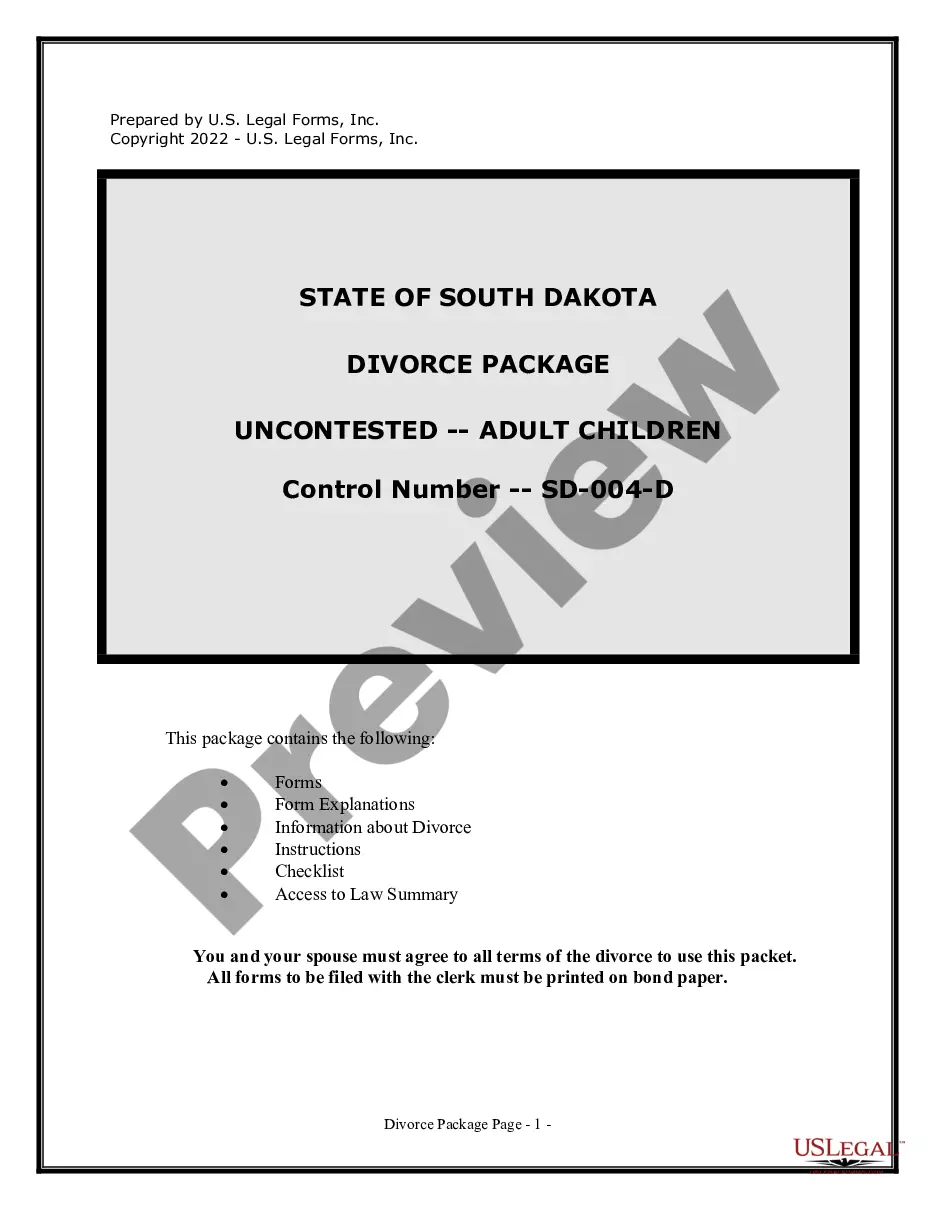

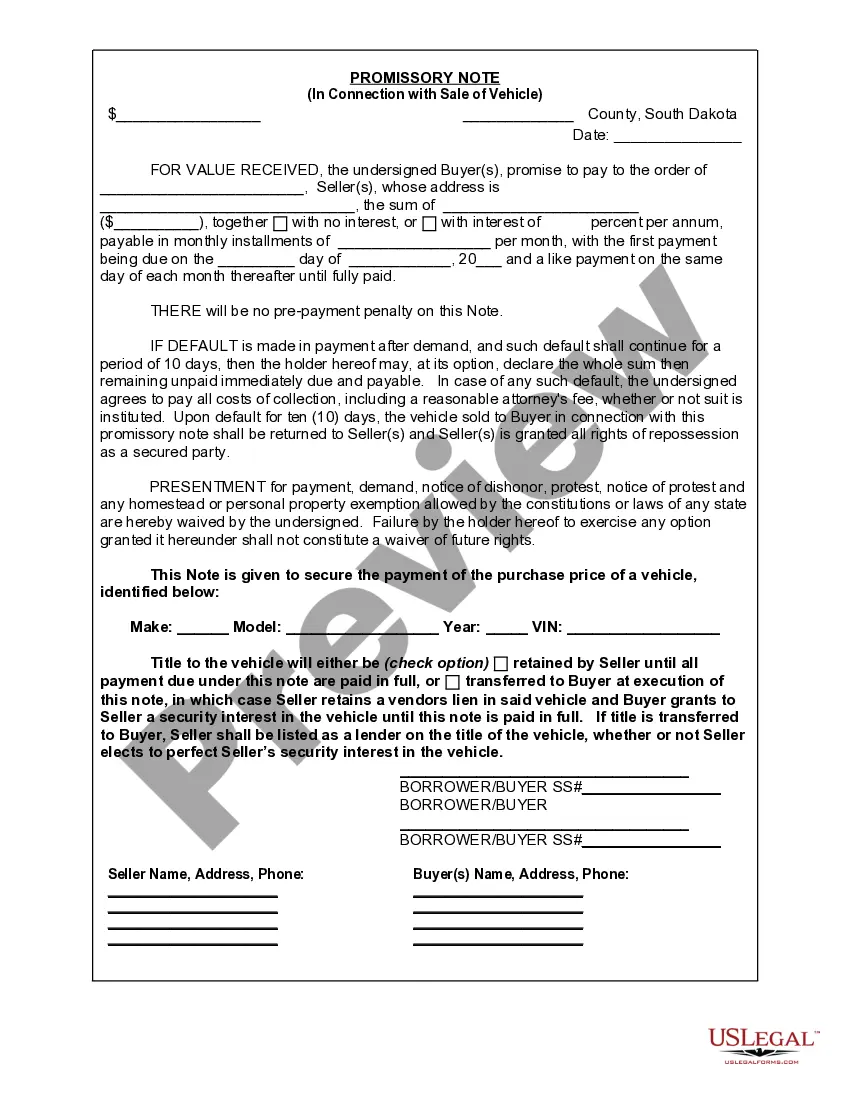

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Sioux Falls South Dakota Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out South Dakota Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Regardless of one's social or professional standing, completing legal documents is a regrettable requirement in the current professional climate.

Too frequently, it’s nearly impossible for an individual without legal training to produce these types of documents independently, primarily due to the intricate language and legal nuances involved.

This is where US Legal Forms can be a game changer.

Ensure that the template you have selected is tailored to your locality, as the laws of one state or county do not apply to another.

Review the form and check a brief summary (if provided) of situations for which the document can be utilized.

- Our service provides an extensive library of over 85,000 state-specific templates suitable for nearly any legal scenario.

- US Legal Forms is also a valuable tool for associates or legal advisors looking to enhance their efficiency by leveraging our DIY papers.

- Whether you need the Sioux Falls South Dakota Promissory Note related to the Sale of a Vehicle or Automobile or any other applicable paperwork for your state or county, everything you require is readily available with US Legal Forms.

- Here’s how to obtain the Sioux Falls South Dakota Promissory Note linked to the Sale of a Vehicle or Automobile in just minutes using our reliable service.

- If you are an existing client, feel free to Log In to your account to access the required form.

- However, if you are new to our platform, be sure to follow these steps before downloading the Sioux Falls South Dakota Promissory Note connected with the Sale of a Vehicle or Automobile.

Form popularity

FAQ

PO Box 7250 Sioux Falls SD serves as a mailing address for various legal and financial institutions. It is often associated with businesses that handle documents like the Sioux Falls South Dakota Promissory Note in Connection with Sale of Vehicle or Automobile. Understanding the purpose of this PO Box can help you identify the sender and the relevance of the correspondence. If you need further clarification, consulting a legal professional or using a platform like uslegalforms can provide additional insights.

Mail from PO Box 7250 Sioux Falls SD 57117 7250 typically includes official correspondence related to legal matters, such as documents related to loans or financial agreements. This could encompass notices or forms associated with the Sioux Falls South Dakota Promissory Note in Connection with Sale of Vehicle or Automobile. If you receive mail from this address, it may contain essential information that requires your attention. Always review the contents carefully, as they may impact your financial commitments.

