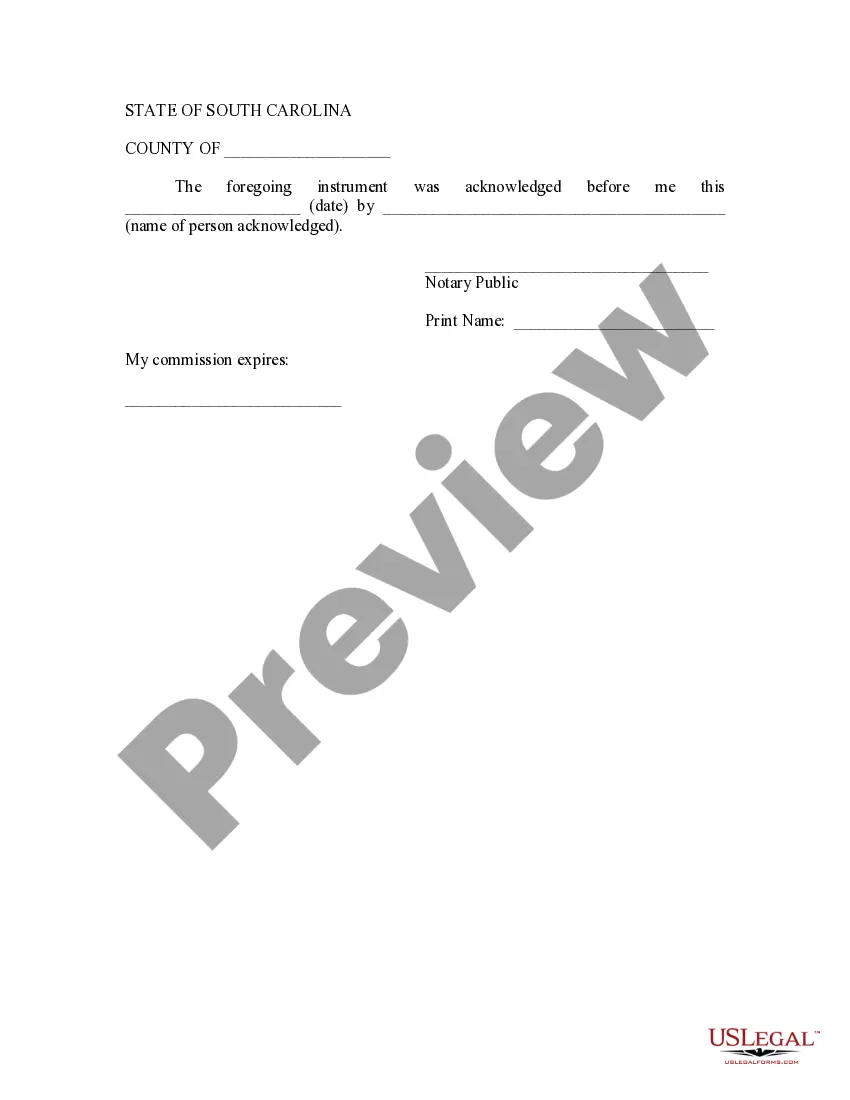

Title: North Charleston, South Carolina Letter to Lien holder to Notify of Trust: A Comprehensive Guide Introduction: If you are a resident of North Charleston, South Carolina, and have recently established a trust, it is vital to inform your lien holder about the change in ownership status. This article serves as a detailed description of the North Charleston South Carolina Letter to Lien holder to Notify of Trust, providing you with relevant information and keywords to help you draft the letter appropriately. Additionally, we will highlight different types of letters that may be required based on specific situations. 1. Understanding the Purpose and Importance: When an individual creates a trust, they transfer the ownership of certain assets from themselves to a trustee, who is responsible for managing those assets for the benefit of the trust's beneficiaries. In North Charleston, contacting your lien holder to notify them of this change is crucial to ensuring a smooth transfer of ownership and maintaining transparency. 2. General Structure and Content of the Letter: To create an effective North Charleston South Carolina Letter to Lien holder to Notify of Trust, consider including the following sections: a. Your Contact Information: Begin the letter by providing your full name, address, telephone number, and email address to facilitate easy communication. b. Lien holder's Information: Include the lien holder's name, address, telephone number, and any other details necessary to identify them accurately. c. Formal Greeting: Address the lien holder with a formal salutation, such as "Dear [Lien holder's Name]". d. Subject Line: Clearly state the intention of the letter in the subject line, such as "Notice of Trust: Change in Ownership". e. Opening Paragraph: Begin with a concise introduction, explaining your intention to inform the lien holder about the establishment of a trust and the subsequent change in the ownership status of the assets. f. Trust Information: Provide a detailed description of the trust, including its formal name, date of creation, and the names of the trustee(s) and beneficiaries involved. If multiple trustees are involved, ensure to mention each of their identities. g. Affected Assets: Clearly outline the assets impacted by the trust, such as real estate properties, vehicles, or other valuable possessions, as well as their corresponding identification details (e.g., VIN numbers, property addresses, etc.). h. Legal Documentation: Mention any legal documents supporting the establishment of the trust, such as the trust agreement or certificate. If required, provide copies or references to these documents. i. Requested Actions: Specify any actions you expect the lien holder to take regarding the change in ownership, such as updating their records, reissuing titles or documents, or modifying contact information. j. Contact Information: Reiterate your contact details and invite the lien holder to reach out if they have any questions or require additional information. k. Closing Statement: Thank the lien holder for their cooperation and express your intention to work together to facilitate a smooth transition. l. Closing Salutation and Signature: End the letter with a professional closing, such as "Sincerely", followed by your full name and signature. 