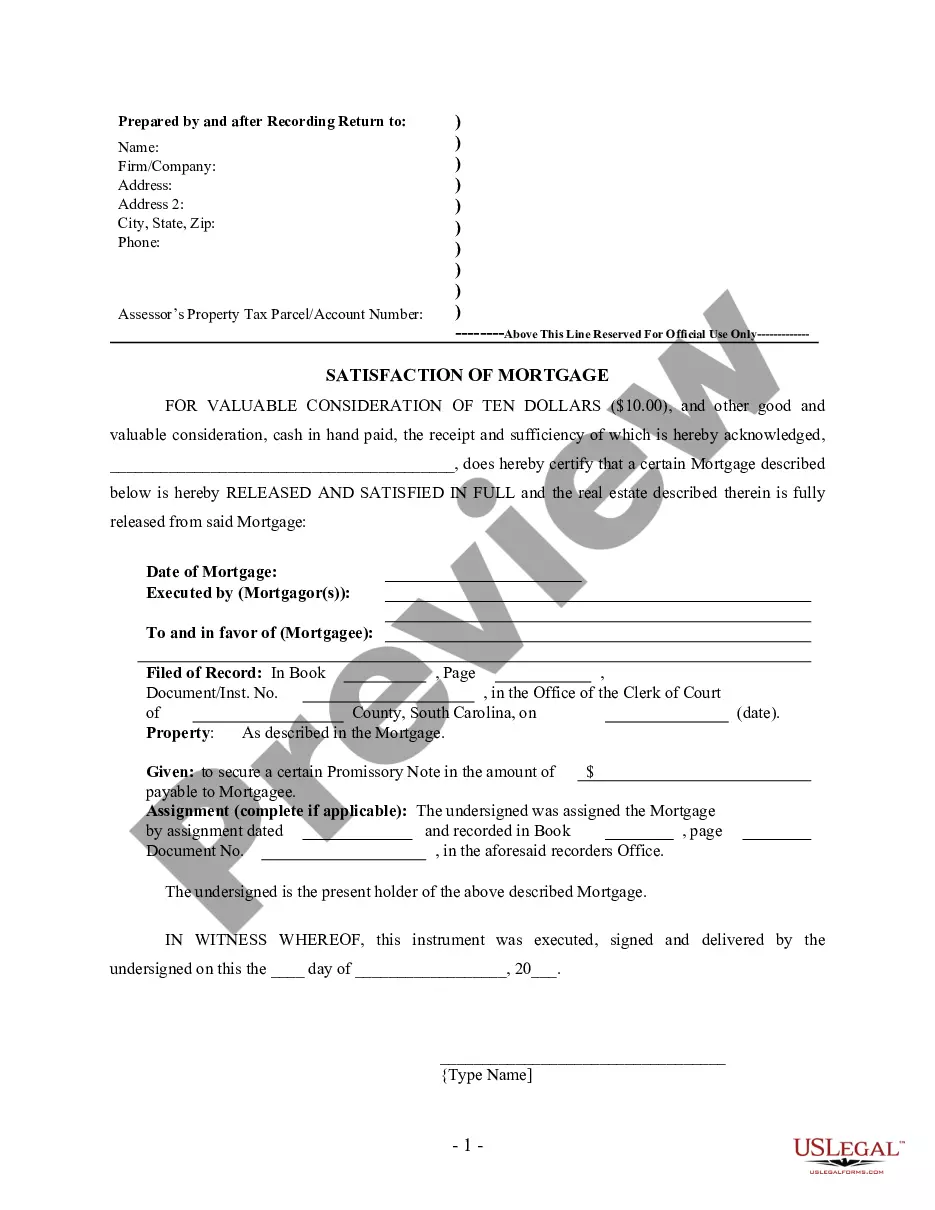

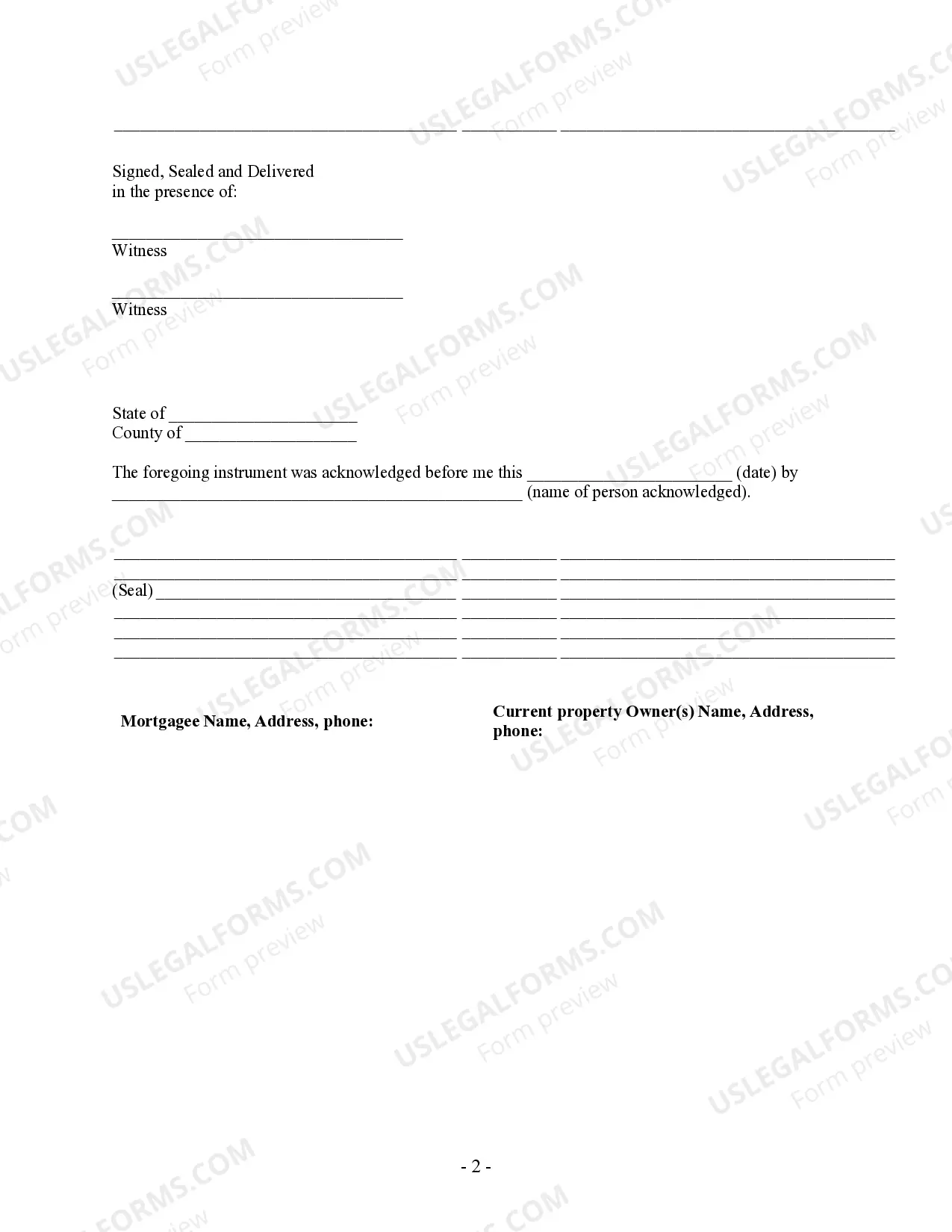

North Charleston South Carolina Satisfaction of Mortgage by Lender — Individual Lender or Holder is a legal document that signifies the complete repayment of a mortgage loan by a borrower and the satisfaction of the mortgage debt. This document is important for both the borrower and the lender as it releases the property from the mortgage lien and restores the borrower's full ownership rights. In North Charleston, South Carolina, there are typically two main types of Satisfaction of Mortgage by Lender — Individual Lender or Holder: 1. Voluntary Satisfaction: This type occurs when a borrower has fully repaid their mortgage loan and requests the lender or holder of the mortgage to release the lien on the property. The borrower must ensure that all outstanding payments, including principal and interest, have been made before initiating the process of obtaining a satisfaction of mortgage. 2. Involuntary Satisfaction: This type occurs when a mortgage is paid off due to external factors such as foreclosure or bankruptcy. In such situations, the lender or holder of the mortgage may initiate the satisfaction of mortgage process to officially release the property from the mortgage lien. The North Charleston South Carolina Satisfaction of Mortgage by Lender — Individual Lender or Holder document typically includes the following key information: 1. Borrower Details: The document identifies the borrower by their name, address, and any other relevant personal information. 2. Lender or Holder Details: The document specifies the name and contact information of the lender or holder of the mortgage. 3. Property Information: The document includes a description of the property for which the mortgage was granted, including its address and legal description. 4. Mortgage Details: The document outlines the specifics of the mortgage, such as the original loan amount, the interest rate, and the repayment terms. 5. Declaration of Satisfaction: This is the crucial section where the lender or holder of the mortgage acknowledges that the mortgage has been fully repaid, satisfied, and releases any claim or lien on the property. 