Registering an out-of-state vehicle in South Dakota involves providing necessary documentation such as the vehicle's title, proof of insurance, and identification. It is advised to complete your registration soon after moving to South Dakota to avoid any penalties. When creating a Sioux Falls South Dakota Promissory Note in Connection with Sale of Vehicle or Automobile, this registration process is a crucial step to finalize your vehicle transaction.

To obtain an EIN number in South Dakota, you must apply through the IRS, which can be done quickly online. This number is essential for businesses, including those selling vehicles, as it helps with tax reporting. When drafting a Sioux Falls South Dakota Promissory Note in Connection with Sale of Vehicle or Automobile, having your EIN readily available can streamline the transaction process.

South Dakota does not typically require safety inspections for most vehicles. However, certain vehicles may need to pass emissions tests based on local regulations. If you are selling or buying a vehicle, incorporating a Sioux Falls South Dakota Promissory Note in Connection with Sale of Vehicle or Automobile ensures both parties are aware of any inspection requirements or the vehicle's condition.

Yes, if you plan to sell items online, including vehicles, you will need a business license in South Dakota. This license ensures that you comply with local regulations and may necessitate a seller's permit as well. Having a Sioux Falls South Dakota Promissory Note in Connection with Sale of Vehicle or Automobile can help maintain professionalism and clarity in your transactions.

To obtain a seller's permit in South Dakota, you will need to complete an application with the Department of Revenue. This process also requires you to provide your business information and may involve a brief processing time. If you're selling vehicles, using a Sioux Falls South Dakota Promissory Note in Connection with Sale of Vehicle or Automobile can help clarify the terms to both buyers and the state.

Many people choose to register vehicles in South Dakota due to its favorable tax laws and low registration fees. The state offers a straightforward process for registering vehicles, which can be very appealing. If you're considering registering in South Dakota, drafting a Sioux Falls South Dakota Promissory Note in Connection with Sale of Vehicle or Automobile can make the transition smoother.

To register an out-of-state vehicle in South Dakota, you will need a few key documents. This includes the vehicle's title, proof of South Dakota residency, and a completed application form. Completing a Sioux Falls South Dakota Promissory Note in Connection with Sale of Vehicle or Automobile can streamline this process by providing clear terms of sale to the state.

An on-demand promissory note allows the lender to demand repayment at any time, making it flexible for both parties. This type of note should clearly state the amount owed and the repayment obligations. When selling a vehicle, consider using a Sioux Falls South Dakota Promissory Note in connection with the sale of a vehicle or automobile for stronger terms.