North Charleston South Carolina Loan Modification Agreement is a legally binding contract that allows homeowners in North Charleston, South Carolina to modify the terms of their existing mortgage loan. This agreement is typically pursued by borrowers who are facing financial hardship and struggling to make their mortgage payments. A loan modification agreement can provide several potential benefits to homeowners, such as reducing the interest rate, extending the loan term, or lowering the monthly payments, making it more affordable and manageable for the borrower. The ultimate goal of this agreement is to prevent foreclosure and help homeowners keep their homes. There are several types of loan modification agreements available in North Charleston, South Carolina, depending on the specific needs and circumstances of the borrower. These may include: 1. Rate Modification Agreement: This type of agreement involves reducing the interest rate charged on the mortgage loan, resulting in decreased monthly payments for the borrower. 2. Term Extension Agreement: In this agreement, the loan term is extended, allowing the borrower to repay the loan over a longer period of time. This can help reduce the monthly payments and make them more affordable. 3. Principal Forbearance Agreement: This agreement involves temporarily reducing or suspending a portion of the principal balance owed on the loan. The suspended amount is often added back to the loan balance or paid back in installments after a specific period. 4. Partial Claim Agreement: Homeowners who have fallen behind on their mortgage payments may be eligible for this agreement. It allows them to receive a one-time payment from a secondary source, such as a government agency, to bring the loan current. 5. Deferral Agreement: Under this agreement, the lender may allow the borrower to defer a portion of the mortgage payment for a specified period. The deferred amount is usually added to the end of the loan term or paid back in installments. 6. Combination Modification Agreement: In some cases, multiple modifications may be combined to provide the most effective solution for the borrower. For example, a combination of interest rate reduction and term extension may be used to reduce the monthly payments significantly. It is important to note that the availability of these types of loan modification agreements may vary depending on the lender, the specific loan program, and the borrower's financial situation. Homeowners considering a loan modification should consult with their mortgage service or a qualified housing counselor to understand their options and eligibility criteria.

North Charleston South Carolina Loan Modification Agreement

State:

South Carolina

City:

North Charleston

Control #:

SC-LR006

Format:

Word;

