A Special Durable Power of Attorney for Bank Account Matters in North Charleston, South Carolina is a legal document that grants specific authority to an appointed individual, known as the agent or attorney-in-fact, to handle bank account-related matters on behalf of the principal. This type of power of attorney is specifically tailored to allow the agent to exclusively manage tasks associated with the principal's financial accounts. Keywords: North Charleston, South Carolina, Special Durable Power of Attorney, Bank Account Matters, agent, attorney-in-fact, financial accounts. There are various types of North Charleston, South Carolina Special Durable Power of Attorney for Bank Account Matters, each catering to different needs and situations: 1. General Bank Account Power of Attorney: This type grants the agent broad powers to manage all financial transactions related to the principal's bank accounts. It includes tasks such as depositing and withdrawing funds, writing checks, transferring money between accounts, and managing investments. 2. Limited Bank Account Power of Attorney: A limited power of attorney focuses on specific bank account-related matters, allowing the agent to handle a limited range of financial transactions on the principal's behalf. For example, it may only grant authority to pay bills, manage online banking, or make withdrawals up to a certain limit. 3. Joint Bank Account Power of Attorney: In cases where the principal shares a joint bank account with another individual (such as a spouse or business partner), a joint power of attorney may be established. This allows either party to act independently on behalf of the other, giving the agent the ability to manage the joint bank account without requiring the other party's consent. 4. Springing Bank Account Power of Attorney: A springing power of attorney for bank account matters becomes effective only when a triggering event occurs. This could be a specific date or the mental or physical incapacity of the principal, as determined by a healthcare professional. Once the triggering event occurs, the agent's authority is activated, enabling them to manage the principal's bank accounts. 5. Specific Task Bank Account Power of Attorney: Sometimes, a principal may want to designate an agent for specific tasks related to their bank accounts, rather than granting broad authority. This type of power of attorney enables the agent to carry out only the assigned tasks, such as depositing checks, making online transfers, or handling tax-related matters. In North Charleston, South Carolina, it is essential to consult a lawyer experienced in estate planning and powers of attorney to ensure that the Special Durable Power of Attorney for Bank Account Matters accurately reflects the principal's intentions and aligns with relevant state laws.

North Charleston South Carolina Special Durable Power of Attorney for Bank Account Matters

State:

South Carolina

City:

North Charleston

Control #:

SC-P099H

Format:

Word;

