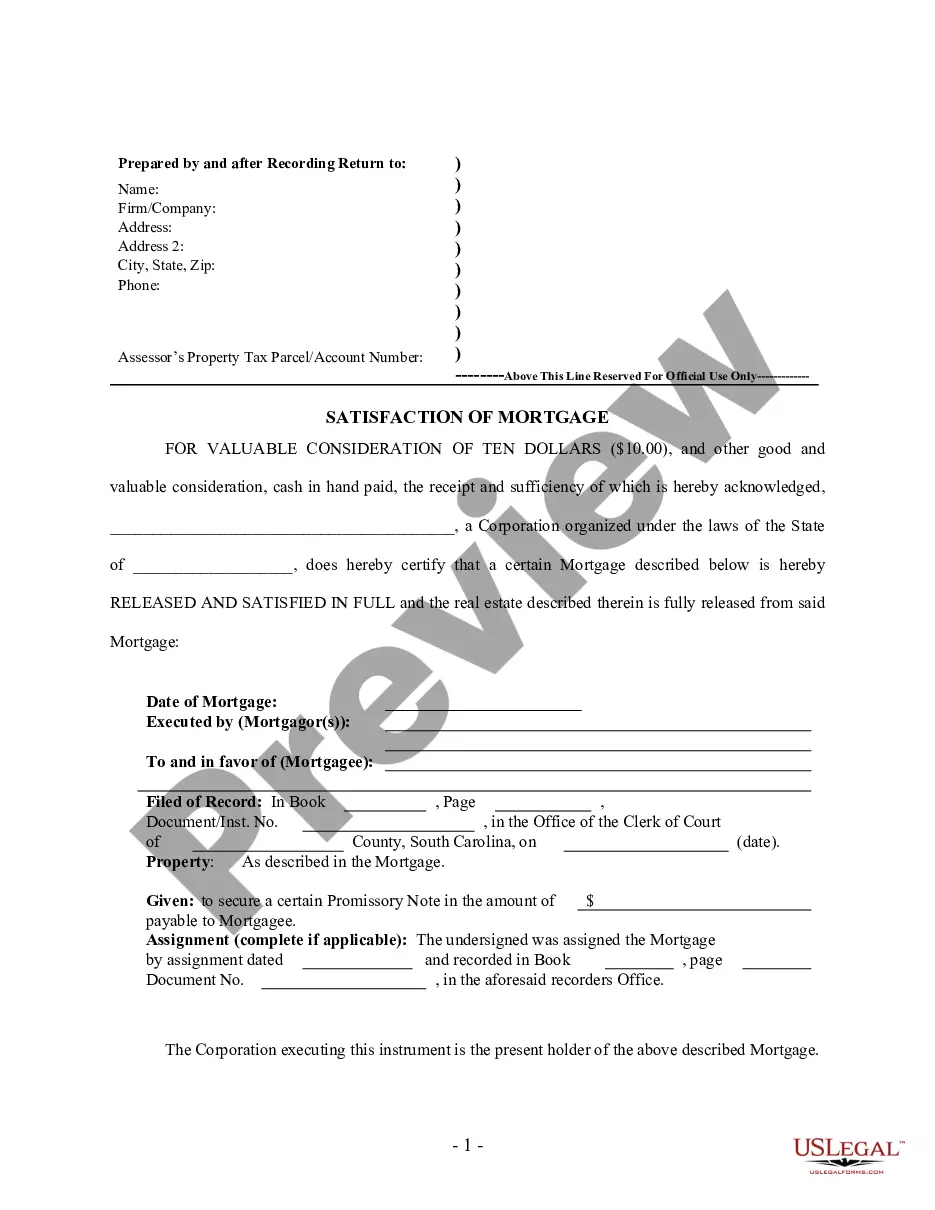

Satisfaction of Mortgage by Lender - by Corporate Lender

</div>

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

South Carolina Law

Assignment: It is recommended that an assignment be in writing and recorded.

Demand to Satisfy: Mortgagor must demand satisfaction in writting, by certified mail or other form of delivery with proof of delivery. Mortgagee has 3 months to enter satisfaction of record.