6. Signatures: To make the document legally valid, both the borrower and the lender or holder must sign and date the satisfaction of mortgage. It's essential to ensure that a North Charleston South Carolina Satisfaction of Mortgage by Lender — Individual Lender or Holder is properly executed and recorded with the appropriate county or city office to officially release the mortgage lien and clear the property title. This allows the borrower to have a clean title and eliminates any potential issues when selling, refinancing, or transferring ownership of the property in the future.

North Charleston South Carolina Satisfaction of Mortgage by Lender - Individual Lender or Holder

State:

South Carolina

City:

North Charleston

Control #:

SC-S123-Z

Format:

Word;

Rich Text

Instant download

Description

This form is for the satisfaction or release of a deed of trust for the state of South Carolina by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

North Charleston South Carolina Satisfaction of Mortgage by Lender — Individual Lender or Holder is a legal document that signifies the complete repayment of a mortgage loan by a borrower and the satisfaction of the mortgage debt. This document is important for both the borrower and the lender as it releases the property from the mortgage lien and restores the borrower's full ownership rights. In North Charleston, South Carolina, there are typically two main types of Satisfaction of Mortgage by Lender — Individual Lender or Holder: 1. Voluntary Satisfaction: This type occurs when a borrower has fully repaid their mortgage loan and requests the lender or holder of the mortgage to release the lien on the property. The borrower must ensure that all outstanding payments, including principal and interest, have been made before initiating the process of obtaining a satisfaction of mortgage. 