Rich Text

Instant download

Description

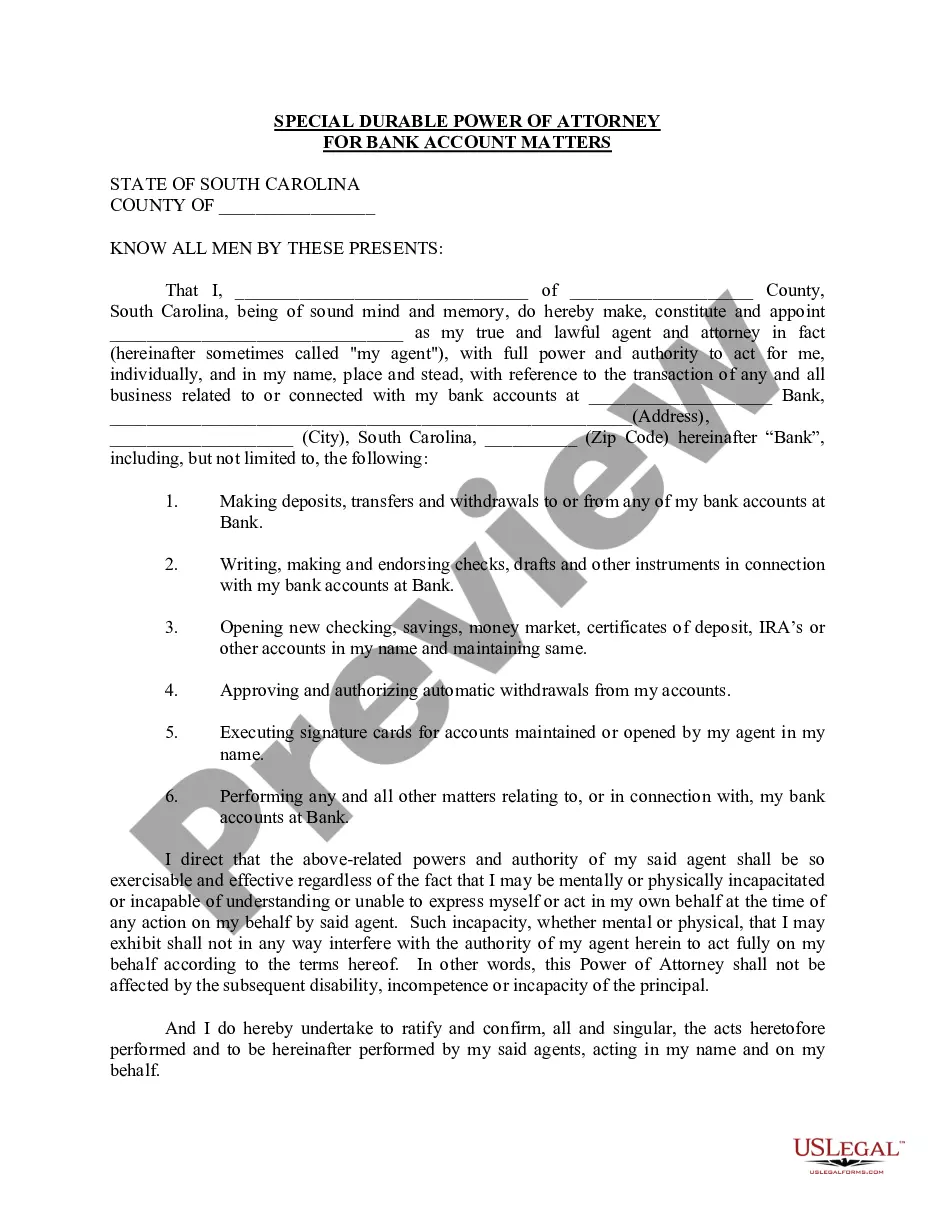

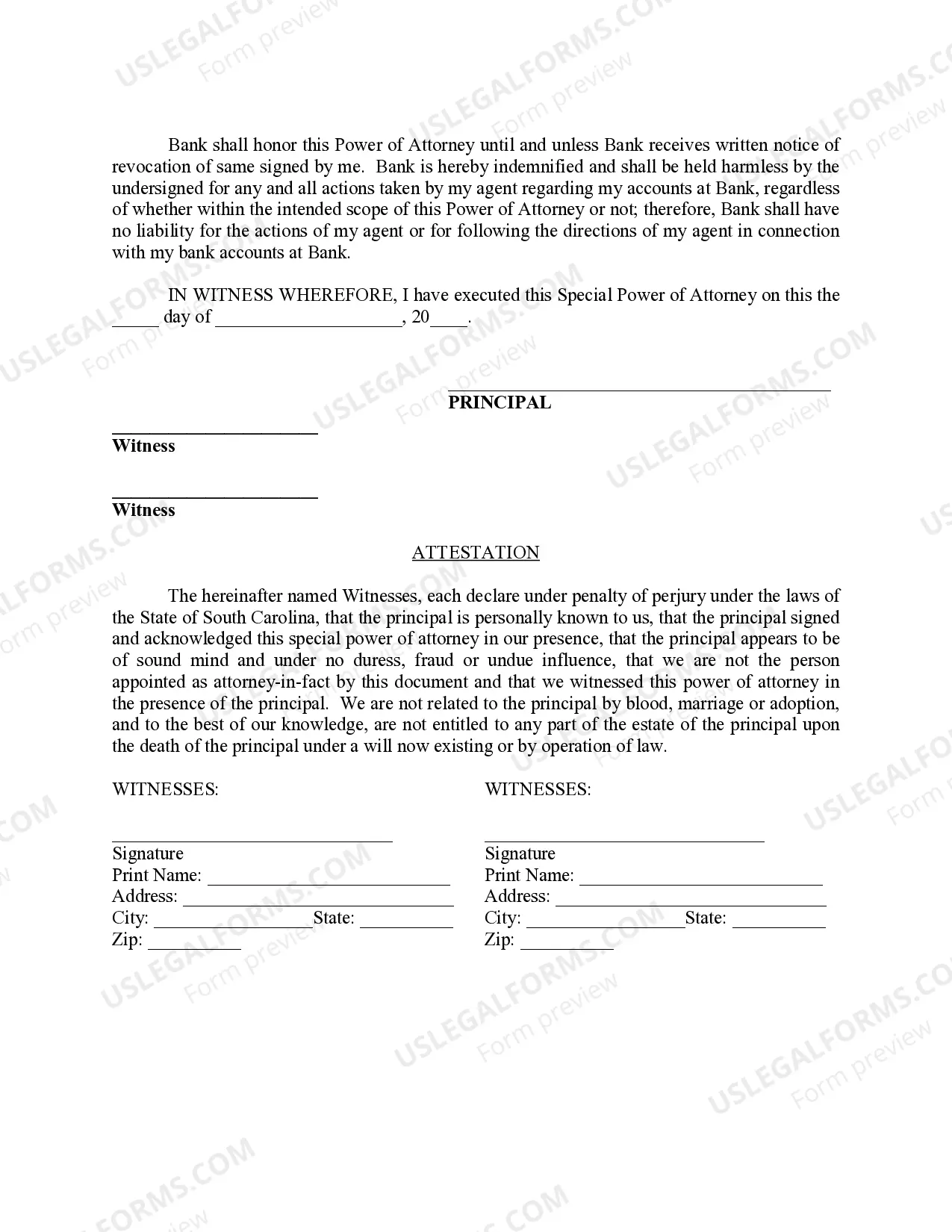

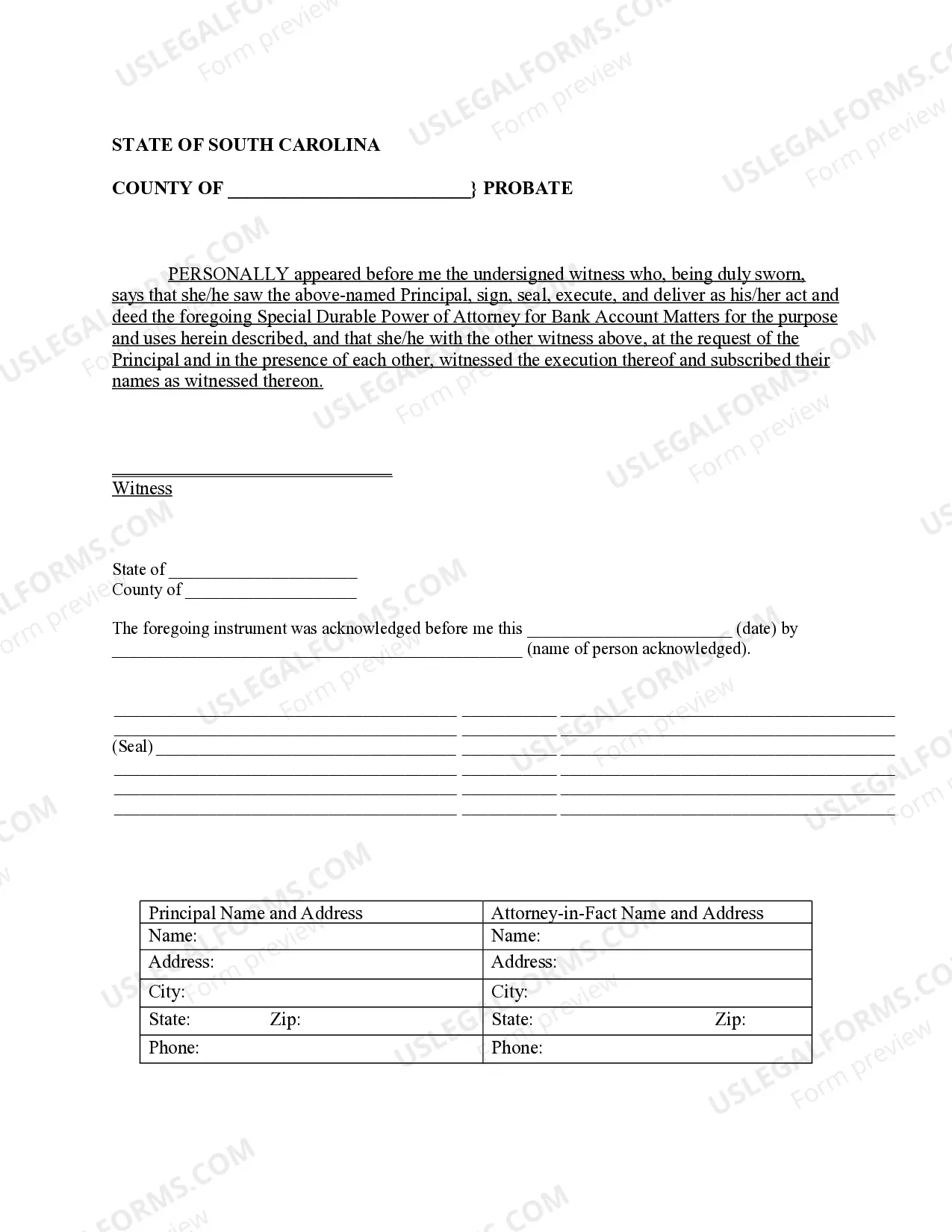

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

A Special Durable Power of Attorney for Bank Account Matters in North Charleston, South Carolina is a legal document that grants specific authority to an appointed individual, known as the agent or attorney-in-fact, to handle bank account-related matters on behalf of the principal. This type of power of attorney is specifically tailored to allow the agent to exclusively manage tasks associated with the principal's financial accounts. Keywords: North Charleston, South Carolina, Special Durable Power of Attorney, Bank Account Matters, agent, attorney-in-fact, financial accounts. There are various types of North Charleston, South Carolina Special Durable Power of Attorney for Bank Account Matters, each catering to different needs and situations: 1. General Bank Account Power of Attorney: This type grants the agent broad powers to manage all financial transactions related to the principal's bank accounts. It includes tasks such as depositing and withdrawing funds, writing checks, transferring money between accounts, and managing investments. 