Recording Satisfaction: In the presence of the officer or his deputy write across the face of the record of the instrument the words, "The debt secured is paid in full and the lien of this instrument is satisfied", or words of like meaning and date the notation and sign it, the signature to be witnessed by the officer or his deputy. Other methods are possible. See code section 29-3-330, below.

Marginal Satisfaction: Satisfaction may be indicated in the margin of the mortgage document. See code section 29-3-330, below.

Penalty: If Mortgagee fails to record within the 3 month period following the written request, penalty is a sum of money not exceeding one-half of the amount of the debt secured by the mortgage, or twenty-five thousand dollars, whichever is less, plus actual damages, costs, and attorney's fees in the discretion of the court, to be recovered by action in any court of competent jurisdiction within the State. And on judgment being rendered for the plaintiff in any such action, the presiding judge shall order satisfaction to be entered.

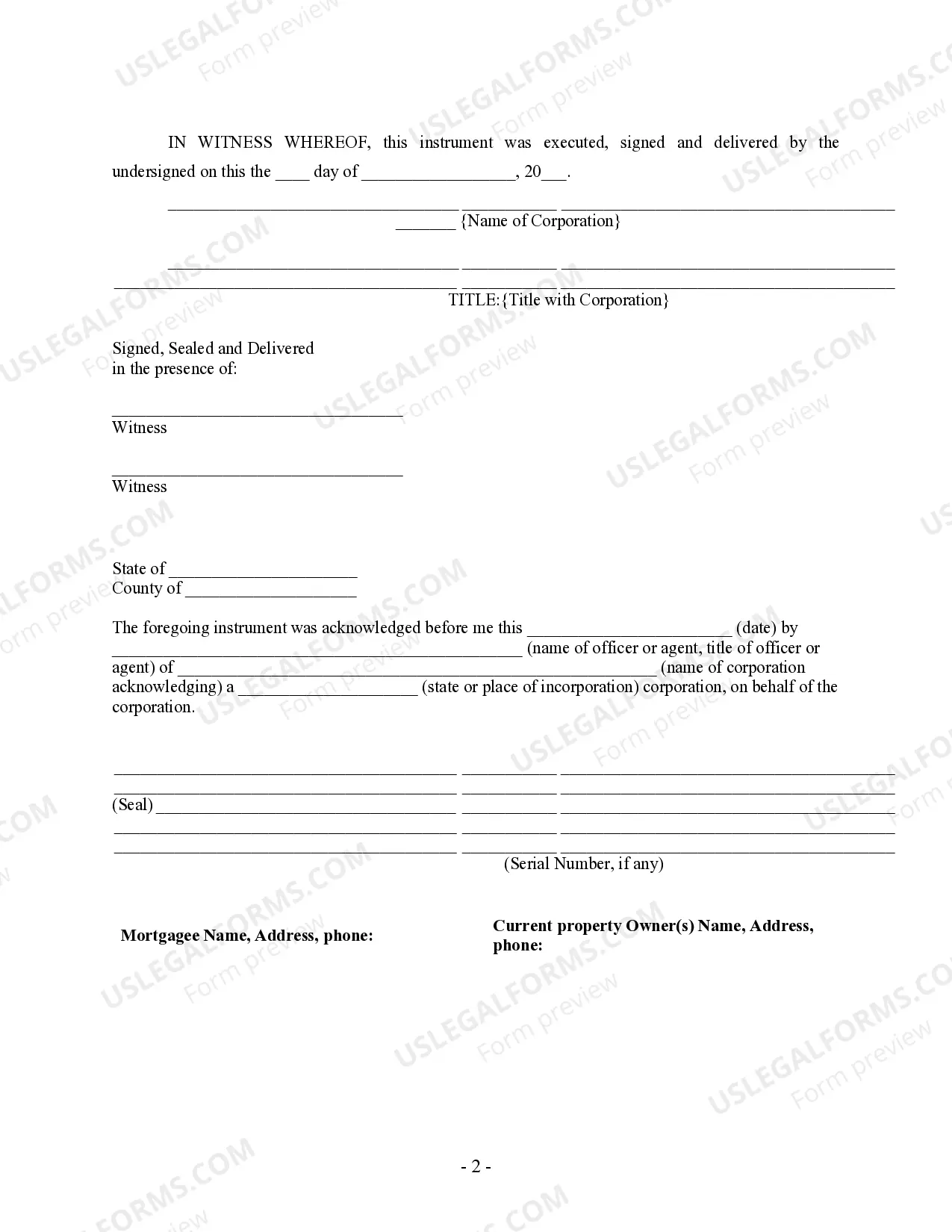

Acknowledgment: An assignment or satisfaction must contain a proper South Carolina acknowledgment, or other acknowledgment approved by Statute.

