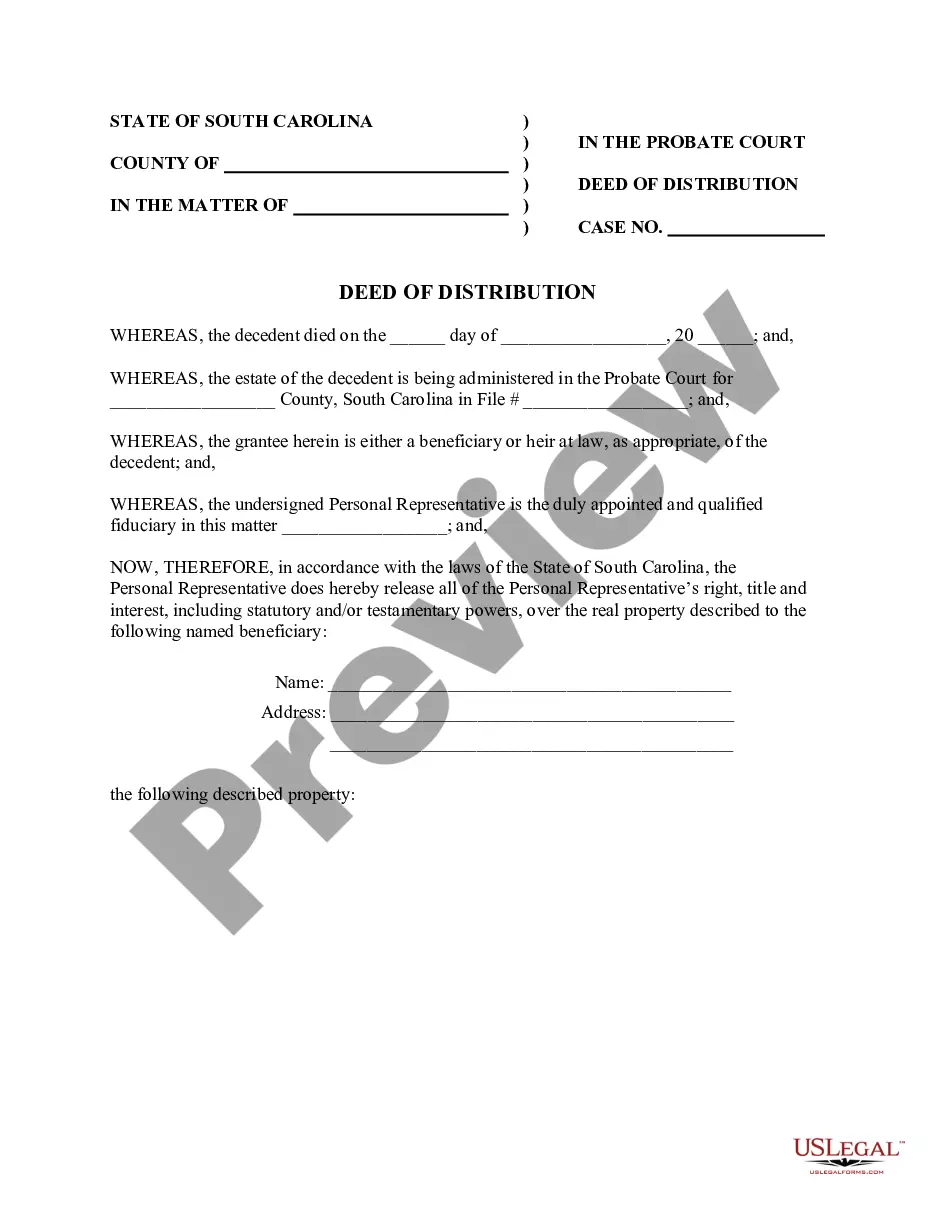

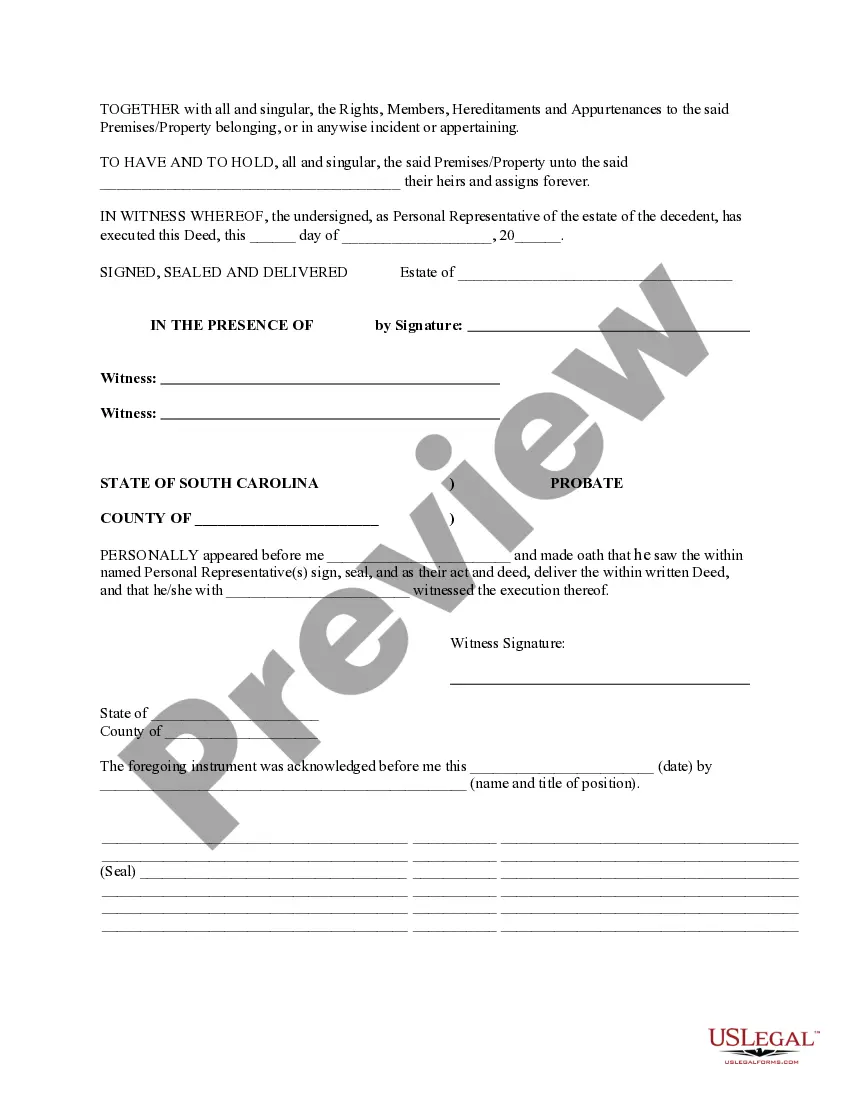

The North Charleston South Carolina Deed of Distribution — Personal Representative to Beneficiary is a legal document that plays a crucial role in the transfer of assets from an estate to the beneficiaries. This deed outlines the specific details of the distribution process, ensuring a smooth and lawful transfer of property rights. For individuals in North Charleston, South Carolina, understanding the intricacies of this deed is essential during the probate process. In North Charleston, South Carolina, there are two main types of Deeds of Distribution — Personal Representative to Beneficiary: the Intestate Deed of Distribution and the Testate Deed of Distribution. Each serves a distinct purpose depending on whether the deceased left a valid will or not. 1. Intestate Deed of Distribution: In cases where the deceased did not leave a valid will, the probate court follows the rules of intestate succession. This deed outlines the distribution of assets according to South Carolina's laws of intestacy, ensuring that property transfers to the rightful beneficiaries. 2. Testate Deed of Distribution: When the deceased has a valid will, probate courts honor the instructions stated within it. The Testate Deed of Distribution reflects the distribution of assets as per the deceased person's wishes, eliminating any confusion or disagreements among the beneficiaries. The North Charleston South Carolina Deed of Distribution — Personal Representative to Beneficiary typically includes the following key information: 1. Personal Representative Details: It identifies the personal representative (also known as an executor or administrator) responsible for overseeing the distribution process. This includes their full name, contact information, and their authority to act on behalf of the estate. 2. Beneficiary Information: The deed lists the beneficiaries entitled to receive assets from the estate. Each beneficiary's full name and contact details are included to ensure accurate distribution and communication. 3. Description of Assets: A comprehensive inventory of the assets within the estate is outlined. This can include real estate holdings, bank accounts, investment portfolios, personal property, and other valuable possessions. A thorough description of each asset ensures transparency and prevents any disputes during the distribution process. 4. Distribution Plan: The deed specifies how each asset will be distributed among the beneficiaries. It may allocate properties or funds based on percentages, specific bequests, or equal shares, as per the deceased's wishes or applicable laws. 5. Legal Acknowledgments: Proper legal language and acknowledgments are included to ensure the validity of the deed. These affirmations emphasize that the personal representative has the authority to distribute the assets and that the beneficiaries acknowledge their receipt. 