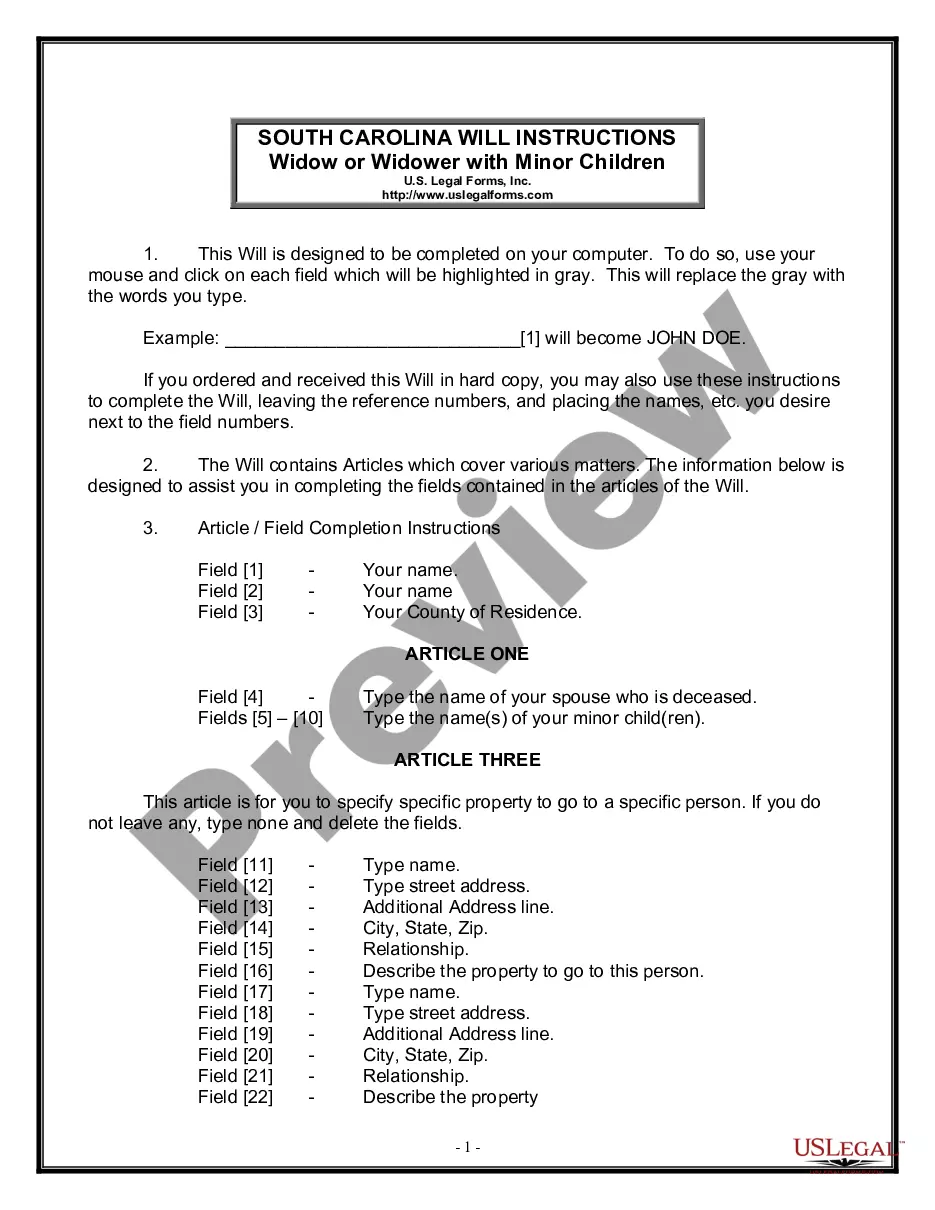

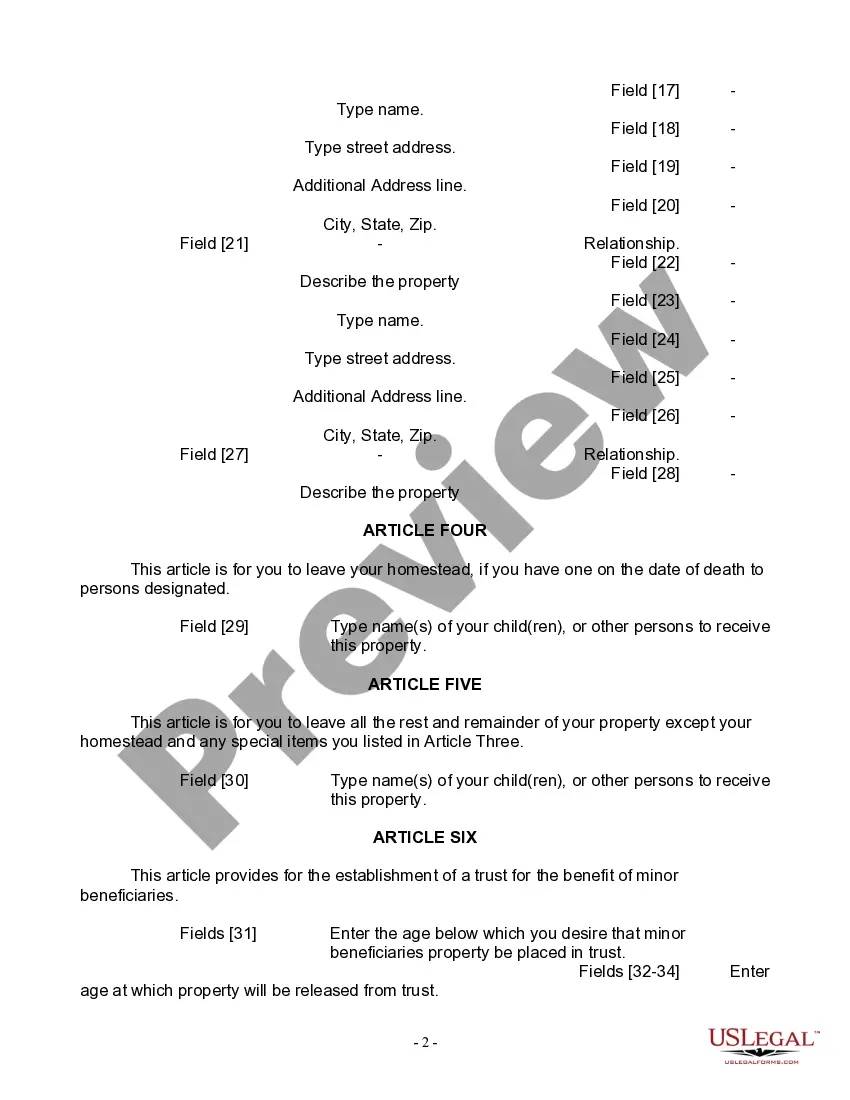

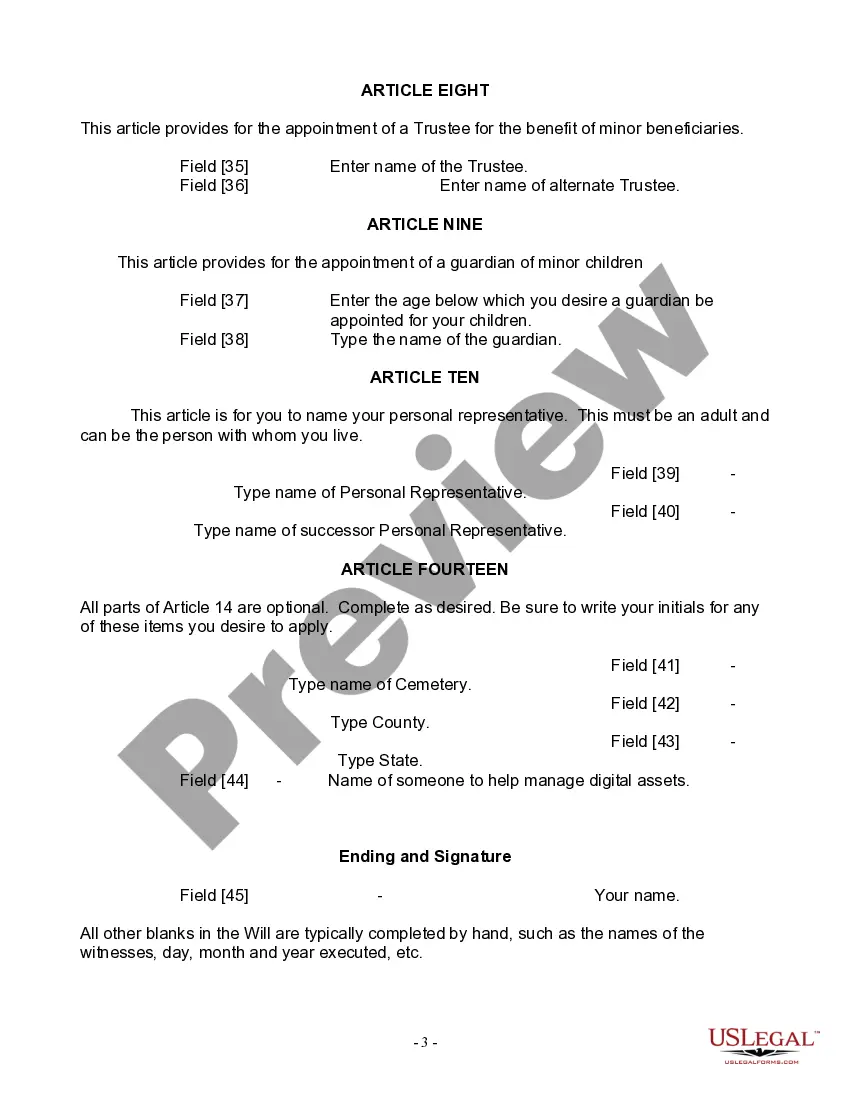

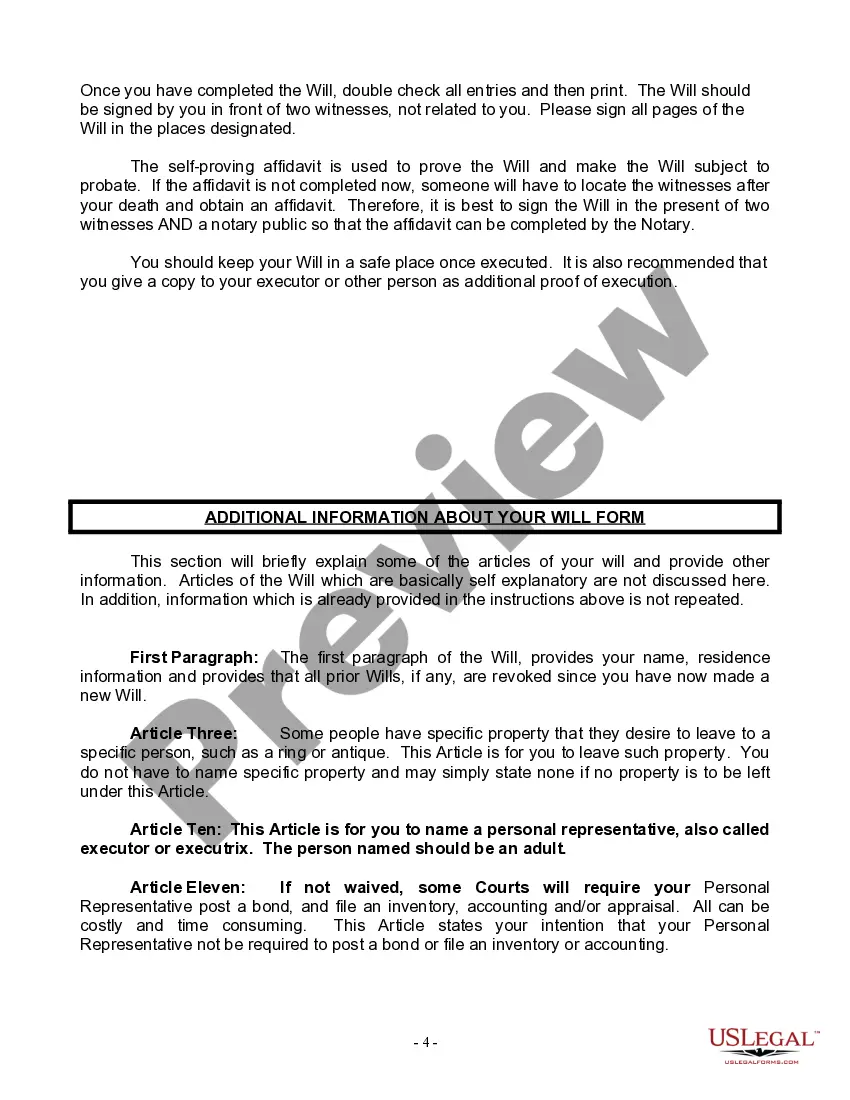

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. A North Charleston South Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children is a legally binding document that allows individuals who have lost their spouse and have minor children to designate how their assets, property, and guardianship of their children will be handled after their death. This form ensures that the testator's wishes are carried out according to state laws. This specific type of will is designed for individuals residing in North Charleston, South Carolina, who are widowed and have minor children. It offers a tailored approach to addressing the unique needs and concerns of widows or widowers with dependents. The North Charleston South Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children typically includes the following key elements: 1. Identification of the testator: The form begins by providing space for the widowed individual's personal details, such as their full name, address, and contact information. 2. Appointment of an executor: The testator can name a trusted individual to carry out the responsibilities of an executor, who will manage the distribution of assets and ensure that the provisions outlined in the will are followed. 3. Appointment of a guardian: In this form, the widowed individual can designate a suitable guardian(s) for their minor children who will assume responsibility for their care and make decisions on their behalf until they come of age. The form may also include provisions regarding the guardian's role, duties, and responsibilities. 