South Carolina Statutes

SECTION 29 3 310. Request for entry of satisfaction.

Any holder of record of a mortgage who has received full payment or satisfaction or to whom a legal tender has been made of his debts, damages, costs, and charges secured by mortgage of real estate shall, at the request by certified mail or other form of delivery with a proof of delivery of the mortgagor or of his legal representative or any other person being a creditor of the debtor or a purchaser under him or having an interest in any estate bound by the mortgage and on tender of the fees of office for entering satisfaction, within three months after the certified mail, or other form of delivery, with a proof of delivery, request is made, enter satisfaction in the proper office on the mortgage which shall forever thereafter discharge and satisfy the mortgage.

HISTORY: 1962 Code Section 45 61; 1952 Code Section 45 61; 1942 Code Section 8703; 1932 Code Section 8703; Civ. C. '22 Section 5224; Civ. C. '12 Section 3461; Civ. C. '02 Section 2375; G. S. 1791; R. S. 1894; 1817 (6) 61; 1928 (35) 1253; 1988 Act No. 494, Section 8(2); 1999 Act No. 67, Section 1.

SECTION 29 3 320. Liability for failure to enter satisfaction.

Any holder of record of a mortgage having received such payment, satisfaction, or tender as aforesaid who shall not, by himself or his attorney, within three months after such certified mail, or other form of delivery, with a proof of delivery, request and tender of fees of office, repair to the proper office and enter satisfaction as aforesaid shall forfeit and pay to the person aggrieved a sum of money not exceeding one half of the amount of the debt secured by the mortgage, or twenty five thousand dollars, whichever is less, plus actual damages, costs, and attorney's fees in the discretion of the court, to be recovered by action in any court of competent jurisdiction within the State. And on judgment being rendered for the plaintiff in any such action, the presiding judge shall order satisfaction to be entered on the judgment or mortgage aforesaid by the clerk, register, or other proper officer whose duty it shall be, on receiving such order, to record it and to enter satisfaction accordingly.

Notwithstanding any limitations under Sections 37 2 202 and 37 3 202, the holder of record of the mortgage may charge a reasonable fee at the time of the satisfaction not to exceed twenty five dollars to cover the cost of processing and recording the satisfaction or cancellation. If the mortgagor or his legal representative instructs the holder of record of the mortgage that the mortgagor will be responsible for filing the satisfaction, the holder of the mortgage shall mail or deliver the satisfied mortgage to the mortgagor or his legal representative with no satisfaction fee charged.

HISTORY: 1962 Code Section 45 62; 1952 Code Section 45 62; 1942 Code Section 8704; 1932 Code Section 8704; Civ. C. '22 Section 5225; Civ. C. '12 Section 3461; Civ. C. '02 Section 2376; G. S. 1792; R. S. 1895; 1817 (6) 61; 1999 Act No. 67, Section 2.

SECTION 29 3 330. Methods of satisfaction or release of security interest; affidavit.

(A) In this section these words shall have the following meaning:

(1) "Mortgage" means a lien against real property that is granted to secure the payment of money; a deed of trust must be given the same meaning as a "mortgage".

(2) "Register" means the official, including the register of deeds, register of mense conveyances or clerk of court charged with the recording and indexing duties in Chapter 5, Title 30.

(3) “Release” means an instrument releasing all real property encumbered from the lien of the mortgage.<br />

<br />

(4) “Satisfaction” means a discharge signed by the mortgagee of record, the trustee of a deed of trust, or by an agent or officer, legal representative, or attorney in fact under a written instrument duly recorded, of either of the foregoing indicating that the property subject to the security instrument is released.<br />

<br />

(5) “Security instrument” means any mortgage, deed of trust, or other written instrument securing the payment of money and being a lien upon real property.<br />

<br />

(B) A security instrument may be satisfied or released by any of the following methods:<br />