Rich Text

Instant download

Description

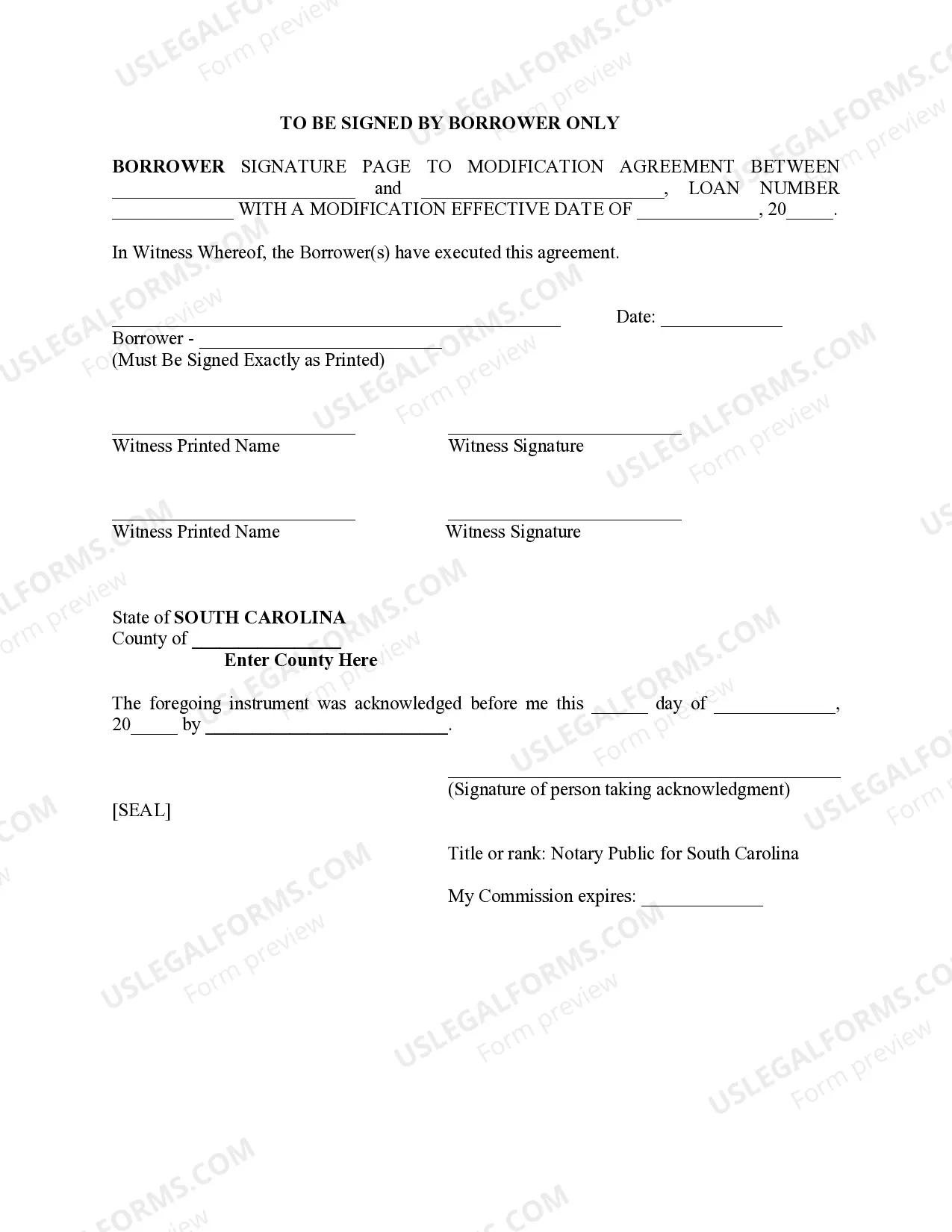

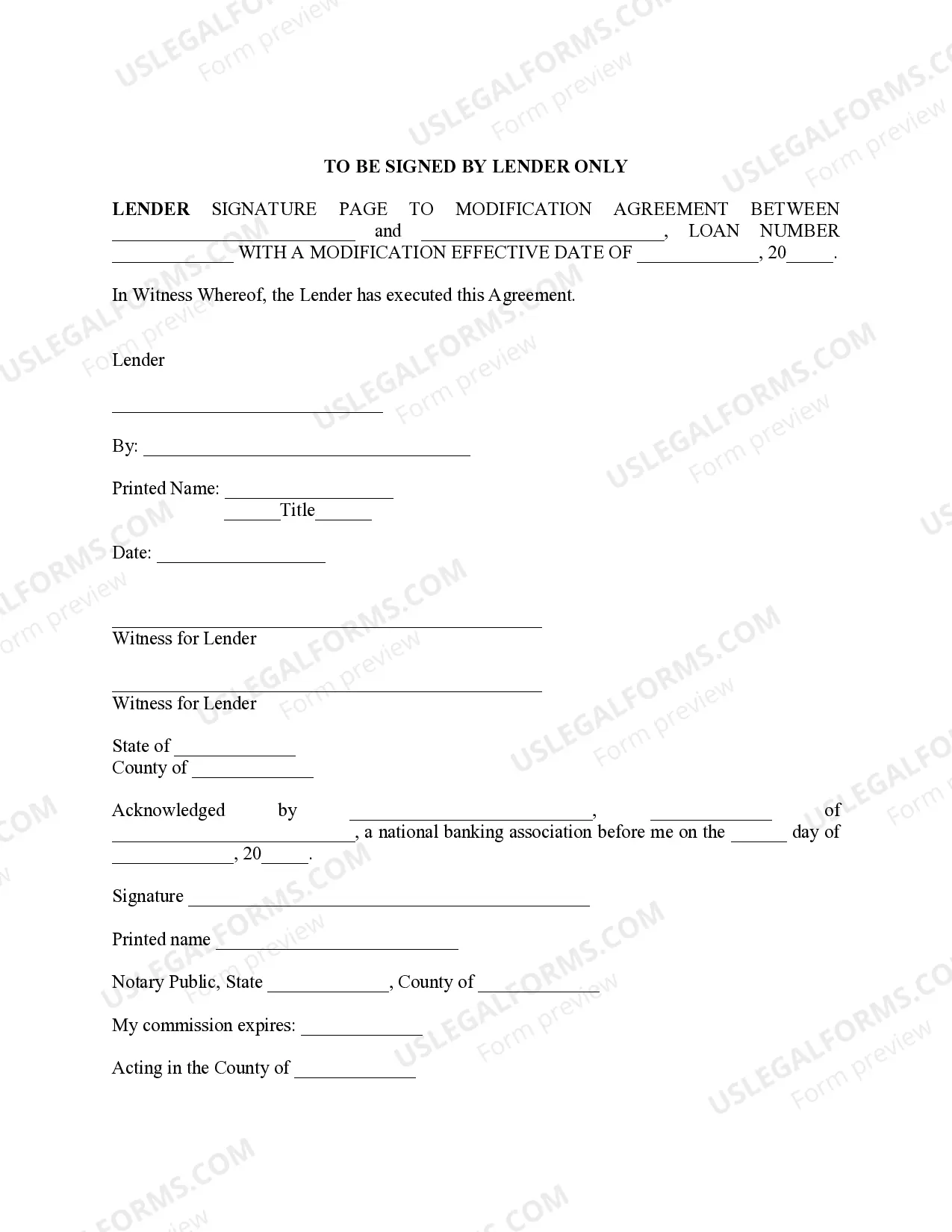

This form is an agreement between you and your mortgage company to change the original terms of your mortgage-such as payment amount, length of loan, interest rate, etc. In most cases, when your mortgage is modified, you can reduce your monthly payment to a more affordable amount.

North Charleston South Carolina Loan Modification Agreement is a legally binding contract that allows homeowners in North Charleston, South Carolina to modify the terms of their existing mortgage loan. This agreement is typically pursued by borrowers who are facing financial hardship and struggling to make their mortgage payments. A loan modification agreement can provide several potential benefits to homeowners, such as reducing the interest rate, extending the loan term, or lowering the monthly payments, making it more affordable and manageable for the borrower. The ultimate goal of this agreement is to prevent foreclosure and help homeowners keep their homes. There are several types of loan modification agreements available in North Charleston, South Carolina, depending on the specific needs and circumstances of the borrower. These may include: 1. Rate Modification Agreement: This type of agreement involves reducing the interest rate charged on the mortgage loan, resulting in decreased monthly payments for the borrower. 2. Term Extension Agreement: In this agreement, the loan term is extended, allowing the borrower to repay the loan over a longer period of time. This can help reduce the monthly payments and make them more affordable. 3. Principal Forbearance Agreement: This agreement involves temporarily reducing or suspending a portion of the principal balance owed on the loan. The suspended amount is often added back to the loan balance or paid back in installments after a specific period. 4. Partial Claim Agreement: Homeowners who have fallen behind on their mortgage payments may be eligible for this agreement. It allows them to receive a one-time payment from a secondary source, such as a government agency, to bring the loan current. 5. Deferral Agreement: Under this agreement, the lender may allow the borrower to defer a portion of the mortgage payment for a specified period. The deferred amount is usually added to the end of the loan term or paid back in installments. 6. Combination Modification Agreement: In some cases, multiple modifications may be combined to provide the most effective solution for the borrower. For example, a combination of interest rate reduction and term extension may be used to reduce the monthly payments significantly. It is important to note that the availability of these types of loan modification agreements may vary depending on the lender, the specific loan program, and the borrower's financial situation. Homeowners considering a loan modification should consult with their mortgage service or a qualified housing counselor to understand their options and eligibility criteria.