3. Variations of North Charleston South Carolina Letter to Lien holder to Notify of Trust: Depending on the specific circumstances of your trust, different types of letters may be needed. Here are a few variations: a. Real Estate Lien holder: If the assets transferred to the trust include real estate properties, a specific letter addressing the mortgage or lien holder would be necessary. b. Vehicle Lien holder: For vehicles held by a lien holder, a separate letter notifying the lien holder of the trust's establishment and change in ownership would be required. Conclusion: With the information and keywords provided in this guide, you can create a well-crafted North Charleston South Carolina Letter to Lien holder to Notify of Trust. Remember to tailor the letter according to your specific situation and provide all relevant details to assist the lien holder in processing the necessary changes. By ensuring transparent communication, you can effectively navigate the process of notifying lien holders about the establishment of your trust in North Charleston, South Carolina.

North Charleston South Carolina Letter to Lienholder to Notify of Trust

Description

How to fill out North Charleston South Carolina Letter To Lienholder To Notify Of Trust?

If you are looking for a valid form, it’s impossible to find a better place than the US Legal Forms website – one of the most extensive online libraries. With this library, you can find a large number of form samples for company and personal purposes by types and regions, or key phrases. With the advanced search feature, getting the latest North Charleston South Carolina Letter to Lienholder to Notify of Trust is as elementary as 1-2-3. In addition, the relevance of every file is confirmed by a team of expert attorneys that on a regular basis check the templates on our website and update them based on the latest state and county requirements.

If you already know about our system and have a registered account, all you need to get the North Charleston South Carolina Letter to Lienholder to Notify of Trust is to log in to your profile and click the Download button.

If you use US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have discovered the sample you require. Read its explanation and utilize the Preview option (if available) to explore its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to get the needed document.

- Confirm your selection. Choose the Buy now button. After that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Choose the format and download it to your system.

- Make modifications. Fill out, revise, print, and sign the acquired North Charleston South Carolina Letter to Lienholder to Notify of Trust.

Each and every template you save in your profile has no expiry date and is yours permanently. You can easily access them using the My Forms menu, so if you want to get an extra copy for modifying or creating a hard copy, you can return and export it once more at any moment.

Take advantage of the US Legal Forms extensive collection to get access to the North Charleston South Carolina Letter to Lienholder to Notify of Trust you were looking for and a large number of other professional and state-specific templates on a single website!