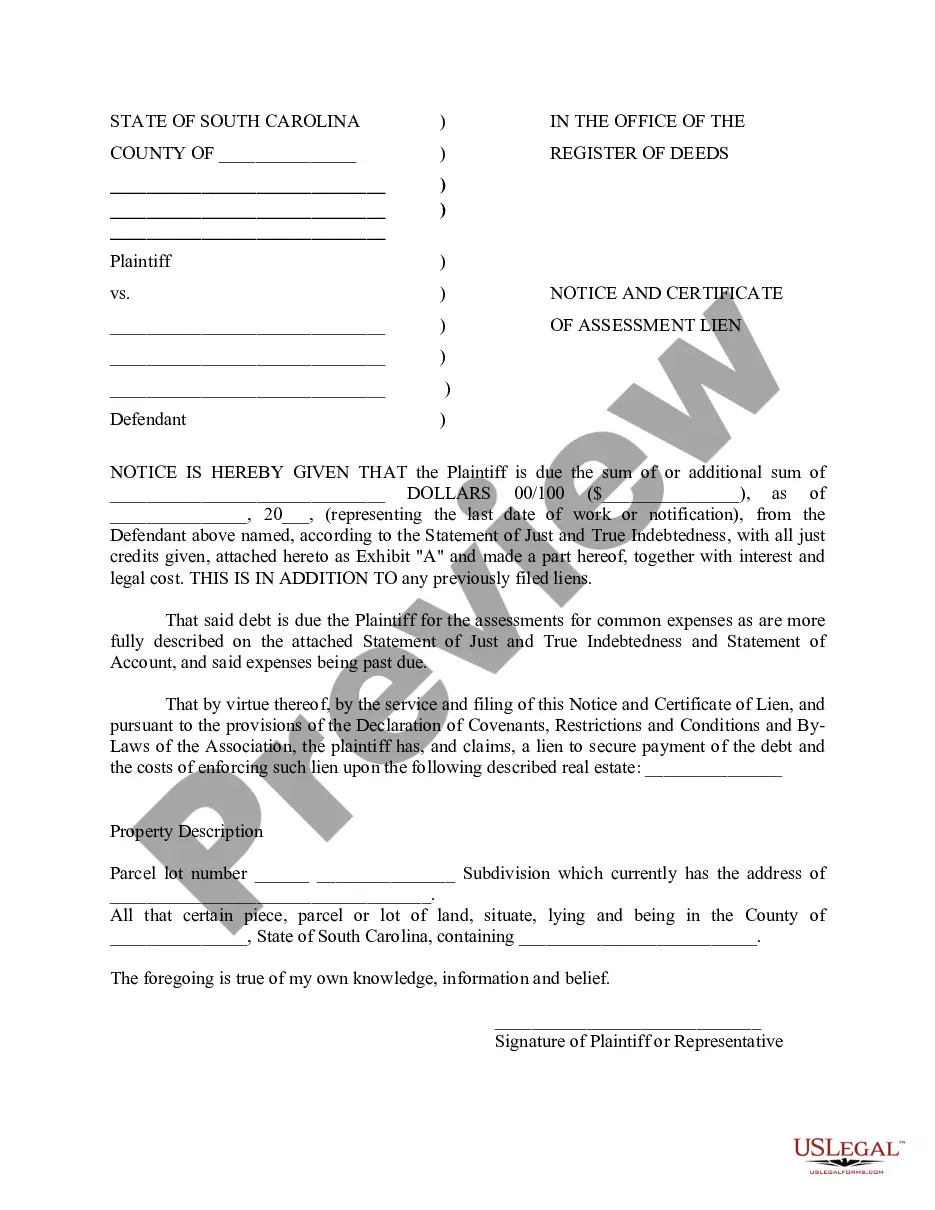

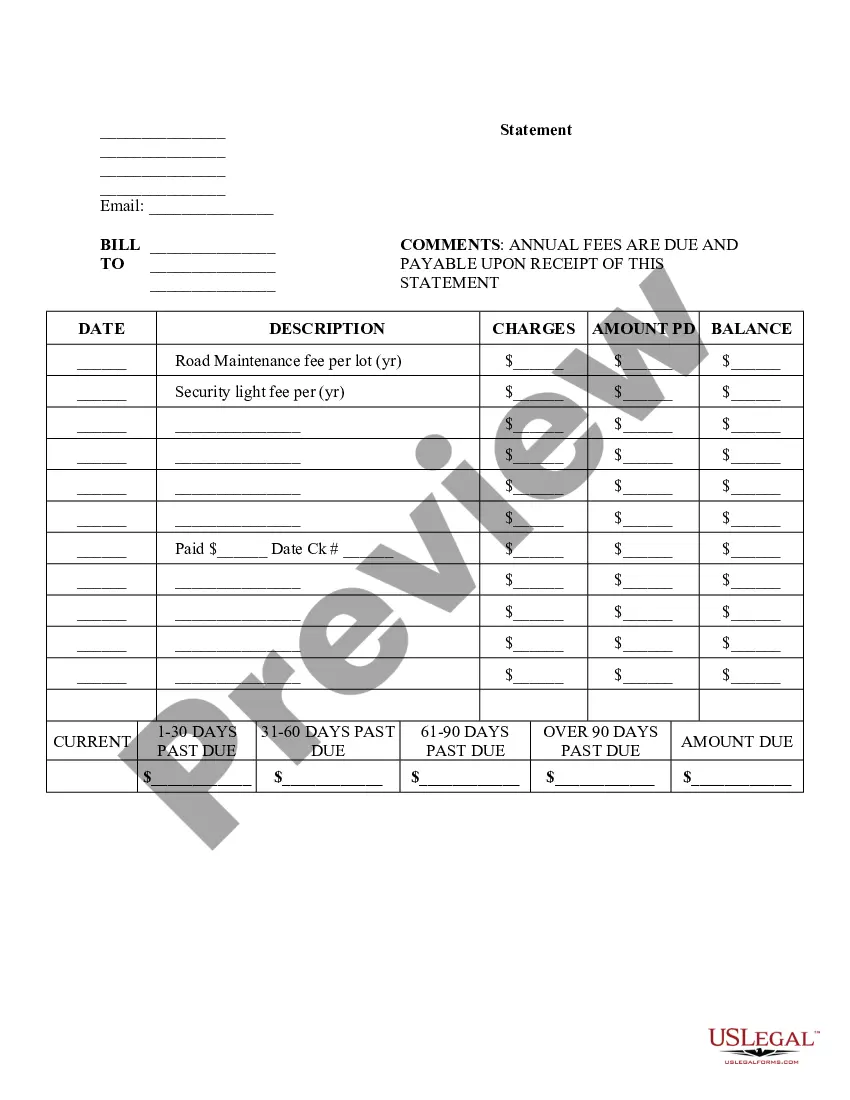

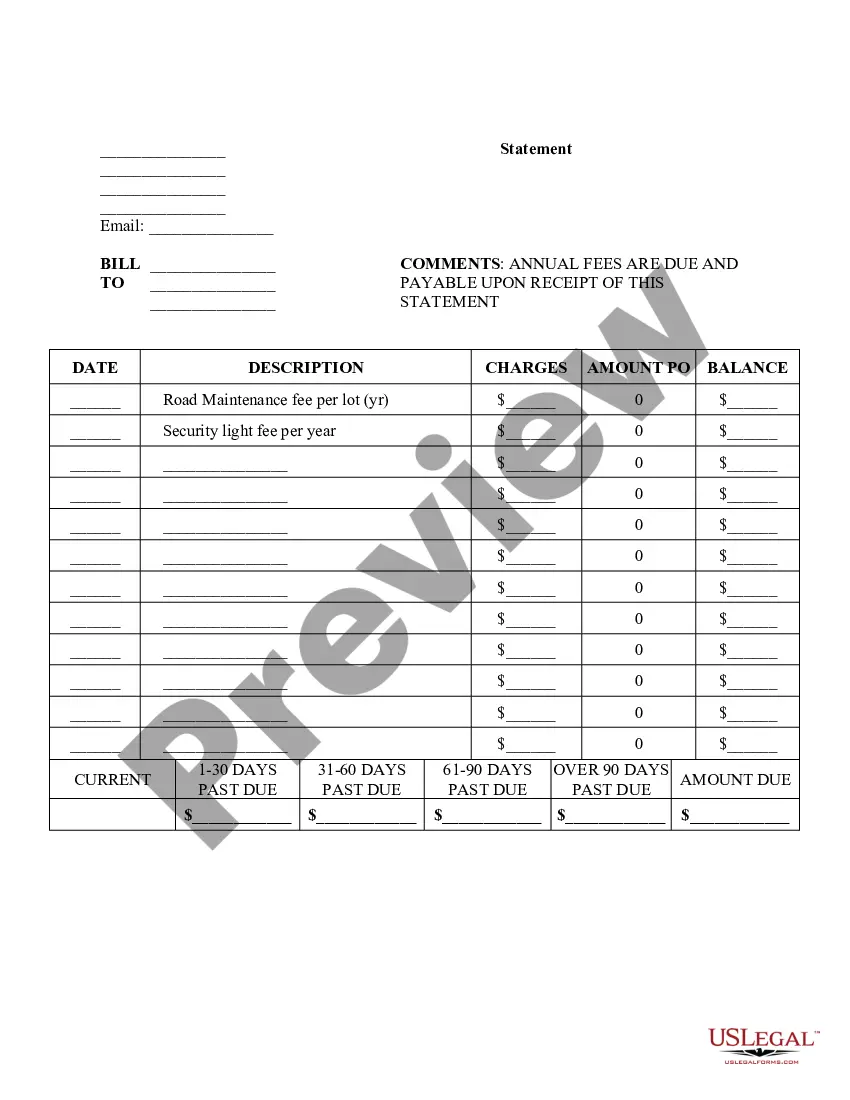

North Charleston South Carolina Notice and Certificate of Assessment Lien is a legal document that serves as a public notice of an outstanding debt owed to the local government related to property taxes or assessments. This document is commonly used to notify the property owner about the existence of a lien placed on their property. The North Charleston South Carolina government may issue different types of Notice and Certificate of Assessment Lien, each serving a specific purpose. Some variations could include: 1. Property Tax Lien Notice: This type of lien arises when the property owner fails to pay their property taxes promptly. The local government files a Notice and Certificate of Assessment Lien to assert their claim on the property to secure the unpaid tax amount. 2. Assessment Lien Notice: In cases where the property owner fails to pay special assessment charges, such as those for public infrastructure improvements like sidewalks or sewer systems, the local government may file a Notice and Certificate of Assessment Lien against the property. 3. Municipal Lien Notice: This category of lien occurs when the property owner fails to pay various charges owed to the municipality, including but not limited to water bills, sewer fees, fines, or other municipal services. The local government can file a Notice and Certificate of Assessment Lien to recover the outstanding amount. The Notice and Certificate of Assessment Lien typically includes essential details such as the property owner's name, property address or parcel identification number, the amount owed, the date of assessment, and the period of delinquency. It also contains a legal description of the property and the official seal of the local government entity responsible for issuing the lien. Once filed, the North Charleston South Carolina Notice and Certificate of Assessment Lien creates a legal claim against the property, ensuring that the underlying debt is satisfied before any subsequent sale or transfer of the property. This lien can impact the property's marketability and may result in foreclosure proceedings if the debt remains unpaid over an extended period. It is crucial for property owners in North Charleston South Carolina to address any Notice and Certificate of Assessment Lien promptly to avoid further complications or legal actions. Seeking professional advice, such as consulting with an attorney, is highly recommended for understanding rights and options available in resolving the lien effectively.