2. Involuntary Satisfaction: This type occurs when a mortgage is paid off due to external factors such as foreclosure or bankruptcy. In such situations, the lender or holder of the mortgage may initiate the satisfaction of mortgage process to officially release the property from the mortgage lien. The North Charleston South Carolina Satisfaction of Mortgage by Lender — Individual Lender or Holder document typically includes the following key information: 1. Borrower Details: The document identifies the borrower by their name, address, and any other relevant personal information. 2. Lender or Holder Details: The document specifies the name and contact information of the lender or holder of the mortgage. 3. Property Information: The document includes a description of the property for which the mortgage was granted, including its address and legal description. 4. Mortgage Details: The document outlines the specifics of the mortgage, such as the original loan amount, the interest rate, and the repayment terms. 5. Declaration of Satisfaction: This is the crucial section where the lender or holder of the mortgage acknowledges that the mortgage has been fully repaid, satisfied, and releases any claim or lien on the property. 6. Signatures: To make the document legally valid, both the borrower and the lender or holder must sign and date the satisfaction of mortgage. It's essential to ensure that a North Charleston South Carolina Satisfaction of Mortgage by Lender — Individual Lender or Holder is properly executed and recorded with the appropriate county or city office to officially release the mortgage lien and clear the property title. This allows the borrower to have a clean title and eliminates any potential issues when selling, refinancing, or transferring ownership of the property in the future.

Free preview

How to fill out North Charleston South Carolina Satisfaction Of Mortgage By Lender - Individual Lender Or Holder?

If you’ve already utilized our service before, log in to your account and save the North Charleston South Carolina Satisfaction of Mortgage by Lender - Individual Lender or Holder on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your North Charleston South Carolina Satisfaction of Mortgage by Lender - Individual Lender or Holder. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!