6. Signatures and Notarization: The deed requires the signatures of both the personal representative and the beneficiaries. Additionally, notarization is usually necessary to authenticate the document. Understanding the North Charleston South Carolina Deed of Distribution — Personal Representative to Beneficiary is crucial for anyone involved in the probate process. This legal document serves as a foundation for transferring assets and ensures a fair and transparent distribution among the rightful beneficiaries.

North Charleston South Carolina Deed of Distribution - Personal Representative to Beneficiary

Description

How to fill out North Charleston South Carolina Deed Of Distribution - Personal Representative To Beneficiary?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for someone with no legal background to draft this sort of papers from scratch, mainly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our platform provides a huge library with over 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you want the North Charleston South Carolina Deed of Distribution - Personal Representative to Beneficiary or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the North Charleston South Carolina Deed of Distribution - Personal Representative to Beneficiary quickly using our reliable platform. In case you are already a subscriber, you can proceed to log in to your account to get the needed form.

However, in case you are unfamiliar with our library, make sure to follow these steps prior to obtaining the North Charleston South Carolina Deed of Distribution - Personal Representative to Beneficiary:

- Be sure the form you have found is good for your area considering that the regulations of one state or area do not work for another state or area.

- Preview the document and read a brief description (if available) of scenarios the paper can be used for.

- If the form you selected doesn’t suit your needs, you can start over and look for the needed document.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your login information or register for one from scratch.

- Choose the payment method and proceed to download the North Charleston South Carolina Deed of Distribution - Personal Representative to Beneficiary as soon as the payment is completed.

You’re all set! Now you can proceed to print out the document or complete it online. Should you have any problems locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.