<br />

(1) The mortgagee of record, the owner or holder of the mortgage, the trustee of a deed of trust, or the legal representative, agent or officer, or attorney in fact, under a written instrument duly recorded of any of the foregoing, may exhibit the security instrument to the register who has charge of the recording of the security instrument and then in the presence of the register write across the face of the record of the security instrument the words “The debt secured is paid in full and the lien of this instrument is satisfied”, “The lien of this instrument has been released”, or words of like meaning and date the notation and sign it. The signature must be witnessed by the register.<br />

<br />

(2) The satisfaction or release of the security instrument may be written upon or attached to the original security instrument and executed by any person above named in the presence of two witnesses and acknowledged, in which event the satisfaction or release must be recorded across the face of the record of the original instrument.<br />

<br />

(3) The mortgagee of record, the trustee of a deed of trust, or an agent or officer, legal representative, or attorney in fact, under a written instrument duly recorded, of either of the foregoing, may execute a satisfaction or release of a mortgage or deed of trust. Any person executing such satisfaction or release which is false is guilty of perjury and subject to Section 16 9 10 and must be liable for damages that any person may sustain as a result of the false affidavit, including reasonable attorney’s fees incurred in connection with the recovery of such damages. This satisfaction or release must be signed in the presence of two witnesses, acknowledged, and must be in substantially the same form as follows:<br />

<br />

“STATE OF SOUTH CAROLINA MORTGAGE/DEED OF TRUST SATISFACTION<br />

PURSUANT TO SECTION 29 3 330(B)(3) OF THE SOUTH CAROLINA CODE OF LAWS, 1976<br />

The undersigned being the mortgagee of record, the trustee of a deed of trust, or the legal representative, agent or officer, or attorney in fact of the mortgagee of record or the trustee of the trust, under a written agreement duly recorded, of either of the foregoing, certifies:<br />

The debt secured by the mortgage/deed of trust recorded in the office of the Clerk of Court or Register of Deeds of _ County in book _ at page _ is:<br />

[ ] paid in full and the lien or the foregoing instrument has been released; or<br />

[ ] the lien of the foregoing instrument has been released.<br />

The Clerk of Court or Register of Deeds may enter this cancellation into record.<br />

Under penalties of perjury, I declare that I have examined this affidavit this _day of _ and, to the best of my knowledge and belief, it is true, correct, and complete.<br />

WITNESS my/our hand this _ day of _, 20 _.<br />

_<br />

(Signature)<br />

_<br />

(Witness Signature)<br />

_<br />

(Witness Signature)<br />

State of _<br />

County of _<br />

This instrument was acknowledged before me this (date) by (name of officer/authorized signer, title of officer/authorized signer), of (name of corporation/entity acknowledging), a (type of entity and state or place of incorporation/formation), on behalf of the corporation/entity.<br />

Signature of Notary _<br />

Notary Public, State of _<br />

Printed Name of Notary _<br />

My Commission Expires: _”<br />

<br />

This notary acknowledgment form does not preclude the use of any other form of acknowledgment permitted by South Carolina law. The filing of this satisfaction shall satisfy or release the lien of the mortgage or deed of trust. Upon presentation, the register shall record this satisfaction or release pursuant to Section 29 3 330(B)(3) and mark the mortgage or deed of trust satisfied or released of record.<br />

<br />

(4) If the security instrument was recorded in counterparts, the original security instrument need not be presented and the satisfaction or release of it may be evidenced by an instrument of satisfaction or release, which may be executed in counterparts, by the mortgagee, the holder of the mortgage, the legal representative, agent or officer, or the attorney in fact under a written instrument duly recorded. Upon presentation of the instrument of satisfaction or release, or a counterpart of it, the register shall record the same.<br />

<br />

(5) Any licensed attorney admitted to practice in the State of South Carolina who can provide proof of payment of funds by evidence of payment made payable to the mortgagee, holder of record, servicer, or other party entitled to receive payment may record, or cause to be recorded, an affidavit, in writing, duly executed in the presence of two witnesses and acknowledged pursuant to the Uniform Recognition of Acknowledgments Act in Chapter 3, Title 26, which states that full payment of the balance or payoff amount of the security instrument has been made and that evidence of payment from the mortgagee, assignee, or servicer exists. This affidavit, duly recorded in the appropriate county, shall serve as notice of satisfaction of the mortgage and release of the lien upon the real property. The filing of the affidavit must be sufficient to satisfy or release the lien. Upon presentation of the instrument of satisfaction or release, the register must record the same. This section may not be construed to require an attorney to record an affidavit pursuant to this item or to create liability for failure to file such affidavit. The licensed attorney signing any such instrument which is false is guilty of perjury and subject to Section 16 9 10 and shall be liable for damages that any person may sustain as a result of the false affidavit, including reasonable attorney’s fees incurred in connection with the recovery of such damages. The affidavit referred to in this item shall be as follows:<br />