North Charleston South Carolina Notice and Certificate of Assessment Lien

Description

How to fill out North Charleston South Carolina Notice And Certificate Of Assessment Lien?

If you’ve already utilized our service before, log in to your account and save the North Charleston South Carolina Notice and Certificate of Assessment Lien on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your North Charleston South Carolina Notice and Certificate of Assessment Lien. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!

Form popularity

FAQ

Filing a lien on property in South Carolina involves submitting the required forms, generally a Notice and Certificate of Assessment Lien, to your county's register of deeds. It's crucial to provide accurate information and supporting documentation to avoid potential disputes later. USLegalForms offers step-by-step guidance to ensure that you file correctly, streamlining the process for you.

To put a lien on someone's property in South Carolina, you typically need to file a formal Notice and Certificate of Assessment Lien with the appropriate county office. This requires documentation that proves the debt owed to you. Using platforms like USLegalForms can simplify the process, ensuring that you fill out the necessary forms correctly and follow local legal protocols.

An estimated assessment notice in South Carolina informs property owners about the estimated value of their property for tax purposes. This notice enables homeowners to understand their potential tax liabilities and respond if they believe the assessed value is incorrect. For detailed guidance on how this notice affects your property and tax situation, consider resources from USLegalForms to help you navigate these assessments.

To find out if there is a lien on a vehicle in South Carolina, you can request a title search through the South Carolina Department of Motor Vehicles. This search will show any liens attached to the vehicle title. It’s essential to be aware of any North Charleston South Carolina Notice and Certificate of Assessment Lien that may apply, particularly if you are considering purchasing a used vehicle. Utilizing resources from US Legal Forms can simplify this process by providing necessary forms and guidance.

Yes, property records in South Carolina are public, allowing individuals to access ownership and lien information. This transparency helps residents stay informed about the North Charleston South Carolina Notice and Certificate of Assessment Lien related to properties they are interested in. You can typically find these records through the county's assessor's office or online databases. The US Legal Forms platform also offers tools to help you locate and interpret these records.

The lien law in South Carolina outlines how liens, including tax liens, are created, maintained, and enforced. Under this law, a lien may be placed on property due to unpaid taxes or other financial obligations. Understanding these laws is crucial for anyone interested in the North Charleston South Carolina Notice and Certificate of Assessment Lien. For complete clarity and compliance, you can refer to resources available on the US Legal Forms site.

To buy tax lien certificates in South Carolina, start by checking the local county auction schedule. You can participate in these auctions, either in person or online, where properties with unpaid taxes are sold. Remember that each county may have different procedures, so make sure to familiarize yourself with the North Charleston South Carolina Notice and Certificate of Assessment Lien process. For further assistance, consider using the US Legal Forms platform, which can help streamline your documentation and understanding.

To look up liens in South Carolina, you can visit the South Carolina Department of Revenue's website, where they provide access to lien records. You may also consult local county offices for specific information related to your property. Using tools like uslegalforms can assist you in navigating a North Charleston South Carolina Notice and Certificate of Assessment Lien efficiently.

In South Carolina, a lien typically remains on your property for ten years if unpaid, after which it may be renewed. However, resolving the lien before this period is crucial, as it can severely impact your ability to manage your property and finances. Staying informed about your North Charleston South Carolina Notice and Certificate of Assessment Lien can help you take timely action.

A tax lien is very serious as it indicates that the government has a legal claim against your property due to unpaid taxes. This legal claim can hinder your financial options, making it difficult to sell or refinance your property. Addressing a North Charleston South Carolina Notice and Certificate of Assessment Lien promptly can help mitigate these risks.