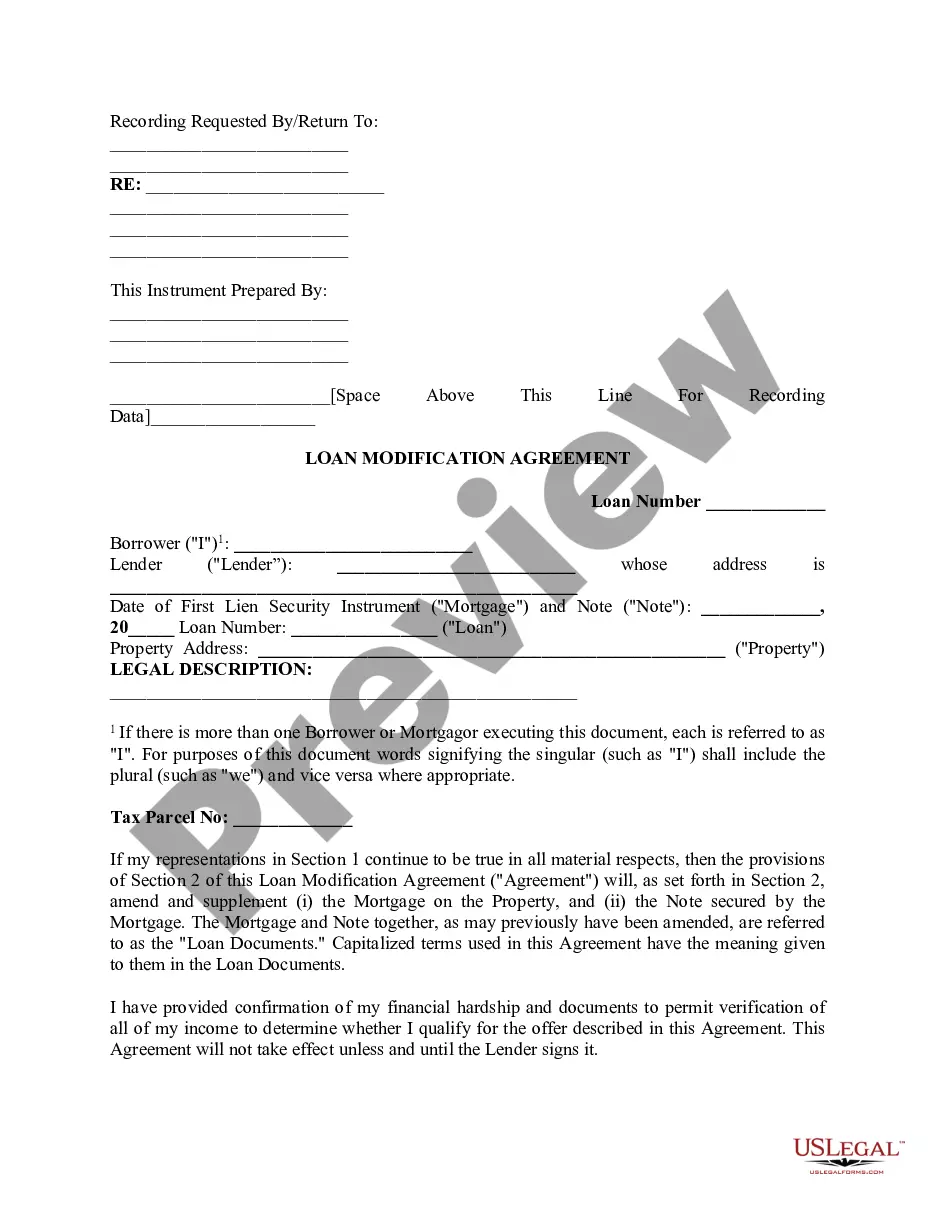

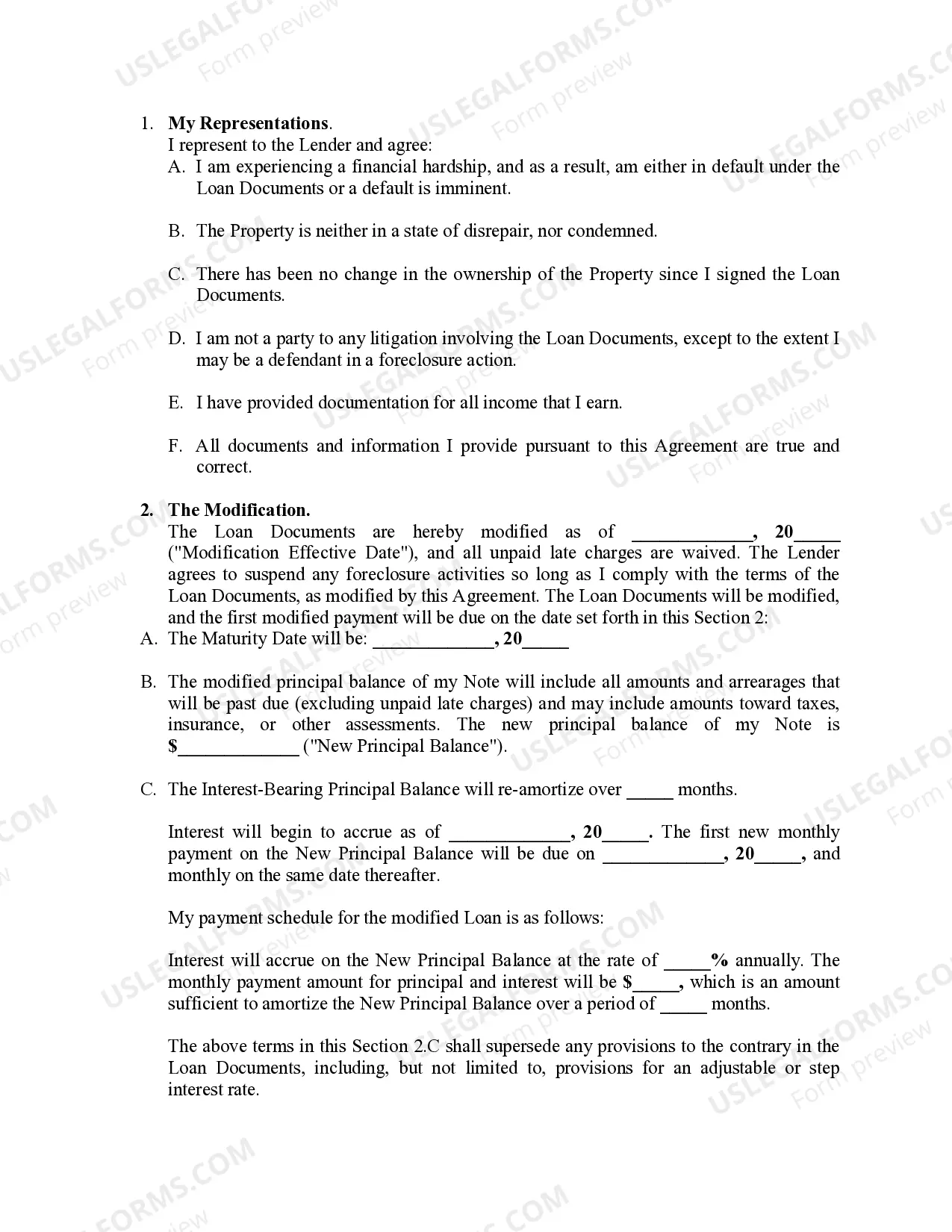

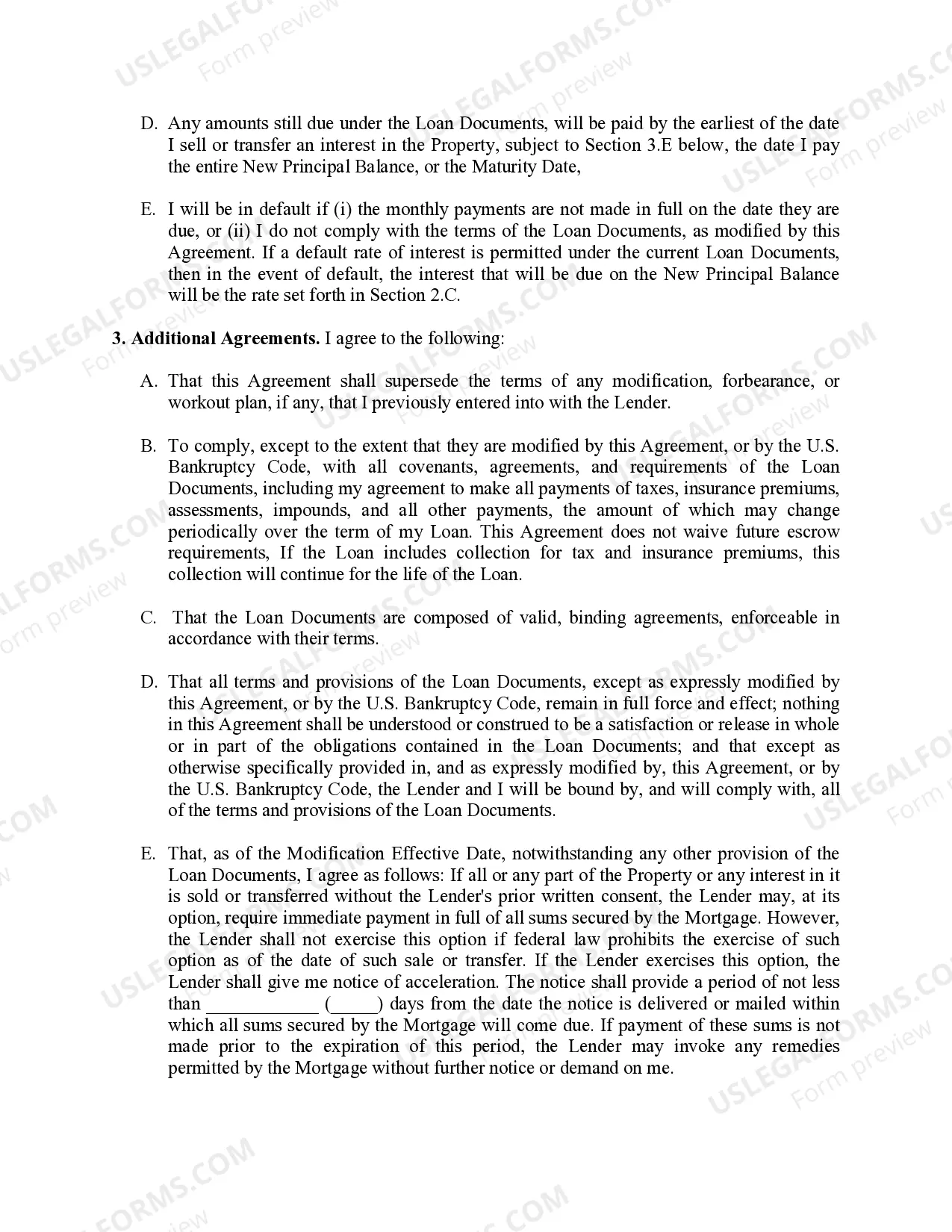

Free preview

How to fill out North Charleston South Carolina Loan Modification Agreement?

If you’ve already used our service before, log in to your account and save the North Charleston South Carolina Loan Modification Agreement on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your North Charleston South Carolina Loan Modification Agreement. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!