<br />

“STATE OF SOUTH CAROLINA MORTGAGE LIEN<br />

COUNTY OF ___________ SATISFACTION AFFIDAVIT<br />

PURSUANT TO SECTION 29 3 330<br />

OF SC CODE OF LAWS, 1976<br />

FOR BOOK ____ PAGE _____<br />

<br />

The undersigned on oath, being first duly sworn, hereby certifies as follows:<br />

<br />

1. The undersigned is a licensed attorney admitted to practice in the State of South Carolina.<br />

<br />

2. That with respect to the mortgage or deed of trust given by _ to _ dated _ and recorded in the offices of the Clerk of Court or Register of Deeds in book _ at page _:<br />

<br />

a. [ ] That the undersigned was given written payoff information and made such payoff and is in possession of a canceled check or other evidence of payment to the mortgagee, holder of record, or representative servicer.<br />

<br />

b. [ ] That the undersigned was given written payoff information and made such payoff by wire transfer or other electronic means to the mortgagee, holder of record, or representative servicer and has confirmation from the undersigned’s bank of the transfer to the account provided by the mortgagee, holder of record, or representative servicer.<br />

<br />

Under penalties of perjury, I declare that I have examined this affidavit this _ day of _ and, to the best of my knowledge and belief, it is true, correct, and complete.<br />

<br />

(Witness) (Signature)<br />

<br />

(Witness) (Name Please Print)<br />

<br />

__________ (Attorney’s S.C. Bar number)<br />

<br />

STATE OF SOUTH CAROLINA ACKNOWLEDGEMENT<br />

COUNTY OF<br />

<br />

The foregoing instrument was acknowledged before me this _ day of _ by _.<br />

_<br />

Notary Public for South Carolina<br />

My Commission Expires: _”<br />

Upon presentation to the office of the Register of Deeds, the register is directed to record pursuant to Section 29 3 330(B)(3) and mark the mortgage or deed of trust satisfied or released of record.<br />

<br />

HISTORY: 1962 Code Section 45 65; 1952 Code Section 45 65; 1942 Code Section 8702; 1932 Code Section 8702; 1924 (33) 929; 1925 (34) 83; 1930 (36) 1283; 1940 (41) 1844; 1964 (53) 1727; 1988 Act No. 494, Section 8(3); 1994 Act No. 382, Section 2; 1994 Act No. 478, Section 1; 1999 Act No. 67, Section 3; 2005 Act No. 73, Section 1; 2011 Act No. 19, Section 1, eff May 9, 2011; 2014 Act No. 198 (H.3134), Section 1, eff June 2, 2014.<br />

Effect of Amendment<br />

The 2011 amendment in subsection (c)(i) substituted “acknowledged pursuant to the Uniform Recognition of Acknowledgments Act in Chapter 3, Title 26,” for “probated”; and in subsection (e) substituted “acknowledged pursuant to the Uniform Recognition of Acknowledgments Act in Chapter 3, Title 26,” for “probated or acknowledged”; and amended the form.<br />

2014 Act No. 198, Section 1, rewrote the section.<br />

<br />

SECTION 29 3 340. Certificate of satisfaction.<br />

<br />

The recording officer or his deputy shall enter on the original mortgage, deed of trust, or other instrument securing the payment and being a lien upon real property when it is produced before him a certificate that a satisfaction has been entered of record and the date of the entry.<br />

<br />

HISTORY: 1962 Code Section 45 66; 1952 Code Section 45 66; 1942 Code Section 8702; 1932 Code Section 8702; 1924 (33) 929; 1925 (34) 83; 1930 (36) 1283; 1940 (41) 1844; 1988 Act No. 494, Section 8(4).