4. Asset distribution: The will allows the widowed individual to specify how their assets, including bank accounts, real estate, investments, personal belongings, and other valuable items, should be distributed among their beneficiaries. This section may also cover any specific bequests or conditional gifts. 5. Trust provisions: If desired, the testator can establish a trust for their minor children to ensure their financial security. This provision can outline how the trust funds will be managed, disbursed, and invested until the children reach a certain age or milestone. 6. Alternate provisions: This section of the form enables the testator to name alternate beneficiaries, executors, or guardians in case the primary choices are unable or unwilling to fulfill their responsibilities. Important Keywords: — North Charleston SoutCarolinain— - Legal Last Will and Testament Form — Widowidowwe— - Minor Children - Executor — Guardia— - Asset distribution - Trust provisions Beneficiariesie— - Bequests - Conditional gifts — Alternate provisions Different types of North Charleston South Carolina Legal Last Will and Testament Forms for Widow or Widower with Minor Children may vary depending on various factors such as specific estate planning needs, tax considerations, and individual circumstances. It is advisable to consult with an attorney or legal professional specializing in estate planning to ensure that the will is properly drafted and aligns with the laws and regulations of North Charleston, South Carolina.

A North Charleston South Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children is a legally binding document that allows individuals who have lost their spouse and have minor children to designate how their assets, property, and guardianship of their children will be handled after their death. This form ensures that the testator's wishes are carried out according to state laws. This specific type of will is designed for individuals residing in North Charleston, South Carolina, who are widowed and have minor children. It offers a tailored approach to addressing the unique needs and concerns of widows or widowers with dependents. The North Charleston South Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children typically includes the following key elements: 1. Identification of the testator: The form begins by providing space for the widowed individual's personal details, such as their full name, address, and contact information. 2. Appointment of an executor: The testator can name a trusted individual to carry out the responsibilities of an executor, who will manage the distribution of assets and ensure that the provisions outlined in the will are followed. 3. Appointment of a guardian: In this form, the widowed individual can designate a suitable guardian(s) for their minor children who will assume responsibility for their care and make decisions on their behalf until they come of age. The form may also include provisions regarding the guardian's role, duties, and responsibilities. 4. Asset distribution: The will allows the widowed individual to specify how their assets, including bank accounts, real estate, investments, personal belongings, and other valuable items, should be distributed among their beneficiaries. This section may also cover any specific bequests or conditional gifts. 5. Trust provisions: If desired, the testator can establish a trust for their minor children to ensure their financial security. This provision can outline how the trust funds will be managed, disbursed, and invested until the children reach a certain age or milestone. 6. Alternate provisions: This section of the form enables the testator to name alternate beneficiaries, executors, or guardians in case the primary choices are unable or unwilling to fulfill their responsibilities. Important Keywords: — North Charleston SoutCarolinain— - Legal Last Will and Testament Form — Widowidowwe— - Minor Children - Executor — Guardia— - Asset distribution - Trust provisions Beneficiariesie— - Bequests - Conditional gifts — Alternate provisions Different types of North Charleston South Carolina Legal Last Will and Testament Forms for Widow or Widower with Minor Children may vary depending on various factors such as specific estate planning needs, tax considerations, and individual circumstances. It is advisable to consult with an attorney or legal professional specializing in estate planning to ensure that the will is properly drafted and aligns with the laws and regulations of North Charleston, South Carolina.