2. Limited Bank Account Power of Attorney: A limited power of attorney focuses on specific bank account-related matters, allowing the agent to handle a limited range of financial transactions on the principal's behalf. For example, it may only grant authority to pay bills, manage online banking, or make withdrawals up to a certain limit. 3. Joint Bank Account Power of Attorney: In cases where the principal shares a joint bank account with another individual (such as a spouse or business partner), a joint power of attorney may be established. This allows either party to act independently on behalf of the other, giving the agent the ability to manage the joint bank account without requiring the other party's consent. 4. Springing Bank Account Power of Attorney: A springing power of attorney for bank account matters becomes effective only when a triggering event occurs. This could be a specific date or the mental or physical incapacity of the principal, as determined by a healthcare professional. Once the triggering event occurs, the agent's authority is activated, enabling them to manage the principal's bank accounts. 5. Specific Task Bank Account Power of Attorney: Sometimes, a principal may want to designate an agent for specific tasks related to their bank accounts, rather than granting broad authority. This type of power of attorney enables the agent to carry out only the assigned tasks, such as depositing checks, making online transfers, or handling tax-related matters. In North Charleston, South Carolina, it is essential to consult a lawyer experienced in estate planning and powers of attorney to ensure that the Special Durable Power of Attorney for Bank Account Matters accurately reflects the principal's intentions and aligns with relevant state laws.

Free preview

How to fill out North Charleston South Carolina Special Durable Power Of Attorney For Bank Account Matters?

If you’ve already utilized our service before, log in to your account and save the North Charleston South Carolina Special Durable Power of Attorney for Bank Account Matters on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your North Charleston South Carolina Special Durable Power of Attorney for Bank Account Matters. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!